An on-going list of 🧵 I’ve written on projects & narratives.

I didn’t expect followers so 🙏, figured I’d organize.

In crypto since 2013, and VC tech industry since 2008 as a 3x founder and investor. I write from that POV.

Give me a follow if you enjoy or want to connect 👇

I didn’t expect followers so 🙏, figured I’d organize.

In crypto since 2013, and VC tech industry since 2008 as a 3x founder and investor. I write from that POV.

Give me a follow if you enjoy or want to connect 👇

/ $LUNA

A #LUNAtic since early 2021. @terra_money is my highest conviction bet on my thesis around growth and utility of stable coins in crypto. With $UST as it’s core product, it’s the perfect blend of GTM strategy, product, design, team, community, investors.

Original 🧵👇

A #LUNAtic since early 2021. @terra_money is my highest conviction bet on my thesis around growth and utility of stable coins in crypto. With $UST as it’s core product, it’s the perfect blend of GTM strategy, product, design, team, community, investors.

Original 🧵👇

https://twitter.com/0xcha0s/status/1457777887684141068

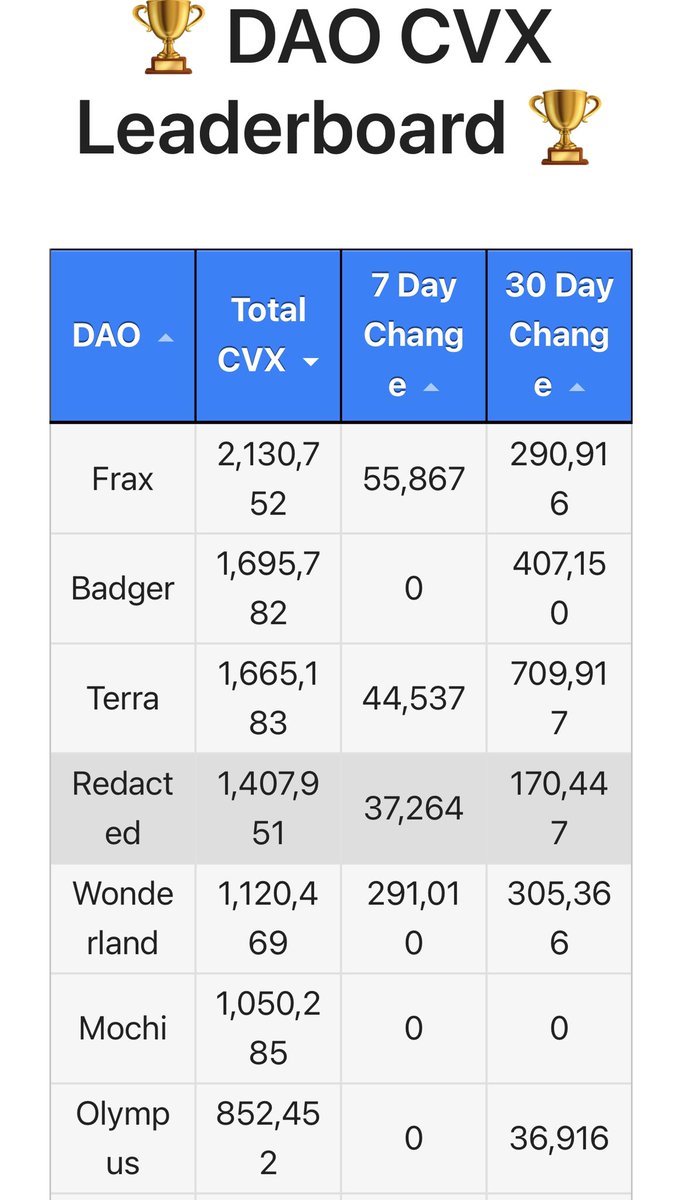

/ $CVX $CRV ecosystem

I started in DeFi in 2020 as a @CurveFinance OG. As my stablecoin thesis solidified, so did my CRV as DeFi liquidity center conviction.

