@fraxfinance @terra_money 4pool. Hot takes from each camp - curve wars over? dai dies? wen 4pool?

I have a unique pov as I'm the intersection of each camp - curve OG, #lunatic, #fraximalist

🔹 overview of 4pool

🔹 $crv wars season 2

🔹 $cvx math games

🔹 4pool endgame

🧵👇

I have a unique pov as I'm the intersection of each camp - curve OG, #lunatic, #fraximalist

🔹 overview of 4pool

🔹 $crv wars season 2

🔹 $cvx math games

🔹 4pool endgame

🧵👇

/ overview of 4pool

First, 4pool motivation from @samkazemian, @fraxfinance founder

🔹 $crv vision - 'savings account for defi'

🔹 $cvx role - prof money manager for @CurveFinance

🔹 4pool role - postive sum, not zero sum ethos

First, 4pool motivation from @samkazemian, @fraxfinance founder

🔹 $crv vision - 'savings account for defi'

🔹 $cvx role - prof money manager for @CurveFinance

🔹 4pool role - postive sum, not zero sum ethos

https://twitter.com/samkazemian/status/1510340791712944129?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ why 4pool

But it doesn't go into why 4pool?

That is actually a multi-billion dollar question. I foreshadowed $ust $frax partnership and the math behind it.

tldr - 3crv is inefficient to scale because of dai & removing will level playing field.

But it doesn't go into why 4pool?

That is actually a multi-billion dollar question. I foreshadowed $ust $frax partnership and the math behind it.

tldr - 3crv is inefficient to scale because of dai & removing will level playing field.

https://twitter.com/0xCha0s/status/1506444813838737408?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ 3crv scalability

This pov isn't just from the #lunatics #fraximalists camp. It's something that is understood and is actively being discussed on @CurveFinance

This pov isn't just from the #lunatics #fraximalists camp. It's something that is understood and is actively being discussed on @CurveFinance

https://twitter.com/CurveFinance/status/1510335188198469632?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ dai dies? - absolutely not

@korpi87 sums up well. Reality is $dai out of 3crv != death

It just means no more free lunch. $mkr has to participate in #curvewars just like everyone else to succeed. That's a good thing, but not a catchy 'dai must die' 🤷♂️

@korpi87 sums up well. Reality is $dai out of 3crv != death

It just means no more free lunch. $mkr has to participate in #curvewars just like everyone else to succeed. That's a good thing, but not a catchy 'dai must die' 🤷♂️

https://twitter.com/korpi87/status/1510390934709706753?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ narratives - $crv wars

Let's talk narratives #curvewars. What I am seeing is an end to season 1, and a start of season 2. What?!

🔹 season 1 - how to play the game - $cvx

🔹 season 2 - changing the game - 4pool

Think of szn 1 as establishing frameworks of gameplay🧠

Let's talk narratives #curvewars. What I am seeing is an end to season 1, and a start of season 2. What?!

🔹 season 1 - how to play the game - $cvx

🔹 season 2 - changing the game - 4pool

Think of szn 1 as establishing frameworks of gameplay🧠

/ #curvewars season 1

@samkazemian mentioned $cvx is the professional money management for $crv. It's actually more than that. It introduces several layers to $crv game play 🧠

1⃣ money manager

2⃣ rent votes

3⃣ own votes

$cvx overview 👇

@samkazemian mentioned $cvx is the professional money management for $crv. It's actually more than that. It introduces several layers to $crv game play 🧠

1⃣ money manager

2⃣ rent votes

3⃣ own votes

$cvx overview 👇

https://twitter.com/0xCha0s/status/1508907645658402824?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ #curvewars framework

Each layer mentioned is independent - money manager, renting, owning.

You can participate in none, 1, 2 or all 3. That is the beauty of $cvx. But if you do all three - roi 📈. It becomes a competitive advantage *by design*, show math pls?

Each layer mentioned is independent - money manager, renting, owning.

