Finally out! On the European Central Bank, technocracy, and one of the most painful chapters in European integration: the #ECB’s treatment of sovereign debt (going from 1988 till 2020)

A quick summary 👇 /1

#Openaccess academic.oup.com/ser/advance-ar…

A quick summary 👇 /1

#Openaccess academic.oup.com/ser/advance-ar…

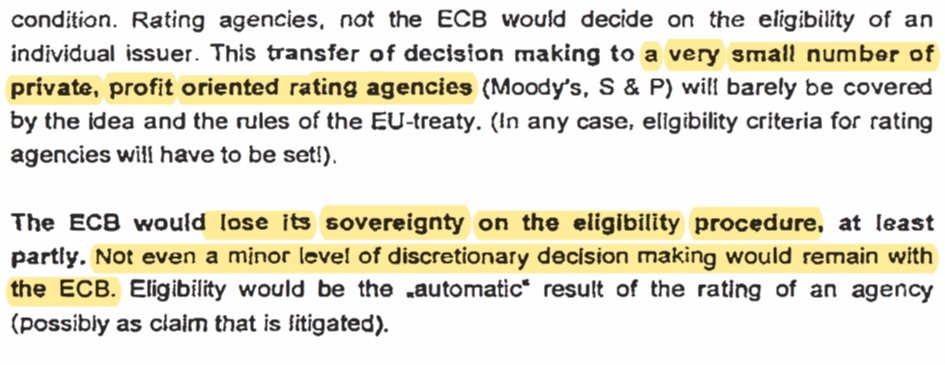

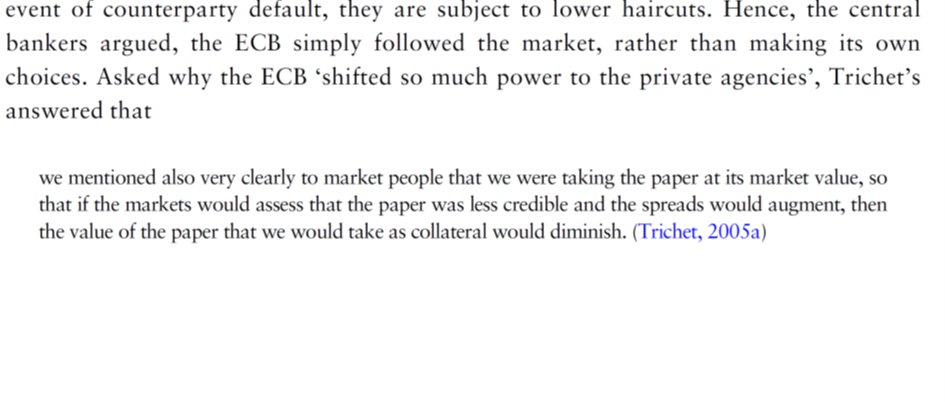

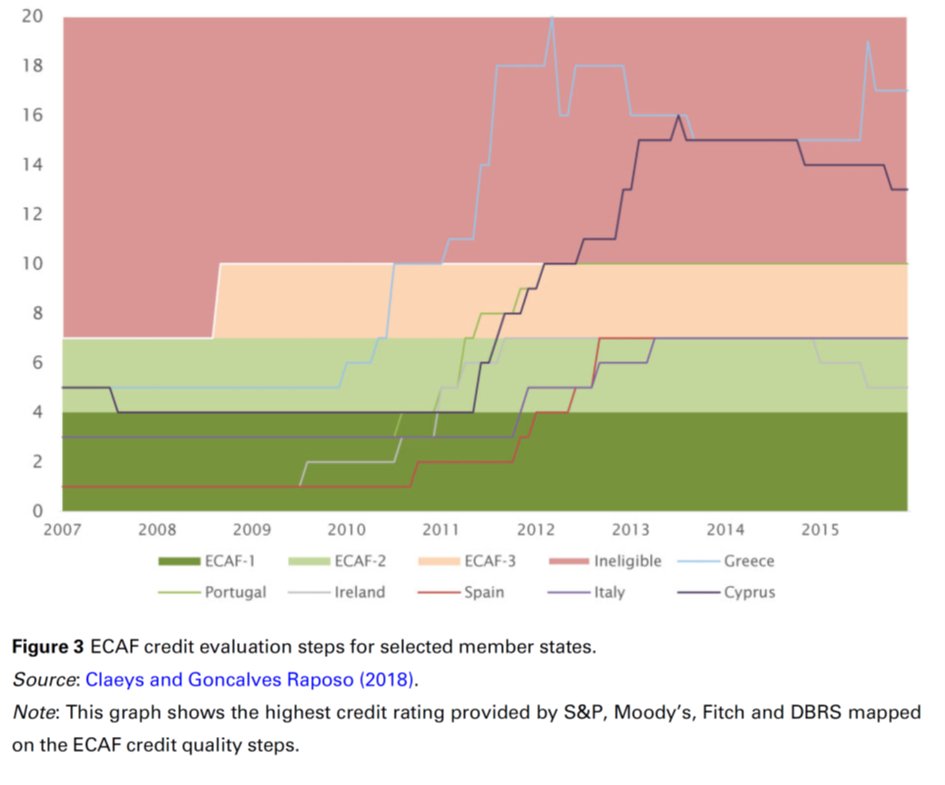

In 2005, the ECB’s treatment of sovereign debt became market-based. From then on, any government whose debt lost the approval of Moodys, S&P and @FitchRatings would no longer be accepted by the ECB /2

These strict rules placed the ECB right at the heart of the 2010-12 sovereign debt panic.

Using interviews and new archival sources I ask: Why didn’t the ECB do more to stabilize markets? And why was one mid-March video call enough to stop the 2020 panic? /3

Using interviews and new archival sources I ask: Why didn’t the ECB do more to stabilize markets? And why was one mid-March video call enough to stop the 2020 panic? /3

The archives show that in 1995 the @bundesbank had fought hard to resist a market-based treatment of sovereign debt /4

I explain the sudden turn to private credit ratings in 2005 through the efforts of board members #Trichet and #Issing to depoliticize the treatment of government debt – deliberately taking away the ECB’s discretion /5

That nuances Athanasios Orphanides‘s view on which the ECB used its 2005 collateral rule as ‘disciplining device against member states’ - the policy may have been a debacle, but not therefore a case of hawkish malice /6

