#ZenTechnologies - An Innovator In Defence Training Solutions ✈

A Thread ! 🧵🧵

Like & retweet for Max Reach !!

Link :

A Thread ! 🧵🧵

Like & retweet for Max Reach !!

Link :

1. Company Overview

Zen technologies develops and manufactures defence training simulators, drones and anti-drone systems. They mainly serve the Ministry of Defence

Zen technologies develops and manufactures defence training simulators, drones and anti-drone systems. They mainly serve the Ministry of Defence

Government of India and its Armed Forces, Security Forces and Paramilitary Forces. They develop state of the art simulators and other equipment that mimic real combat situations for the purpose of training armed forces.

Additionally, the company also provides live in-person simulations and has developed drones and anti-drone systems.

2. Business Segments:

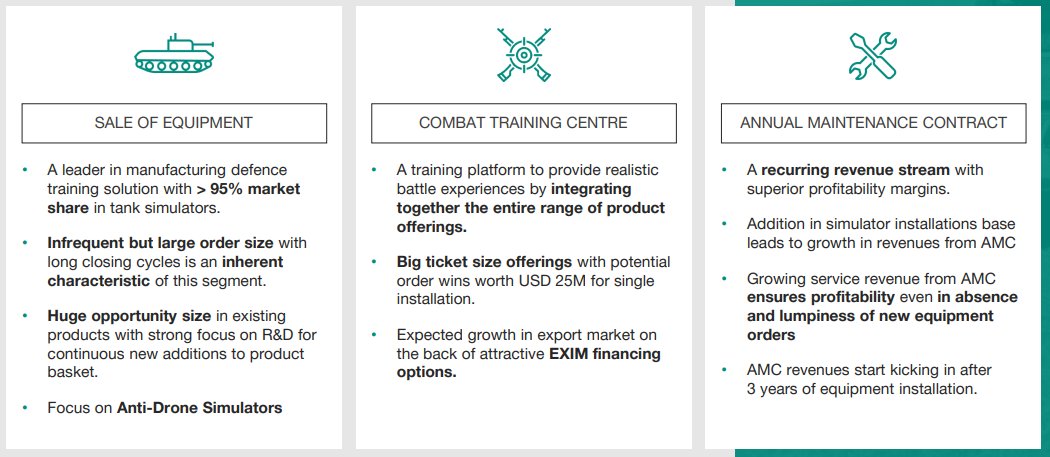

The company has 3 main business segments - Sale Of Equipment, Combat Training Centres and Annual Maintenance Contracts (AMC).

The company has 3 main business segments - Sale Of Equipment, Combat Training Centres and Annual Maintenance Contracts (AMC).

The Tank Simulator is their biggest product in which they have 95% market share. The company has also been growing the AMC segment over the past few years. The AMCs provide the company with annuity revenues derived from product sales made in the past. Not all customers enter

into an equipment maintenance contract with them, but with those who do, the company can potentially generate revenues equivalent to 120% of the initial product sales value over a period of 15 years.

3. Asset Light Model

The company chooses to focus on R&D and has outsourced most of the manufacturing of their products. This gives them the ability to ramp up production significantly if they receive a large order without investing too much into creating capacities.

The company chooses to focus on R&D and has outsourced most of the manufacturing of their products. This gives them the ability to ramp up production significantly if they receive a large order without investing too much into creating capacities.

More than 85% of the company’s manufacturing functions are outsourced which transforms their fixed costs to variable costs

5. Competitive Advantage

The business of the company is mostly R&D based. The company spent 17% of cumulative sales of the past 5 years on R&D. The company has no domestic competitors who develop their products.

The business of the company is mostly R&D based. The company spent 17% of cumulative sales of the past 5 years on R&D. The company has no domestic competitors who develop their products.

Most Indian players in this segment license the technology and focus only on manufacturing. The Indian government’s focus on indigenous development and manufacturing gives the company an advantage over its foreign competitors.

The company also offers a unique service - Zen Combat Training Center. It is a one stop training solution for armed forces and state police forces. It combines live fire, instrumented training and virtual training to set up an all-encompassing solution

which enables coordinated team training under various realistic threat scenarios. The company has no competitors in this segment.