You can participate in none, 1, 2 or all 3. That is the beauty of $cvx. But if you do all three - roi 📈. It becomes a competitive advantage *by design*, show math pls?

/ $cvx as a money manager

From the lens of @fraxfinance @terra_money

🔹 Top 2 in TVL in all stables

🔹 $ust $frax 💵 use this service themself, earning 2x yield vs direct on curve

As LPs they get $crv + $cvx emissions, this matters later

From the lens of @fraxfinance @terra_money

🔹 Top 2 in TVL in all stables

🔹 $ust $frax 💵 use this service themself, earning 2x yield vs direct on curve

As LPs they get $crv + $cvx emissions, this matters later

/ $cvx to rent votes

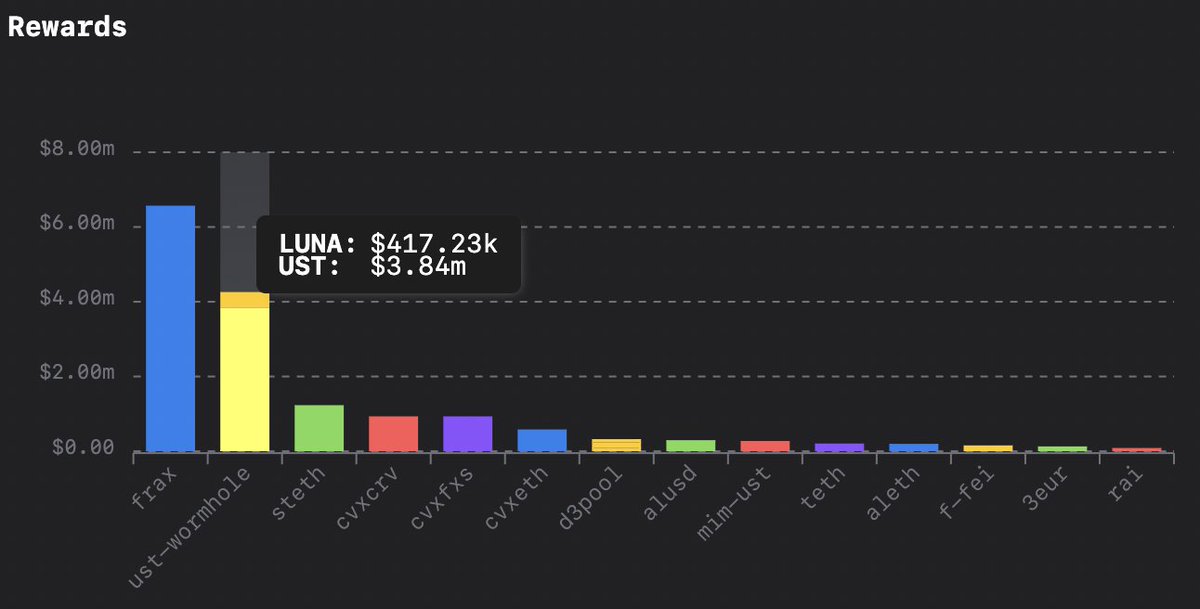

@fraxfinance @terra_money are the top two renters of voting power. Combined bid - $11m of $16m total bribes (67% of votes)

For every $1 spent, they controlled $1.55 worth of $crv $cvx emissions or $17m for their LP - this process repeats every 2 wk

@fraxfinance @terra_money are the top two renters of voting power. Combined bid - $11m of $16m total bribes (67% of votes)

For every $1 spent, they controlled $1.55 worth of $crv $cvx emissions or $17m for their LP - this process repeats every 2 wk

