$NHC $NHC.AX breaks $4 without a sweat

Buying looks to be driven by short-covering in the final 3 trading days pre-dividend and strong fundamental outlook for Australian thermal #coal

Old thread link here, so I don't traumatise my Koala friend further 😉

Buying looks to be driven by short-covering in the final 3 trading days pre-dividend and strong fundamental outlook for Australian thermal #coal

Old thread link here, so I don't traumatise my Koala friend further 😉

https://twitter.com/eadatt/status/1512557261469941760?s=20&t=J8hlSU4Vf8X47dwl1TgQMQ

Interesting thread and statistics on seaborne thermal #coal

There is a lot of nuance and frictional elements in the physical supply chain to keep in mind when reading these statistics

#coaltwitter

There is a lot of nuance and frictional elements in the physical supply chain to keep in mind when reading these statistics

#coaltwitter

https://twitter.com/AXSMarine/status/1512379584922193926?t=2s51t35DgkWCWEYiJeISkQ&s=19

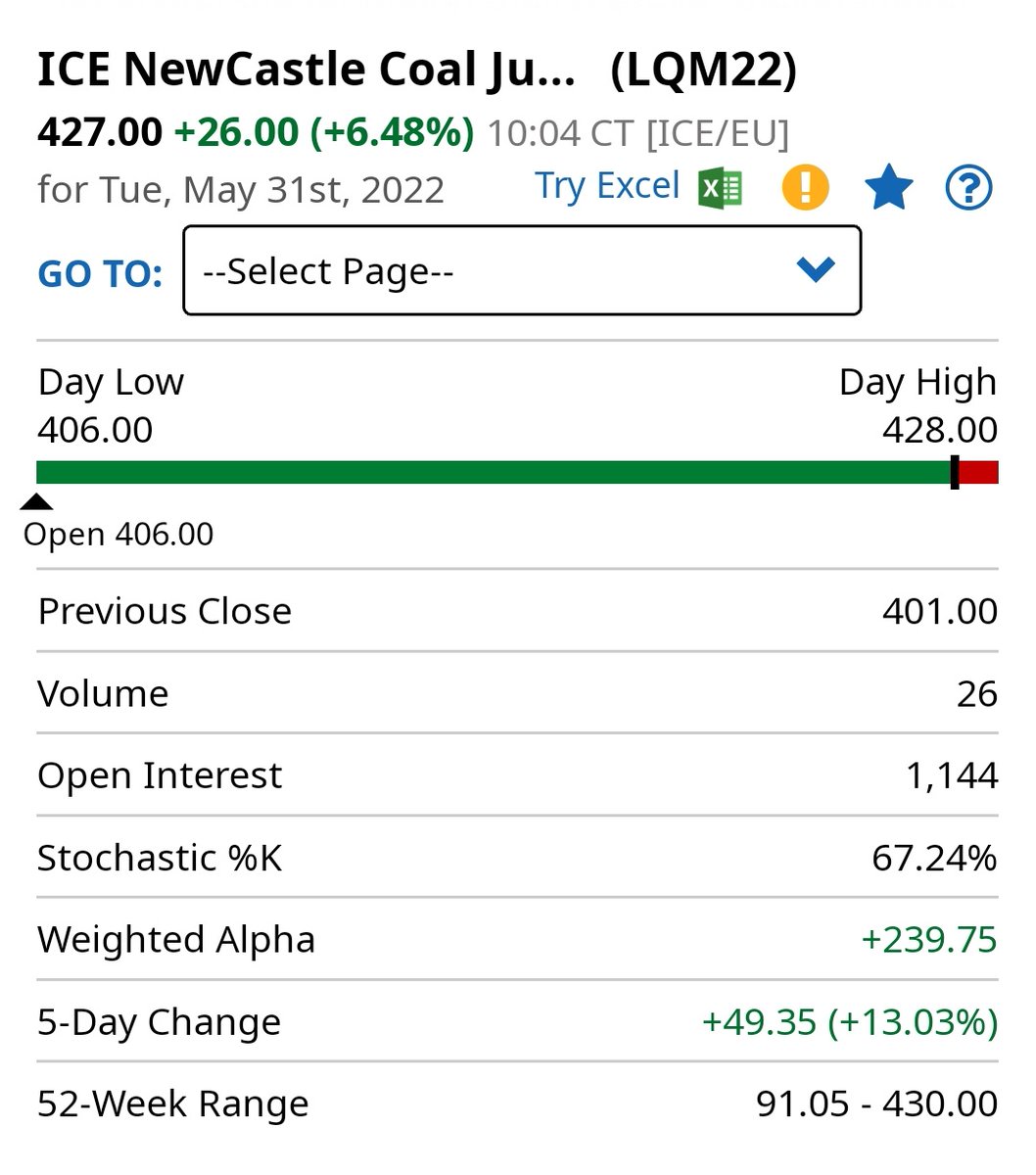

...and there we have it folks, Newcastle thermal #coal futures once again break $300/t in early trade 🔥🔥🔥

