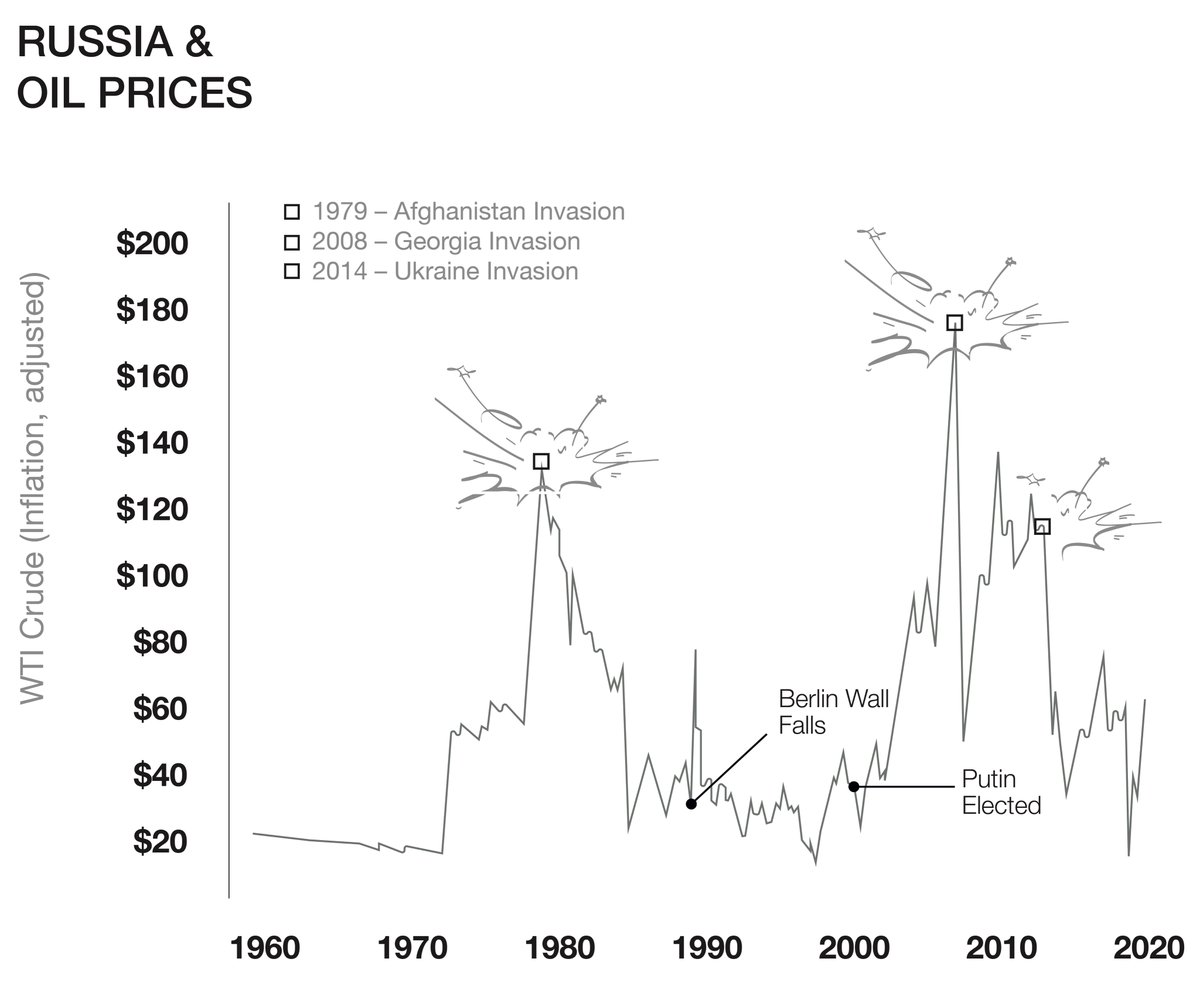

There was a solution to the green problem but it involved deepening European-Russian relations. Crazy how we have terrible war because so many people keep Climate & Geopolitics in separate silos & are unable to do 'joined-up thinking'. #GeopoliticsOfGHGs

