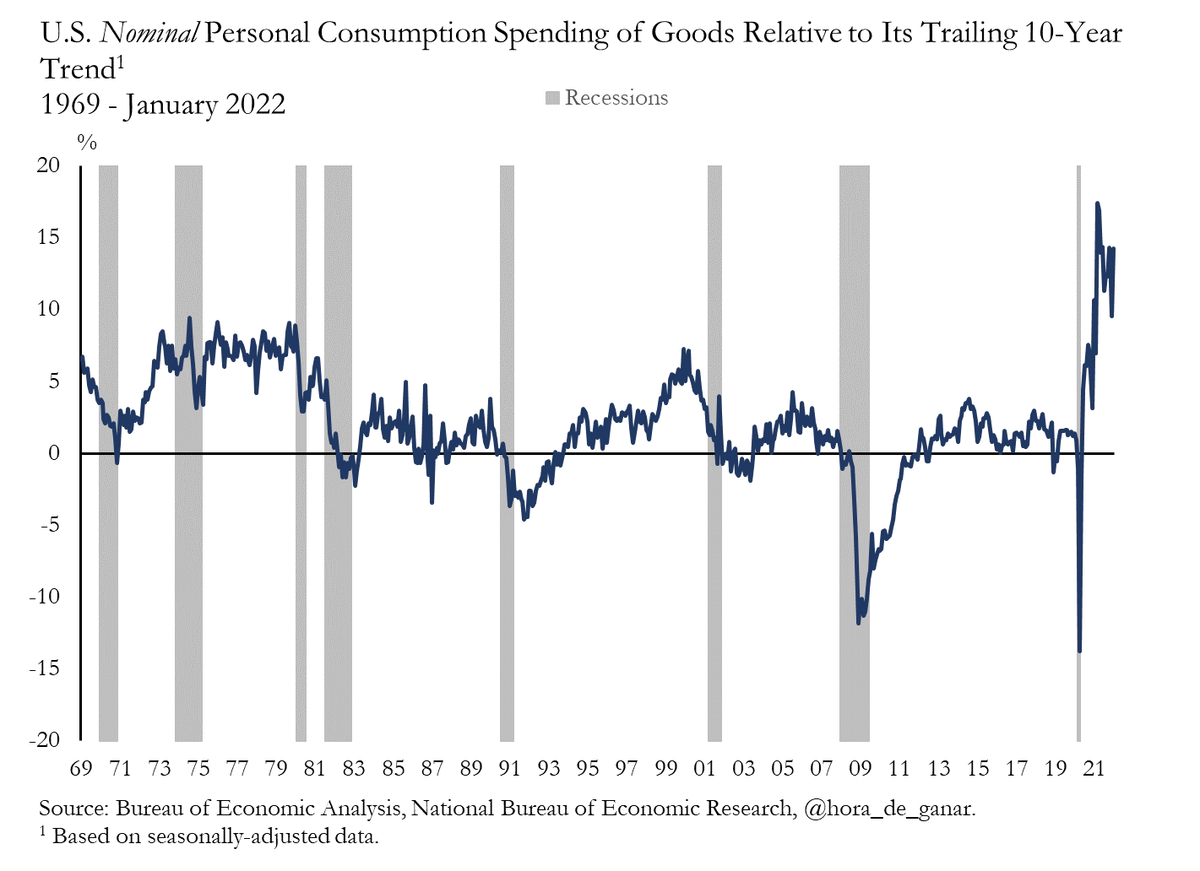

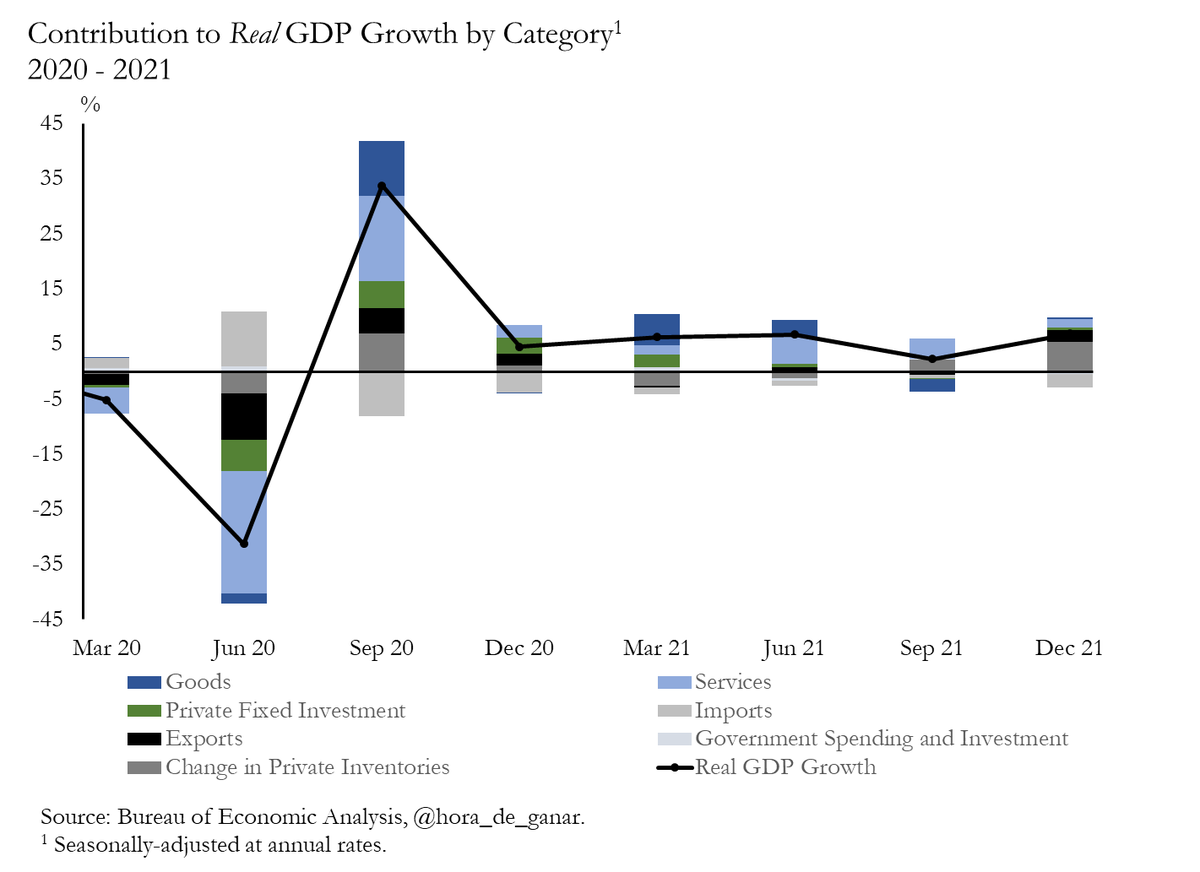

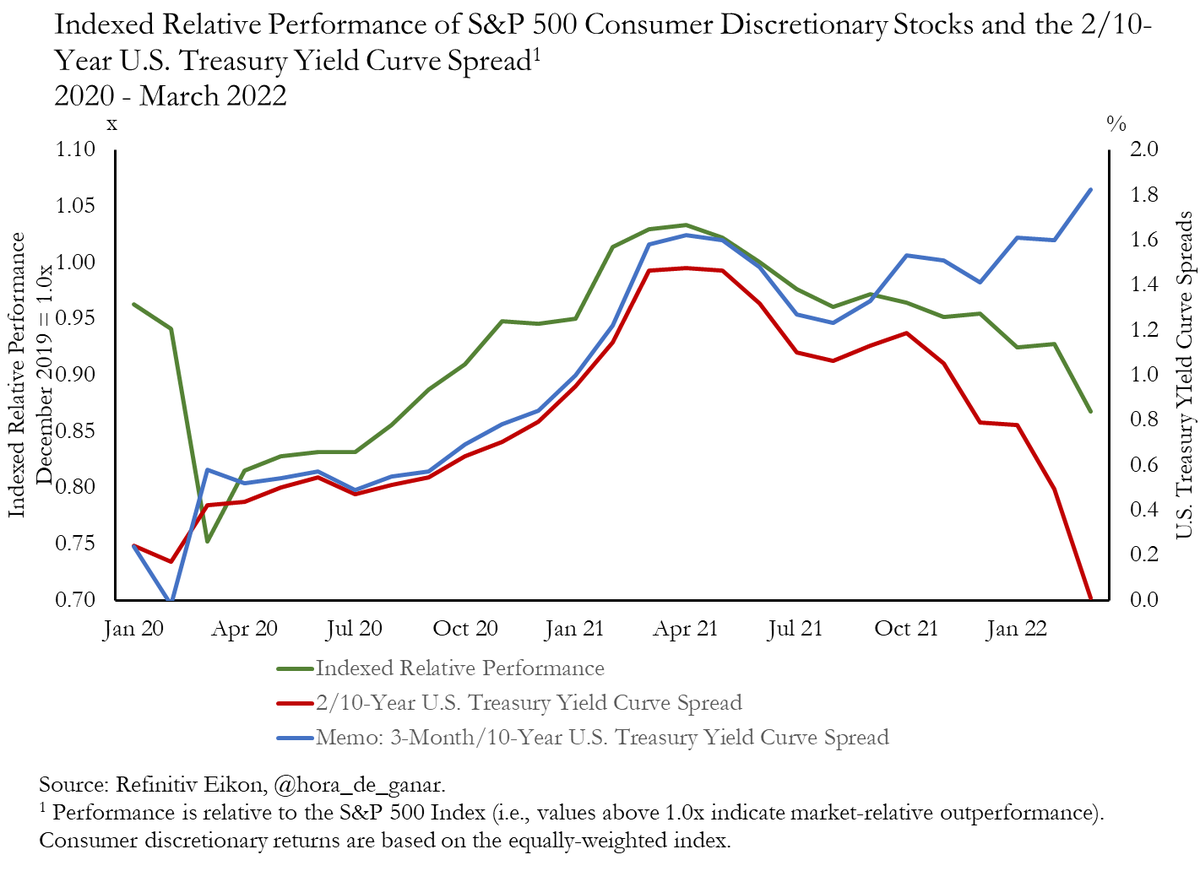

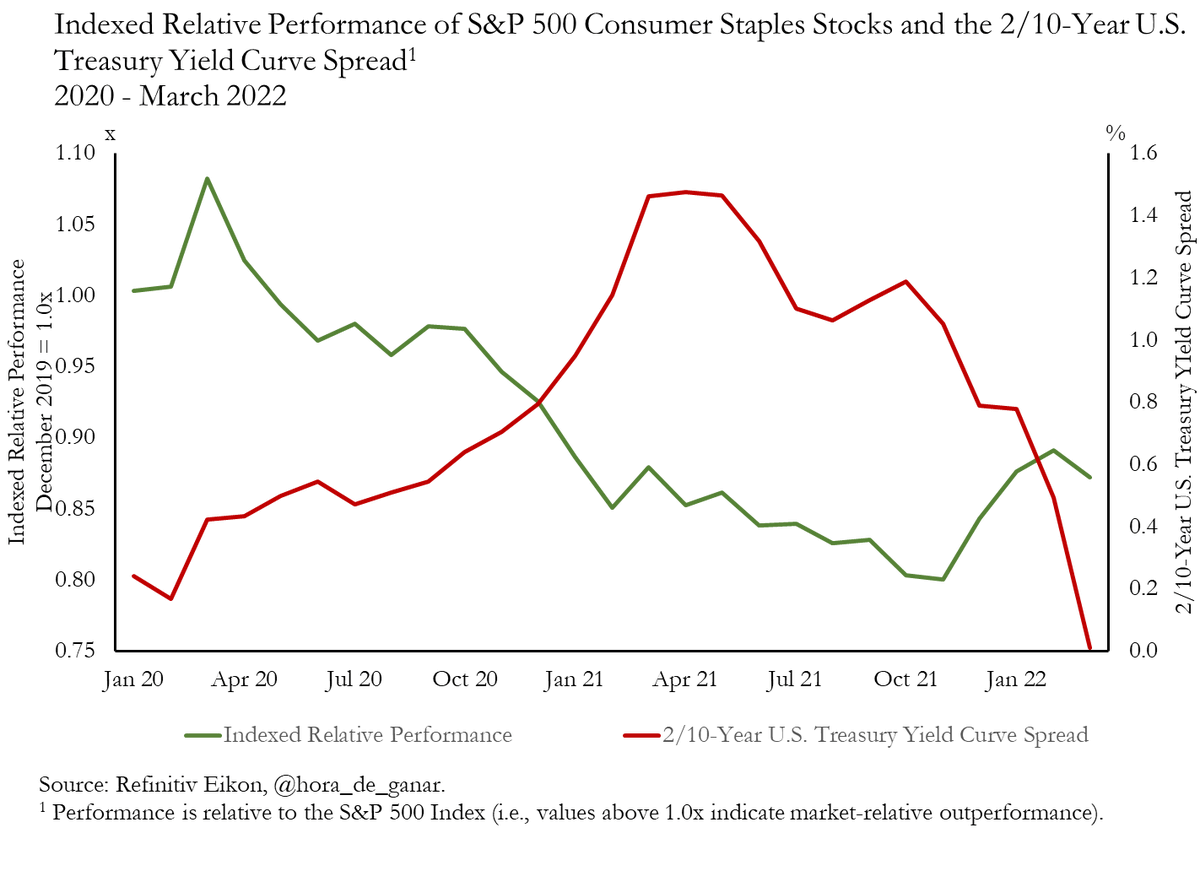

When real consumer goods spending has driven 50% of GDP growth post-pandemic, we should expect the message from the yield curve, that peaked in April of 2021, to agree with that of consumer discretionary stocks. Markets have been pricing slowing growth for a year now. 1/x