$NHC $WHC $YAL minting it in this environment

$NHC.AX $WHC.AX $YAL.AX

#coaltwitter

$NHC $WHC $YAL minting it in this environment

$NHC.AX $WHC.AX $YAL.AX

#coaltwitter

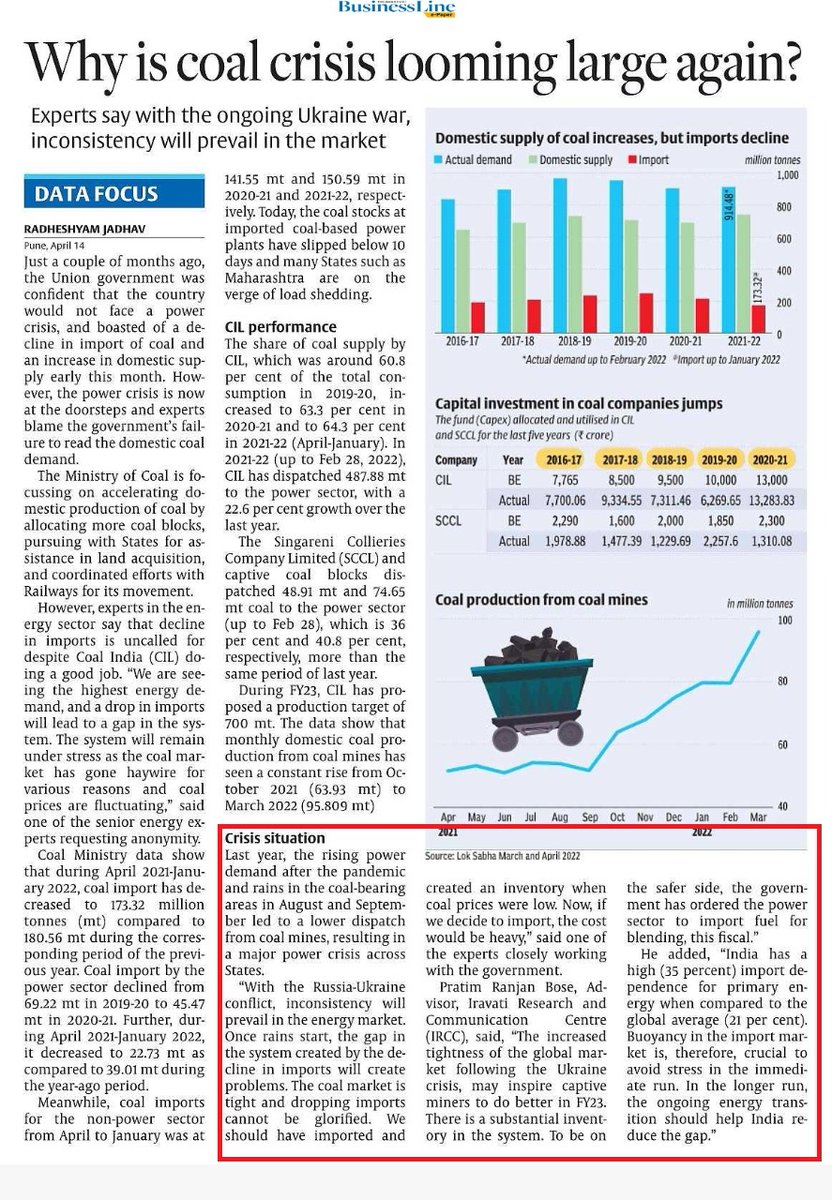

Indian electrical generation is ~75% #coal by source. Current powerplant inventory sits at around 9 days of supply.

Summer electricity spike driven by AC usage will require restocking before May to fulfill demand

NewC futures creeping up 😁

#CoalTwitter

reuters.com/business/energ…

Summer electricity spike driven by AC usage will require restocking before May to fulfill demand

NewC futures creeping up 😁

#CoalTwitter

reuters.com/business/energ…

Rhetoric around India buying Russian #coal ignores practical elements around logistics.

Bulk carrier rates will🔼with more coal hitting seaborne market+supply chain issues(ie. insurance)

Australia/India FTA best but few AU tonnes available!

#coaltwitter

cnbc.com/2022/04/14/aft…

Bulk carrier rates will🔼with more coal hitting seaborne market+supply chain issues(ie. insurance)

Australia/India FTA best but few AU tonnes available!

#coaltwitter

cnbc.com/2022/04/14/aft…

Disruptions at Richards Bay Coal Terminal (RBCT) which exported ~58Mt of coking & thermal #coal also going to squeeze seaborne market supply.

>50% of RCBT's coal is exported to India 👀

It's like watching a trainwreck in slow motion 🙈🙈🙈

#CoalTwitter

miningmx.com/top-story/4933…

>50% of RCBT's coal is exported to India 👀

It's like watching a trainwreck in slow motion 🙈🙈🙈

#CoalTwitter

miningmx.com/top-story/4933…

India #coal market fundamentals are expected to remain strong, with seasonal monsoon supply disruptions fairly typical July through to September.

This coupled with a high dependence on coal imports for electricity generation = strong outlook

H/T: @iravatiresearch

#coaltwitter

This coupled with a high dependence on coal imports for electricity generation = strong outlook

H/T: @iravatiresearch

#coaltwitter

Superb quarterly report from $WHC $WHC.AX

Good commentary on current market conditions and interesting to see #coal future prices trading >US$270/t for the next 12 months at present

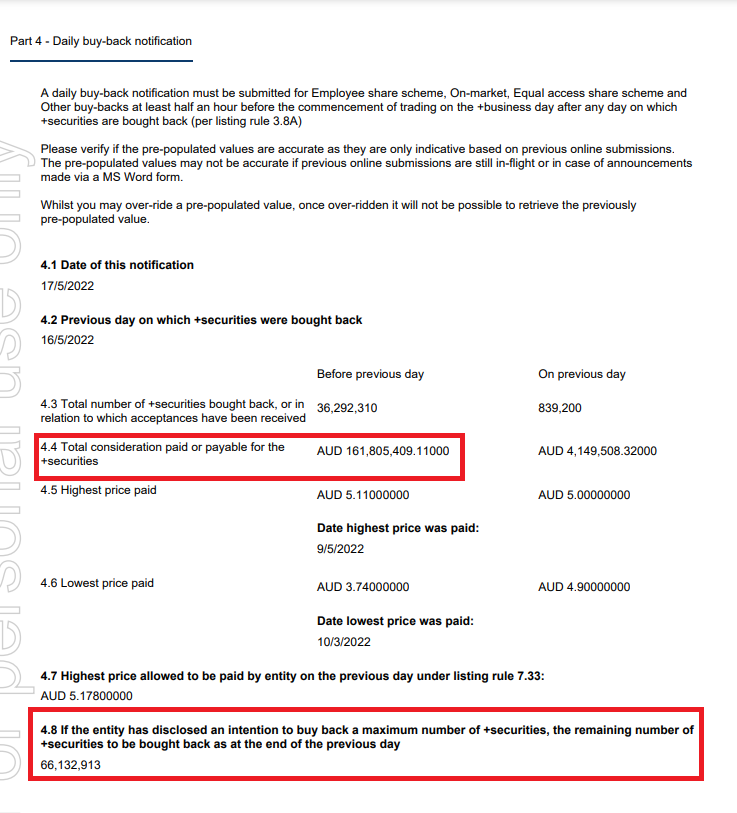

Will WHC finally get closer to fair value? Buyback will kick in again today w/ 8.5% outstanding

