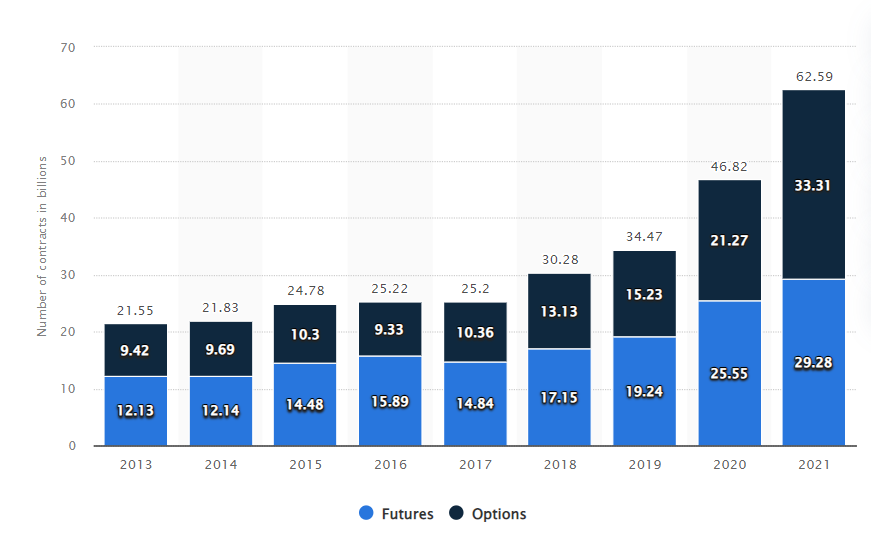

Option contracts trading vol. broke records consecutively each of the last 4yrs

According to @USOCC , US Options Market alone had a notional value of $36T in Q1'21. Therefore...

🧵Thread introducing the new Option Contracts Sheriff in @MetisDAO town:

@dopex_io 💎💎

According to @USOCC , US Options Market alone had a notional value of $36T in Q1'21. Therefore...

🧵Thread introducing the new Option Contracts Sheriff in @MetisDAO town:

@dopex_io 💎💎

2/ In this thread we'll see:

3. What is @dopex_io

7. Option Contracts (Calls vs Puts): What are they?

13. 2-Token Model & Synths

18. @dopex_io Native Products

22. Integration w/ @dopex_io

23. Upcoming producs (Holy sh*t)

28. Mutualism: @dopex_io & @MetisDAO

Let's dive in👇

3. What is @dopex_io

7. Option Contracts (Calls vs Puts): What are they?

13. 2-Token Model & Synths

18. @dopex_io Native Products

22. Integration w/ @dopex_io

23. Upcoming producs (Holy sh*t)

28. Mutualism: @dopex_io & @MetisDAO

Let's dive in👇

3/ What is @dopex_io ?

@dopex_io is a decentralized options protocol based on Arbitrum & laying roots in #Avalanche, #BSC & soon: @MetisDAO

Besides stealing the show by bringing Option Contracts to crypto, @dopex_io also utilizes some blue-chip protocols in its architecture🛠️

@dopex_io is a decentralized options protocol based on Arbitrum & laying roots in #Avalanche, #BSC & soon: @MetisDAO

Besides stealing the show by bringing Option Contracts to crypto, @dopex_io also utilizes some blue-chip protocols in its architecture🛠️

4/ Some of these blue-chip protocols are:

• @SushiSwap - To re-purchase assets for pools after each epoch

• @chainlink - To retrieve last prices from external APIs

• @UMAprotocol - Synthetic derivatives minted on Dopex will be based on the UMA protocol

• @SushiSwap - To re-purchase assets for pools after each epoch

• @chainlink - To retrieve last prices from external APIs

• @UMAprotocol - Synthetic derivatives minted on Dopex will be based on the UMA protocol

5/ Options are contracts that give you the option, but not the obligation, to buy/sell an asset at a predetermined price & date🤝📜

Its most popular uses are Speculation (Calls) & Hedging (Puts)💡

Its most popular uses are Speculation (Calls) & Hedging (Puts)💡

6/ Call Options🔺

These are mainly used for speculation💸

By just paying a small fee beforehand, known as a Premium, bullish speculators can bank big profits if the predetermined (Strike) price is lower than the market price at the end of the time period(predetermined time)📆💰

These are mainly used for speculation💸

By just paying a small fee beforehand, known as a Premium, bullish speculators can bank big profits if the predetermined (Strike) price is lower than the market price at the end of the time period(predetermined time)📆💰