#SPX

#SPX

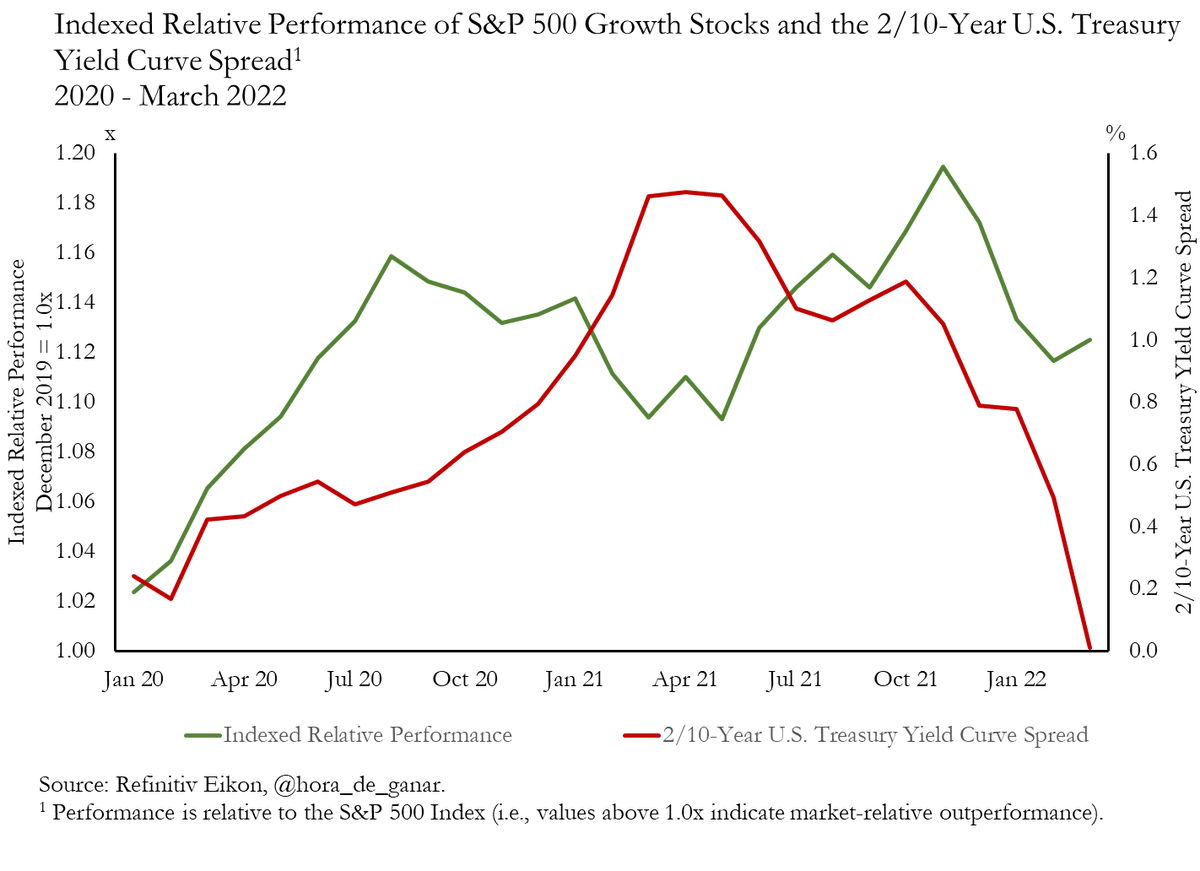

That was evident in growth stocks leading following the peak in the yield curve in Apr. ‘21. But then in October, STIR futures began selling off as Fed turned aggressive as short-end BEI made new highs and the appeal of growth stocks faded, while defensive stocks shined. 2/x

The question now is whether the outperformance of growth stocks of the last two weeks tells us something new about the growth path of the economy and whether we should bet on them rather than on defensives. 3/x

