#CardiffCity 2020/21 financial results covered a season when they finished 8th in the Championship. Manager Neil Harris was replaced by Mick McCarthy in January 2021, since succeeded by Steve Morison In November 2021. Some thoughts in the following thread.

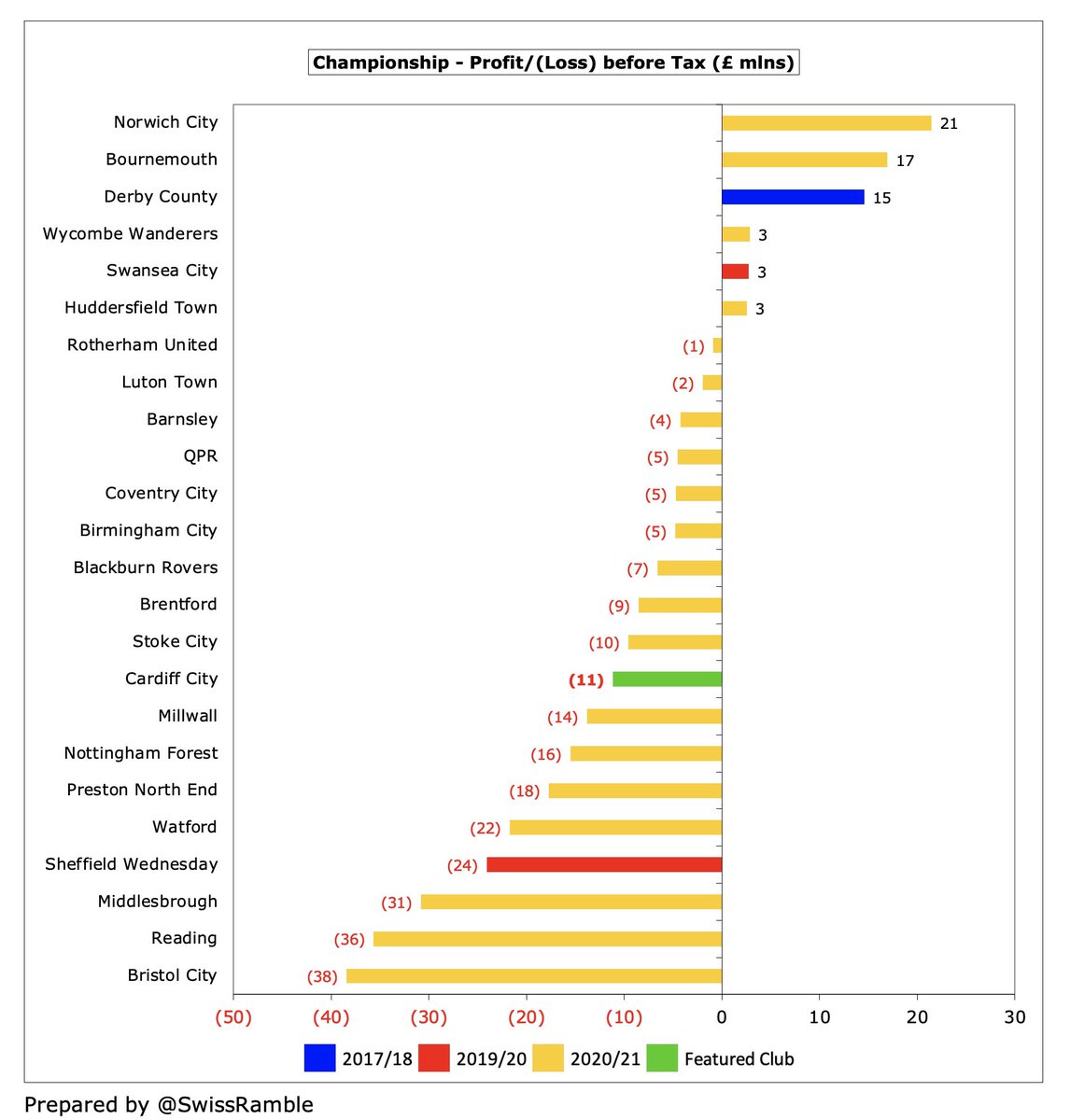

#CardiffCity pre-tax loss narrowed from £12m to £11m, as revenue rose £9m (20%) from £46m to £55m and operating expenses were cut £3m (4%), though profit on player sales fell £11m from £14m to £3m.