Good commentary on current market conditions and interesting to see #coal future prices trading >US$270/t for the next 12 months at present

Will WHC finally get closer to fair value? Buyback will kick in again today w/ 8.5% outstanding

#coaltwitter morning news

$WHC $WHC.AX broker upgrade to $6.25 TP (Shaws)

$YAL $YAL.AX quarterly out - production disruptions from weather, but production guidance held. Future dividends likely to be fully franked w/ tax losses likely extinguished

NewC futures continue to rise

$WHC $WHC.AX broker upgrade to $6.25 TP (Shaws)

$YAL $YAL.AX quarterly out - production disruptions from weather, but production guidance held. Future dividends likely to be fully franked w/ tax losses likely extinguished

NewC futures continue to rise

The Indian summer has well and truly started with widespread blackouts and acute #coal shortages for electricity generation

June will be the peak demand period and likely to be strong demand for seaborne coal to supplement local supplies

#CoalTwitter

bnnbloomberg.ca/eight-hour-bla…

June will be the peak demand period and likely to be strong demand for seaborne coal to supplement local supplies

#CoalTwitter

bnnbloomberg.ca/eight-hour-bla…

Newcastle #coal futures strengthen further in early trade

Slight backwardation from May 2022 and now the whole 12 month curve trades >US$290/t.

$WHC $NHC $YAL will absolutely print in this environment and may see easing labour costs w/ vax mandates dropped in NSW

#CoalTwitter

Slight backwardation from May 2022 and now the whole 12 month curve trades >US$290/t.

$WHC $NHC $YAL will absolutely print in this environment and may see easing labour costs w/ vax mandates dropped in NSW

#CoalTwitter

Great thread on the global #coal markets which continue to look bullish in the near-term

Pretty incredible the best bear case anyone can come up with is new Mongolian rail lines that apparently will solve a global molecule crisis! 🤣

#coaltwitter

Pretty incredible the best bear case anyone can come up with is new Mongolian rail lines that apparently will solve a global molecule crisis! 🤣

#coaltwitter

https://twitter.com/SStapczynski/status/1518467991624876032?t=713fX28IUQ9dwoDIBqtSXw&s=19

Australian #coal looking very attractive for coal starved India with the new free trade agreement removing the prior 2.5% import duty

#coaltwitter

spglobal.com/commodityinsig…

#coaltwitter

spglobal.com/commodityinsig…

China will scrap tariffs for #coal imports from May 1 to March 31, 2023 to ensure energy supply 🔥🔥🔥

Will tighten up a VERY tight seaborne market

$WHC $NHC $YAL ran hard into the close today 👀

$WHC.AX $NHC.ax $YAL.AX

#coaltwitter

gss.mof.gov.cn/gzdt/zhengcefa…

Will tighten up a VERY tight seaborne market

$WHC $NHC $YAL ran hard into the close today 👀

$WHC.AX $NHC.ax $YAL.AX

#coaltwitter

gss.mof.gov.cn/gzdt/zhengcefa…

China Locks Down Northern Hub for Coal Shipping

" ..sends coal from mining regions of the north to coastal industrial centers in the south. The price set at the port is an important benchmark for China’s #coal market, which is the largest in the world. "

bnnbloomberg.ca/china-locks-do…

" ..sends coal from mining regions of the north to coastal industrial centers in the south. The price set at the port is an important benchmark for China’s #coal market, which is the largest in the world. "

bnnbloomberg.ca/china-locks-do…

Indian temperatures are absolutely brutal right now

But massive #coal shortages are causing powerplants to shut down

We're only 1 month into summer, so likely to be high demand for seaborne thermal coal going forward

#coaltwitter

But massive #coal shortages are causing powerplants to shut down

We're only 1 month into summer, so likely to be high demand for seaborne thermal coal going forward

#coaltwitter

https://twitter.com/energy_blogger/status/1520599436136976384?t=iLcAIgnsOASfSjOmKO_1Pg&s=19

Glad I'm not the only one talking about the India FTA being a golden opportunity for Australian #coal producers

From @SPGCICoal 🤠

#coaltwitter

spglobal.com/commodityinsig…

From @SPGCICoal 🤠

#coaltwitter

spglobal.com/commodityinsig…

Civil unrest beginning in India over widespread power outages in brutal summer heat

Not enough #coal for power stations

$YAL $YAL.AX exports around 20% of its production to Indian buyers and may pay out fully franked divvies shortly

#coaltwitter

bnnbloomberg.ca/a-115-degree-h…

Not enough #coal for power stations

$YAL $YAL.AX exports around 20% of its production to Indian buyers and may pay out fully franked divvies shortly

#coaltwitter

bnnbloomberg.ca/a-115-degree-h…

June 22 Newcastle #coal contract up >6% in early trade

Industry structure is ripe for things to start getting silly again (>$400/t)

#coaltwitter

Industry structure is ripe for things to start getting silly again (>$400/t)

#coaltwitter

India's Government intervenes in the electricity sector with all #coal powerplants mandated to generate power at fully capacity

This will bring online some inactive powerplants reliant on imported thermal coal, boosting seaborne demand 🔥🔥

#coaltwitter

m.economictimes.com/industry/energ…

This will bring online some inactive powerplants reliant on imported thermal coal, boosting seaborne demand 🔥🔥

#coaltwitter

m.economictimes.com/industry/energ…

more on the Indian #coal situation from Javier

#coaltwitter

#coaltwitter

https://twitter.com/JavierBlas/status/1522531025368326144

"Got any #coal?"