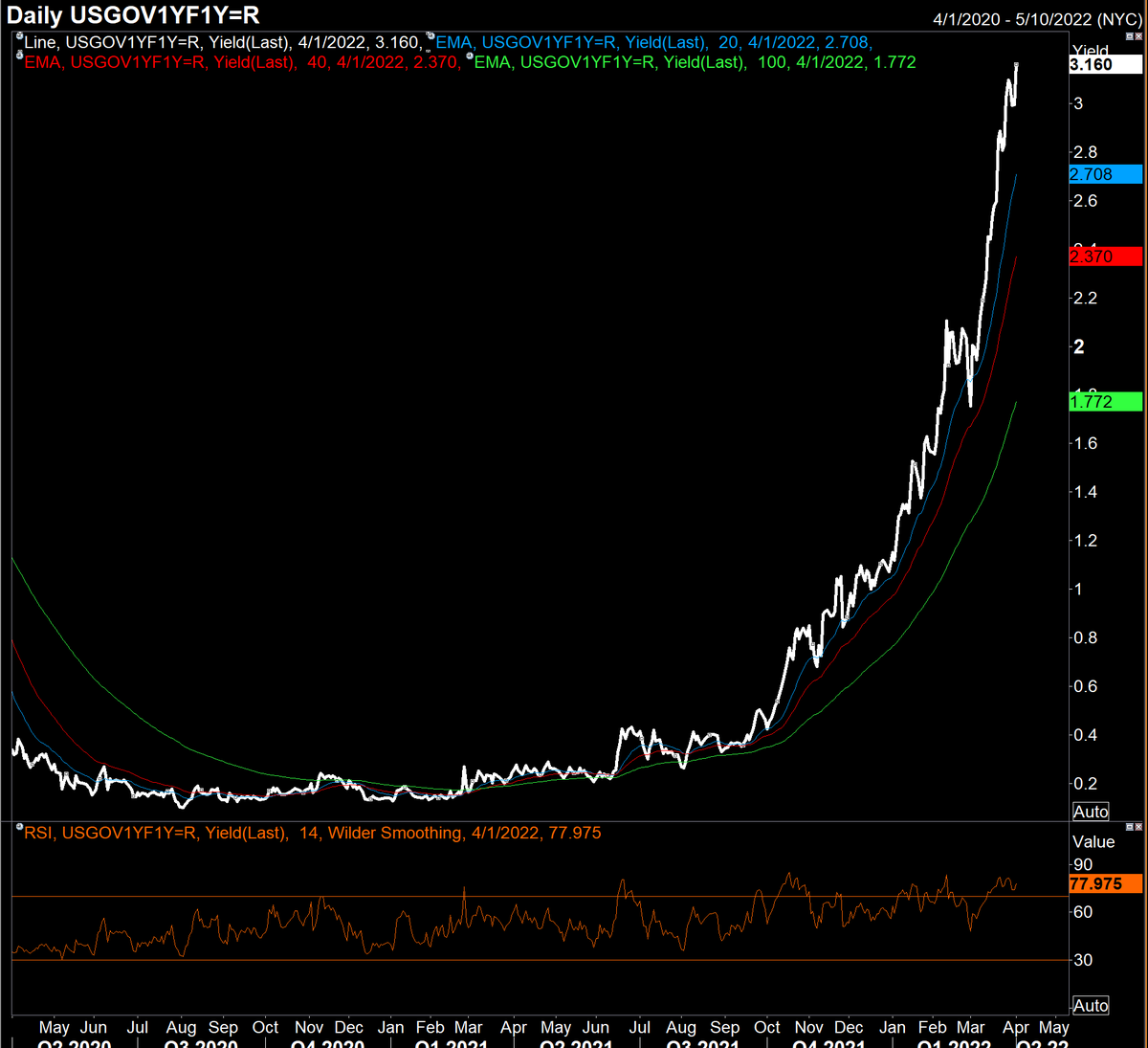

But as I mentioned, the slowing growth narrative has been playing out for a year now. No letup in rate pressure either, as there’s been no inflection in 1Yx1Y rates in the last two weeks. In other words, the recent appeal of growth stocks looks like a head-fake. 4/x

