(1/19)

About:

Incorporated in 1903, IHCL is promoted by Tata Sons Pvt Ltd.

It operates the largest chain of hotels in South Asia. IHCL, its subsidiaries and associates are widely recognised under

the umbrella brand name

‘Taj Hotels Resorts and Palaces’ which has 171 Hotels!

About:

Incorporated in 1903, IHCL is promoted by Tata Sons Pvt Ltd.

It operates the largest chain of hotels in South Asia. IHCL, its subsidiaries and associates are widely recognised under

the umbrella brand name

‘Taj Hotels Resorts and Palaces’ which has 171 Hotels!

(2/19)

Global Presence:

IHCL has a room inventory of 19920+ globally across 4 continents, 12 countries and in over 100 locations. This includes presence in India, North America,

United Kingdom, Africa, Middle East, Malaysia, Sri Lanka, Maldives, Bhutan and Nepal.

Global Presence:

IHCL has a room inventory of 19920+ globally across 4 continents, 12 countries and in over 100 locations. This includes presence in India, North America,

United Kingdom, Africa, Middle East, Malaysia, Sri Lanka, Maldives, Bhutan and Nepal.

(3/19)

Hospitality Sector Backdrop:

After being beaten down by covid waves across the globe, the hospitality sector is still going through the recovery phase.

One silver lining being the projected growth rate in India. Which has given hopes for a faster recovery.

Hospitality Sector Backdrop:

After being beaten down by covid waves across the globe, the hospitality sector is still going through the recovery phase.

One silver lining being the projected growth rate in India. Which has given hopes for a faster recovery.

(4/19)

Understanding RevPAR:

RevPar is an important metrics to look at while analysing the Hotel stocks.

Simply put, RevPAR is used to assess a hotel's ability to fill its available rooms at an average rate. If RevPAR increases, that means the occupancy rate is increasing.

Understanding RevPAR:

RevPar is an important metrics to look at while analysing the Hotel stocks.

Simply put, RevPAR is used to assess a hotel's ability to fill its available rooms at an average rate. If RevPAR increases, that means the occupancy rate is increasing.

(5/19)

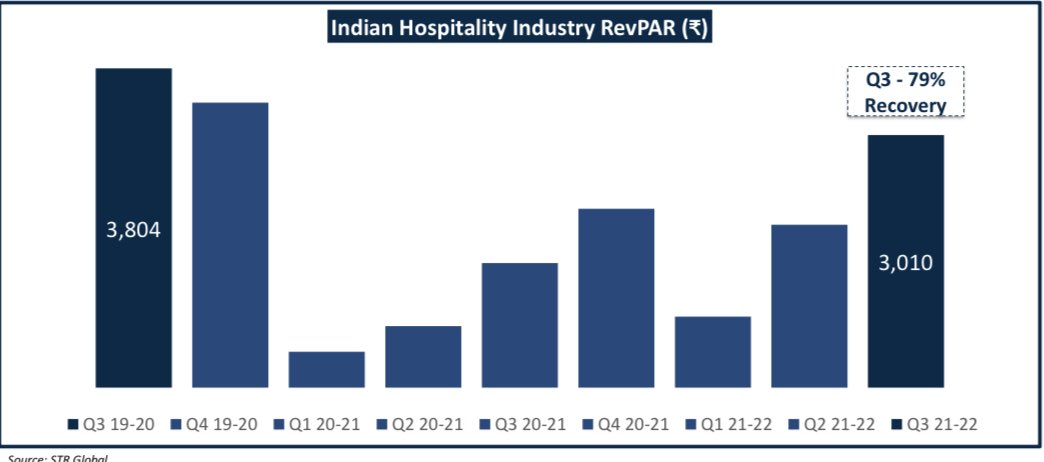

Owing to faster recovery across the economy, the RevPAR has seen significant recovery in the Q3FY22.

With world economy continuously opening up further and lifting of international flight restrictions will take this number higher.

Owing to faster recovery across the economy, the RevPAR has seen significant recovery in the Q3FY22.

With world economy continuously opening up further and lifting of international flight restrictions will take this number higher.