Mongolian coal production down 58% YoY - coalmint.com/intel/Mongolia…

China highlighting stable coal supply as a national concern

mp.weixin.qq.com/s?__biz=MjM5OT…

$WHC $WHC.AX highlighting the tightness of physical high CV coal supply yesterday -

Mongolian coal production down 58% YoY - coalmint.com/intel/Mongolia…

China highlighting stable coal supply as a national concern

mp.weixin.qq.com/s?__biz=MjM5OT…

$WHC $WHC.AX highlighting the tightness of physical high CV coal supply yesterday -

https://twitter.com/LukeyTrags/status/1523890709354672130

Update: $XRO $XRO.AX spitting out $2 million ANNUALLY in FCF - Enterprise value ~$11 billlion

$WHC $WHC.AX spitting out $400 mil a MONTH in FCF @ US$300/t coal + 10% buyback & franked dividends going forward - Enterprise value ~$5 billion

#coal > tech

$WHC $WHC.AX spitting out $400 mil a MONTH in FCF @ US$300/t coal + 10% buyback & franked dividends going forward - Enterprise value ~$5 billion

#coal > tech

https://twitter.com/eadatt/status/1507243331889528832

Newcastle #coal up 4% in early trade

Reminder that current front end spot price of US$385/t equate to almost AU$560/t!

$WHC $WHC.AX receiving a premium to spot (~5%) in recent sales contracts as per their conference call yesterday. SAAS-like margins >80%

#CoalTwitter

Reminder that current front end spot price of US$385/t equate to almost AU$560/t!

$WHC $WHC.AX receiving a premium to spot (~5%) in recent sales contracts as per their conference call yesterday. SAAS-like margins >80%

#CoalTwitter

#coal and cash and good place to be at the moment 🙂

Good morning, Newcastle #coal futures break US$400/t once again at the front end

$NHC $NHC.AX likely to release their quarterly in the next week

Deficit in physical supply puts

$WHC $WHC.AX $YAL $YAL.AX in a fantastic position with weak AUD providing further upside

#CoalTwitter

$NHC $NHC.AX likely to release their quarterly in the next week

Deficit in physical supply puts

$WHC $WHC.AX $YAL $YAL.AX in a fantastic position with weak AUD providing further upside

#CoalTwitter

Gentle reminder that $WHC $WHC.AX still has ~$230 mill worth of buyback capacity or ~44 million shares at current prices. I'm expecting them to re-up the buyback plus have the capacity to pay out franked dividends going forward

Namaste 🙏🏽

Namaste 🙏🏽

"Soaring temperatures have prompted higher energy demand in recent weeks and left India facing a 25-million-tonne shortfall at a time when coal spot prices have skyrocketed since the start of the year."

India's #coal needs to double by 2040

#coaltwitter

straitstimes.com/asia/south-asi…

India's #coal needs to double by 2040

#coaltwitter

straitstimes.com/asia/south-asi…

India's big #coal problem picked up by Javier from Bloomberg - this issue is not going away anytime soon despite what anyone thinks

#CoalTwitter

#CoalTwitter

https://twitter.com/JavierBlas/status/1526572324647993344

$WHC $WHC.AX random thoughts

For Q4 - ~4Mt equity prod, FX 74c, realised price US$280/t (~AU$380/t), all-in-cost ~$100/t. FCF = ~$1.1 Bill for the quarter ex-capex. Tax - minus $330 mil

$230 mil in buyback capacity - no EGM notice yet- AGM in Oct

86c final ff divvy incoming?

For Q4 - ~4Mt equity prod, FX 74c, realised price US$280/t (~AU$380/t), all-in-cost ~$100/t. FCF = ~$1.1 Bill for the quarter ex-capex. Tax - minus $330 mil

$230 mil in buyback capacity - no EGM notice yet- AGM in Oct

86c final ff divvy incoming?

"Pakistan is facing a threat of low levels of #coal inventory that might take 3,900 MW out of the national grid"

"two-hour system-wide power outages would have to be scheduled in the month of June, three hours in July, and four in August"

#CoalTwitter

tribune.com.pk/story/2357100/1

"two-hour system-wide power outages would have to be scheduled in the month of June, three hours in July, and four in August"

#CoalTwitter

tribune.com.pk/story/2357100/1

India ramping up power plants that rely on imported #coal with government mandating the reopening of closed power plants.

9500MW is still under outage - try and calculate how many coal tonnes are required to bring this capacity back 😲

#CoalTwitter

From an industry publication

9500MW is still under outage - try and calculate how many coal tonnes are required to bring this capacity back 😲

#CoalTwitter

From an industry publication

Good morning, most expensive Newcastle #coal load EVER sold last night for US$442.50/t 😱

#CoalTwitter

#CoalTwitter

https://twitter.com/Kallang22/status/1527087310319128576?s=20&t=aQ_X0NKyATfc1XTtZXt0oA

If you missed it, here's a #coal Twitter space we held last night with @SpadeOfGlory & @TwinTurboCe1ica where we went over fundamentals that you need to know if you invest in the sector

#coaltwitter

twitter.com/i/spaces/1gqGv…

#coaltwitter

twitter.com/i/spaces/1gqGv…

@SpadeOfGlory @TwinTurboCe1ica India taking no prisoners dealing with the local powerplants who are not importing enough thermal #coal

Effectively this penalises powerplants who have been delaying import purchases due to the present high prices. Should squeeze a very very tight physical market

#coaltwitter

Effectively this penalises powerplants who have been delaying import purchases due to the present high prices. Should squeeze a very very tight physical market

#coaltwitter

Excellent article on India's electricity grid and it's issues with keeping up with demand

Likely that imported #coal demand will grow from the region given low stockpiles and inactive powerplants resuming generation under gov mandates

#CoalTwitter

reuters.com/world/india/in…

Likely that imported #coal demand will grow from the region given low stockpiles and inactive powerplants resuming generation under gov mandates

#CoalTwitter

reuters.com/world/india/in…

A majority Labor government is very bullish for Aussie #coal - just 1 seat away from a majority at this point according to the AEC; less need to deal with minority parties.