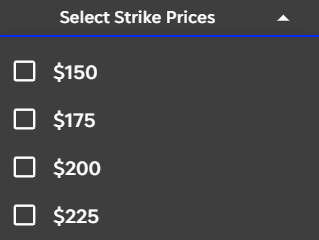

7/ If you think that #METIS price, for example, could see a steep rise in the following 30 days, but you don't want to/can't buy a #METIS bag at the moment

You can buy #METIS call options, which will give you the right to buy #METIS at a predetermined price in 1mo📆

Example:

You can buy #METIS call options, which will give you the right to buy #METIS at a predetermined price in 1mo📆

Example:

8/ Let's use $170 as the predetermined price (Strike Price)

Imagine #METIS is currently at $150, and you believe that in 1 month, after @AaveAave integration, its price could moon big time

Therefore, you get #METIS call options at a Strike Price of $175

Imagine #METIS is currently at $150, and you believe that in 1 month, after @AaveAave integration, its price could moon big time

Therefore, you get #METIS call options at a Strike Price of $175

9/ This means that if #METIS price is anywhere above ($175 + Premium paid), you´re in Profit!

Or, as Option traders would say: You're in the money😎

Some terms:

In the money: Making Profit

At the money: Breaking even

Out the money: NGMI (better no not excercise ur right)

Or, as Option traders would say: You're in the money😎

Some terms:

In the money: Making Profit

At the money: Breaking even

Out the money: NGMI (better no not excercise ur right)

10/ Put Options🔻

Mainly used for Portfolio Hedging🧮

If you are long on an asset, & u think it might go down, Puts give u the right, but not the obligation, to sell it at a predetermined date & price, mitigating most market price risk✅

Mainly used for Portfolio Hedging🧮

If you are long on an asset, & u think it might go down, Puts give u the right, but not the obligation, to sell it at a predetermined date & price, mitigating most market price risk✅

11/ 📈Price goes up? You don't excercise your Put option, and you're you're mad long on the asset, so you make bank

📉Price goes down? You excercise your Put option, sell at a way higher price, and if you want, buy again at current low price (Still have your assets & made bank)

📉Price goes down? You excercise your Put option, sell at a way higher price, and if you want, buy again at current low price (Still have your assets & made bank)

12/ These are just the most popular strategies, but there are thousands of investment strategies & techniques involving options

Funny enough, these are just uses for the option buyers, but we haven't even covered all the potential benefits for the option WRITERS at @dopex_io ✍️

Funny enough, these are just uses for the option buyers, but we haven't even covered all the potential benefits for the option WRITERS at @dopex_io ✍️

13/ 2-Token Model & Synths

Back 2 @dopex_io

Its 2-token model consists in $DPX & $rDPX (governance token w fee accrual capabilities and rebates token with platform uses, respectively)

You will absolutely love Synths, but before going there, let's describe both tokens briefly

Back 2 @dopex_io

Its 2-token model consists in $DPX & $rDPX (governance token w fee accrual capabilities and rebates token with platform uses, respectively)

You will absolutely love Synths, but before going there, let's describe both tokens briefly

14/ $DPX

• Limited supply, governance token: used to vote in proposals and have a voice regarding protocol-related decisions

• Accrues fees and revenue from pools, vaults and wrappers built over the dopex protocol after every global epoch

• Max Supply: 500,000 DPX

• Limited supply, governance token: used to vote in proposals and have a voice regarding protocol-related decisions

• Accrues fees and revenue from pools, vaults and wrappers built over the dopex protocol after every global epoch

• Max Supply: 500,000 DPX

15/ $rDPX

• Minted/distributed for any losses incurred by pool depositors

• Amt of tokens minted is determined based on the net value of losses incurred at the end of a pool's epoch

• No max supply but w/ mechanics to avoid it from being valueless

• Minted/distributed for any losses incurred by pool depositors

• Amt of tokens minted is determined based on the net value of losses incurred at the end of a pool's epoch

• No max supply but w/ mechanics to avoid it from being valueless

16/ $rDPX

• rDPX would be a fee requirement for future app layer additions to Dopex such as vaults

• Collateral to borrow funds from Margin to leverage option positions

• Fee accrual can be boosted via staking rDPX

And my personal favorite...

MINTING SYNTHS🤯🤯🤯

• rDPX would be a fee requirement for future app layer additions to Dopex such as vaults

• Collateral to borrow funds from Margin to leverage option positions

• Fee accrual can be boosted via staking rDPX

And my personal favorite...

MINTING SYNTHS🤯🤯🤯

17/ Synths are syntethic assets representing traditional markets' assets like stonks, ETFs, forex, commodities etc. which can then be deposited into option pools to earn further yield😏

You don't HAVE to mint synths tho, $rDPX itself has been all green for a fat minute too🟢🔺

You don't HAVE to mint synths tho, $rDPX itself has been all green for a fat minute too🟢🔺

18/ @dopex_io Native Products

Besides some triple-digit APY farms and option buying, @dopex_io have 2 main products VERY worth mentioning:

💎SSOVs (Single-Staking Option Vaults)

💎TZWAPs (Dopex version of Time-Weighter Average Price)

Besides some triple-digit APY farms and option buying, @dopex_io have 2 main products VERY worth mentioning:

💎SSOVs (Single-Staking Option Vaults)

💎TZWAPs (Dopex version of Time-Weighter Average Price)

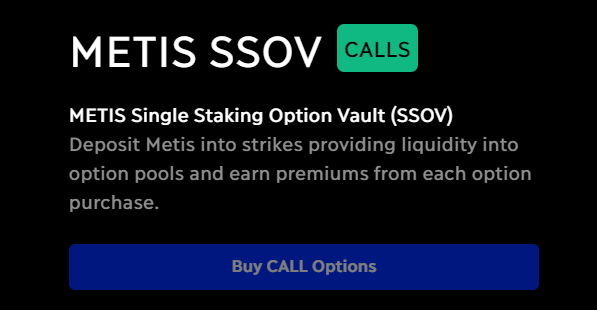

19/ SSOVs

SSOVs allow users to lockup tokens for a specified

period of time & earn farming yield on their staked

assets

Assets are deposited into a contract which can sell options to buyers at selected strikes: anyone can interact with the vault to buy the options from it

SSOVs allow users to lockup tokens for a specified

period of time & earn farming yield on their staked

assets

Assets are deposited into a contract which can sell options to buyers at selected strikes: anyone can interact with the vault to buy the options from it

20/ SSOVs are:

• A way to introduce DeFi users to options, & Options users to DeFi

• Composable: Options are tokenized ERC20 tokens

• Scalable: can be built for various assets on EVM-compatible chains

@MetisDAO dec storage lowered fees ALOT, so SSOVs will compound HIGHER APY

• A way to introduce DeFi users to options, & Options users to DeFi

• Composable: Options are tokenized ERC20 tokens

• Scalable: can be built for various assets on EVM-compatible chains

@MetisDAO dec storage lowered fees ALOT, so SSOVs will compound HIGHER APY

21/ TZWAPs

@dopex_io 's Time-Weighted Average Price order smart contract📌

Users can open TWAP orders and customize:

• Token

• Batch Size

• Interval (of the buys/sells)

@dopex_io 's Time-Weighted Average Price order smart contract📌

Users can open TWAP orders and customize:

• Token

• Batch Size

• Interval (of the buys/sells)

22/ Integration w/ @dopex_io

All Dopex products aim to be fully composable so that any other DeFi builder can use them as one of the building blocks🏗️

Some integrations may require WL & review by the Dopex devs, but team's super accessible (Got some of this info by dm'ing em)

All Dopex products aim to be fully composable so that any other DeFi builder can use them as one of the building blocks🏗️

Some integrations may require WL & review by the Dopex devs, but team's super accessible (Got some of this info by dm'ing em)

23/ In case you're wondering: Yes. @dopex_io is audited.

Not 1 audit, not 2 audits: 3 audits

Audited by:

@SolidifiedHQ

@SolidityFinance

(2 of those audits by Solidity: one was for $vBNB)

Not 1 audit, not 2 audits: 3 audits

Audited by:

@SolidifiedHQ

@SolidityFinance

(2 of those audits by Solidity: one was for $vBNB)

24/ Upcoming Products: Here's the real sauce

• SSOVs V3 (insane)

• Atlantic Options

• OTC trading & negotiations

• Interest Rate Options

• Yes/No Vaults (Prediction vaults)

• A f*cking STABLECOIN for their eco

• rDPX v2

• SSOVs V3 (insane)

• Atlantic Options

• OTC trading & negotiations

• Interest Rate Options

• Yes/No Vaults (Prediction vaults)

• A f*cking STABLECOIN for their eco

• rDPX v2

25/ Not going into all of em in-depth, but SSOVs V3 will allow:

• Collateral deposit/option writing during epoch

• Writing shorter-term options

• Option writers can say "F it, I quit" & take their funds before expiry

• Better collateral efficiency

• NFT Boosts🤯📈

• Collateral deposit/option writing during epoch

• Writing shorter-term options

• Option writers can say "F it, I quit" & take their funds before expiry

• Better collateral efficiency

• NFT Boosts🤯📈

26/ @dopex_io currently uses European Options, which allow you to exercise your option only at the predetermined date (mitigates risk for writers)

Atlantic Options: Mix between European & American, can be exercised on discrete/specific dates before expiration

Atlantic Options: Mix between European & American, can be exercised on discrete/specific dates before expiration

27/ This version of Atlantic Options will be a meta product that allows to build leveraged products with no liquidation (and A LOT more)

OTC Desk:

•Treasuries/DAOs can efficiently manage hedges (big orders)

•NFT whales/traders can efficiently trade rare NFTs or NFTs in bulk

OTC Desk:

•Treasuries/DAOs can efficiently manage hedges (big orders)

•NFT whales/traders can efficiently trade rare NFTs or NFTs in bulk

28/ I don't need to tell you:

How relevant is the deployment of a @dopex_io eco stablecoin (dpxUSD)

How much capital the Yes/No vaults could attract (even from outside of crypto).

That if you're convinced Curve rates will remain stable, IR Options are a very nice alternative

How relevant is the deployment of a @dopex_io eco stablecoin (dpxUSD)

How much capital the Yes/No vaults could attract (even from outside of crypto).

That if you're convinced Curve rates will remain stable, IR Options are a very nice alternative

29/ MUTUALISM: @MetisDAO @dopex_io

Mutualism: interaction between individuals of different species that results in positive (beneficial) effects on interacting populations

@dopex_io & @MetisDAO will both come out WAY better off out of this integration

Here's how:

Mutualism: interaction between individuals of different species that results in positive (beneficial) effects on interacting populations

@dopex_io & @MetisDAO will both come out WAY better off out of this integration

Here's how:

30/ From this partnership @dopex_io will get:

• Way larger userbase (more revenue)

• Monopoly in Andromeda's option sector (gold mine for em)

• Larger variety of product offerings: This L2 does have a token, so $METIS can join the party & get it poppin

• Best infrastructure

• Way larger userbase (more revenue)

• Monopoly in Andromeda's option sector (gold mine for em)

• Larger variety of product offerings: This L2 does have a token, so $METIS can join the party & get it poppin

• Best infrastructure

31/ Besides, @MetisDAO extremely low fees will make @dopex_io SSOVs and Farms way more attractive, since they will be able to compound higher APYs

Remember vaults do everything themselves, so all the fees are involved and deducted from APY

Low Fees = Higher Returns

Remember vaults do everything themselves, so all the fees are involved and deducted from APY

Low Fees = Higher Returns

32/ @MetisDAO will get:

• 1st Options protocol in the network, therefore bringing new audience

• Liquidity locked in the network for the epochs length

• Hedging alternatives for Metisians

• Up & coming blue-chip protocol

• Familiarity for AVAX, BSC, & ARB users

• 1st Options protocol in the network, therefore bringing new audience

• Liquidity locked in the network for the epochs length

• Hedging alternatives for Metisians

• Up & coming blue-chip protocol

• Familiarity for AVAX, BSC, & ARB users

33/ So, now that u know what the heck is up & also know that the Deposit Period for $METIS SSOVs has already started...

Did u bridge ya funds to @MetisDAO already, or whatchu waiting for, anon?

GREAT bridges:

@SynapseProtocol @PolyNetwork2 @relay_chain @TheBoringDAO & our own

Did u bridge ya funds to @MetisDAO already, or whatchu waiting for, anon?

GREAT bridges:

@SynapseProtocol @PolyNetwork2 @relay_chain @TheBoringDAO & our own

34/ Terminamos!

If you enjoyed this thread, found it useful or insightful, don't forget to give me a Follow and a Like/RT on the 1st tweet! Also, Follow @MetisDAO & @dopex_io

LET'S RIDE, ANON

app.dopex.io/ssov/call/METIS

If you enjoyed this thread, found it useful or insightful, don't forget to give me a Follow and a Like/RT on the 1st tweet! Also, Follow @MetisDAO & @dopex_io

LET'S RIDE, ANON

app.dopex.io/ssov/call/METIS

• • •

Missing some Tweet in this thread? You can try to

force a refresh