(6/19)

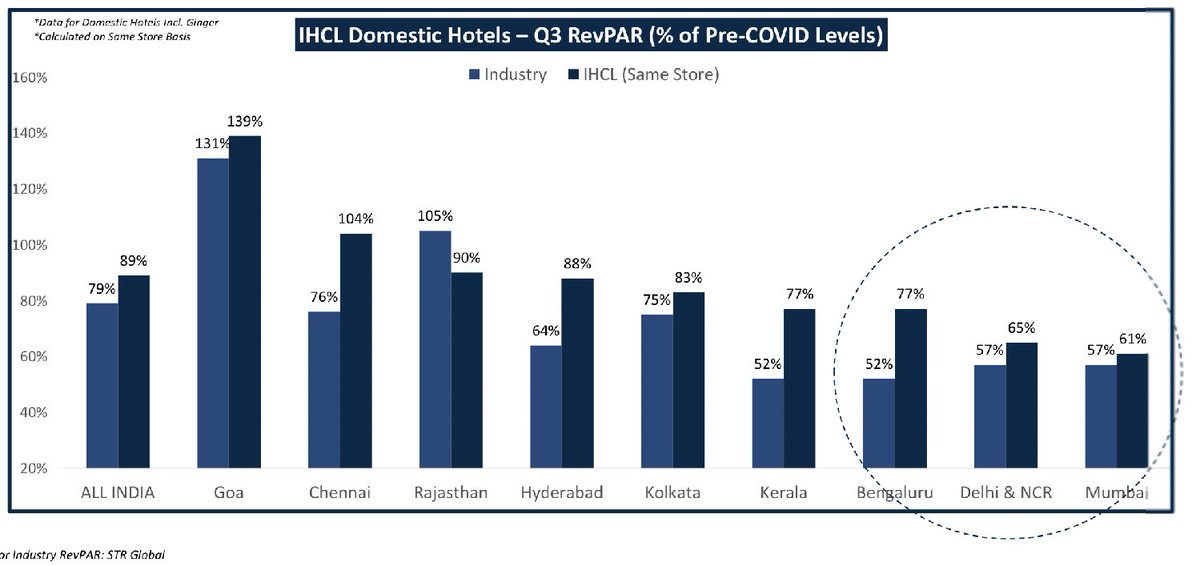

Better than Industry Numbers:

IHCLs Domestic market is showing better recovery numbers than its competitors across India.

However, the management said that Big cities like Mumbai, Delhi & Mumbai are still underperforming which is a concern.

Better than Industry Numbers:

IHCLs Domestic market is showing better recovery numbers than its competitors across India.

However, the management said that Big cities like Mumbai, Delhi & Mumbai are still underperforming which is a concern.

(7/19)

IHCLs Rate Premium:

It means companies ability to charge higher than the industry without causing disruption in demand.

Due to its strong brand name, the company’s average rate premium is now higher than its pre covid level (1.48 in Q3FY22 vs 1.35 in Q3FY20)

IHCLs Rate Premium:

It means companies ability to charge higher than the industry without causing disruption in demand.

Due to its strong brand name, the company’s average rate premium is now higher than its pre covid level (1.48 in Q3FY22 vs 1.35 in Q3FY20)

(8/19)

Companies focus going forward:

1. Business across India

2. To open more than 1 Hotel a month in CY22

3. Reduction in structural cost-

Total expenditure is down 17% YOY, Toal fixed cost is down 15% YOY, Corporate overheads down 23% YOY.

Companies focus going forward:

1. Business across India

2. To open more than 1 Hotel a month in CY22

3. Reduction in structural cost-

Total expenditure is down 17% YOY, Toal fixed cost is down 15% YOY, Corporate overheads down 23% YOY.

(9/19)

Asset Light approach:

IHCL has been expanding its footprint mainly through management contracts. The company aims to increase its inventory to 23,000 rooms by FY22 from current level of 19,920 rooms with more than 60% of its inventory held through

management contracts.

Asset Light approach:

IHCL has been expanding its footprint mainly through management contracts. The company aims to increase its inventory to 23,000 rooms by FY22 from current level of 19,920 rooms with more than 60% of its inventory held through

management contracts.

(10/19)

Strong parentage and strategic importance to the Tata group; demonstrated support from parent,

(Tata sons has a ~38% stake in IHCL)

IHCL is one of the largest companies in terms of market capitalisation within the Tata group with market capitalisation of ₹34,466 crore.

Strong parentage and strategic importance to the Tata group; demonstrated support from parent,

(Tata sons has a ~38% stake in IHCL)

IHCL is one of the largest companies in terms of market capitalisation within the Tata group with market capitalisation of ₹34,466 crore.

(11/19)

QIP funds to strengthen Financials

The board of IHCL on 25th March decided to raise ₹2,000 crore through Qualified Institutional Placement (QIP)

The company plans to use the proceeds for repaying debt of ~₹1,900 crore.

QIP funds to strengthen Financials

The board of IHCL on 25th March decided to raise ₹2,000 crore through Qualified Institutional Placement (QIP)

The company plans to use the proceeds for repaying debt of ~₹1,900 crore.