/ $cvx to own votes

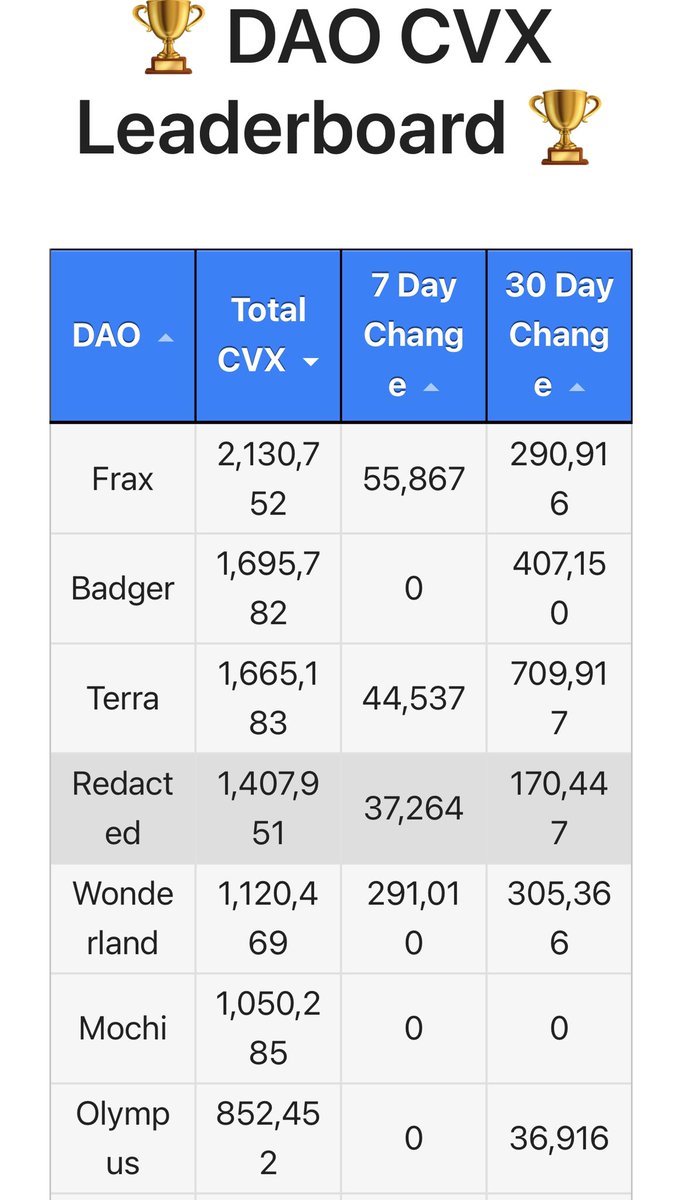

$fxs $luna realized you can own a piece too. As #1 and #3, they rep 8.1% of the pie.

Owning $cvx makes their bids more efficient. Ex. terra

🔹$4m ust bribe rd 14

🔹$.65 ust recyled rd 15

@terra_money bribes are 16% more efficient than if no $cvx

$fxs $luna realized you can own a piece too. As #1 and #3, they rep 8.1% of the pie.

Owning $cvx makes their bids more efficient. Ex. terra

🔹$4m ust bribe rd 14

🔹$.65 ust recyled rd 15

@terra_money bribes are 16% more efficient than if no $cvx

/ #curvewars playbook

@fraxfinance created the best practice playbook for protocols invested in $crv economy.

@terra_money quickly adapted. They both are invested in $crv long-term via $cvx because it's a cost of the business of stables.

@fraxfinance created the best practice playbook for protocols invested in $crv economy.

@terra_money quickly adapted. They both are invested in $crv long-term via $cvx because it's a cost of the business of stables.

https://twitter.com/samkazemian/status/1510169882364502017?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ #curvewars season 2

Now, it's about changing the $crv gameboard, and exerting influence. Remember, $luna and $fxs are long-term eco participants

🔹 LP - what is a more optimal way to LP

🔹 rent - maximize $ roi

🔹 own - leverage ownership %

Now, it's about changing the $crv gameboard, and exerting influence. Remember, $luna and $fxs are long-term eco participants

🔹 LP - what is a more optimal way to LP

🔹 rent - maximize $ roi

🔹 own - leverage ownership %

https://twitter.com/samkazemian/status/1510169882364502017?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ $cvx math games

4pool breaks the old framework.

