(1/19)

About:

VBL is one of the largest franchisee of PepsiCo in the world. The Company produces & distributes a wide range of carbonated soft drinks (CSDs), variety of non-carbonated beverages (NCBs), including packaged drinking water sold under trademarks owned by PepsiCo.

About:

VBL is one of the largest franchisee of PepsiCo in the world. The Company produces & distributes a wide range of carbonated soft drinks (CSDs), variety of non-carbonated beverages (NCBs), including packaged drinking water sold under trademarks owned by PepsiCo.

(2/19)

Soft Drinks Market:

March-June is considered as the most important time for this business & we have seen both 1st & 2nd wave lockdowns taking place in these months. This had impacted the industry revenue.

However, the industry is delivering better numbers since then.

Soft Drinks Market:

March-June is considered as the most important time for this business & we have seen both 1st & 2nd wave lockdowns taking place in these months. This had impacted the industry revenue.

However, the industry is delivering better numbers since then.

(3/19)

Key growth drivers for the industry:

1. Young Demography

2. Rapid urbanisation & growing middle class

3. Electrification across the country to help with the penetration of cooling infrastructure

4. India’s hot tropical climate

Key growth drivers for the industry:

1. Young Demography

2. Rapid urbanisation & growing middle class

3. Electrification across the country to help with the penetration of cooling infrastructure

4. India’s hot tropical climate

(4/19)

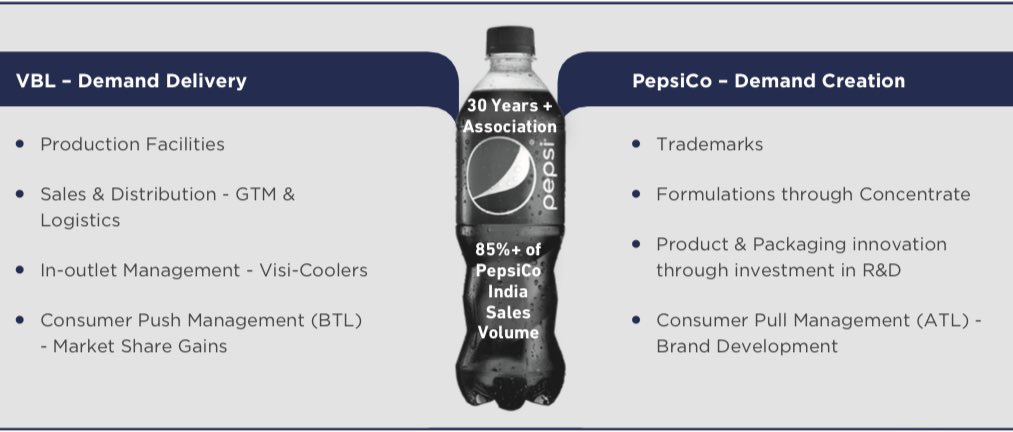

Let’s talk about VBL & PepsiCo:

The Company enjoys a strategic & longstanding over 30-year association with PepsiCo India, since the beverage company’s entry into India.

Today, it accounts for 85%+ of its sales volumes in India.

Let’s talk about VBL & PepsiCo:

The Company enjoys a strategic & longstanding over 30-year association with PepsiCo India, since the beverage company’s entry into India.

Today, it accounts for 85%+ of its sales volumes in India.

(5/19)

VBL has a sales team that collaborates closely with PepsiCo on local advertising & marketing campaigns.

The Company has been granted franchise rights for PepsiCo’s beverage products in 27 States & 7 UTs in 🇮🇳, in addition to Nepal, Sri Lanka, Morocco, Zambia & Zimbabwe.

VBL has a sales team that collaborates closely with PepsiCo on local advertising & marketing campaigns.

The Company has been granted franchise rights for PepsiCo’s beverage products in 27 States & 7 UTs in 🇮🇳, in addition to Nepal, Sri Lanka, Morocco, Zambia & Zimbabwe.

(6/19)

Business Model of VBL:

PepsiCo offers brands, concentrates & marketing support to VBL. In turn, VBL takes complete control over the manufacturing & supply chain processes, managing capital allocation strategies & pricing decisions.

Business Model of VBL:

PepsiCo offers brands, concentrates & marketing support to VBL. In turn, VBL takes complete control over the manufacturing & supply chain processes, managing capital allocation strategies & pricing decisions.

(7/19)

Current Capacity of VBL:

• VBL has 31 manufacturing facilities in India, & 6 globally.

• Further, it has a robust supply chain with 100+ owned depots, 2,500+ owned vehicles, 2,000+ primary distributors.

• It has installed 840,000+ visicoolers across various markets

Current Capacity of VBL:

• VBL has 31 manufacturing facilities in India, & 6 globally.

• Further, it has a robust supply chain with 100+ owned depots, 2,500+ owned vehicles, 2,000+ primary distributors.

• It has installed 840,000+ visicoolers across various markets

(8/19)

The brands Operated by VBL:

Pepsi, Mirinda, Mountain Dew, Slice Fizzy, Seven-Up, Sting,

Evervess, Duke, Tropicana Slice, Tropicana Juices, Gatorade, & packaged drinking water brands Aquafina & Aquavess.

VBL will also start manufacturing Kurkure Puffcorn for PepsiCo.

The brands Operated by VBL:

Pepsi, Mirinda, Mountain Dew, Slice Fizzy, Seven-Up, Sting,

Evervess, Duke, Tropicana Slice, Tropicana Juices, Gatorade, & packaged drinking water brands Aquafina & Aquavess.

VBL will also start manufacturing Kurkure Puffcorn for PepsiCo.