https://twitter.com/SStapczynski/status/1510552308417204226

we proposed this #GeopoliticsOfGHGs solution in 2019 researchgate.net/publication/33…

https://twitter.com/70sBachchan/status/1275444557191147527

We'll never know if West-Russia negotiations were done in good faith. December-January 2022:"German Economics Minister Robert Habeck wants to engage Russia economically by cooperating on renewable energy supplies to help de-escalate tensions over Ukraine"

https://twitter.com/policytensor/status/1472177268785045504

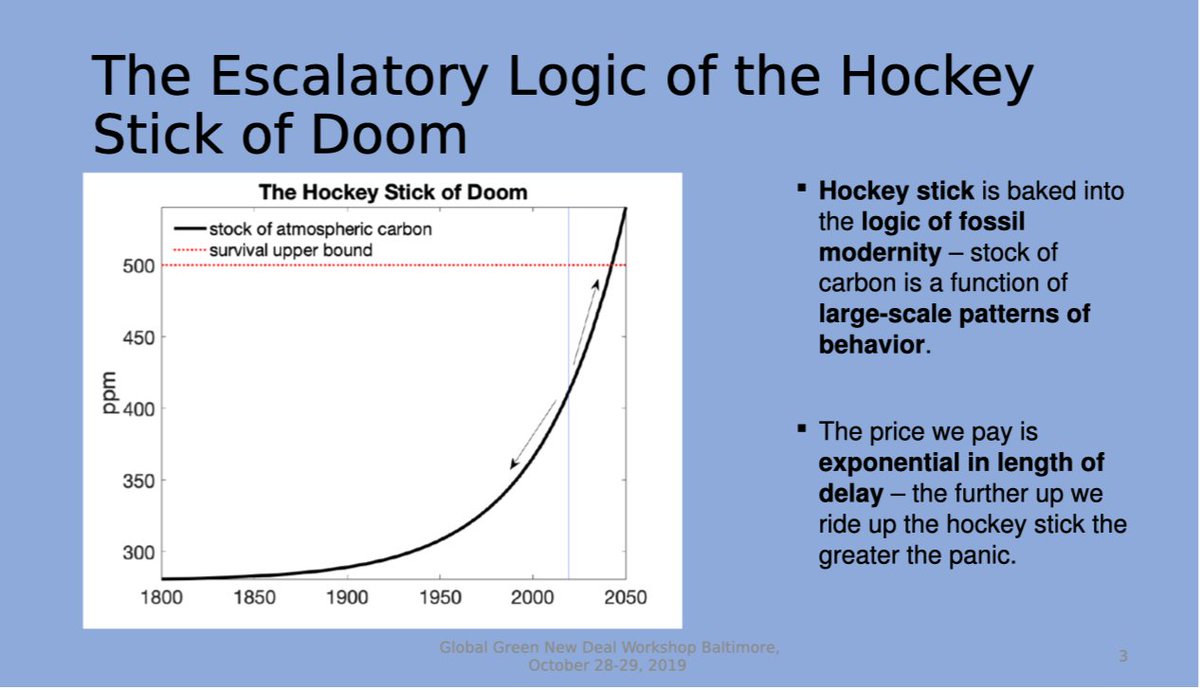

4/ Its so horribly sad. If we don't have political actors negotiating for a a rational phaseout of fossil fuels we are going to get bloodbaths with irrational actors feeling like they have no future and willing to risk everything.

Our #GeopoliticsOfGHGs: researchgate.net/publication/33…

Our #GeopoliticsOfGHGs: researchgate.net/publication/33…

5/ It's Mutually Assured Destruction for Russia, China, US to remain🌎largest producers of Oil & Gas & Coal. Each suffers Billion $+ disasters. Damage done by Atlantic hurricanes in 2017 was more than HALF the Pentagon's budget! Boreal fires choke Russians

https://twitter.com/70sBachchan/status/1451192784119951378

• • •

Missing some Tweet in this thread? You can try to

force a refresh