🚀 DeFi Growth Hacking 🚀

10 Steps To Increase Liquidity & Moon those Multiples

👇

🧵/

10 Steps To Increase Liquidity & Moon those Multiples

👇

🧵/

1/ Reward & encourage WASH TRADING

(树上开花 part 1)

Start off by paying all your users more wash-trading rewards than what they bleed out in trading fees:

e.g. Let ‘em buy at 40K, sell at 39.9K, get +0.2K rewards… buy at 40K, sell at 39.9K, get +0.2K rewards… Repeat.

(树上开花 part 1)

Start off by paying all your users more wash-trading rewards than what they bleed out in trading fees:

e.g. Let ‘em buy at 40K, sell at 39.9K, get +0.2K rewards… buy at 40K, sell at 39.9K, get +0.2K rewards… Repeat.

When the masses catch on, now you switch up the game:

only half ur users gain more in rewards than they bleed.

By the next trading epoch the bottom half'll be competing tooth & nail trading even more to get to the top.

Voila!

Sit back & watch ur `volume per user` count 📈📈

only half ur users gain more in rewards than they bleed.

By the next trading epoch the bottom half'll be competing tooth & nail trading even more to get to the top.

Voila!

Sit back & watch ur `volume per user` count 📈📈

2/ Build your own army of imaginary traders

(树上开花 part 2)

Organic user acquisition too hard? Why bother. Just make 1000 imaginary frens with 1000 unique wallets and press TRADE.

Top 3 benefits:

- 100% delta-hedged

- transaction fees = profit

- infinitely scalable

(树上开花 part 2)

Organic user acquisition too hard? Why bother. Just make 1000 imaginary frens with 1000 unique wallets and press TRADE.

Top 3 benefits:

- 100% delta-hedged

- transaction fees = profit

- infinitely scalable

3/ Build your own imaginary pools of liquidity

(无中生有)

Bootstrapping an AMM pool got too hard so just build a vAMM instead!

Why compete with Uniswap when u can just set K = 69696969. 👈👈 Some hella *deep* pool right here.

(无中生有)

Bootstrapping an AMM pool got too hard so just build a vAMM instead!

Why compete with Uniswap when u can just set K = 69696969. 👈👈 Some hella *deep* pool right here.

4/ Make some arbitrage for others to take ... if you can afford it 🍗

Every time your price matches the rest of the market’s just have a trustworthy fren (see #2) stir up some trouble and move your price off the mark.

Some speedy whale is bound to come in & chew through xy=k.

Every time your price matches the rest of the market’s just have a trustworthy fren (see #2) stir up some trouble and move your price off the mark.

Some speedy whale is bound to come in & chew through xy=k.

5/ Dilute old users to acquire new users

(李代桃僵)

Always rug the old.

See, new users have 100% lifetime value left in them whereas old users u already milked some, maybe even most, of their value.

#airdrops !!!

(李代桃僵)

Always rug the old.

See, new users have 100% lifetime value left in them whereas old users u already milked some, maybe even most, of their value.

#airdrops !!!

6/ Call everything by its opposite name, to confuse

(混水摸魚)

What is impermanent loss?

Well it’s a lotta things, but impermanent ain’t one.

Hot tip: confused users are great users.

(混水摸魚)

What is impermanent loss?

Well it’s a lotta things, but impermanent ain’t one.

Hot tip: confused users are great users.

7/ Finger-trap users so they can’t get out after getting in

(上屋抽梯)

Learn from the pros:

(1) Olympus DAO

(2) Bitclout

(3) Perpetual protocol

Ok so technically there’s one way to get out:

twiddle-dumb needs to convince twiddle-dumber to take his place.

(上屋抽梯)

Learn from the pros:

(1) Olympus DAO

(2) Bitclout

(3) Perpetual protocol

Ok so technically there’s one way to get out:

twiddle-dumb needs to convince twiddle-dumber to take his place.

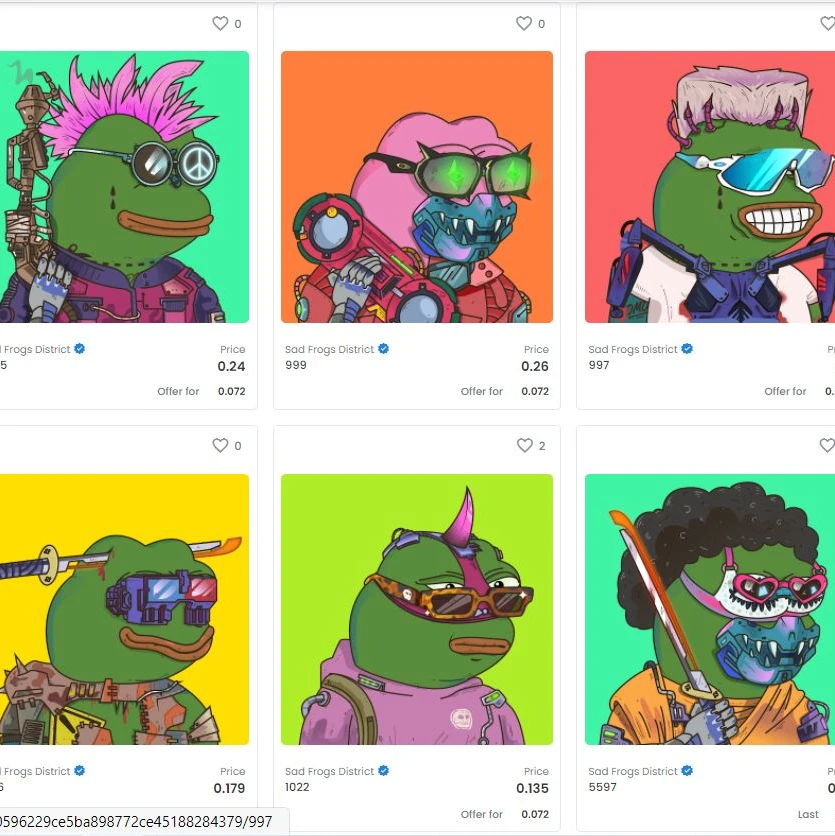

9/ Release an NFT that has nothing to do with your Dex but SEIZE THE HYPE TRAIN while it lasts

(顺手牵羊)

(顺手牵羊)

10/ Definitely do NOT let your VCs know you are using these strategies

(瞒天过海)

... unless they appreciate the meta game...

... but they all invested in so many competitors!

Chivalry ded in metaverse 😡🗯️

Never leak ur alpha!

(瞒天过海)

... unless they appreciate the meta game...

... but they all invested in so many competitors!

Chivalry ded in metaverse 😡🗯️

Never leak ur alpha!

End/

Happy April Fools frenz!

U can read the full article on @DeribitInsights:

insights.deribit.com/market-researc…

Happy April Fools frenz!

U can read the full article on @DeribitInsights:

insights.deribit.com/market-researc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh