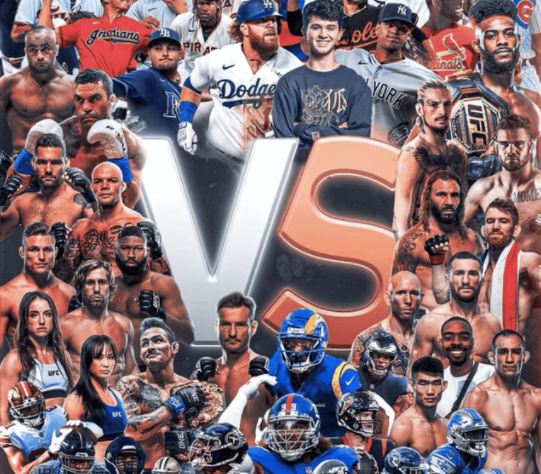

Just got a @vaynersports pass 🎉

"The VSP is a utility-first sports NFT project providing ways for fans to connect with athletes and unlock access to world renowned events and once in a lifetime experiences."

This will be THE sports NFT to own 🏀🥊🎮🏌️♂️

pass.vaynersports.com

"The VSP is a utility-first sports NFT project providing ways for fans to connect with athletes and unlock access to world renowned events and once in a lifetime experiences."

This will be THE sports NFT to own 🏀🥊🎮🏌️♂️

pass.vaynersports.com

@vaynersports @ajv The mint was .155, so it's not that much more expensive on OS now. I just bought off of OS with the low gas. I have read that the mint process was bad, high gas and some issues. I think this is behind us, and will if anything provide a lower entry point for new holders. NFA, DYOR

As a big fan of Esports, Soccer and MMA, I chose traits that fitted my personal sports interests. However, by reading from the website "all pass yields the same access". So I don't know yet the differences in "sports traits".

This is @ajv work. I don't buy it because of Gary or any association with him. I bought it because I think sports NFTs has huge real-value potential and utility, and it seems like this has been well thought out/planned for a long time.

If I can also get access to new mints, access to sports events; probably tickets, merch, exclusive events with athletes, then I am sold.

#NFTCommunity #NFTs #NFT #vaynersports #VaynerSportsPass #VSP $ETH #Opensea #NFTMint

#NFTCommunity #NFTs #NFT #vaynersports #VaynerSportsPass #VSP $ETH #Opensea #NFTMint

• • •

Missing some Tweet in this thread? You can try to

force a refresh