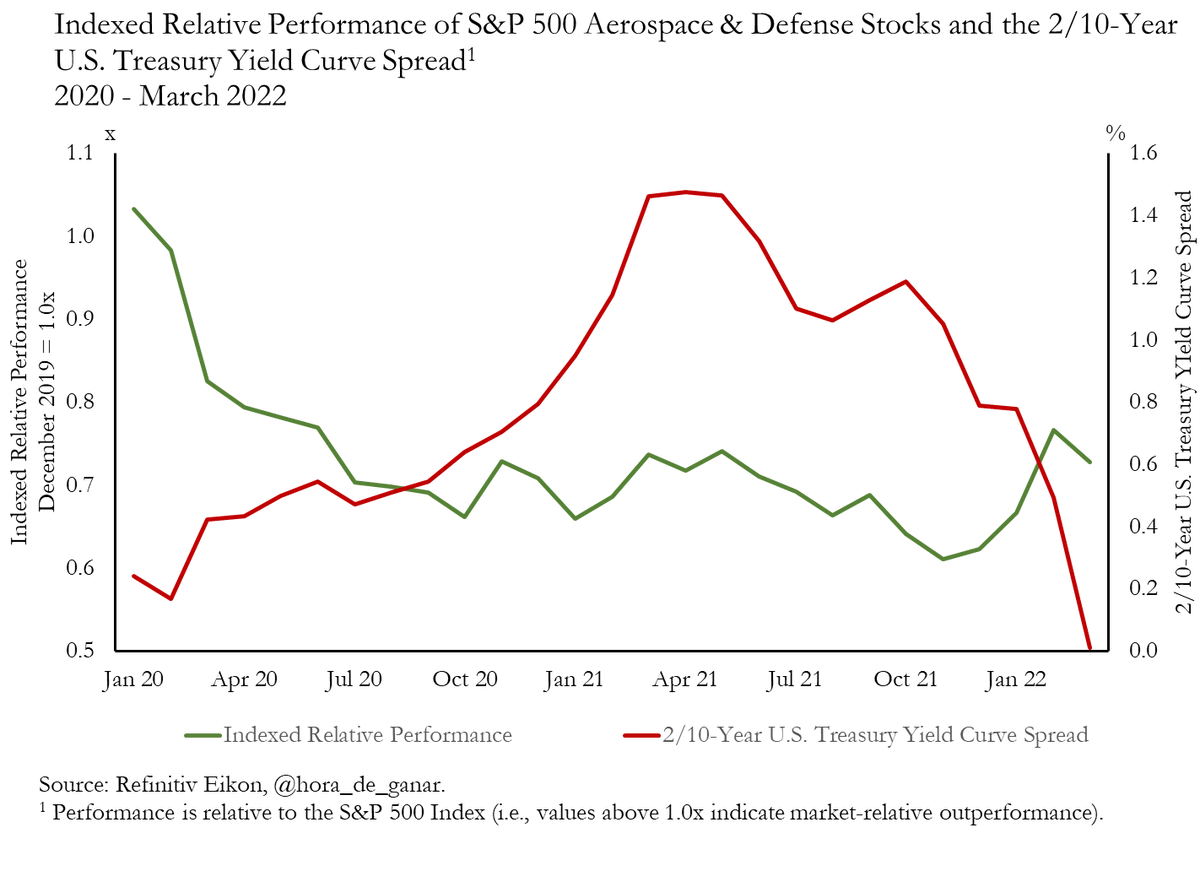

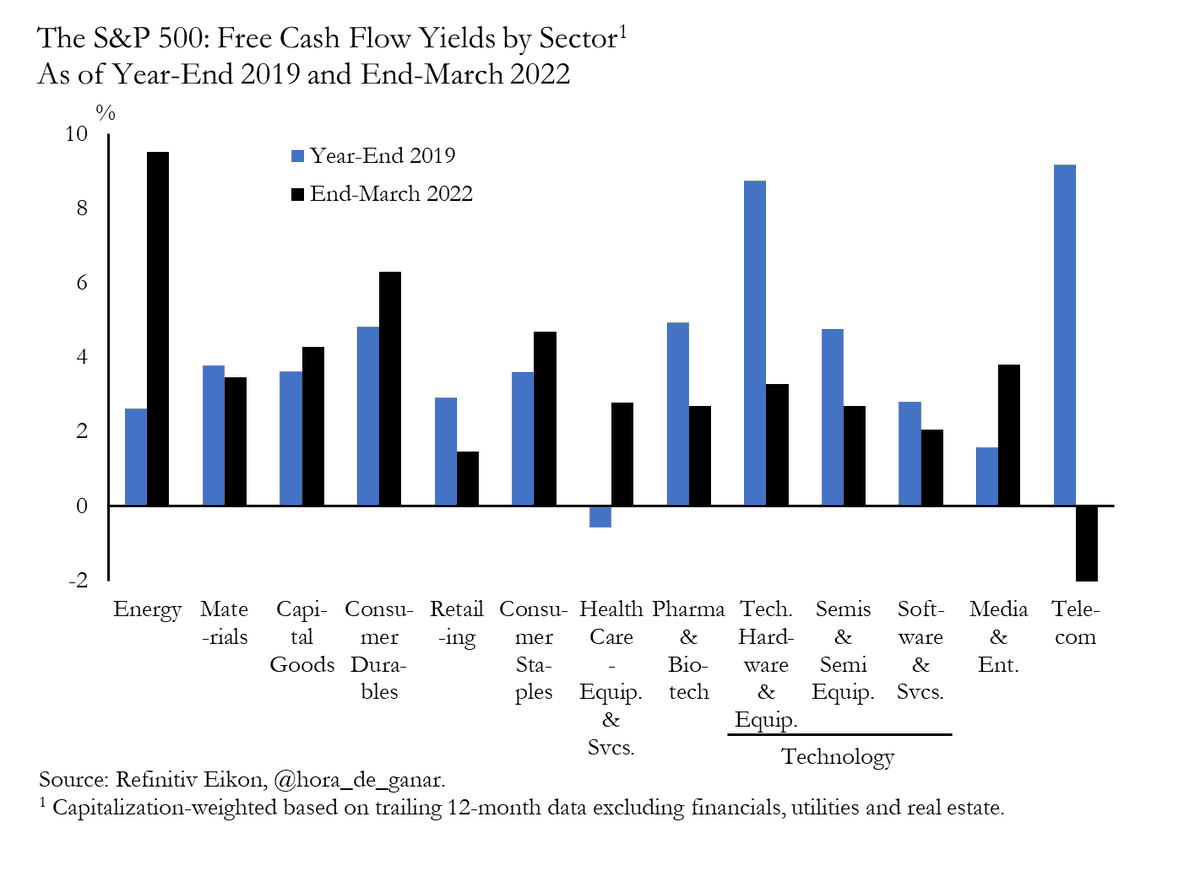

Through the rest of the cycle, I prefer consumer staples & defense over tech, as the dynamic that we saw emerge back in Q4 of last year should re-assert itself (i.e., betting on somewhat hard-landing scenario). Moreover, the margin of error for tech has narrowed post-Covid. 5/x

• • •

Missing some Tweet in this thread? You can try to

force a refresh