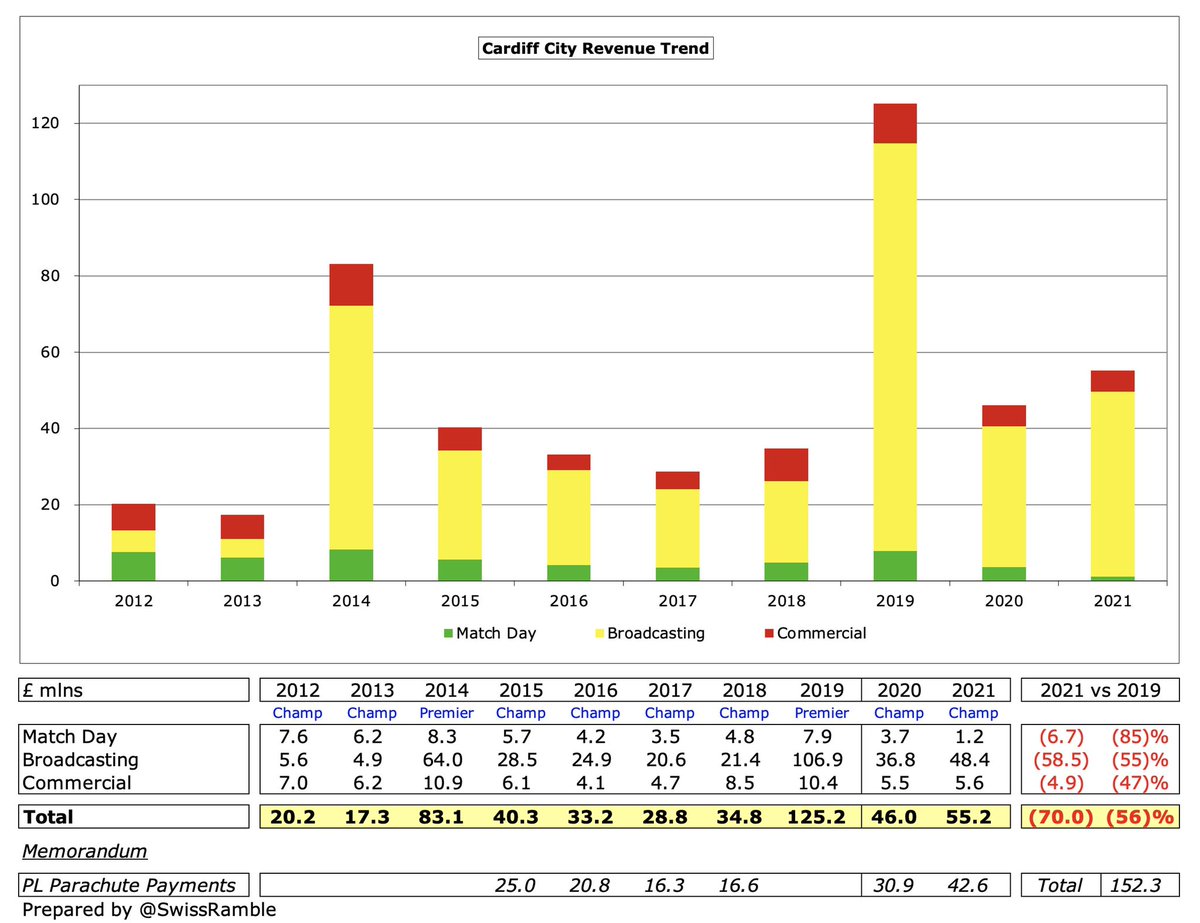

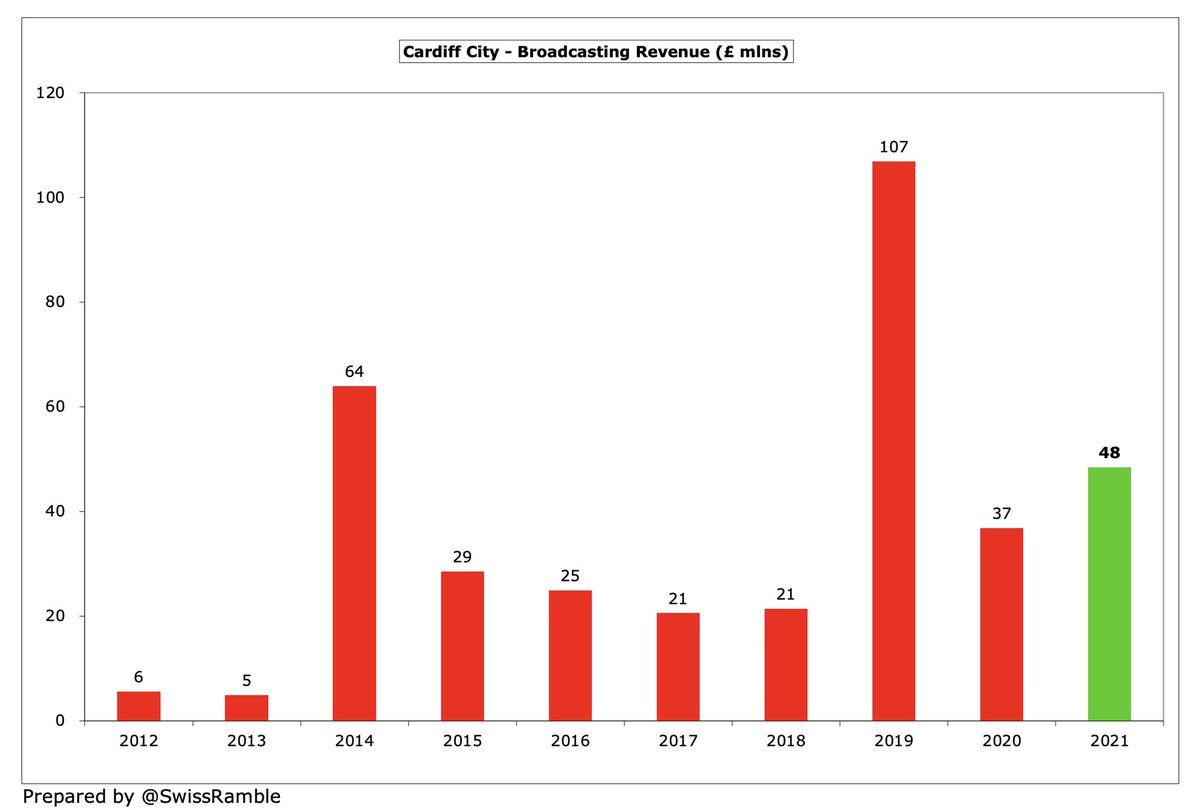

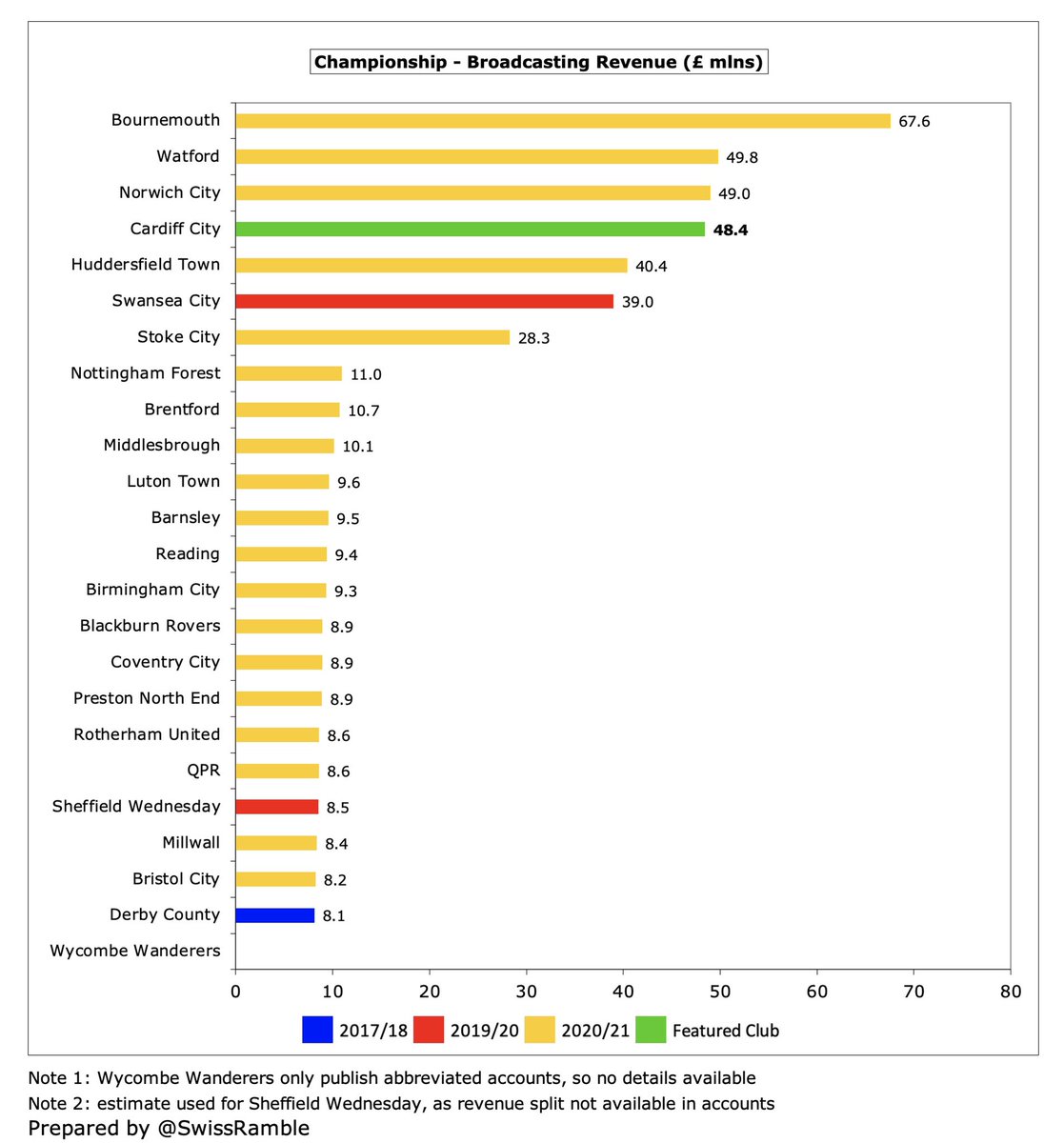

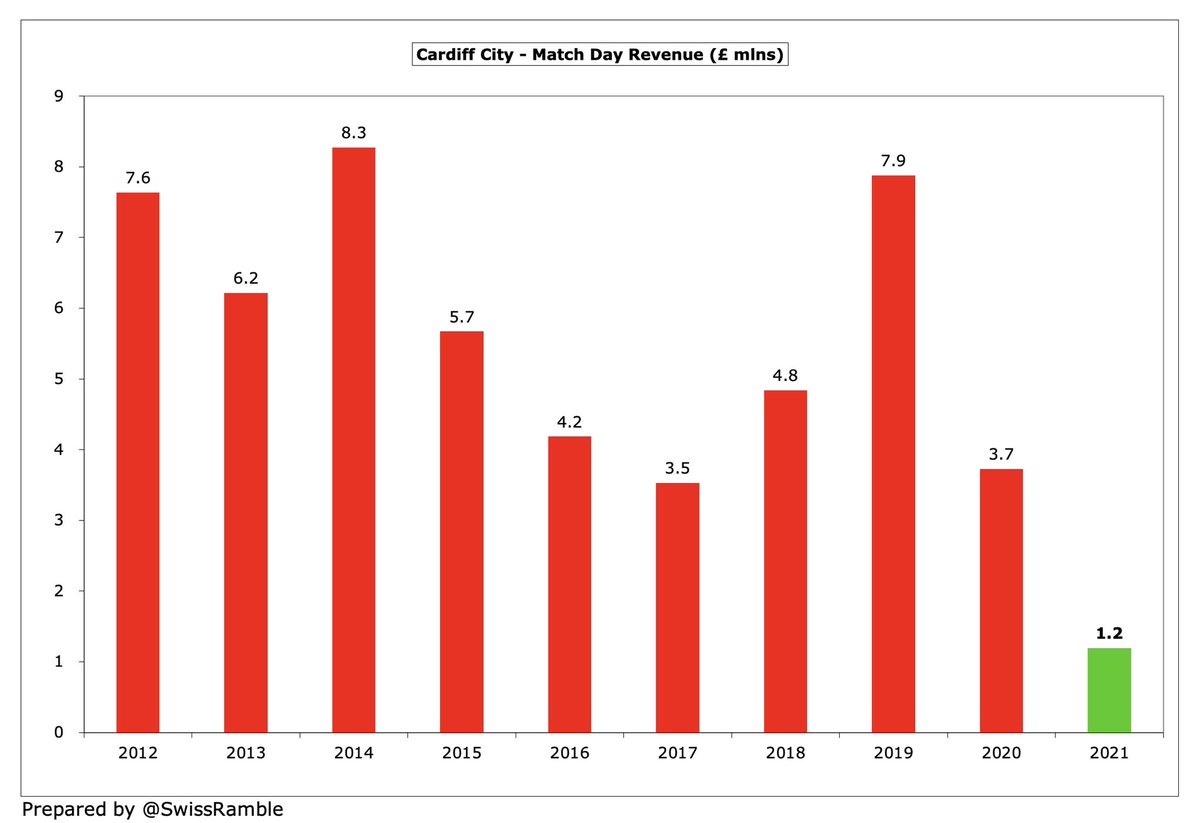

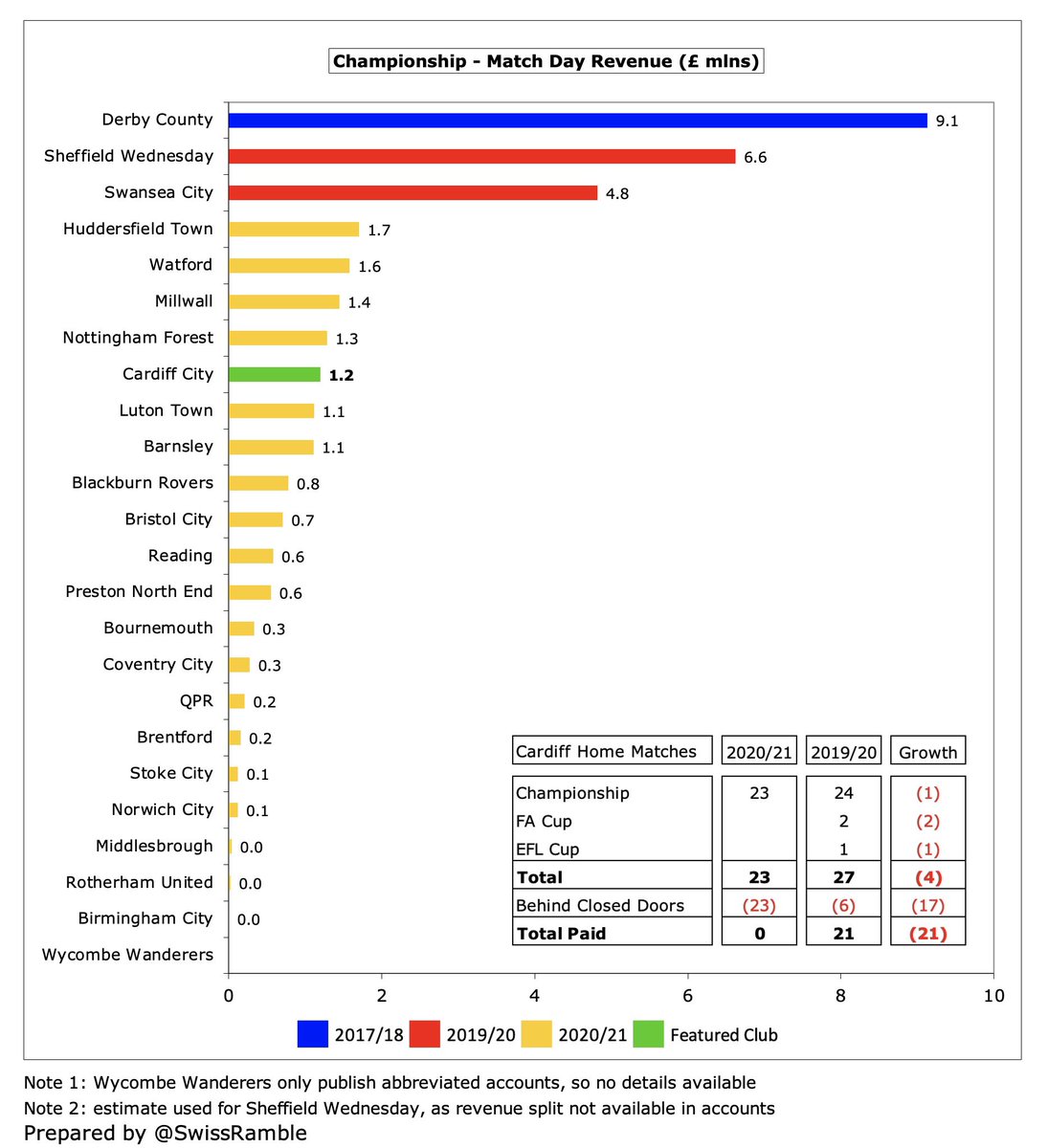

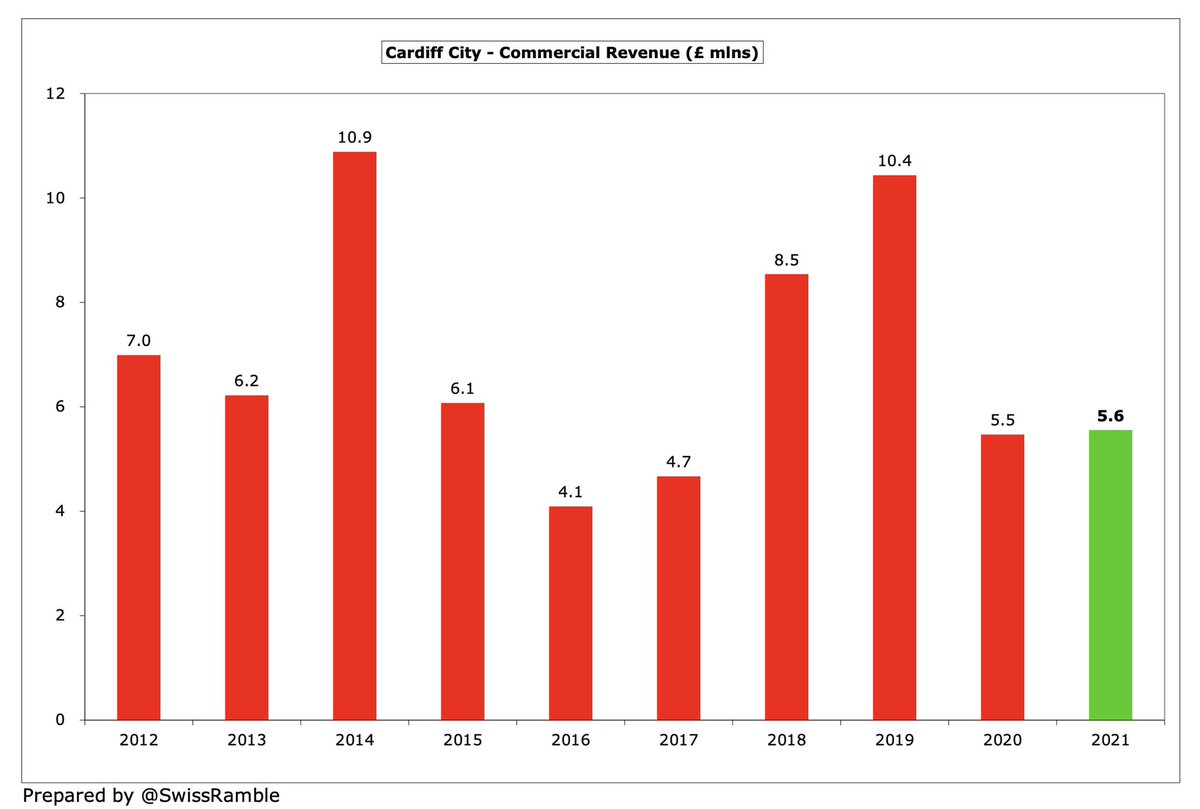

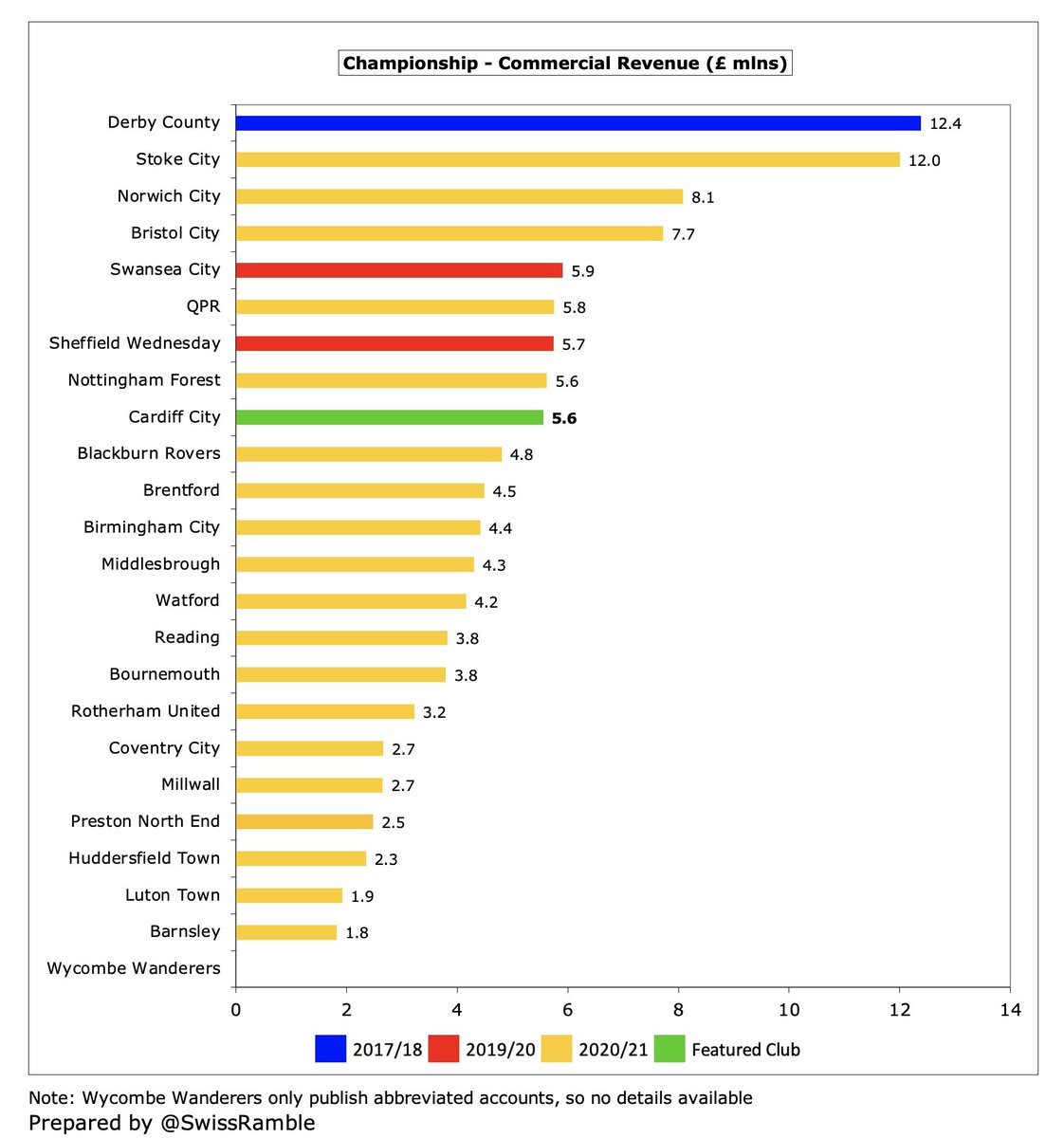

#CardiffCity broadcasting income rose £11m (31%) from £37m to £48m, as money deferred for games played after 2020 accounts offset lower parachute payments. Match day fell £2.5m (68%) from £3.7m to £1.2m, as games played without fans. Commercial slightly increased to £5.6m.

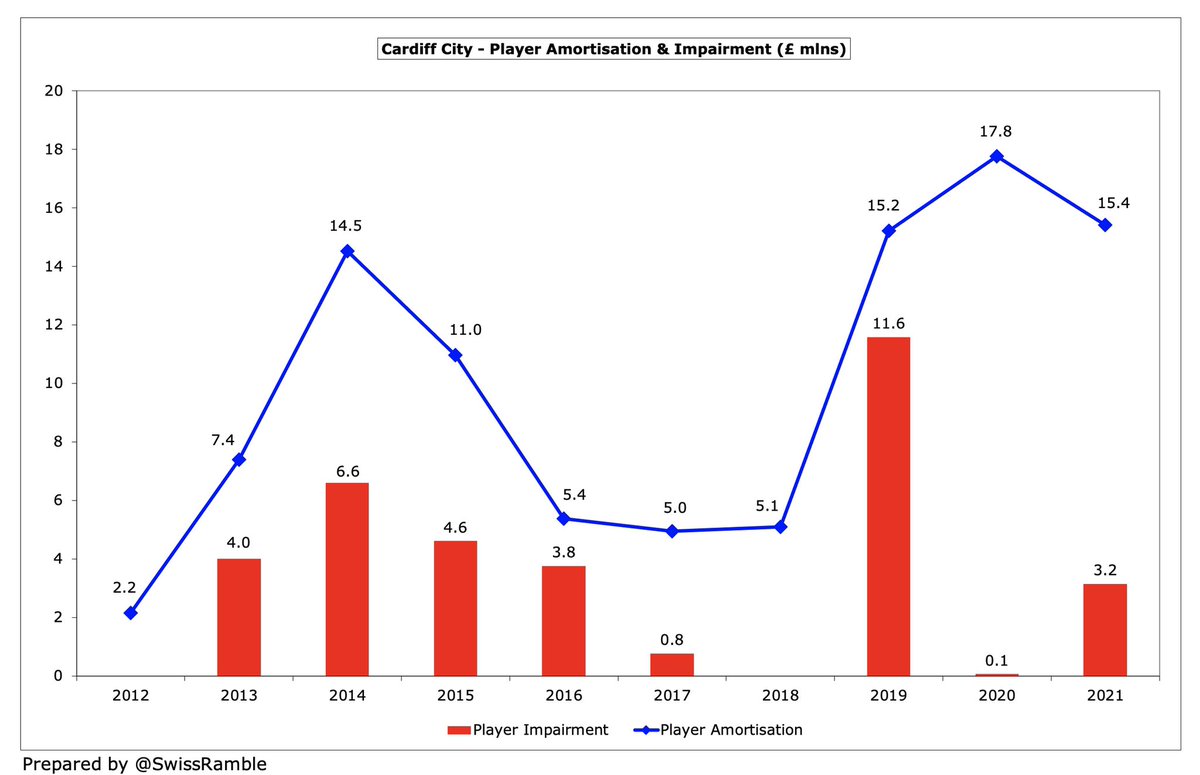

#CardiffCity cut the wage bill by £2.1m (6%) from £35.6m to £33.5m, while player amortisation fell £2.4m (13%) from £17.8m to £15.4m and other expenses decreased £1.1m (8%) to £13.1m. However, club booked £3.2m impairment to write-down player values.

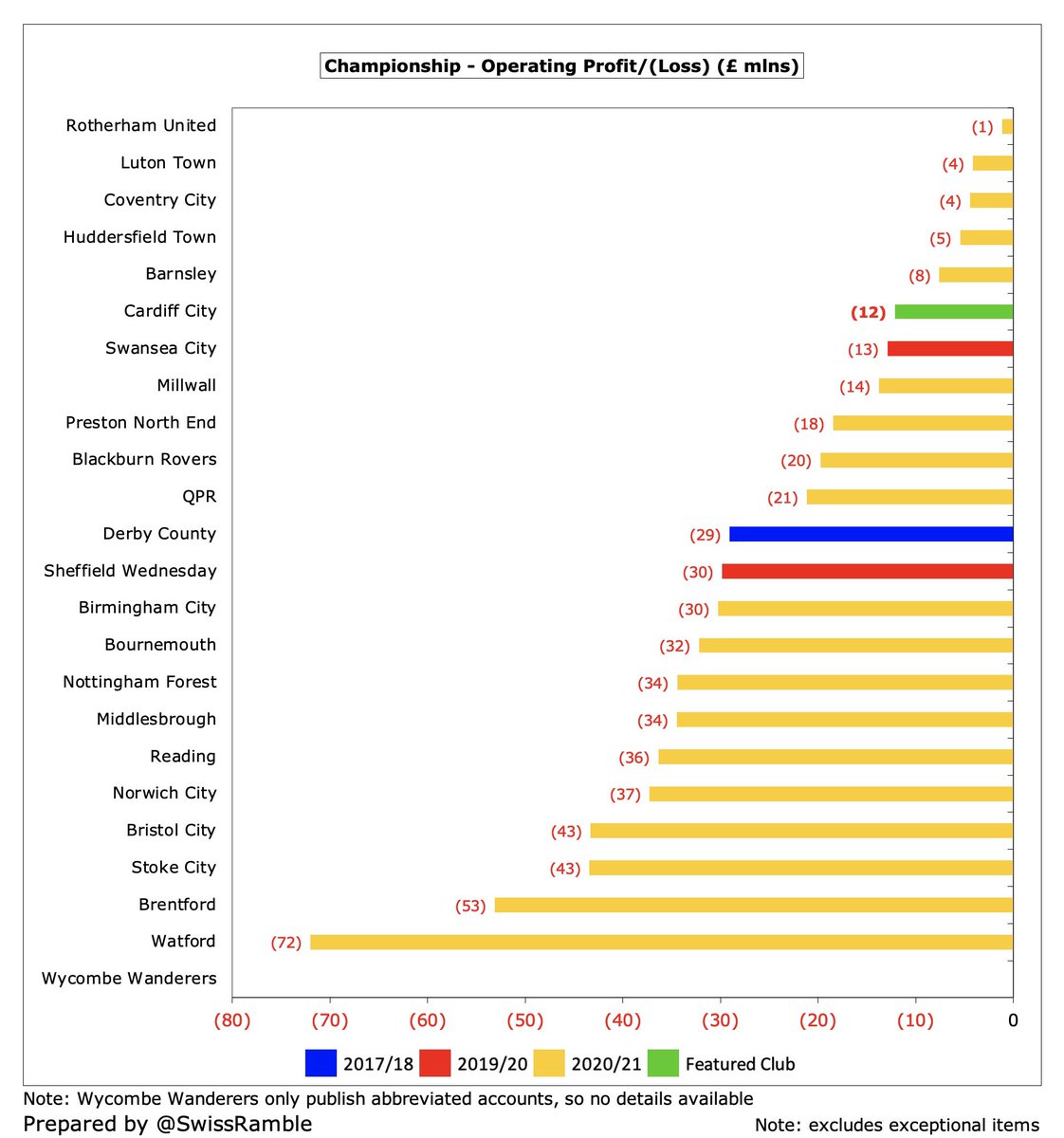

Although #CardiffCity £11m loss is clearly not great, it was nowhere near as much as some others in 2020/21 Championship, e.g. Bristol City £38m, Reading £36m & #Boro £31m. Highest profits from 2 clubs relegated from the Premier League the prior season: #NCFC £21m & #AFCB £17m.

