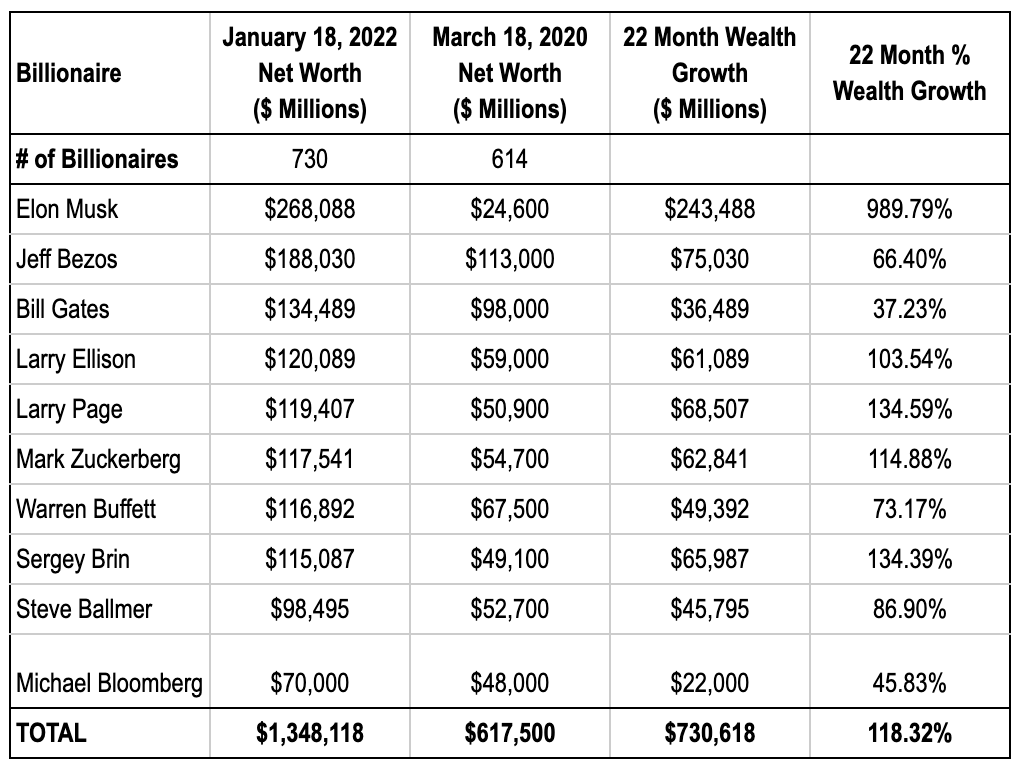

BREAKING: America's billionaires have officially gotten $2 TRILLION richer during the pandemic, largely tax-free

Elon Musk's wealth alone shot up by 1,080%

Workers struggling to afford gas, groceries, healthcare are paying their fair share this Tax Day. Billionaires should too.

Elon Musk's wealth alone shot up by 1,080%

Workers struggling to afford gas, groceries, healthcare are paying their fair share this Tax Day. Billionaires should too.

Billionaire wealth growth is doing great in this economy.

Jeff Bezos ⬆️ 68%

Elon Musk ⬆️ 1080%

Larry Page ⬆️ 134%

Warren Buffett ⬆️ 84%

Steve Ballmer ⬆️ 89%

Charles Koch ⬆️ 65%

Walton family ⬆️ 26%

Corporate profits are at record highs, too.

axios.com/corporate-prof…

Jeff Bezos ⬆️ 68%

Elon Musk ⬆️ 1080%

Larry Page ⬆️ 134%

Warren Buffett ⬆️ 84%

Steve Ballmer ⬆️ 89%

Charles Koch ⬆️ 65%

Walton family ⬆️ 26%

Corporate profits are at record highs, too.

axios.com/corporate-prof…

Billionaire wealth and corporate profits are directly connected. How? Billionaires don't take a paycheck like you and I do. They make their money in stocks—and they can go decades without paying taxes on that income because right now, it's only taxed when the stocks are sold.

This is what we're talking about when we say we need a billionaires income tax.

Why should billionaires pay little or no taxes when they sit on the couch and watch their stocks go up, while working families pay their fair share every year on every paycheck?

Why should billionaires pay little or no taxes when they sit on the couch and watch their stocks go up, while working families pay their fair share every year on every paycheck?

Billionaires are taking joyrides to space and buying superyachts. Elon Musk trying to buy Twitter for fun. There are 127 new billionaires since the pandemic began.

Pretty sure they'll all be fine if we ask them to pay up each year on the income they've gained.

Pretty sure they'll all be fine if we ask them to pay up each year on the income they've gained.

"But that money isn't in the bank."

Billionaires are borrowing against those wealth gains to secure sweetheart low-interest loans. That money is in fact very, very real. And they can keep doing it until they die and pass it onto their heirs tax-free.

It's called buy-borrow-die.

Billionaires are borrowing against those wealth gains to secure sweetheart low-interest loans. That money is in fact very, very real. And they can keep doing it until they die and pass it onto their heirs tax-free.

It's called buy-borrow-die.

President Biden and Senate Finance Chair @RonWyden have both proposed plans for a billionaires income tax.

We're leading the outside charge to make billionaires pay their fair share on their wealth gains. Join us.

actionnetwork.org/forms/tell-con…

We're leading the outside charge to make billionaires pay their fair share on their wealth gains. Join us.

actionnetwork.org/forms/tell-con…

You can read the full report here:

americansfortaxfairness.org/issue/tax-day-…

americansfortaxfairness.org/issue/tax-day-…

If billionaires can get $2 trillion richer during a pandemic, they can afford to pay their fair share in taxes.

Join @4TaxFairness @RonWyden @RepBowman @RBReich @MoveOn @HCAN this Tax Day and join in the fight to #TaxBillionaires!

bit.ly/TaxDayLaunch

Join @4TaxFairness @RonWyden @RepBowman @RBReich @MoveOn @HCAN this Tax Day and join in the fight to #TaxBillionaires!

bit.ly/TaxDayLaunch

• • •

Missing some Tweet in this thread? You can try to

force a refresh