(9/19)

Revenue Trend:

• Sales Volume 5 Year CAGR - 20%

• India, Sri Lanka, Nepal contributes 81% of Net revenues; African countries contributes 19%

• Segment wise sales volume-

1. Packaged drinking water-23.3%

2. NCB - 6.4%

3. CSD - 70.3%

Revenue Trend:

• Sales Volume 5 Year CAGR - 20%

• India, Sri Lanka, Nepal contributes 81% of Net revenues; African countries contributes 19%

• Segment wise sales volume-

1. Packaged drinking water-23.3%

2. NCB - 6.4%

3. CSD - 70.3%

(10/19)

Growth positive triggers:

1. Focus on under penetrated regions:

VBL has plans to set up new facilities in Bihar and J&K. So they can grow in territories like Bihar, Odisha, Chhattisgarh, Jharkhand, & MP.

The mgmt believes they can grow at 35% CAGR in these regions.

Growth positive triggers:

1. Focus on under penetrated regions:

VBL has plans to set up new facilities in Bihar and J&K. So they can grow in territories like Bihar, Odisha, Chhattisgarh, Jharkhand, & MP.

The mgmt believes they can grow at 35% CAGR in these regions.

(11/19)

2. Margin risk due to inflation almost covered:

VBL had taken a couple of steps to hedge the rising cost. One was by light weighting the preforms & the other was by increasing their inventory last year.

Thus VBL is confident of sustaining EBIT margins above 20%

2. Margin risk due to inflation almost covered:

VBL had taken a couple of steps to hedge the rising cost. One was by light weighting the preforms & the other was by increasing their inventory last year.

Thus VBL is confident of sustaining EBIT margins above 20%

(12/19)

3. Diversified Portfolio:

PepsiCo is periodically launching new products according to the market trends. Which is helping it to sustain in this market with healthy margins.

The premium product Sting is growing at 440% YoY & is contributing 5% of total sales vs ~1% YOY

3. Diversified Portfolio:

PepsiCo is periodically launching new products according to the market trends. Which is helping it to sustain in this market with healthy margins.

The premium product Sting is growing at 440% YoY & is contributing 5% of total sales vs ~1% YOY

(13/19)

4. Better operating efficiency:

• Adjacent territories offer better

operating leverage & asset utilization - economies of scale

• Production & logistics optimization including backward integration

• Use of technology to improve sales & operational process.

4. Better operating efficiency:

• Adjacent territories offer better

operating leverage & asset utilization - economies of scale

• Production & logistics optimization including backward integration

• Use of technology to improve sales & operational process.

(14/19)

Other factors:

1. Economy unlocking in the main months of March to June.

2. Higher acceptance of newly launched products

3. Newly acquired south and west India market numbers is set to show better numbers after economy unlocking.

Other factors:

1. Economy unlocking in the main months of March to June.

2. Higher acceptance of newly launched products

3. Newly acquired south and west India market numbers is set to show better numbers after economy unlocking.

(15/19)

Key Risks:

1. Possible 4th Wave of Covid

2. Failure of acceptance of new products

3. Sustained rise in input prices

4. Price war with the competitors

5. If de leveraging doesn’t go according to the plan and Debt/EBITDA fails to fall below 1.5x

Key Risks:

1. Possible 4th Wave of Covid

2. Failure of acceptance of new products

3. Sustained rise in input prices

4. Price war with the competitors

5. If de leveraging doesn’t go according to the plan and Debt/EBITDA fails to fall below 1.5x

(16/19)

Key Numbers:

1. Net Sales up 36.8% YOY

2. EBITDA up 37.7% YOY

3. PAT up 108.8% YOY

4. EBITDA 5 year CAGR : 18.6%

5. Net Debt to Equity : 0.7x

6. PEG Ratio : 0.86

7. Int Coverage : 5.95

8. ROCE : 17.4%

9. 5 Year Sales CAGR : 21.8%

10.ROE : 18.6%

Key Numbers:

1. Net Sales up 36.8% YOY

2. EBITDA up 37.7% YOY

3. PAT up 108.8% YOY

4. EBITDA 5 year CAGR : 18.6%

5. Net Debt to Equity : 0.7x

6. PEG Ratio : 0.86

7. Int Coverage : 5.95

8. ROCE : 17.4%

9. 5 Year Sales CAGR : 21.8%

10.ROE : 18.6%

(17/19)

Shareholding Pattern:

1. Promoters : 64.89%

2. FIIs : 21.23%

3. DIIs : 7.06%

4. Public : 6.82%

Shareholding Pattern:

1. Promoters : 64.89%

2. FIIs : 21.23%

3. DIIs : 7.06%

4. Public : 6.82%

(18/19)

VBL has a strong product portfolio. It’s continuous expansion plans are healthy as the company has good leverage ratios.

Last two years washout during peak months due to covid was the key problem but that is in the past. Thus, Q1FY23 can be very strong for VBL.

VBL has a strong product portfolio. It’s continuous expansion plans are healthy as the company has good leverage ratios.

Last two years washout during peak months due to covid was the key problem but that is in the past. Thus, Q1FY23 can be very strong for VBL.

(19/19)

What are your thoughts about VBL?

@caniravkaria @DhanValue @kuttrapali26 @VRtrendfollower @Anshi_________ @stockifi_Invest @mehrotra_saket @MadhusudanKela

What are your thoughts about VBL?

@caniravkaria @DhanValue @kuttrapali26 @VRtrendfollower @Anshi_________ @stockifi_Invest @mehrotra_saket @MadhusudanKela

• • •

Missing some Tweet in this thread? You can try to

force a refresh