Either way, existing production hubs and permitted projects just got a lot more valuable 😁

#coaltwitter

Either way, existing production hubs and permitted projects just got a lot more valuable 😁

#coaltwitter

"India's insatiable power appetite to keep #coal relevant for decades: GE Power India MD"

Will shift to HELE-type coal plants in India similar to East Asia. These require high CV coals with low deleterious elements. nsenergybusiness.com/features/coal-…

#coaltwitter

spglobal.com/commodityinsig…

Will shift to HELE-type coal plants in India similar to East Asia. These require high CV coals with low deleterious elements. nsenergybusiness.com/features/coal-…

#coaltwitter

spglobal.com/commodityinsig…

China building 169 new #coal power plants which will consume approximately 559 million tons of coal per annum.

interested to see if domestic supply can fulfill this additional incremental demand, or whether this will increase seaborne demand

#coaltwitter

bnnbloomberg.ca/china-coal-exp…

interested to see if domestic supply can fulfill this additional incremental demand, or whether this will increase seaborne demand

#coaltwitter

bnnbloomberg.ca/china-coal-exp…

Doing some back of envelope calcs and its absolutely incredible that $WHC $WHC.AX likely generating more QUARTERLY cashflow at current prices than $S32 $S32.AX did in their last HALF year report 🤯🤯🤯

WHC market cap - $5.3 bil

S32 market cap - $22 bil

#CoalTwitter

WHC market cap - $5.3 bil

S32 market cap - $22 bil

#CoalTwitter

First of all, you're done.The Greens don't even have that kind of muscle anymore. Bandt sick, right? You're getting chased out of Canberra by Albanese. You think you can come to my #coal mine and take over? I talked to Albanese, I can make a deal with him, and still keep my mine!

"I got a business to run. I gotta kick asses sometimes to make it run right. We had a little argument, Bandt and me, so I had to straighten him out."

#coaltwitter #coal @puppyeh1

#coaltwitter #coal @puppyeh1

https://twitter.com/TinaMQ/status/1518803659261644800?s=20&t=DGxx3MzlEelYdjC7Ah3hrA

Labor #coal bulls leading the charge and on track to form a majority government

Contrary to popular belief, they recognise the coal industry as an important sector for Australia

Contrary to popular belief, they recognise the coal industry as an important sector for Australia

https://twitter.com/i/status/1518803659261644800

Newcastle #coal futures flying out of the traps this evening

Brutally strong action, will it push all time highs?

#coaltwitter

Brutally strong action, will it push all time highs?

#coaltwitter

Good morning

Newcastle #coal testing all time highs overnight

Glencore want a higher bid from Yankuang for their Yancoal stake like everyone else! No surprises there

$YAL $YAL.AX #CoalTwitter

Newcastle #coal testing all time highs overnight

Glencore want a higher bid from Yankuang for their Yancoal stake like everyone else! No surprises there

$YAL $YAL.AX #CoalTwitter

Nice commentary from GS re: Aussie thermal #coal producers $NHC & $WHC

Finally the mainstream starting to cotton on to potential large capital initiatives from the big coal players

$NHC.AX $WHC.AX #coaltwitter

afr.com/markets/equity…

Finally the mainstream starting to cotton on to potential large capital initiatives from the big coal players

$NHC.AX $WHC.AX #coaltwitter

afr.com/markets/equity…

Spot the difference - thermal & coking #coal prices have converged at the front end of the futures curve. Aussie producers $WHC $NHC & $YAL would be fabulously profitable at current prices

Personally still bullish on thermal > coking coals

$WHC.AX $NHC.AX $YAL.AX #coaltwitter

Personally still bullish on thermal > coking coals

$WHC.AX $NHC.AX $YAL.AX #coaltwitter

My face watching the Aussie dollar dropping like a stone against the USD

Can't wait till we break 70c on the downside!

Can't wait till we break 70c on the downside!

Love being an investor in Australian energy assets

NewC futures down slightly since Friday but so is the AUD/USD FX cross

Net effect in Australian dollars is down less than commodity price

Never forget the benefits of natural hedges

NewC futures down slightly since Friday but so is the AUD/USD FX cross

Net effect in Australian dollars is down less than commodity price

Never forget the benefits of natural hedges

Incredibly Newcastle thermal #coal still trading above coking coal in certain parts of the curve

$NHC $WHC $YAL all gushing cash and AUD/USD FX cross likely to drop below 70c again imminently 🥂

$NHC.AX $WHC.AX $YAL.AX

#coaltwitter

$NHC $WHC $YAL all gushing cash and AUD/USD FX cross likely to drop below 70c again imminently 🥂

$NHC.AX $WHC.AX $YAL.AX

#coaltwitter

Newcastle thermal #coal so consistent it's almost boring vs other energy markets

It's actually become cheaper on a MMBtu basis relative to other energy sources

Bodes well that thermal coal may stay elevated for a considerable timeframe looking forward

#coaltwitter

It's actually become cheaper on a MMBtu basis relative to other energy sources

Bodes well that thermal coal may stay elevated for a considerable timeframe looking forward

#coaltwitter

Volatility in the #coal space today as QLD royalty changes expected tomorrow

Expecting a 'super-profits' style tax amendment with a greater % above $ X at worst. QLD doesn't believe high pricing will persist

been buying $WHC $NHC $YAL 🤠

#coaltwitter

$WHC.AX $NHC.AX $YAL.AX

Expecting a 'super-profits' style tax amendment with a greater % above $ X at worst. QLD doesn't believe high pricing will persist

been buying $WHC $NHC $YAL 🤠

#coaltwitter

$WHC.AX $NHC.AX $YAL.AX

.... and there it is

QLD introduce 3 additional tiers to #coal royalties, similar in notion to the one I proposed previously

Interestingly, NSW did not propose any similar measures in today's budget

⏫ hurdle rate for new QLD projects now

#coaltwitter

QLD introduce 3 additional tiers to #coal royalties, similar in notion to the one I proposed previously

Interestingly, NSW did not propose any similar measures in today's budget

⏫ hurdle rate for new QLD projects now

#coaltwitter

https://twitter.com/eadatt/status/1538733083393859584?s=20&t=ImKPwQvKOxjW-i5GHGCosA

Proportion of #coal production in QLD:

$WHC - 0%

$NHC - 0%

$YAL - 16%

$SMR - 100%

$BCB - 100%

$TER - 100% of Aussie assets

NSW thermal the safest place to hide at this point IMO

#coaltwitter

$WHC.AX $NHC.AX $YAL.AX $SMR.AX $BCB.AX TER.AX

$WHC - 0%

$NHC - 0%

$YAL - 16%

$SMR - 100%

$BCB - 100%

$TER - 100% of Aussie assets

NSW thermal the safest place to hide at this point IMO

#coaltwitter

$WHC.AX $NHC.AX $YAL.AX $SMR.AX $BCB.AX TER.AX

Quick back of envelope on how QLD #coal producers may be affected financially by the new royalty structures