(12/19)

Post 3rd wave recovery. What to expect?

January was sluggish due to the 3rd covid wave.

However, post re opening the company is witnessing strong revival in business from February.

Business in March-May 2022 is expected to be higher than pre-covid levels in 2019

Post 3rd wave recovery. What to expect?

January was sluggish due to the 3rd covid wave.

However, post re opening the company is witnessing strong revival in business from February.

Business in March-May 2022 is expected to be higher than pre-covid levels in 2019

(13/19)

Let’s look into some numbers:

1. FY22e PAT is expected to be in negative however much less severe than FY21a

2. Revenue up from ₹615cr in Q3FY21 to ₹1,134cr in Q3FY22

3. Occupancy ratio up from 58% in September to 65.4 in December

4. EBITDA 37.7% vs 16.8% YOY

Let’s look into some numbers:

1. FY22e PAT is expected to be in negative however much less severe than FY21a

2. Revenue up from ₹615cr in Q3FY21 to ₹1,134cr in Q3FY22

3. Occupancy ratio up from 58% in September to 65.4 in December

4. EBITDA 37.7% vs 16.8% YOY

(14/19)

Some industry specific numbers:

1. 9M Room revenue ₹598cr vs ₹271cr

2. 9M F&B Revenue ₹515cr Vs ₹228 cr

3. Other Revenue ₹365 cr Vs ₹267cr

4. 9M ARR in ₹ : ₹9,395 Vs ₹6,680cr

5. RevPAR in ₹ : ₹4,752 Vs ₹2,237cr

Some industry specific numbers:

1. 9M Room revenue ₹598cr vs ₹271cr

2. 9M F&B Revenue ₹515cr Vs ₹228 cr

3. Other Revenue ₹365 cr Vs ₹267cr

4. 9M ARR in ₹ : ₹9,395 Vs ₹6,680cr

5. RevPAR in ₹ : ₹4,752 Vs ₹2,237cr

(15/19)

It’s inventory:

Inventory by Geography-

• Domestic - 17360

• International - 2560

Inventory by Contract type-

• Group companies - 8547

• Management contract - 6888

• Holding Company - 4485

It’s inventory:

Inventory by Geography-

• Domestic - 17360

• International - 2560

Inventory by Contract type-

• Group companies - 8547

• Management contract - 6888

• Holding Company - 4485

(16/19)

Key risks-

1. Macro factors have a huge role to play in this sector. So any kind of slowdown will impact the demand

2. Key subsidiaries still continuing to make losses

3. Any delay in fast recovery will hamper the sentiment of investors

Key risks-

1. Macro factors have a huge role to play in this sector. So any kind of slowdown will impact the demand

2. Key subsidiaries still continuing to make losses

3. Any delay in fast recovery will hamper the sentiment of investors

(17/19)

Shareholding pattern:

1. Promoters - 41.1%

2. FII - 15.9%

3. DII - 25.2%

4. Others - 17.9%

Top shareholders:

1. HDFC AMC - 4.5%

2. Nippon life - 3.5%

3 SBI Fund Management - 3%

4. Amansa Capital - 2.3%

5. LIC - 2.1%

Shareholding pattern:

1. Promoters - 41.1%

2. FII - 15.9%

3. DII - 25.2%

4. Others - 17.9%

Top shareholders:

1. HDFC AMC - 4.5%

2. Nippon life - 3.5%

3 SBI Fund Management - 3%

4. Amansa Capital - 2.3%

5. LIC - 2.1%

(18/19)

Conclusion-

The overall hotel business is witnessing fast recovery in recent times with room demand outpacing room supply.

IHCL is expected to post good performance in Q4 however 3rd wave in January will have its impact on the numbers as well.

Conclusion-

The overall hotel business is witnessing fast recovery in recent times with room demand outpacing room supply.

IHCL is expected to post good performance in Q4 however 3rd wave in January will have its impact on the numbers as well.

(19/19)

Do you think the sluggish days for this sector is over or is there more to come!?

@caniravkaria @Jitendra_stock @PAlearner @ishmohit1 @varinder_bansal @kuttrapali26 @AvadhMaheshwar2 @datta_arvind @Arunstockguru @BandiShreyas

Do you think the sluggish days for this sector is over or is there more to come!?

@caniravkaria @Jitendra_stock @PAlearner @ishmohit1 @varinder_bansal @kuttrapali26 @AvadhMaheshwar2 @datta_arvind @Arunstockguru @BandiShreyas

• • •

Missing some Tweet in this thread? You can try to

force a refresh