The ECB's strategy worked initially, keeping debate about sovereign debt and collateral rules within a small circle of central bankers and financial market analysts /7

When credit ratings started to drop, however, the ECB’s staunch adherence to its self-imposed rules became a key driver of the 2010-12 bond market panic /8

But the ECB did learn! The 2010-12 debacle set the central bank up for a much more effective 2020 pandemic response, quickly casting away its self-imposed rules /9

However, the status of government debt remains shaky. (At least formally) the ECB still relies on credit ratings.

Rather than technocratic depoliticization, the treatment of government debt needs a genuine political answer: Only the EU member states can solve this issue /end

Rather than technocratic depoliticization, the treatment of government debt needs a genuine political answer: Only the EU member states can solve this issue /end

Article available open access here: academic.oup.com/ser/advance-ar…

Indebted like a state to Dirk Bezemer @bpdebruin @JoergBibow @gregclaeys @leahroseelydown @clemfon @DanielaGabor @PMehrling @steffenmurau @vivienaschmidt @MatthiasThiema3 @bruno_amable @smrwsk

Also in conversation with @BJMbraun @henning_randall @yanisvaroufakis @cornelban73 @nikdeboer @MatsGalvenius @pdegrauwe @WhelanKarl @ManuMoschella @adam_tooze @dmugge @KatharinaPistor @lexhoogduin @PhilippaSigl @maxkrahe @FlorianMKern @NewLeftEViews @PRoufos @nescio13

Maybe also of interest to @VMRConstancio @heimbergecon @willem_buiter @fwred @inesgraposo @FrancescoPapad1 @chrisvdkwaak @benoit_nguyen @BarthelemyEcon @SMerler @AerdtHouben @RensvanTilburg @DavidBokhorst @Lukkezen

• • •

Missing some Tweet in this thread? You can try to

force a refresh