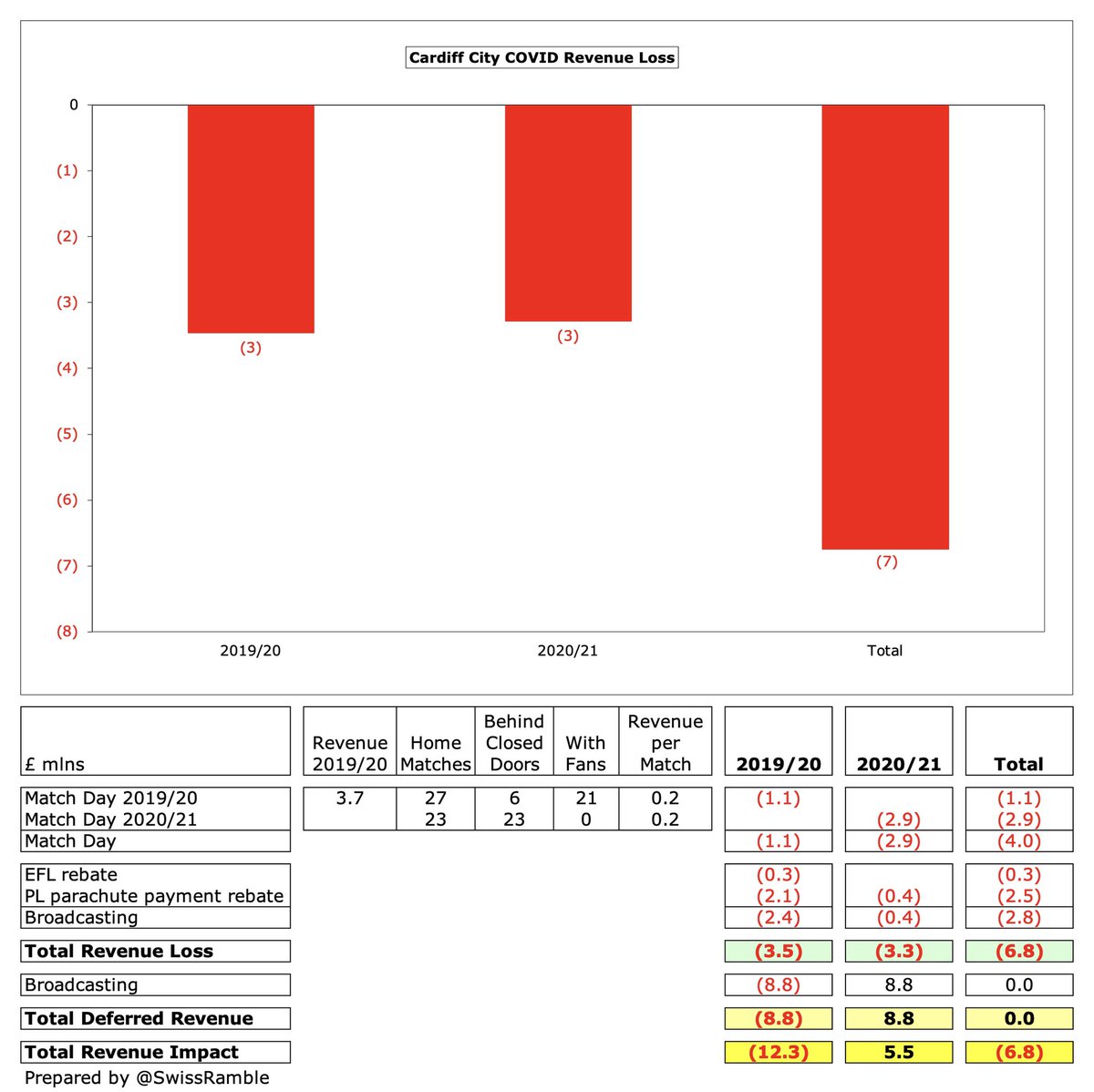

#CardiffCity chairman Mehmet Dalman said, “The pandemic hit us hard”. Impact not quantified, but I estimate at least £3m lost revenue in 2021 (mainly match day), giving £7m in past 2 years. However, 2021 boosted by £8.8m deferred TV revenue for games played after 2020 accounts.

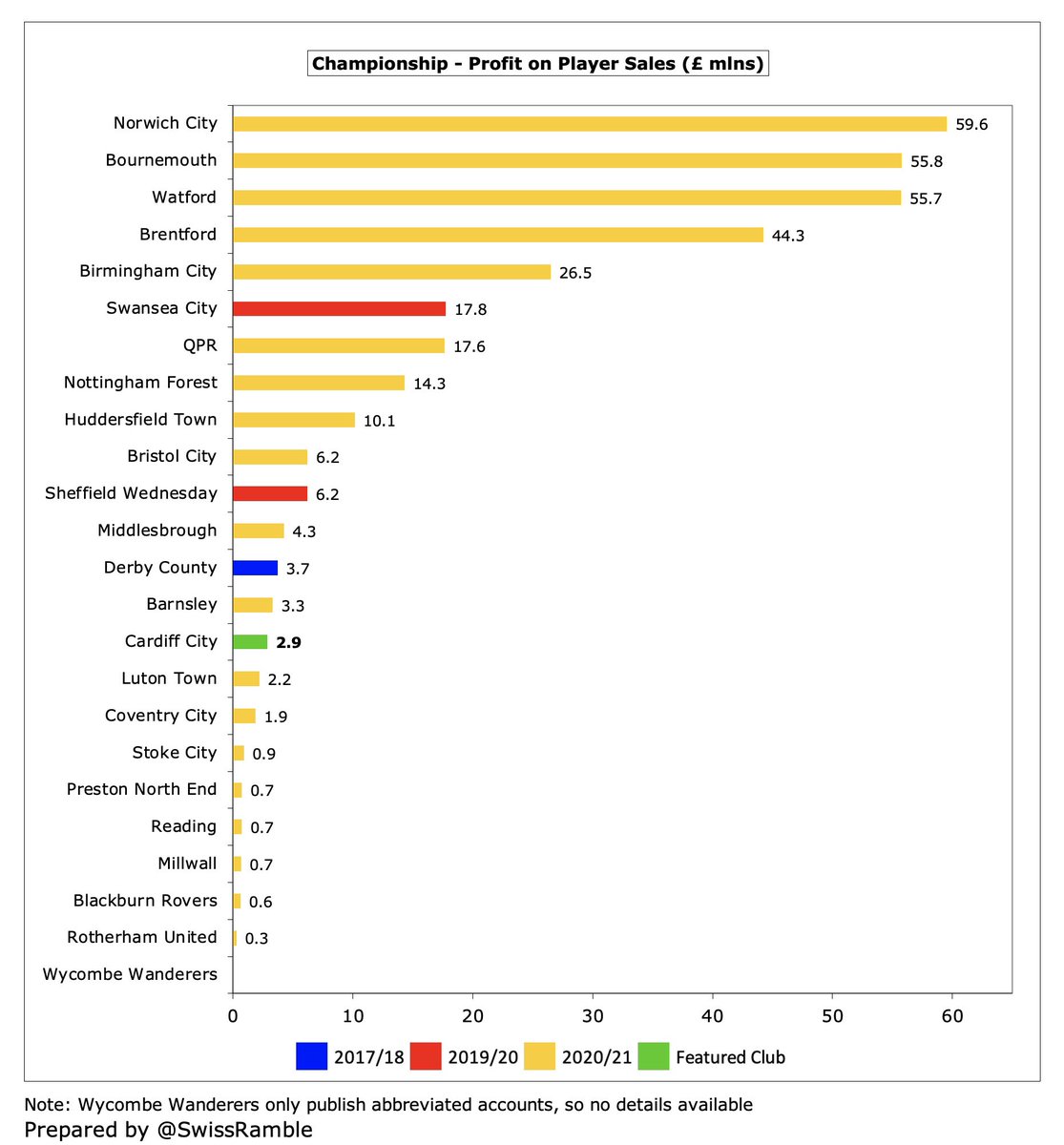

#CardiffCity profit on player sales fell £11m from £14m to £3m, including Neil Etheridge to Birmingham City and Callum Paterson to #SWFC. Significantly lower than the 3 clubs relegated from the Premier League, who each generated between £56m and £60m.

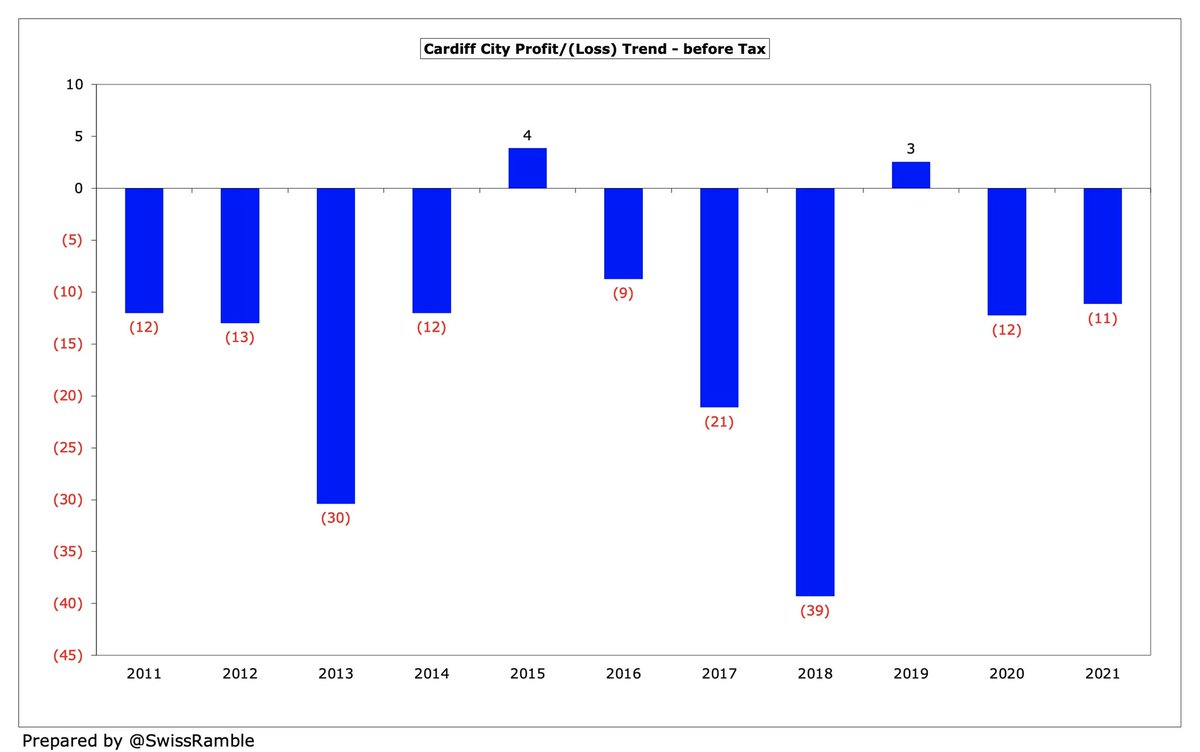

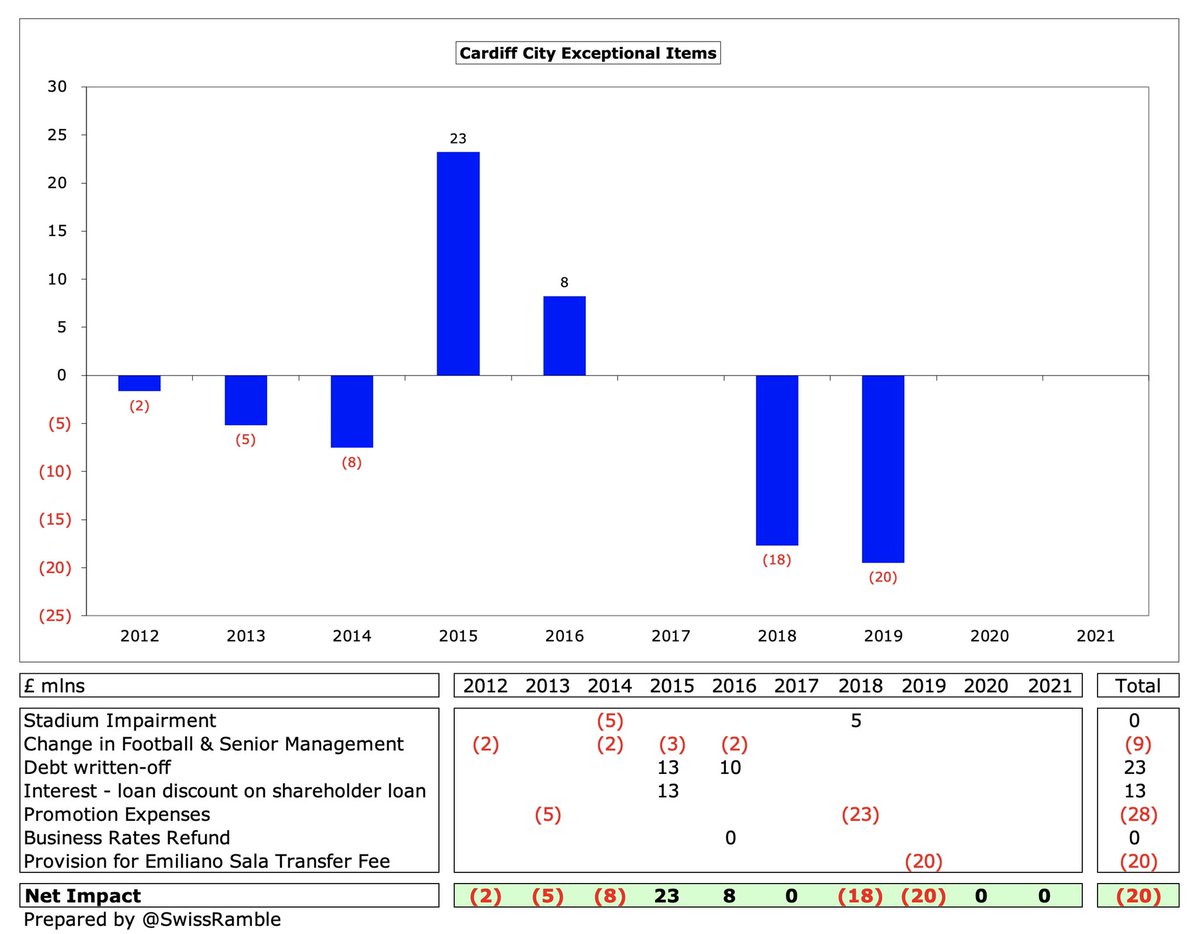

In the 11 since Vincent Tan bought #CardiffCity in May 2010, they have accumulated £154m of losses, £81m in the last 5 years. In that period the club has only had two (small) profits, £4m in 2015 and £3m in 2019. They even contrived to lose £12m in the Premier League in 2014.

Furthermore, #CardiffCity 2015 £4m profit was entirely due to once-off factors (£13m debt-write-off and £13m interest adjustment). If the club is correct that they will not need to pay a transfer fee for Sala, then future financials will be boosted by reversal of £20m provision.