Here's to hoping that $WHC $WHC.AX is buyback maxxing at these levels. Still another $85 mill to buyback with 7 trading days left till the blackout

#coaltwitter

Here's to hoping that $WHC $WHC.AX is buyback maxxing at these levels. Still another $85 mill to buyback with 7 trading days left till the blackout

#coaltwitter

Using proprietary Datt model - Queensland now equivalent to Kyrgyzstan in terms of jurisdictional risk

😶😶😶

😶😶😶

Good article on the 🤡🤡🤡s that run Queensland and the trail of broken promises along the way

brisbanetimes.com.au/politics/queen…

brisbanetimes.com.au/politics/queen…

Newcastle thermal #coal out of the traps quickly this evening up to US$394/t 🔥🔥🔥

Queensland producers pain will benefit NSW producers over time. NSW now has an entrenched structural competitive advantage in a labour constrained market

#coaltwitter

Queensland producers pain will benefit NSW producers over time. NSW now has an entrenched structural competitive advantage in a labour constrained market

#coaltwitter

Interestingly, $NHC's New Acland 3, which is rumoured to be permitted soon, shouldn't be subject to Queensland's punitive new royalty scheme - given NHC own the vast majority of the freehold land (titled pre-1910) upon where the proposed mine sits

Millners 1

QLD gov 0

$NHC.AX

Millners 1

QLD gov 0

$NHC.AX

More context around $NHC's #coal royalty exemption

1) extract from the QLD state legislation in force

2) bit of history around how QLD mining law evolved

$NHC.AX

#coaltwitter

1) extract from the QLD state legislation in force

2) bit of history around how QLD mining law evolved

$NHC.AX

#coaltwitter

Newcastle thermal #coal cracks US$400/t once again!

This equates to AU$580/t 🤑🤑

$WHC $NHC $YAL would all be absolutely creaming it at even half these prices assuming all in costs of AU$100/t

$WHC.AX $NHC.AX $YAL.AX

#coaltwitter

This equates to AU$580/t 🤑🤑

$WHC $NHC $YAL would all be absolutely creaming it at even half these prices assuming all in costs of AU$100/t

$WHC.AX $NHC.AX $YAL.AX

#coaltwitter

So interesting to see the divergence between thermal and met #coal blow out for the rest of the calendar year

Makes me increasingly cautious about a quick recovery stemming from the Chinese reopening

#CoalTwitter

Makes me increasingly cautious about a quick recovery stemming from the Chinese reopening

#CoalTwitter

"China could face further power shortages this summer despite taking drastic measures to boost coal production... relies on coal for 60% of its electricity"

"proportion of thermal coal >5,500 kcal has fallen to the lowest level since 2020"

#coaltwitter

reuters.com/markets/commod…

"proportion of thermal coal >5,500 kcal has fallen to the lowest level since 2020"

#coaltwitter

reuters.com/markets/commod…

Interesting to see #coal become relatively cheaper on an MMBtu basis against other energy commodities

Elements for a fundamental shift towards sustainably higher prices for coal firmly in place IMO

#coaltwitter

Elements for a fundamental shift towards sustainably higher prices for coal firmly in place IMO

#coaltwitter

Met/Thermal #coal spread has blown out like crazy over last week

Thermal now trading 58% ABOVE met coal usually its the opposite

Now in ENTIRELY unprecedented circumstances with winter in the Northern hemisphere upcoming 🥶

#coaltwitter

Thermal now trading 58% ABOVE met coal usually its the opposite

Now in ENTIRELY unprecedented circumstances with winter in the Northern hemisphere upcoming 🥶

#coaltwitter

Check out my recent chat with Juddy here, talking about everyone's favourite #coal company Whitehaven Coal!

$WHC $WHC.AX #coaltwitter

$WHC $WHC.AX #coaltwitter

https://twitter.com/cjayfive/status/1545191114327867392

Newcastle thermal #coal futures sail over AU$600/t with the AUD now trading at US 68c

Flooding has interrupted shipments in some parts of NSW

$WHC $NHC $YAL $WHC.AX $NHC.AX $YAL.AX #coaltwitter

Flooding has interrupted shipments in some parts of NSW

$WHC $NHC $YAL $WHC.AX $NHC.AX $YAL.AX #coaltwitter

Newcastle thermal #coal now >AU$650/t 🔥🔥🔥

Feels like things are about to get absolutely silly!

$WHC $NHC $YAL $WHC.AX $NHC.AX $YAL.AX all printing at these prices 😁

#coaltwitter

Feels like things are about to get absolutely silly!

$WHC $NHC $YAL $WHC.AX $NHC.AX $YAL.AX all printing at these prices 😁

#coaltwitter

Standout quarter from $WHC $WHC.AX

Outperformed saleable volume and on realised prices

An absolute cash machine and still dirt cheap at current valuations

Thermal #coal still the place to be!

#coaltwitter

Outperformed saleable volume and on realised prices

An absolute cash machine and still dirt cheap at current valuations

Thermal #coal still the place to be!

#coaltwitter

points of interest from $WHC $WHC.AX conference call:

- Strong interest from EU in met (!!) coal initially but anticipate thermal interest going forward

- customers desire 2-3 yr contracts at high price points just to lock in supply. 1 yr contracts at present

- Strong interest from EU in met (!!) coal initially but anticipate thermal interest going forward

- customers desire 2-3 yr contracts at high price points just to lock in supply. 1 yr contracts at present

$WHC $WHC.AX 2/n

- franking credits have accrued from last FY

- capital allocation: happy w/ BB results, final divvy will be franked

- 20-50% of NPAT to be paid out via divvies and BB

- balance sheet will be reconsidered (capital returns on the horizon?!?)

- franking credits have accrued from last FY

- capital allocation: happy w/ BB results, final divvy will be franked

- 20-50% of NPAT to be paid out via divvies and BB

- balance sheet will be reconsidered (capital returns on the horizon?!?)

$WHC $WHC.AX 3/n

- some permitting delays with Narrabri stage 3 - climate time wasters

- cost structure: good labour relations and labour costs settled mostly. Retention payments for mine workers due to very tight labour conditions.

- diesel and consumables have risen

- some permitting delays with Narrabri stage 3 - climate time wasters

- cost structure: good labour relations and labour costs settled mostly. Retention payments for mine workers due to very tight labour conditions.