What happens when 67% of bribes go to 1 pool?

rd 14 ex - $10.8 bribes => $16.8m📈 emissions, liquidity black hole. POL of $frax $ust more lucrative $crv $cvx emissions.

$ust $frax scale $crv while maintaining peg together

4pool breaks the old framework.

What happens when 67% of bribes go to 1 pool?

rd 14 ex - $10.8 bribes => $16.8m📈 emissions, liquidity black hole. POL of $frax $ust more lucrative $crv $cvx emissions.

$ust $frax scale $crv while maintaining peg together

/ 3crv effects - the math

If $dai removed, they'll just have to incentivize like everyone else - or risk losing ground to other stables protocols.

If $dai removed, they'll just have to incentivize like everyone else - or risk losing ground to other stables protocols.

https://twitter.com/crypto_condom/status/1510648576791261186?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ have we lost the plot

But in all this hoopla, @joey__santoro asked the right question. What about decentralization? Wasn't the point of $ust $frax to remove dependence on centralized stables like $usdc $usdt? Have we lost the plot?

But in all this hoopla, @joey__santoro asked the right question. What about decentralization? Wasn't the point of $ust $frax to remove dependence on centralized stables like $usdc $usdt? Have we lost the plot?

https://twitter.com/joey__santoro/status/1510338537291280386?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ 4pool is not the endgame

@stablekwon @samkazemian are just getting started. Growing centralized stables isn’t the goal, but necessary as they are off ramps (for now)

@stablekwon @samkazemian are just getting started. Growing centralized stables isn’t the goal, but necessary as they are off ramps (for now)

https://twitter.com/0xCha0s/status/1510464631810187268?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ 4pool roadmap

The roadmap will take time⌛️, not even step 1

🔹 Establish 4pool

🔹 3crv pools => 4pool

🔹 $ust grows on on/off ramps, $frax $ust focus on defi utility

🔹 $ust $frax new defacto d2pool when less reliant on $usdc $usdt ramps

The roadmap will take time⌛️, not even step 1

🔹 Establish 4pool

🔹 3crv pools => 4pool

🔹 $ust grows on on/off ramps, $frax $ust focus on defi utility

🔹 $ust $frax new defacto d2pool when less reliant on $usdc $usdt ramps

/ key takeaways

🔹 $crv wars not over, just evolved

🔹 $luna $frax don't need to own any $cvx, just the majority of the bribes

🔹 $cvx 📈 ownership + POL makes 🎡 stronger 🔥

🔹 @terra_money @fraxfinance will grow $crv, and $cvx is the levered play 💰

🔹 $crv wars not over, just evolved

🔹 $luna $frax don't need to own any $cvx, just the majority of the bribes

🔹 $cvx 📈 ownership + POL makes 🎡 stronger 🔥

🔹 @terra_money @fraxfinance will grow $crv, and $cvx is the levered play 💰

https://twitter.com/wagmiAlexander/status/1510722855138324482?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ thank you

This post was for #curvewars #lunatics #fraximalists

Pls share original post if helpful 🙏

This post was for #curvewars #lunatics #fraximalists

Pls share original post if helpful 🙏

https://twitter.com/0xCha0s/status/1510804760261283847?s=20&t=XZJbAGzf4ai1z4-f4BVslg

/ would love a share of this perspective

#CurveWars

@crypto_condom

@DefiMoon

@CurveCap

@CredibleCrypto

#Lunatics

@Cephii1

@danku_r

@CryptoHarry_

@lejimmy

@ItsAlwaysZonny

#fraximalists

@samkazemian

@kamikaz_ETH

@Rewkang

@knowerofmarkets

#CurveWars

@crypto_condom

@DefiMoon

@CurveCap

@CredibleCrypto

#Lunatics

@Cephii1

@danku_r

@CryptoHarry_

@lejimmy

@ItsAlwaysZonny

#fraximalists

@samkazemian

@kamikaz_ETH

@Rewkang

@knowerofmarkets

• • •

Missing some Tweet in this thread? You can try to

force a refresh