#CardiffCity have made very little money from player sales, only £34m in total in the last decade, most of which came in just two years (£10m in 2015 and £14m in 2020). This season will include the sales of Kieffer Moore to #AFCB and Robert Glatzel to Hamburg.

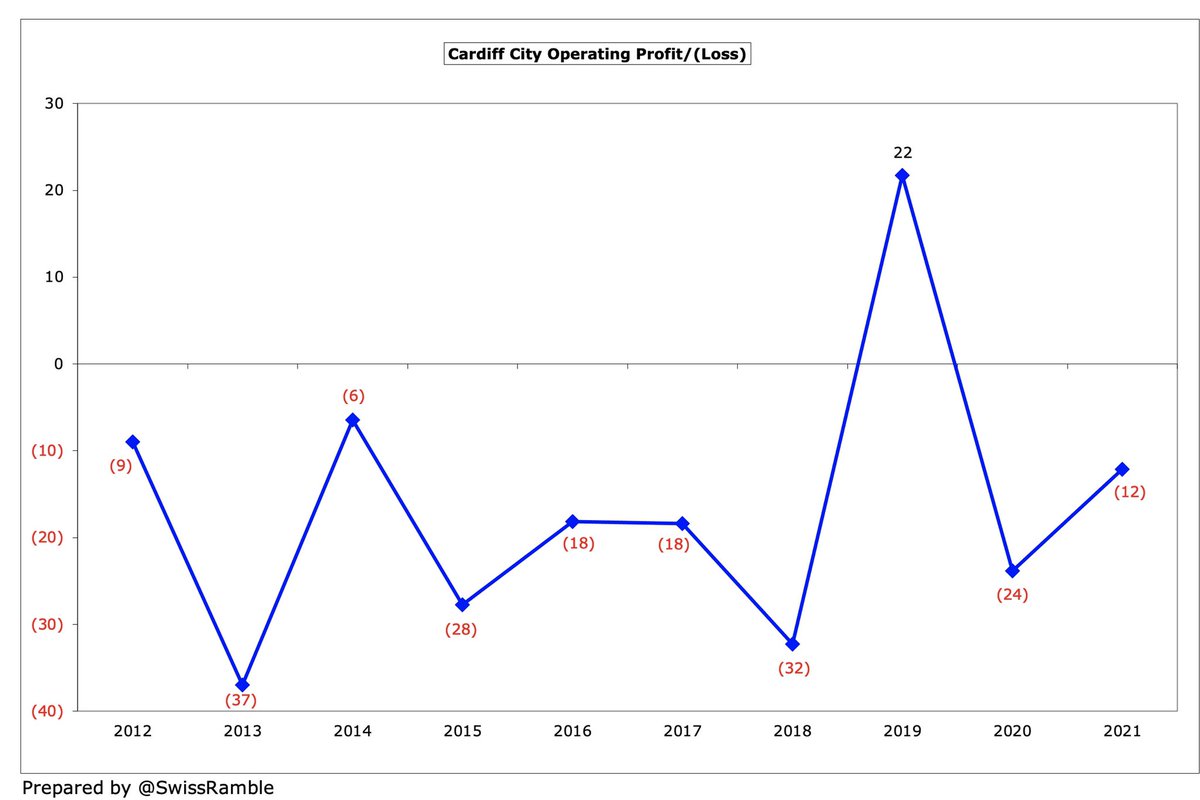

#CardiffCity operating loss (excluding player sales and interest) halved from £24m to £12m, one of the best results in the Championship, where almost every club has big operating losses, i.e. nearly half of them are above £30m. Generated £22m profit in the Premier League in 2019.

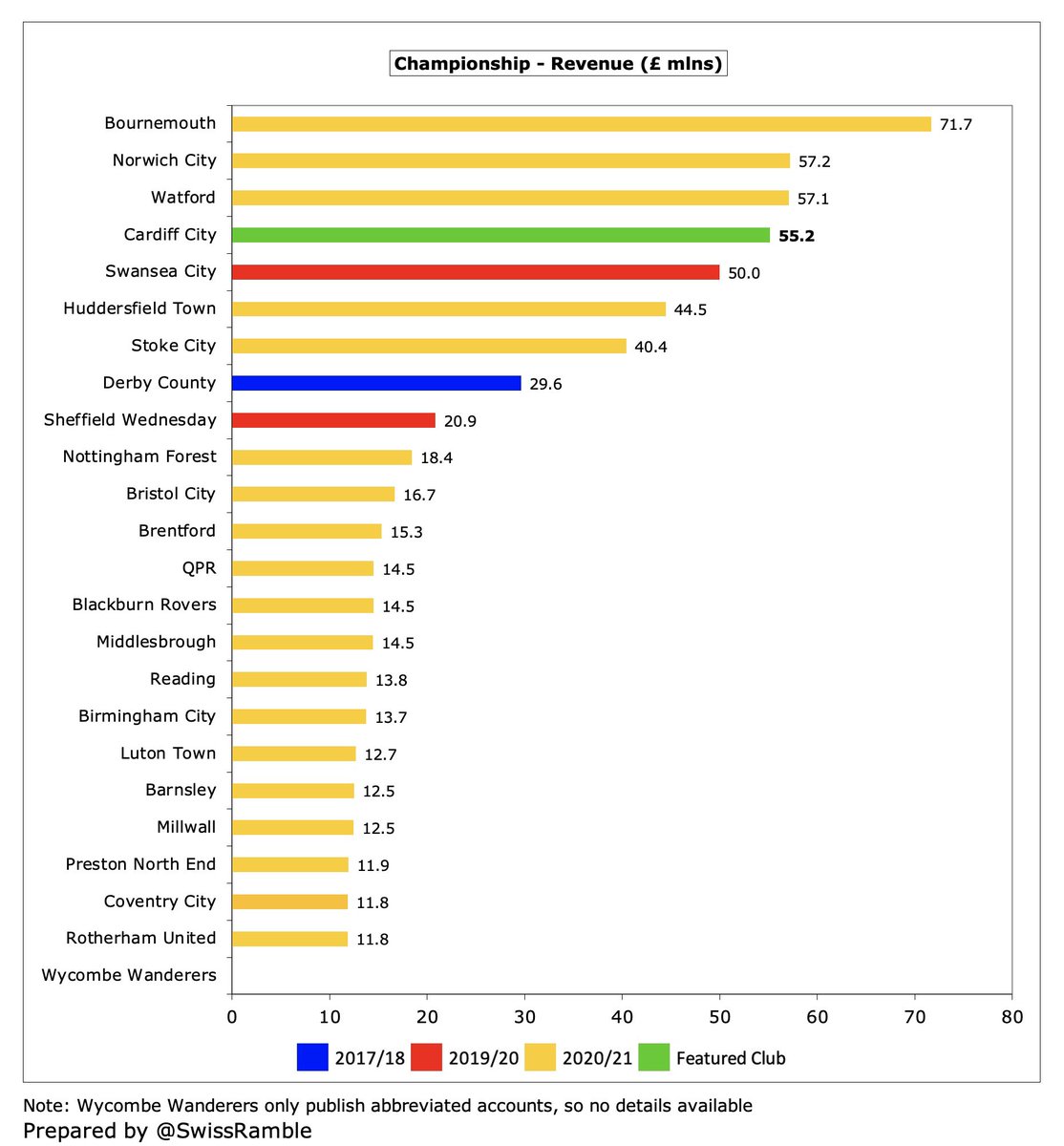

#CardiffCity £55m revenue is £70m (56%) down from the pre-pandemic £125m peak in the Premier League two years ago. 2020/21 was boosted by £8.8m deferred revenue from extended 2019/20 season. If that is excluded, revenue would have dropped from £55m to £46m.

#CardiffCity £55m revenue was 4th highest in the Championship, only surpassed by the 3 clubs most recently relegated from the Premier League, who all received higher parachute payments: #AFCB £72m, #NCFC £57m and Watford £57m.

#CardiffCity 2020/21 £34.2m parachute payment was boosted by £8.8m deferred revenue from 2019/20, less £0.4m broadcaster’s rebate, giving adjusted £42.6m. As a result, revenue booked in accounts increased from £30.9m, even though gross payment was lower in year two.

After all the adjustments, #CardiffCity broadcasting income rose £11m (31%) from £37m to £48m, though this was much lower than the £107m they earned in the top flight two years ago. Most Championship clubs earn £8-10m, but there is a massive gap to clubs with parachutes.

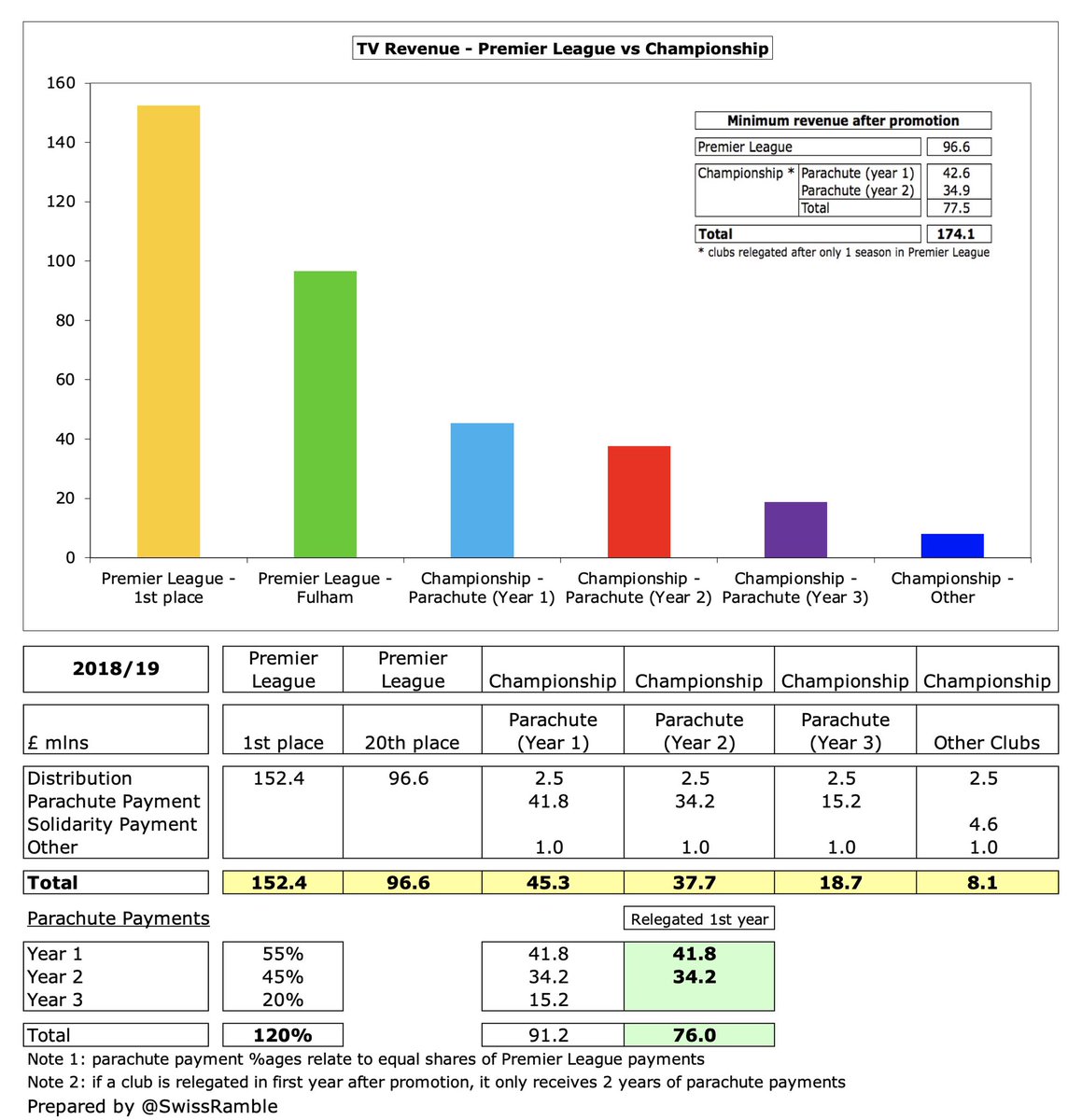

#Cardiff City received around £74m in parachute payments in the last 2 years, but they have lost this advantage this season. They only got two years of payments instead of the usual three, as they were relegated after just one season in the Premier League.

#CardiffCity match day income fell £2.5m (68%) from £3.7m to £1.2m, as all home games were played behind closed doors, though many fans still renewed their season tickets. Down from £7.9m in the Premier League in 2019.