- diesel and consumables have risen

$WHC $WHC.AX 4/n

- higher demurrage costs

- piloting autonomous hauling at certain mines, has the potential to reduce costs

- 'enjoying watching the cash roll through the door'

- market is very tight, even low quality producers able to sell very easily. barely any excess coal

- higher demurrage costs

- piloting autonomous hauling at certain mines, has the potential to reduce costs

- 'enjoying watching the cash roll through the door'

- market is very tight, even low quality producers able to sell very easily. barely any excess coal

$WHC $WHC.AX 5/n

- shipping/transport delays have largely cleared

- very difficult to obtain purchaseable coal

- not indulging new customers on the met coal side

- current met/thermal price mismatch last seen in 1970s (multiple energy shocks) - maybe multi-year

- shipping/transport delays have largely cleared

- very difficult to obtain purchaseable coal

- not indulging new customers on the met coal side

- current met/thermal price mismatch last seen in 1970s (multiple energy shocks) - maybe multi-year

$WHC $WHC.AX 6/n

- difficult to see new energy sources come online in the short-term

- China needs much more 5500+ CV coal, big loser is Indonesia which sells most lower CV coals

- no change expected in NSW royalties vs QLD tax rises

- difficult to see new energy sources come online in the short-term

- China needs much more 5500+ CV coal, big loser is Indonesia which sells most lower CV coals

- no change expected in NSW royalties vs QLD tax rises

$WHC $WHC.AX 7/n

- QLD pretty much considered uninvestable by the industry after the tax/royalty rises

- Vickery won't be pursuing development for at least 12 months -still at studies stage - FY24 at the very earliest

- Japanese customers very interested in Vickery products

- QLD pretty much considered uninvestable by the industry after the tax/royalty rises

- Vickery won't be pursuing development for at least 12 months -still at studies stage - FY24 at the very earliest

- Japanese customers very interested in Vickery products

$WHC $WHC.AX 7/n

- 3000MW of new thermal coal power plants coming online in Japan shortly with 30-40 yr asset lives that require Vickery spec coal

- met/thermal cannot be blended due to different characteristics

- fragility of energy systems given changes in the market place

- 3000MW of new thermal coal power plants coming online in Japan shortly with 30-40 yr asset lives that require Vickery spec coal

- met/thermal cannot be blended due to different characteristics

- fragility of energy systems given changes in the market place

$WHC $WHC.AX 8/n

- thinks that energy security will be re-rated as a priority now

- cannot fathom prices reverting back to sub-$100/t levels

- Russian coal doesn't satisfy demand from China/Indian customers

- coal producers being priced at huge discount rates well over 15%

- thinks that energy security will be re-rated as a priority now

- cannot fathom prices reverting back to sub-$100/t levels

- Russian coal doesn't satisfy demand from China/Indian customers

- coal producers being priced at huge discount rates well over 15%

An idea that I've been stewing on following the $WHC $WHC.AX conference call:

Is it far fetched to imagine a Japanese generation consortium putting up the capex for Vickery in exchange for off-take??

Is it far fetched to imagine a Japanese generation consortium putting up the capex for Vickery in exchange for off-take??

$WHC $WHC.AX from a follow on call 1/n

- Customers are desperate for coal

Not one customer has mentioned pricing, their issue is supply

- No settlement for annual thermal #coal price, gap is too large

- Analogy: 'when coal is short, you find out who your friends are'

- Customers are desperate for coal

Not one customer has mentioned pricing, their issue is supply

- No settlement for annual thermal #coal price, gap is too large

- Analogy: 'when coal is short, you find out who your friends are'

$WHC $WHC.AX from a follow on call 2/n

- pricing likely going to stay solid for sometime, unless there is a 'magical' change in alternative energy sources

- forward curve is thin but gives you an indication we'll be in the $300+/t territory for sometime

- we're in a good period

- pricing likely going to stay solid for sometime, unless there is a 'magical' change in alternative energy sources

- forward curve is thin but gives you an indication we'll be in the $300+/t territory for sometime

- we're in a good period

$WHC $WHC.AX from a follow on call 3/n

- won't be locking in price at this time, but will be locking in premiums for a 12 month horizon

- premiums are very chunky now, reflecting current market tightness

- noone is incentivised to build new coal mines - no new incremental supply

- won't be locking in price at this time, but will be locking in premiums for a 12 month horizon

- premiums are very chunky now, reflecting current market tightness

- noone is incentivised to build new coal mines - no new incremental supply

$WHC $WHC.AX from a follow on call 4/n

-how will cash find its way back to shareholder pockets?

-historically excess distributed via special dividends, but prefer BB at this stage

-20-50% of NPAT figure includes divvies and BBs

-BB delivering to long-term shareholders

-how will cash find its way back to shareholder pockets?

-historically excess distributed via special dividends, but prefer BB at this stage

-20-50% of NPAT figure includes divvies and BBs

-BB delivering to long-term shareholders

$WHC $WHC.AX from a follow on call 4/n

-new demand is drawing supply away from existing customers

-can't really justify further development capex with current valuations

- selling coal isn't the problem now, but who the coal goes to at what premium 🔥

Fin.

-new demand is drawing supply away from existing customers

-can't really justify further development capex with current valuations

- selling coal isn't the problem now, but who the coal goes to at what premium 🔥

Fin.

Average $WHC $WHC.AX investor when they finally get a quarter where guidance not missed, but actually beaten for once!

iykyk 😂

#coaltwitter

iykyk 😂

#coaltwitter

$WHC $WHC.AX target price upgraded to $8.50 by Morgan Stanley 🔥

#coaltwitter representatives believe this is still too conservative 😁

#coaltwitter representatives believe this is still too conservative 😁

https://twitter.com/Muschipeter1/status/1549414097413963776

Excellent podcast for #coal investors and the coal curious

A great insight into the critical nature coal has played in the progression of modern civilization and it's critical nature today

#coaltwitter

podcasts.google.com/feed/aHR0cHM6L…

A great insight into the critical nature coal has played in the progression of modern civilization and it's critical nature today

#coaltwitter

podcasts.google.com/feed/aHR0cHM6L…

Shoulder season vintage contracts for Newcastle Coal futures getting icy smashing past US$400/t

God knows how crazy this is going to get over Northern Hemisphere winter 🧨

Europeans: "where's the #coal gone?"