6. New Products

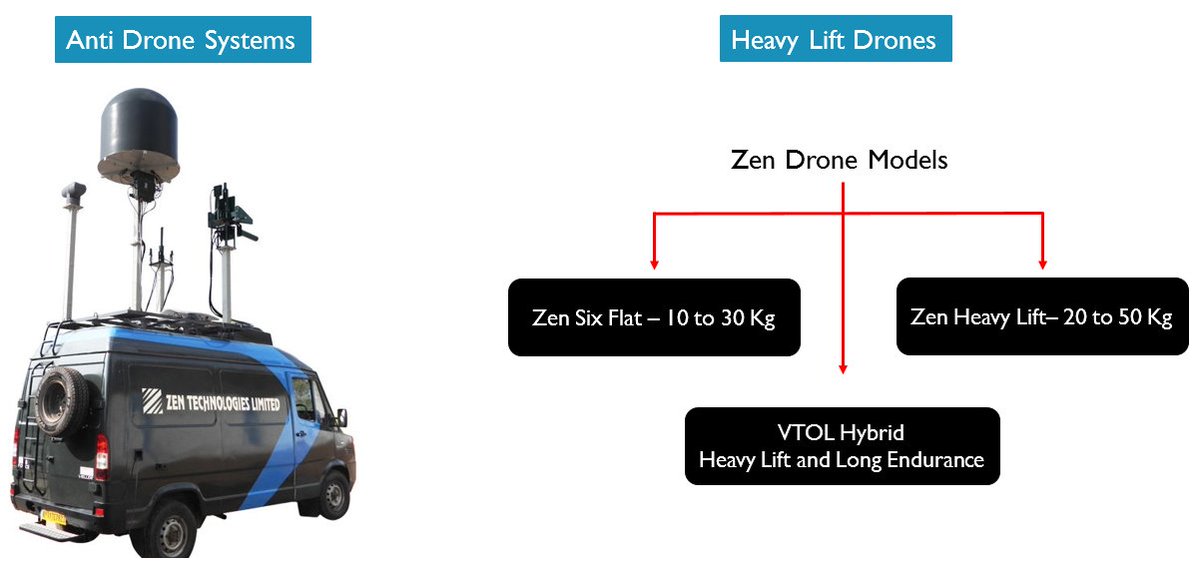

The company has developed new products like drones, anti-drones systems and their simulators for training viz. Integrated Air Defense Combat Simulators, drone simulators and anti-drone simulators.

The company has developed new products like drones, anti-drones systems and their simulators for training viz. Integrated Air Defense Combat Simulators, drone simulators and anti-drone simulators.

The company has also developed a medical simulator for healthcare training. These products have a huge opportunity size and the company expects them to contribute significantly to future revenues.

In September 2021, the company received an order of ~₹155 crore from Indian Air Force (IAF) for the supply of Counter Unmanned Aircraft Systems (CUAS). The order will be carried out in a 12 month time frame.

7. Sector Tailwinds

Government policy along with the current political climate has provided the company with major tailwinds. The current global scenario has made militaries around the world aware that they need to be combat ready at all times.

Government policy along with the current political climate has provided the company with major tailwinds. The current global scenario has made militaries around the world aware that they need to be combat ready at all times.

The company’s products help keep the troops combat ready at a much cheaper cost than actual combat training. In addition to this, the government banned the import of various defence related equipment. 9 of Zen Technologies’ simulators were included in this list.

Zen Technologies got a huge boost in August when the government announced Drone Rules 2021. Under this, the government liberalized a lot of the restrictive rules around the use of drones. They also made it easier for doing R&D and manufacturing drones.

Drone companies had to go through a huge legal process before these rules. They had to fill 25 forms which has been reduced to 5 and they had to pay some 72 types of fees which has been reduced to 4.

The government has also been allocating more funds towards healthcare. The company believes this will create the need for training of medical personnel which will help push sales for their medical simulators.

8. Financials

The revenues of the company are very lumpy. They have high revenues in some years and very low in others. They are very dependent on government spending on training of forces and 90% of the revenues come from existing customers.

The revenues of the company are very lumpy. They have high revenues in some years and very low in others. They are very dependent on government spending on training of forces and 90% of the revenues come from existing customers.

They are trying to change this by increasing the share of the AMC business which provides an annuity type revenue stream.

The revenues of the company fell sharply during Covid as the government cut defence spending and allocated more funds towards healthcare. The company manages this risk by having low fixed costs. The company is also debt-free

9. Future Outlook

The opportunity size is much larger for the newer products that the company is developing such as drones, anti-drone systems and medical simulators. Until now the government was the main client for the company, but these new products can be sold to the private

The opportunity size is much larger for the newer products that the company is developing such as drones, anti-drone systems and medical simulators. Until now the government was the main client for the company, but these new products can be sold to the private

sector as well. The demand for anti-drone systems by private clients has increased after the Saudi Aramco oil wells were attacked by drone strikes. The recent war between Armenia and Azerbaijan also highlighted the importance of drones in warfare -

where Azerbaijan was able to end the war and destroy the Armenian weapon systems using only their drone fleet.

10. Risks

Currently, most of the company’s revenues are dependent on a single client - the Indian government. Any cut in defence spending will affect the company’s revenues negatively. The company also has to incur large R&D costs with no guarantee of product sales.

Currently, most of the company’s revenues are dependent on a single client - the Indian government. Any cut in defence spending will affect the company’s revenues negatively. The company also has to incur large R&D costs with no guarantee of product sales.

• • •

Missing some Tweet in this thread? You can try to

force a refresh