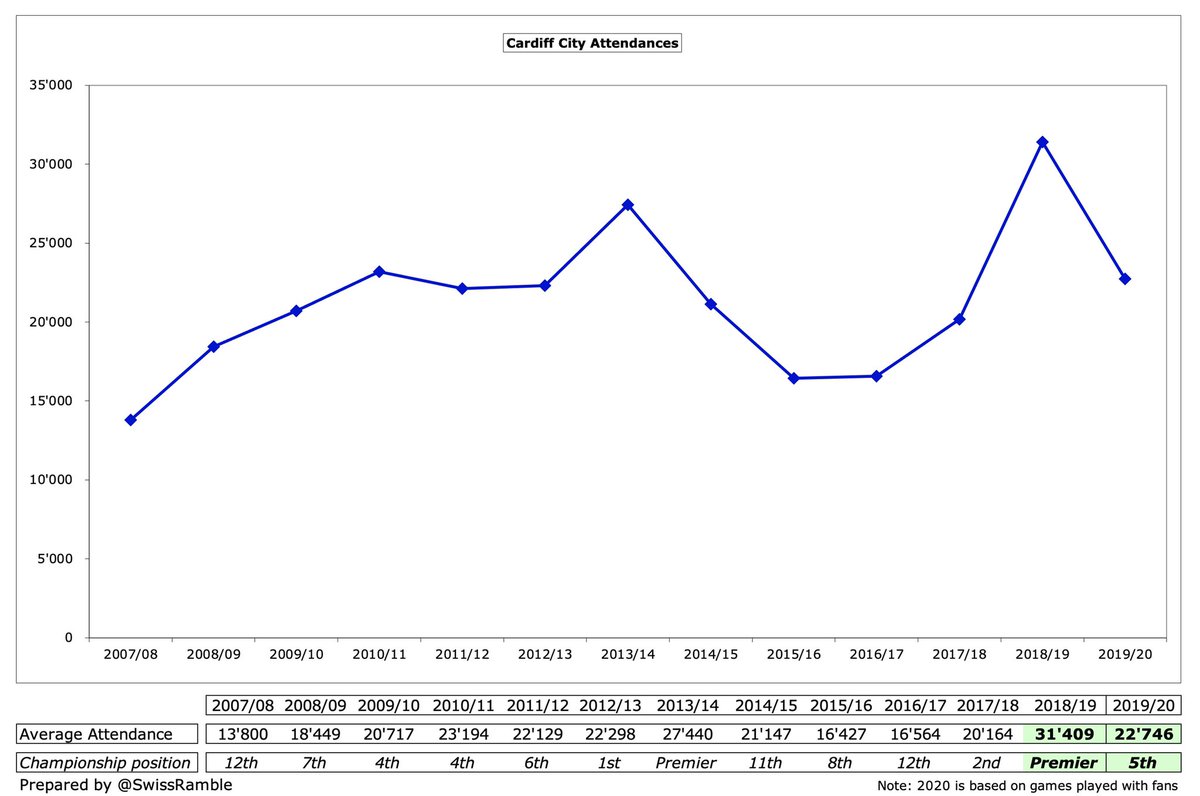

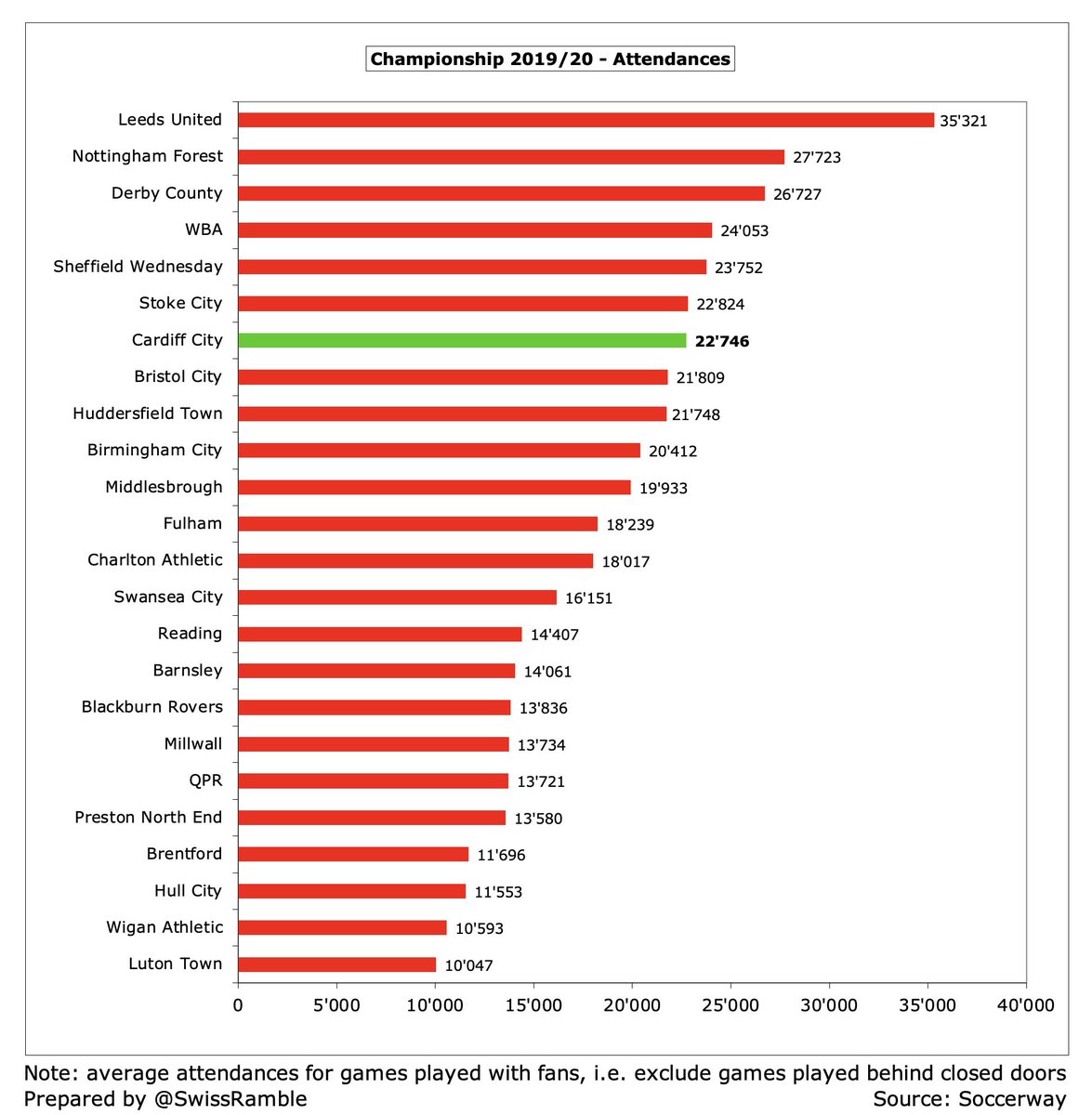

#CardiffCity average attendance in 2019/20 (for games played with fans) was 22,746, which was 7th highest in the Championship. However, this was 8,663 (28%) lower than the 41,409 they achieved in the Premier League, which the club said was “a direct result of relegation”.

#CardiffCity commercial income increased slightly by £0.1m to £5.6m, though the club said that the pandemic had caused loss of revenue and sponsorship opportunities. Now in the Championship top ten, though less than half of Stoke City £12m.

Since 2011 the #CardiffCity shirt sponsor has been Visit Malaysia, reportedly worth £3m a year, though this was rebranded as Malaysia Berjaya from the 2020/21 season. The long-term kit supplier deal with Adidas is due to expire in 2022.

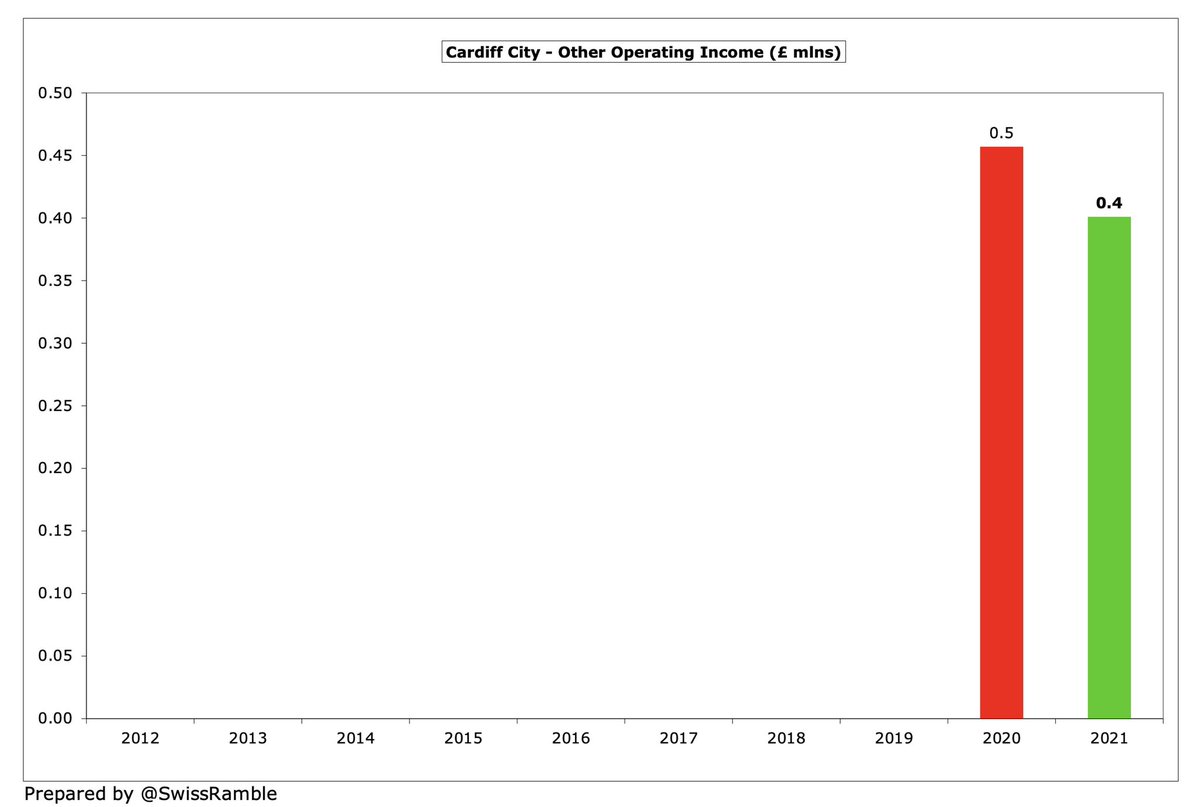

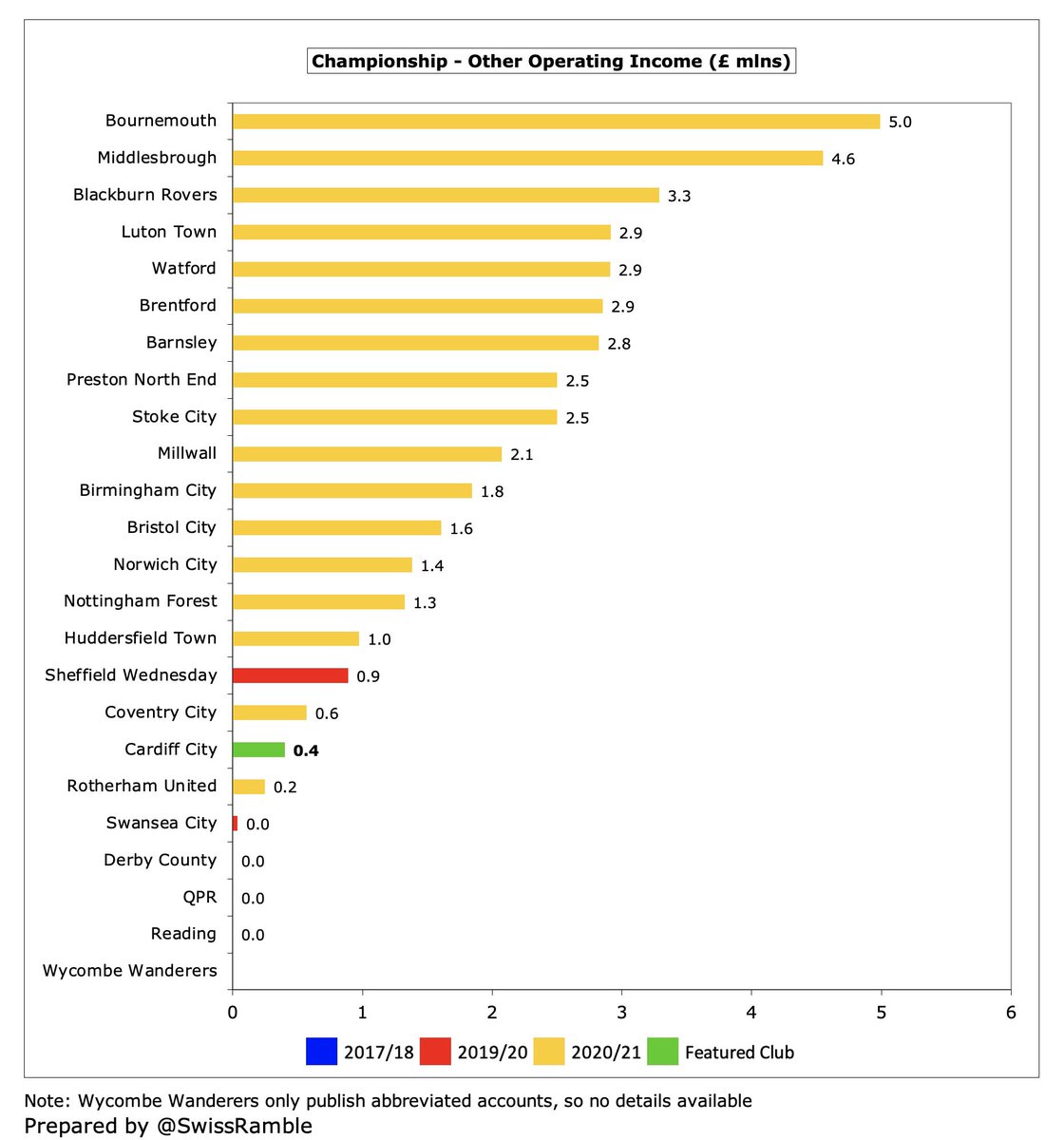

#CardiffCity booked £0.4m other operating income for a furlough claim, down from prior year’s £0.5m. One of the lowest in the Championship, as other clubs received business interruption insurance, while some also included player loans, e.g. #AFCB had £1.8m in their £5.0m.

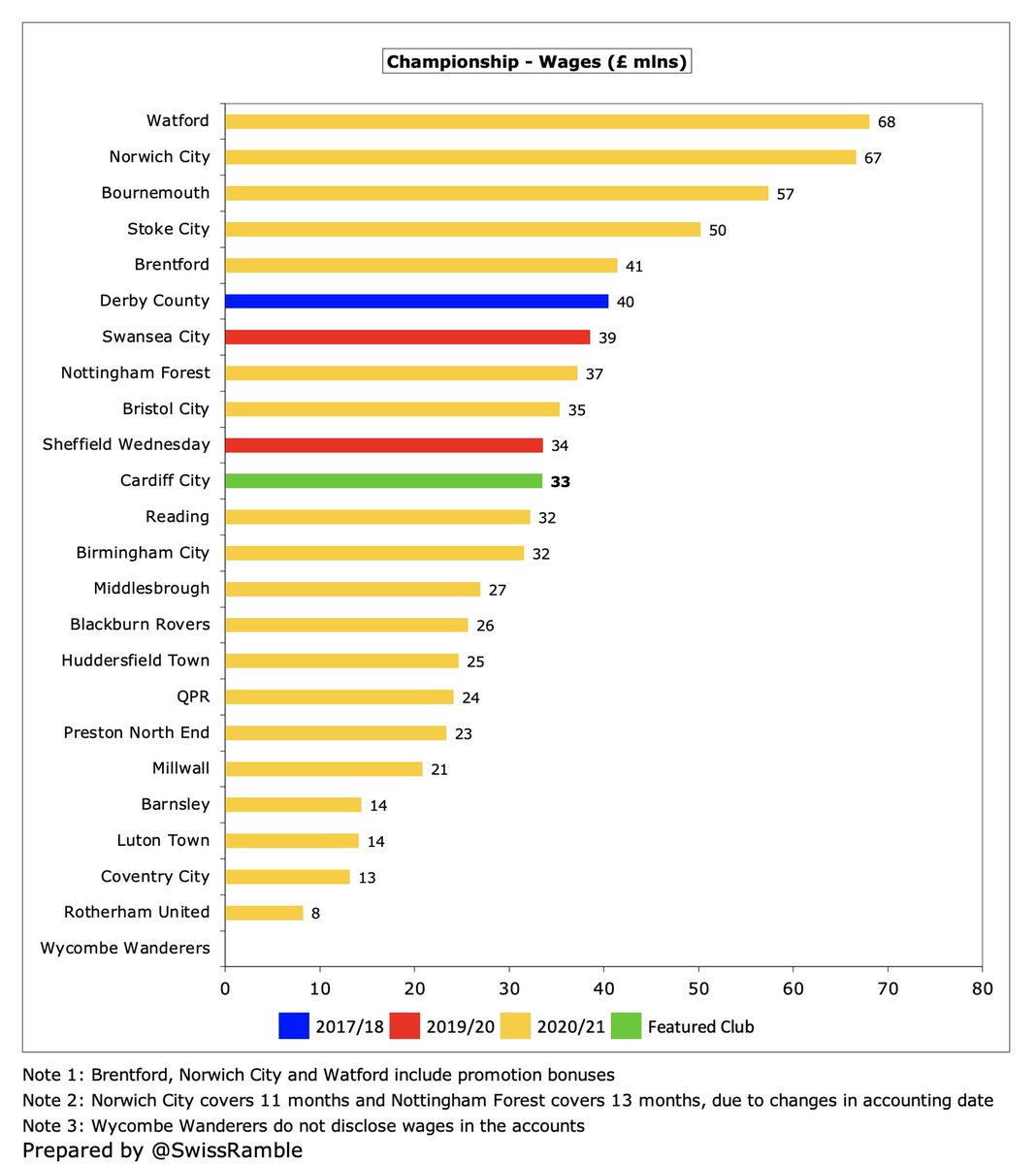

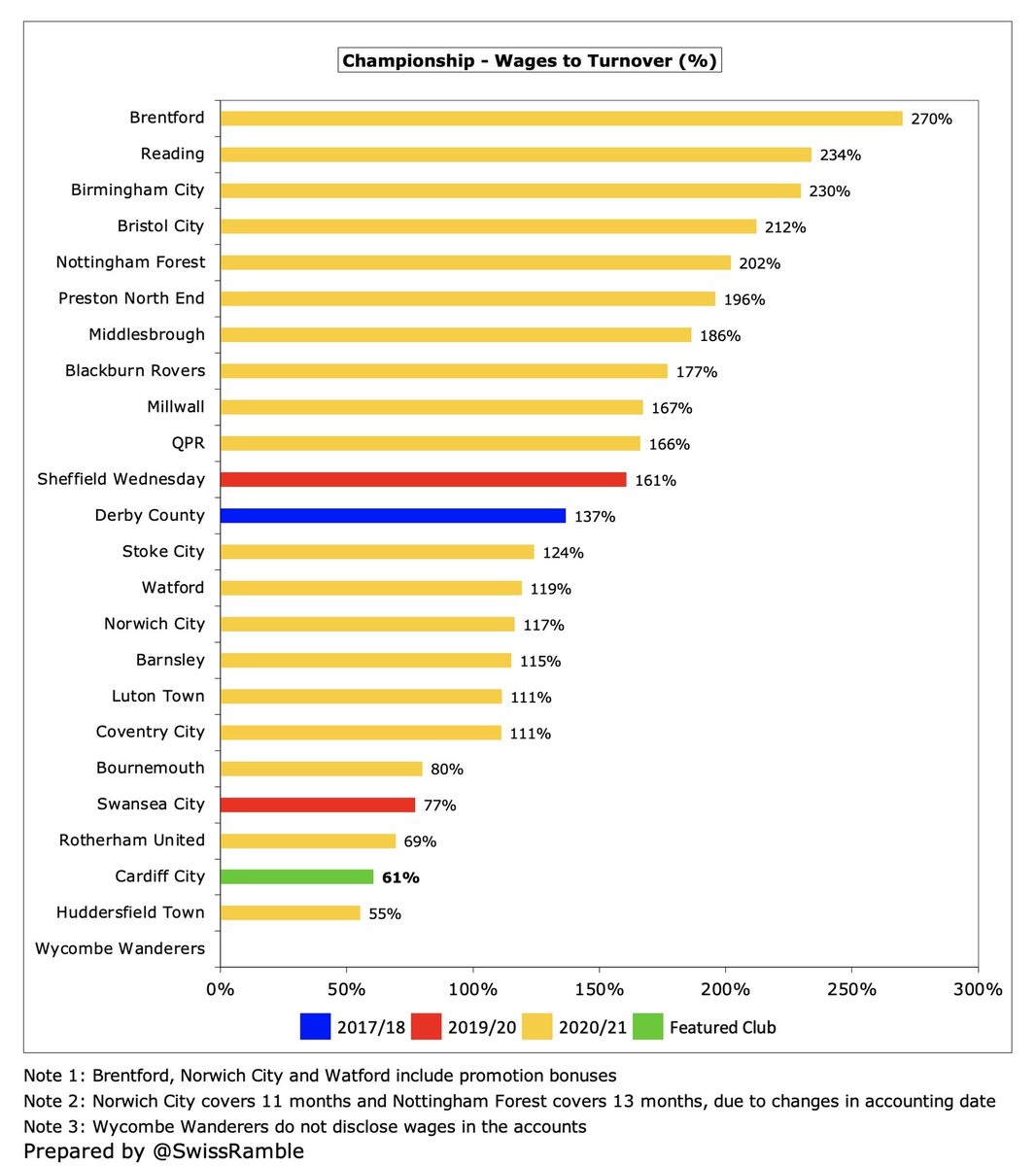

#CardiffCity wages fell £2.1m (6%) from £35.6m to £33.5m, as player salaries were down from £27.9m to £26.0m. Likely to further fall in 2021/22, as some players come to the end of their contracts. Worth noting that Cardiff only paid £54m when competing in the top flight.