#coaltwitter

$WHC $NHC $WHC.AX $NHC.AX are minting here

God knows how crazy this is going to get over Northern Hemisphere winter 🧨

Europeans: "where's the #coal gone?"

#coaltwitter

$WHC $NHC $WHC.AX $NHC.AX are minting here

Feels like some kind of sick joke now

Pick your fighter $IGO or $WHC??

When will #coal get the ESG rerate?!?

$WHC.AX $IGO.AX #coaltwitter

Pick your fighter $IGO or $WHC??

When will #coal get the ESG rerate?!?

$WHC.AX $IGO.AX #coaltwitter

"Nippon Steel Corp. agreed on an annual supply deal through March with Glencore for power plant #coal at US$375 per ton"

Nippon got themselves a bargain going into winter!

H/T @InspectionDeep #coaltwitter #thermalcoal

bnnbloomberg.ca/mining-giant-g…

Nippon got themselves a bargain going into winter!

H/T @InspectionDeep #coaltwitter #thermalcoal

bnnbloomberg.ca/mining-giant-g…

For those not in the know, this is DEEPLY BULLISH for sustaining #coal prices at these levels

For context in FY22, Glencore struck a price of ~$110/t.

To strike a contract price, >3 times the previous years price is unprecendented, demonstrative of supply shortage

#CoalTwitter

For context in FY22, Glencore struck a price of ~$110/t.

To strike a contract price, >3 times the previous years price is unprecendented, demonstrative of supply shortage

#CoalTwitter

Excellent interview with @brbobbr on ESG, the energy transition and plenty of economic history regarding commodities

Well worth your time 👌🏽

podcasts.google.com/feed/aHR0cHM6L…

Well worth your time 👌🏽

podcasts.google.com/feed/aHR0cHM6L…

Great article on the forward demand for coking/met #coal from the perspective of an Asian buyer

#coaltwitter

afr.com/companies/mini…

#coaltwitter

afr.com/companies/mini…

Have been contemplating whether we see price softness in thermal #coal over the coming two months given its the shoulder season where demand should soften.

Prices are still near ATHs which makes me wonder how silly things are going to get during peak Dec-Jan window

#coaltwitter

Prices are still near ATHs which makes me wonder how silly things are going to get during peak Dec-Jan window

#coaltwitter

Well that was a short shoulder season pullback!

NewC #coal back to US$425/t 🔥

Still a couple of months away from the main event ⏳

#coaltwitter

NewC #coal back to US$425/t 🔥

Still a couple of months away from the main event ⏳

#coaltwitter

Not to be a wet blanket but this move to ~$7 for $WHC $WHC.AX doesn't excite me

Wake me up if and when we get >$10

Wake me up if and when we get >$10

Still kinda boring but nice to see $WHC $WHC.AX heading towards $8

Average thermal #coal investor in market carnage

NewC futures >US$450/t with no sign of prices abating. At this point in the cycle, quality matters.

$WHC $WHC.AX likely to see some multiple expansion post-reporting. They *might* even hit a 3x FCF multiple!😎

#coaltwitter

NewC futures >US$450/t with no sign of prices abating. At this point in the cycle, quality matters.

$WHC $WHC.AX likely to see some multiple expansion post-reporting. They *might* even hit a 3x FCF multiple!😎

#coaltwitter

"Long term thermal #coal prices assumptions should be $50/t.... it's a DYING industry!!"

"5 year forward curve tells me $270/t"

#coaltwitter

"5 year forward curve tells me $270/t"

#coaltwitter

Quick snapshot of $WHC $WHC.AX results 🔥🔥🔥

$4.92 bill revenue - implied realised price of ~AU$350/t

$1.95 bill NPAT (!!)

Current P/E ratio (backward looking) - 3.8x

Current NEWC spot = ~AU$600/t

5 year forward price = ~AU$370/t

DIRT CHEAP on any basis

#coaltwitter #coal

$4.92 bill revenue - implied realised price of ~AU$350/t

$1.95 bill NPAT (!!)

Current P/E ratio (backward looking) - 3.8x

Current NEWC spot = ~AU$600/t

5 year forward price = ~AU$370/t

DIRT CHEAP on any basis

#coaltwitter #coal

BTW I'm glad $WHC $WHC.AX were stingy with the dividend

The real opportunity and value accretive move here is to undertake a buyback, of the likes the Australian market has never seen at these absurd price multiples.

This would provide enormous returns for long-term holders

The real opportunity and value accretive move here is to undertake a buyback, of the likes the Australian market has never seen at these absurd price multiples.

This would provide enormous returns for long-term holders

Shared some longer thoughts on the path forward for $WHC $WHC.AX

Enjoy!

bit.ly/3Ti1pSk

#coaltwitter #coal

Enjoy!

bit.ly/3Ti1pSk

#coaltwitter #coal

Excellent interview with Whitehaven Leader, Paul Flynn, who provides a comprehensive overview of the #coal industry and present market context.

Recommended reading for all $WHC $WHC.AX investors

#coaltwitter

afr.com/companies/ener…

Recommended reading for all $WHC $WHC.AX investors

#coaltwitter

afr.com/companies/ener…

Fantastic interview with @NatalieBiggs_C6 who shares excellent insights into what's driving the high quality thermal #coal markets to new all time highs as well as what the future holds for the coal industry.

H/T: @TwainsMustache

#coaltwitter

podcasts.google.com/feed/aHR0cHM6L…

H/T: @TwainsMustache

#coaltwitter

podcasts.google.com/feed/aHR0cHM6L…

$WHC $WHC.AX buyers gunning down the sell side today. #coal buyers in control!

Trading at all time (dividend-adjusted) highs with an aggressive buyback program in place

#coaltwitter

Trading at all time (dividend-adjusted) highs with an aggressive buyback program in place

#coaltwitter

Australian fund managers and investors who thought $WHC was overvalued at $2.50 😏

#coaltwitter #coal $WHC.AX

#coaltwitter #coal $WHC.AX

• • •

Missing some Tweet in this thread? You can try to

force a refresh