@ConvexFinance is a levered bet on CRV. Stellar community, and pays out handsomely in yield. 💰

Latest post 👇

I started in DeFi in 2020 as a @CurveFinance OG. As my stablecoin thesis solidified, so did my CRV as DeFi liquidity center conviction.

@ConvexFinance is a levered bet on CRV. Stellar community, and pays out handsomely in yield. 💰

Latest post 👇

https://twitter.com/0xcha0s/status/1508907645658402824

/ $BNT

@Bancor since Dec 2020, and is one of my thesis picks for DeFi for the masses.

It’s unique AMM design is a moat. It’s DeFi for dummies.

I share the v2.1 limitations. I expect v3 release next month will melt faces.

Pre v3🧵 here, follow me for post v3 post soon👇

@Bancor since Dec 2020, and is one of my thesis picks for DeFi for the masses.

It’s unique AMM design is a moat. It’s DeFi for dummies.

I share the v2.1 limitations. I expect v3 release next month will melt faces.

Pre v3🧵 here, follow me for post v3 post soon👇

https://twitter.com/0xCha0s/status/1458903602630737929

/ $ASTRO

My thesis was every major L1 nation-state needs a core exchange and money market.

@astroport_fi is @terra_money premium dex. In 3 months, it’s become a top 3 dex in volume with support for $UNI + $CRV + $BAL type pool options.

Follow for on-going updates

OG post👇

My thesis was every major L1 nation-state needs a core exchange and money market.

@astroport_fi is @terra_money premium dex. In 3 months, it’s become a top 3 dex in volume with support for $UNI + $CRV + $BAL type pool options.

Follow for on-going updates

OG post👇

https://twitter.com/0xCha0s/status/1470953080044888072

/ $BTC 🤝 $UST

One of the boldest and strategic moves of @terra_money is the $10b target for #bitcoin reserves

Recaps and thoughts on @stablekwon first interview post-announcement was not surprisingly high engagement. 👇

One of the boldest and strategic moves of @terra_money is the $10b target for #bitcoin reserves

Recaps and thoughts on @stablekwon first interview post-announcement was not surprisingly high engagement. 👇

https://twitter.com/0xCha0s/status/1505006732250124289

/ DeFi Governance

Governance participation is important. It’s an active duty & will be a key narrative as we mature together as a community.

Highlighting an example of how activism works with effort and a @stablekwon push.

#LUNAtics mold your world vision. Votes are power

Governance participation is important. It’s an active duty & will be a key narrative as we mature together as a community.

Highlighting an example of how activism works with effort and a @stablekwon push.

#LUNAtics mold your world vision. Votes are power

https://twitter.com/0xCha0s/status/1488161858129436675

/ “Nations” vs “Businesses”

Web3 challenges existing mental models. Depending on a protocols approach and design, different eval frameworks should be applied.

L1’s are more like nation economies. Protocols like CVX might be better evaluating as a business.

I share 💭 here 👇

Web3 challenges existing mental models. Depending on a protocols approach and design, different eval frameworks should be applied.

L1’s are more like nation economies. Protocols like CVX might be better evaluating as a business.

I share 💭 here 👇

https://twitter.com/0xCha0s/status/1506741118775484423

/ $UST $FRAX

At this point you know my love of decentralized stables due to

🔹 censorship resistance

🔹 scalability

🔹 efficiency

Love @terra_money and @fraxfinance.

Shared thoughts on a d2pool to challenge incumbent 3pool and rationale below 👇

At this point you know my love of decentralized stables due to

🔹 censorship resistance

🔹 scalability

🔹 efficiency

Love @terra_money and @fraxfinance.

Shared thoughts on a d2pool to challenge incumbent 3pool and rationale below 👇

https://twitter.com/0xcha0s/status/1506444813838737408

• • •

Missing some Tweet in this thread? You can try to

force a refresh