After the decrease, #CardiffCity £33m wage bill was around mid-table in the Championship, less than half of Watford £68m and #NCFC £67m (though their figures did include hefty promotion bonuses).

#CardiffCity wages to turnover ratio decreased from 77% to 61%, which was second lowest (best) in the Championship, where most clubs have unsustainable ratios above 100% (with no fewer than 5 higher than 200% in 2020/21). Cardiff had an incredibly low 43% in the Premier League.

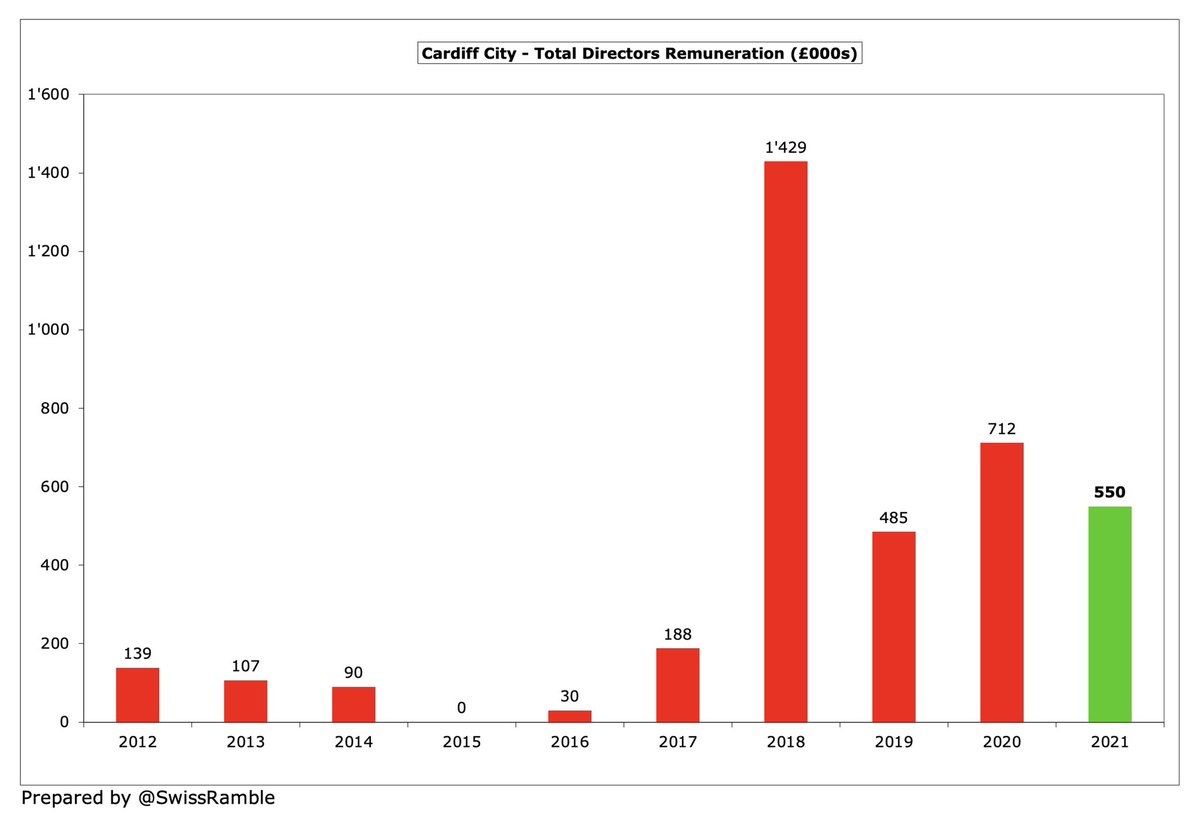

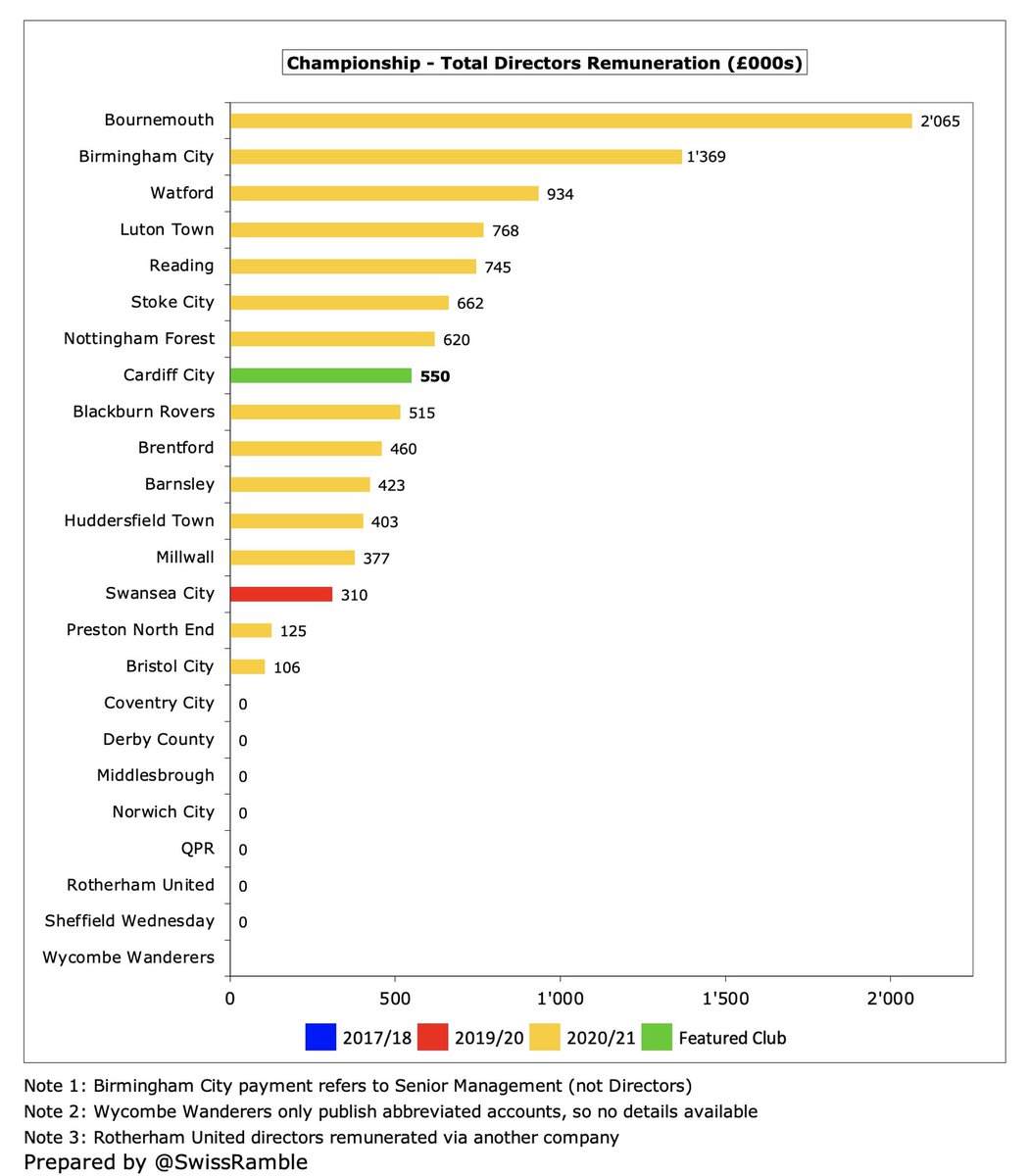

#CardiffCity total directors’ remuneration fell 23% from £712k to £550k, the 8th highest in the Championship. Highest paid director down from £507k to £413k. Also paid £322k to two companies in which chairman Mehmet Dalman has interests (WMG and Tormen), down from £586k.

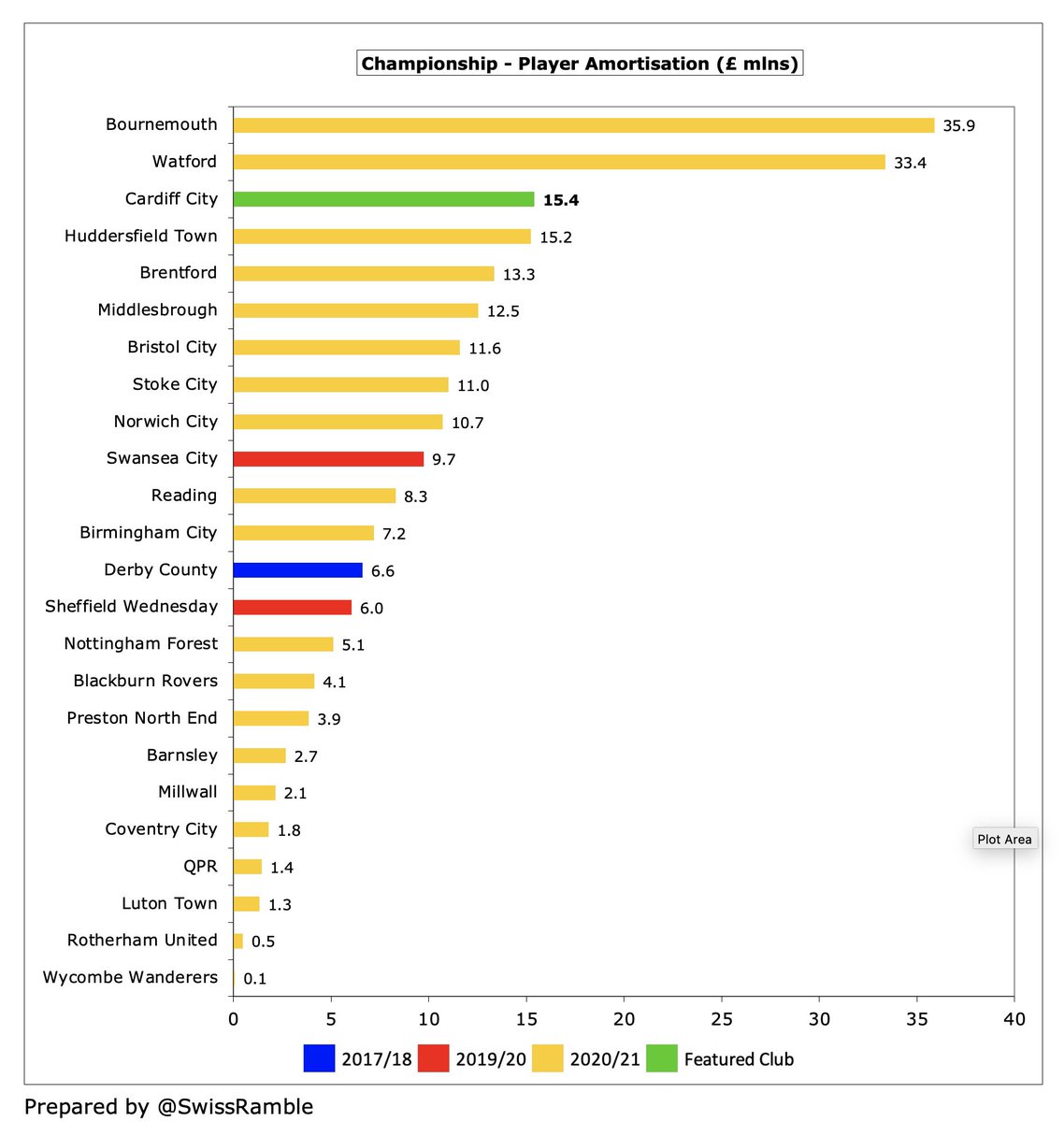

#CardiffCity player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £2.4m (13%) from £17.8m to £15.4m, though still 3rd highest in the Championship, only below #AFCB £36m & Watford £33m. Booked £3.2m impairment to reduce player values.

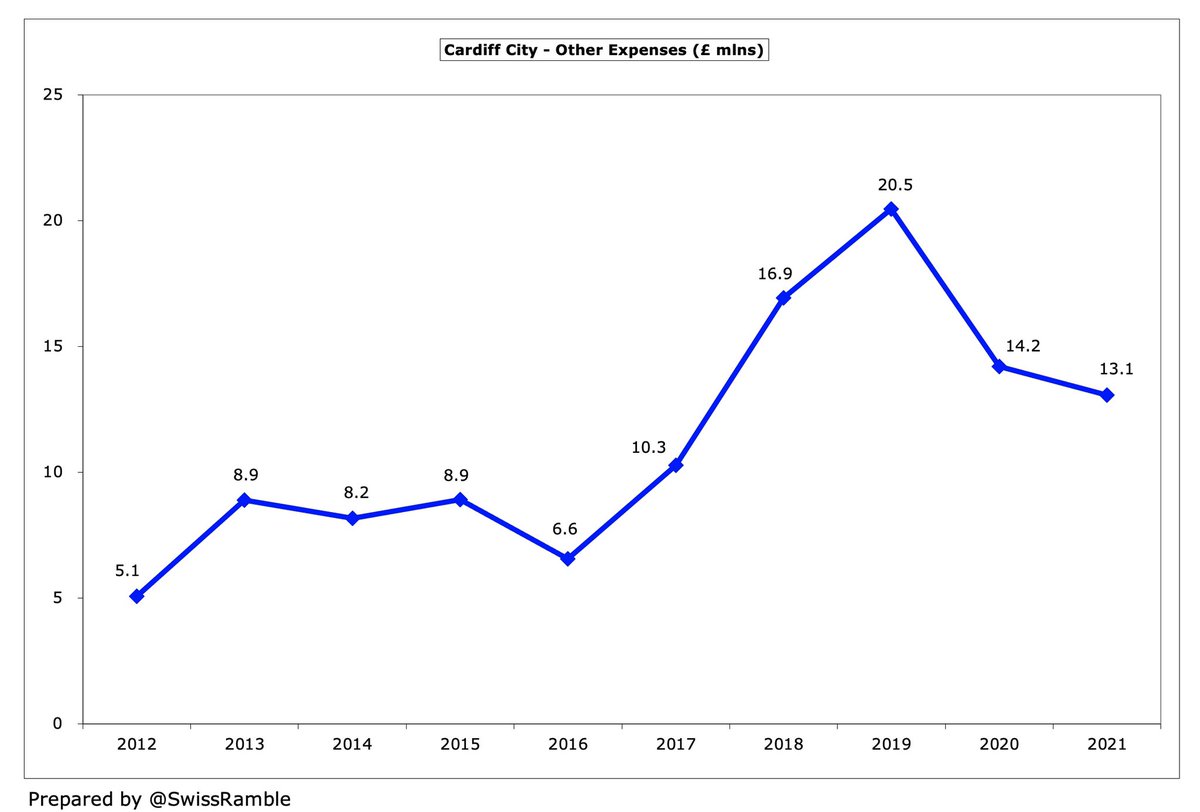

#CardiffCity other expenses were cut £1.1m (8%) from £14.2m to £13.1m, partly due to the reduced cost of staging games without fans, though some costs increased due to the “return to play” protocols required to meet EFL regulations.

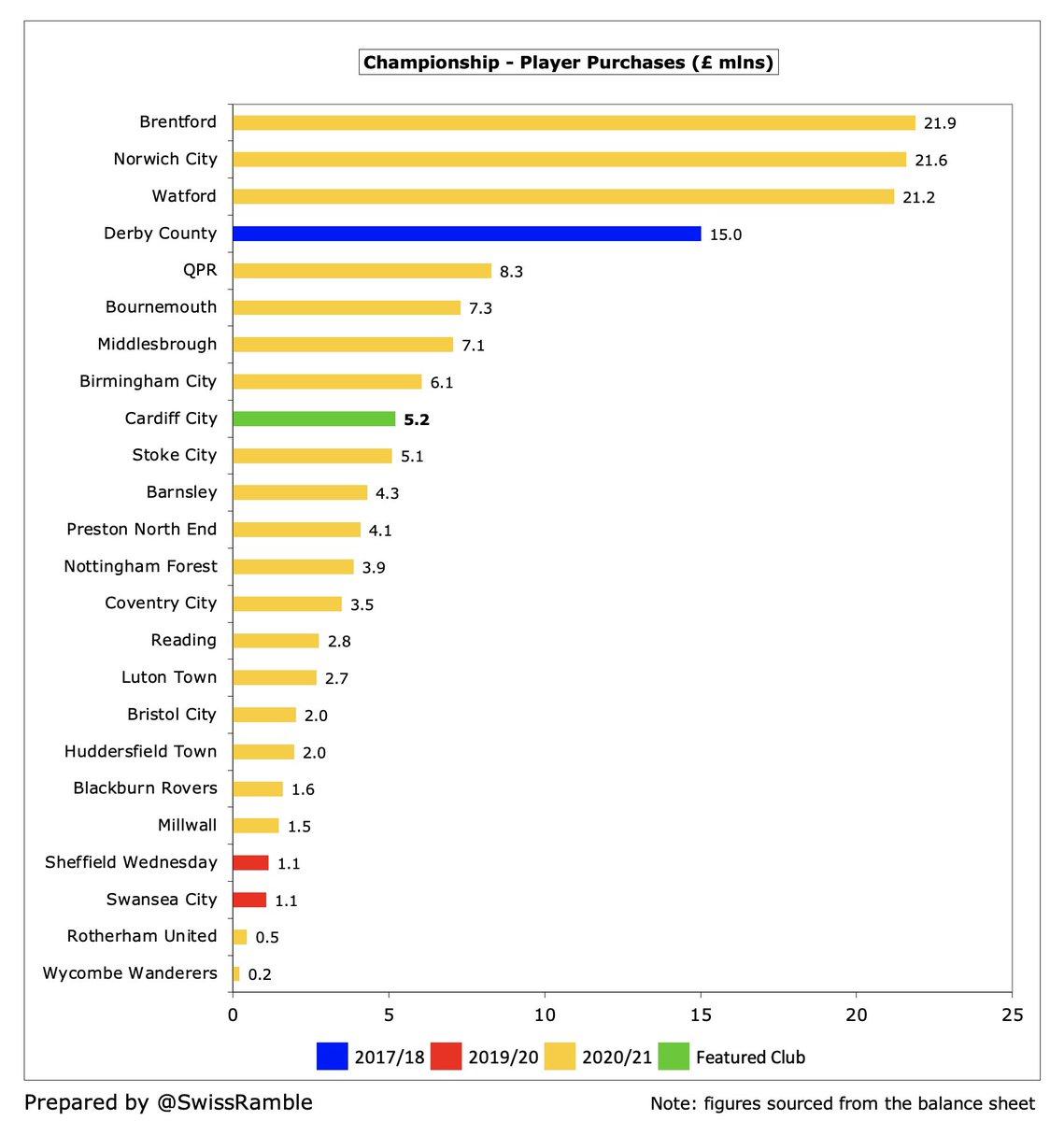

#CardiffCity only spent £5m on players in 2020/21, including Kieffer Moore from #WAFC. This was less than a third of the previous season’s £19m and well down from £38m outlay in 2019 Premier League. Three Championship clubs spent more than £20m (Brentford, #NCFC and Watford).

Interestingly, #CardiffCity £82m gross transfer spend in last five years is less than £88m outlay in the preceding 5-year period. Highest expenditure was in the two Premier League seasons. Before January window, Dalman said, “There’s still no money – we’ll do the best we can.”

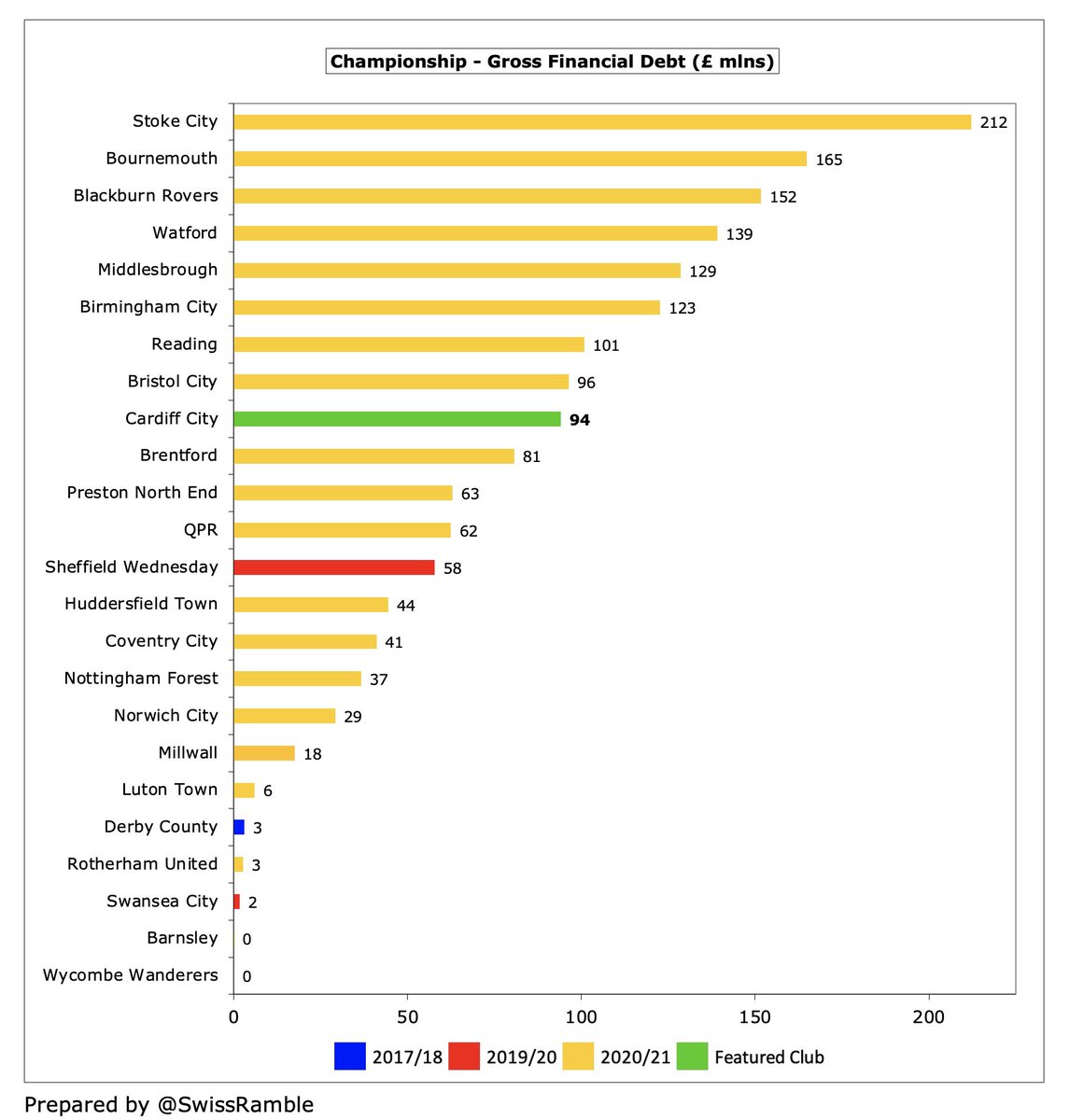

#CardiffCity gross debt rose £1m to £94m, mainly from owner Vincent Tan £61m (up £15m), Tomen Finance £15.8m (where Dalman has a significant influence), Tan’s son £3m and Dalman £2m. Also £12m other loans, including £6.2m from the EFL.

#CardiffCity £94m debt is 9th highest in the Championship, though far below the likes of Stoke City £212m, # AFCB £165m and Blackburn Rovers £152m. However, Cardiff’s debt would be much higher without Tan converting £93m into capital and writing-off £23m in the last decade.

Since these accounts were closed, #CardiffCity have taken on an additional £22.1m of debt from unnamed parties at chunky interest rates of up to 9%, though they did repay £3.1m. Tan converted another £6.6m of debt into equity.

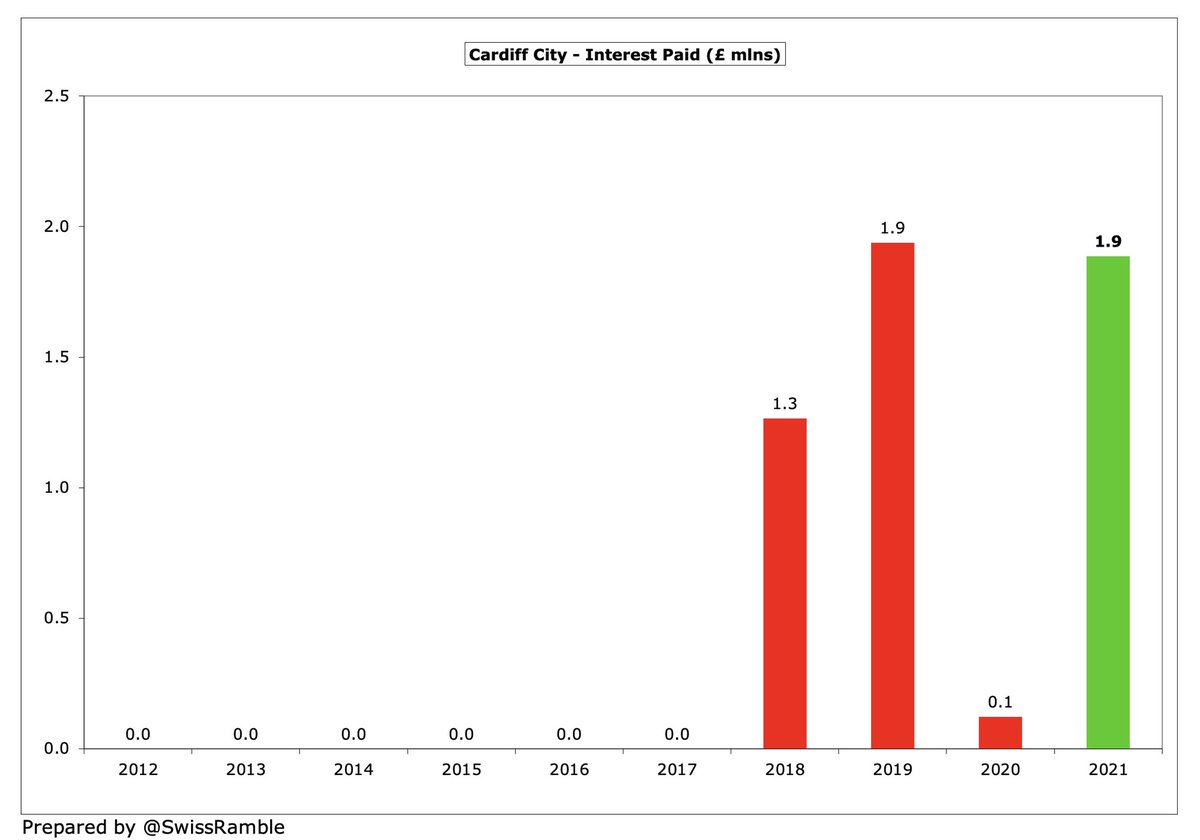

#CardiffCity paid £1.9m interest in 2020/21, up from £0.1m. Around £39m of Tan’s loan is at 7%, but the interest to date has been waived. The remaining £22m of the owner’s debt is interest-free (like most debt provided by owners in this division). The Tomen loan is charged at 9%.

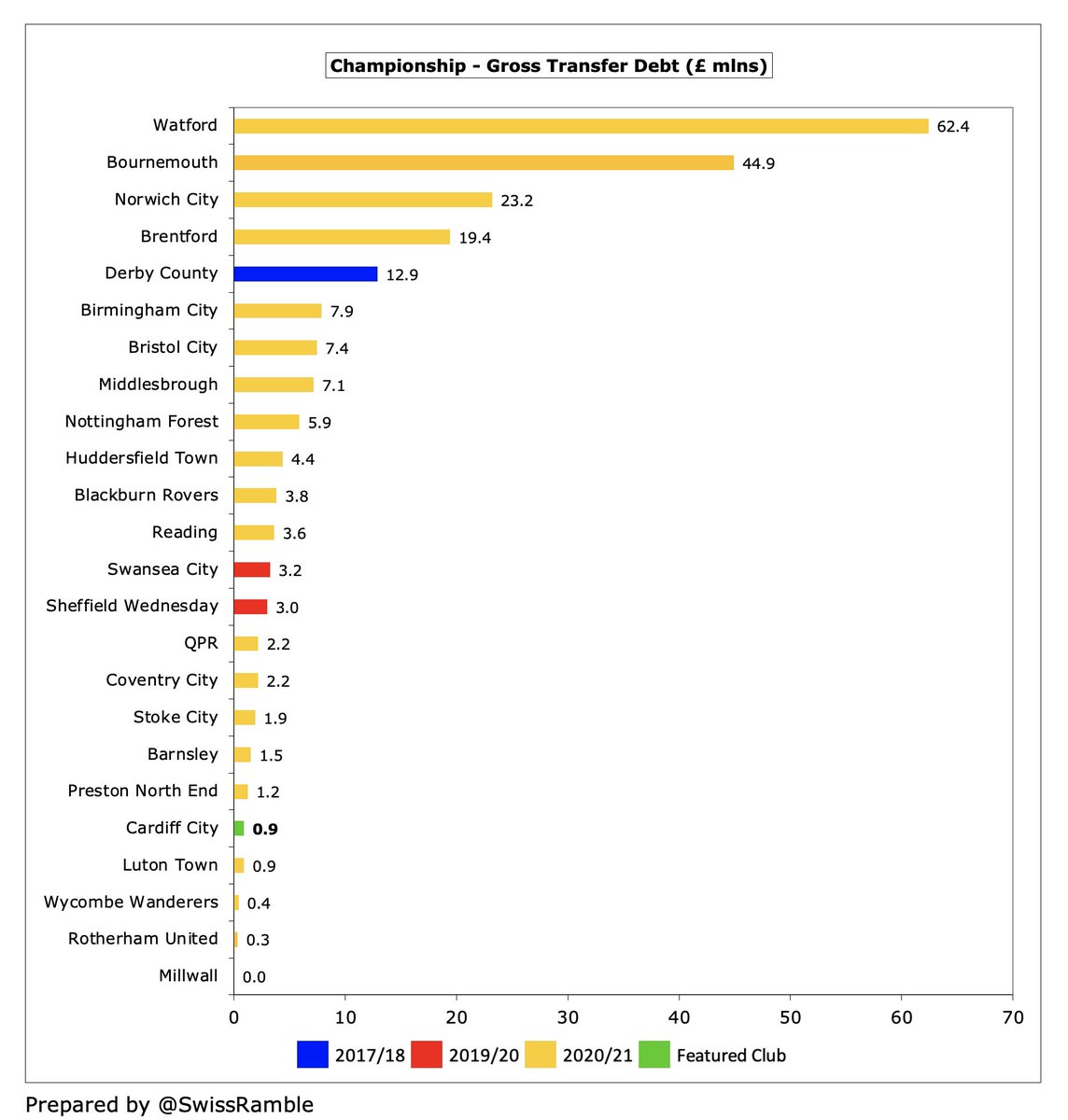

#CardiffCity transfer debt (for outstanding stage payments) was cut from £3.9m to just £0.9m, one of the lowest in the Championship, far below Watford £62m and #AFCB £45m. They are in turn owed £7m by other clubs. Also £5.9m contingent liabilities.

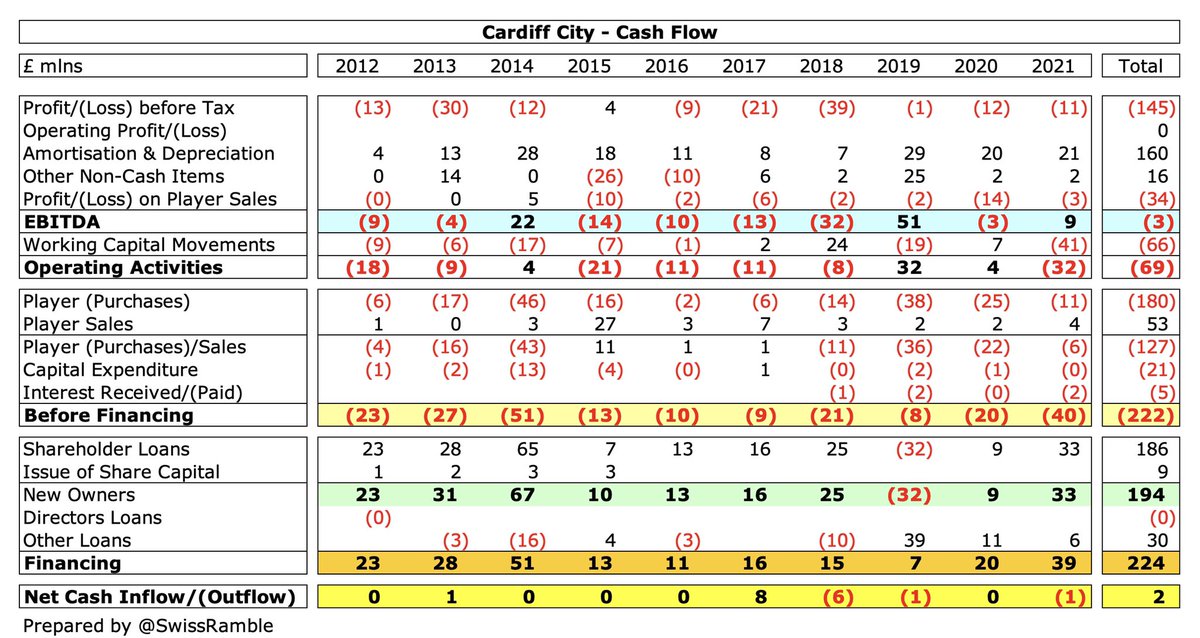

#CardiffCity £12m operating loss became £32m negative cash flow after adjusting for non-cash movements, but club then spent £6m on players (purchases £11m, sales £4m) and £2m interest. This was funded by £33m owner loans (Tomen £16m, Tan £15m & Dalman £2m) and £6m external loans.

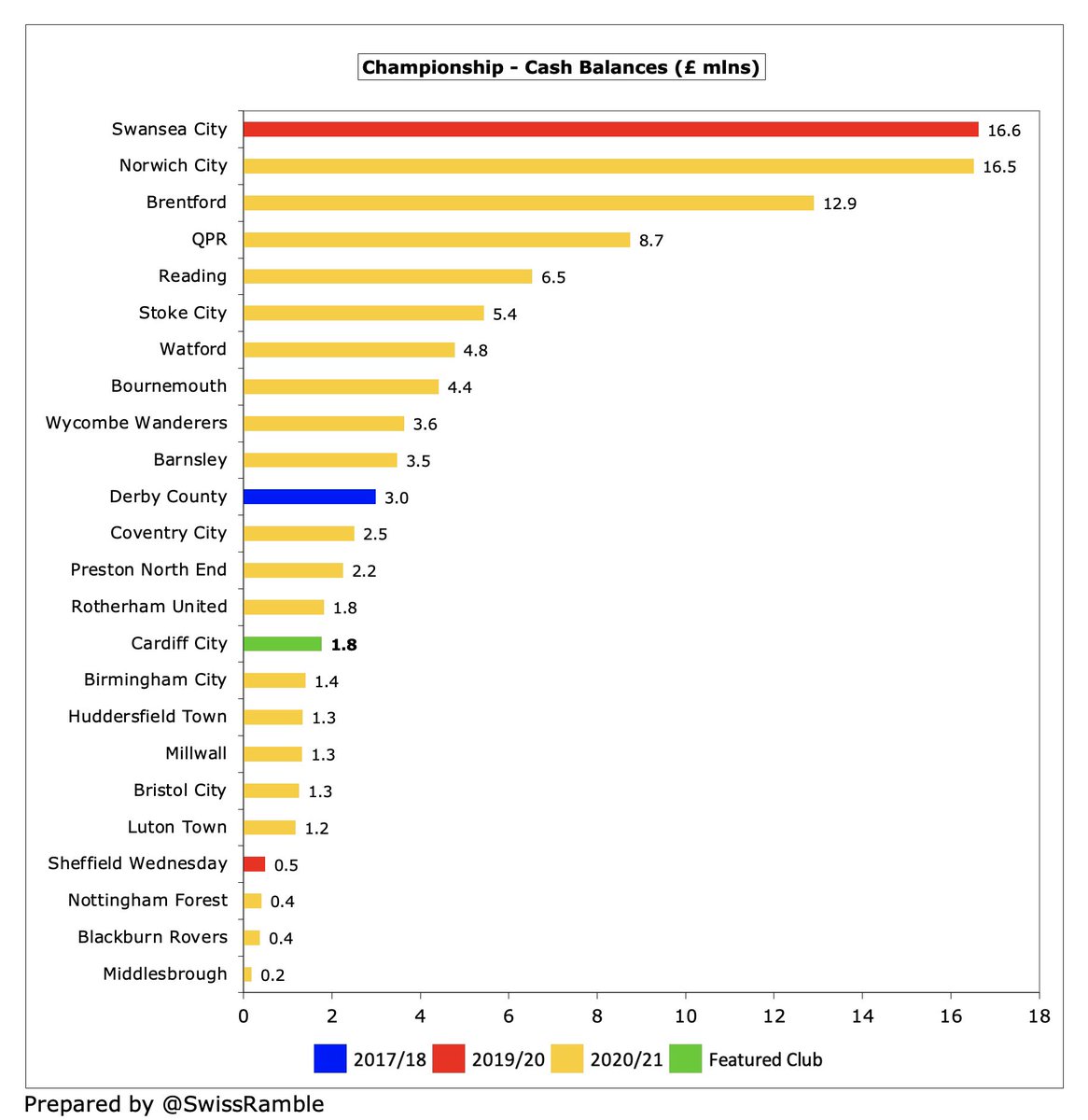

As a result, #CardiffCity cash balance fell by £0.6m from £2.4m to £1.8m. This was on the low side, but in fairness most Championship clubs have less than £3m cash in the bank.

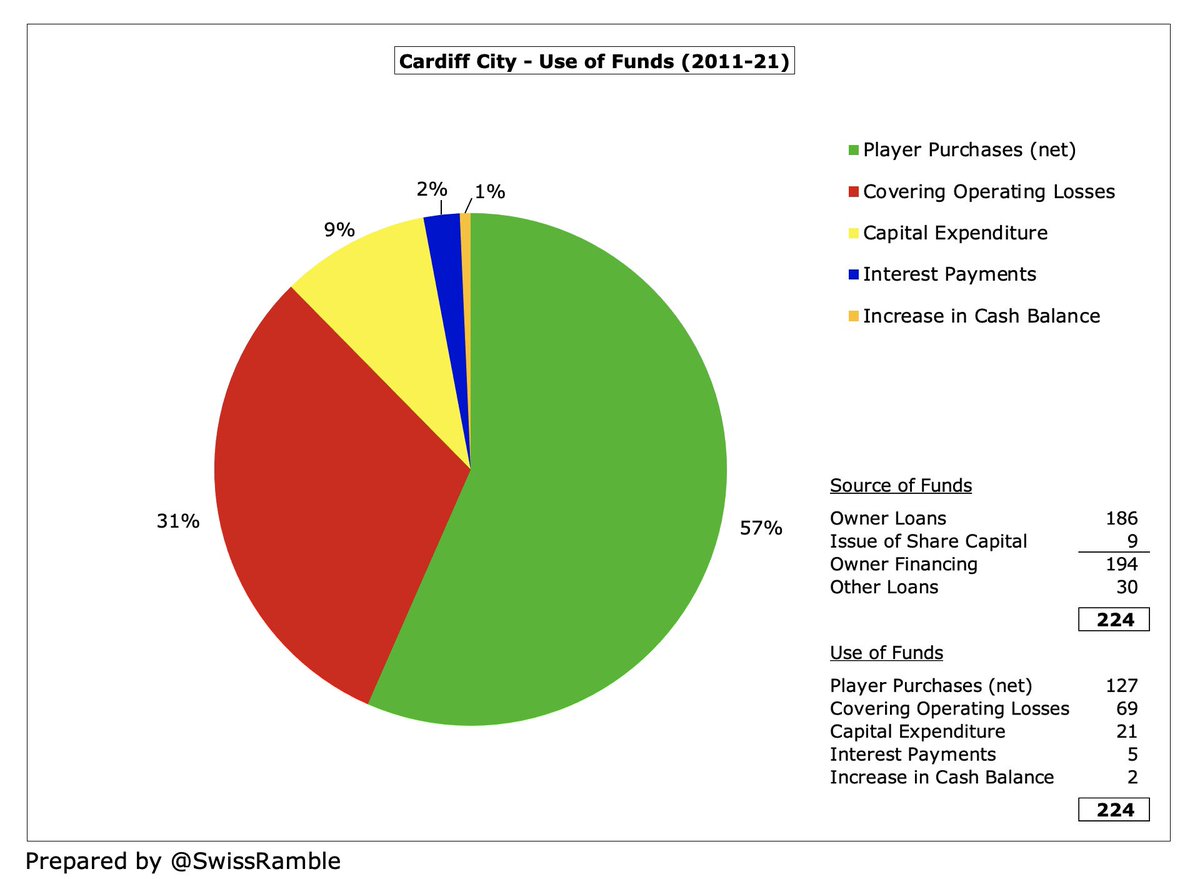

In the last decade #CardiffCity have been very reliant on owner financing £194m plus external loans £30m. This has been used to fund £127m of player purchases (net), £21m infrastructure investment and £5m interest payments, while covering £69m of operating losses.

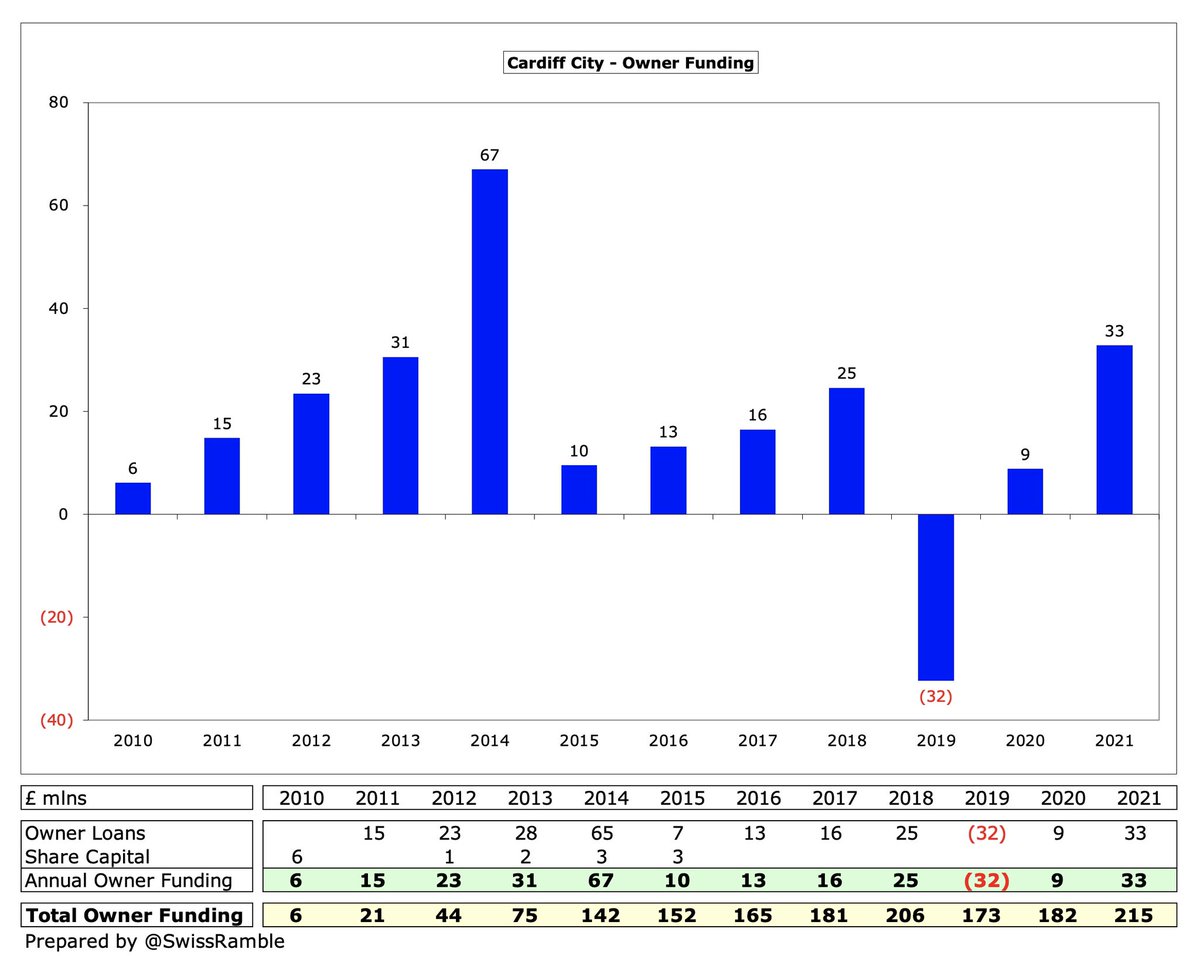

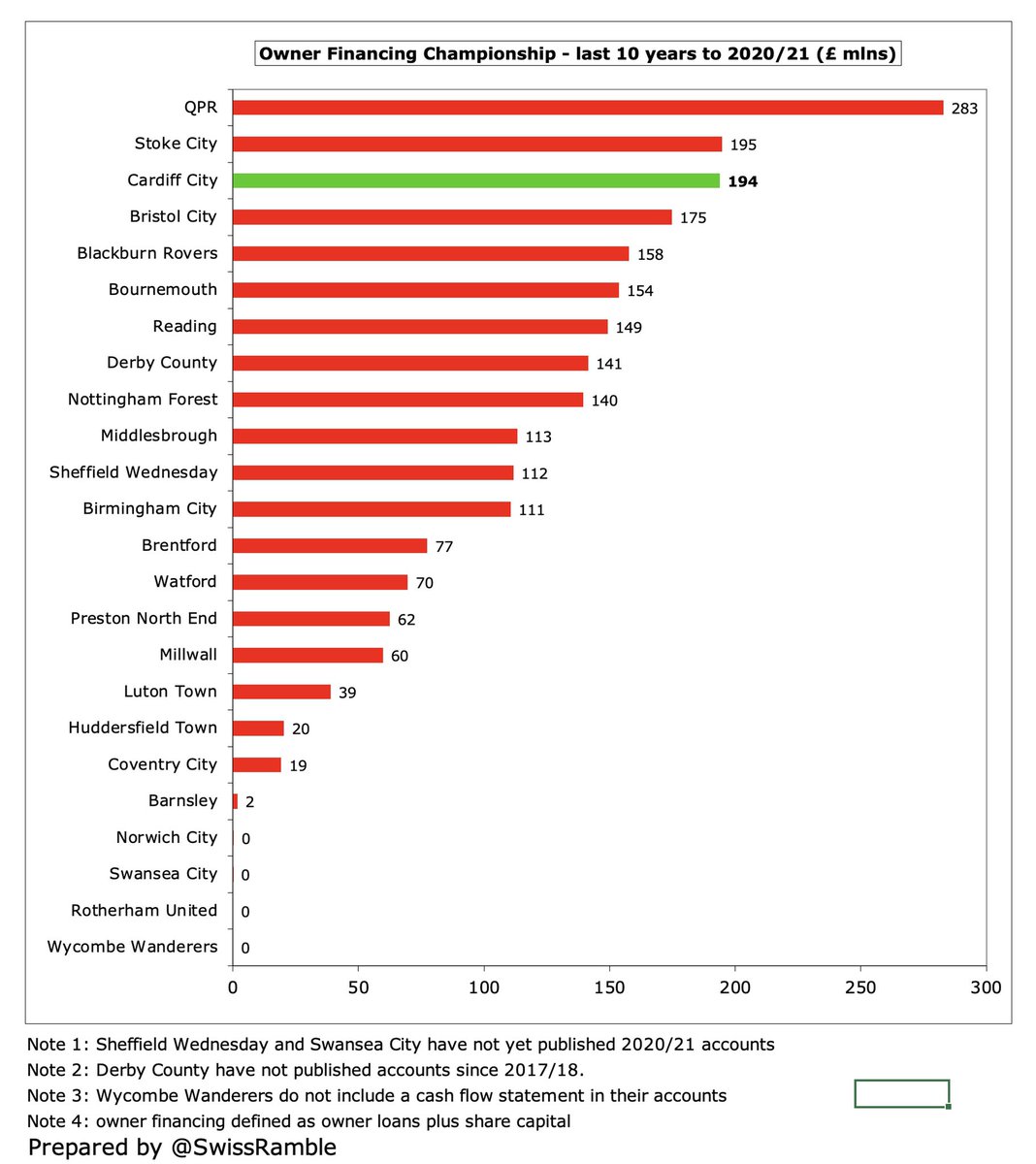

Owners, mainly Vincent Tan, have provided £215m of funding to #CardiffCity since the Malaysian bought the club with £194m in 10 years to 2021 being the third highest in the Championship. Dalman said “the future of the club would look much more precarious” without Tan’s support.

#CardiffCity have no issues with Profitability & Sustainability regulations, as reported losses are already within the limit for the 3-year monitoring period even before adjusting for allowable deductions (academy, community & infrastructure), promotion bonus and COVID impact.

#CardiffCity has appealed to Court of Arbitration for Sport against FIFA ruling in the Sala transfer case and are confident of a favourable outcome. Although the accounts include £21m provision, if they lose the case, they will have to find the money to pay Nantes.

There have been recent media reports of takeover interest in #CardiffCity, though no formal offers have yet been submitted. Tan apparently is in no hurry to sell, but the magnitude of the losses (plus the various legal cases) might make him think again.

#CardiffCity chairman Mehmet Dalman said that the club still hopes to “achieve our aim of promotion back to the Premier League”, though this task has become much more difficult now that the club’s parachute payments have ceased.

• • •

Missing some Tweet in this thread? You can try to

force a refresh