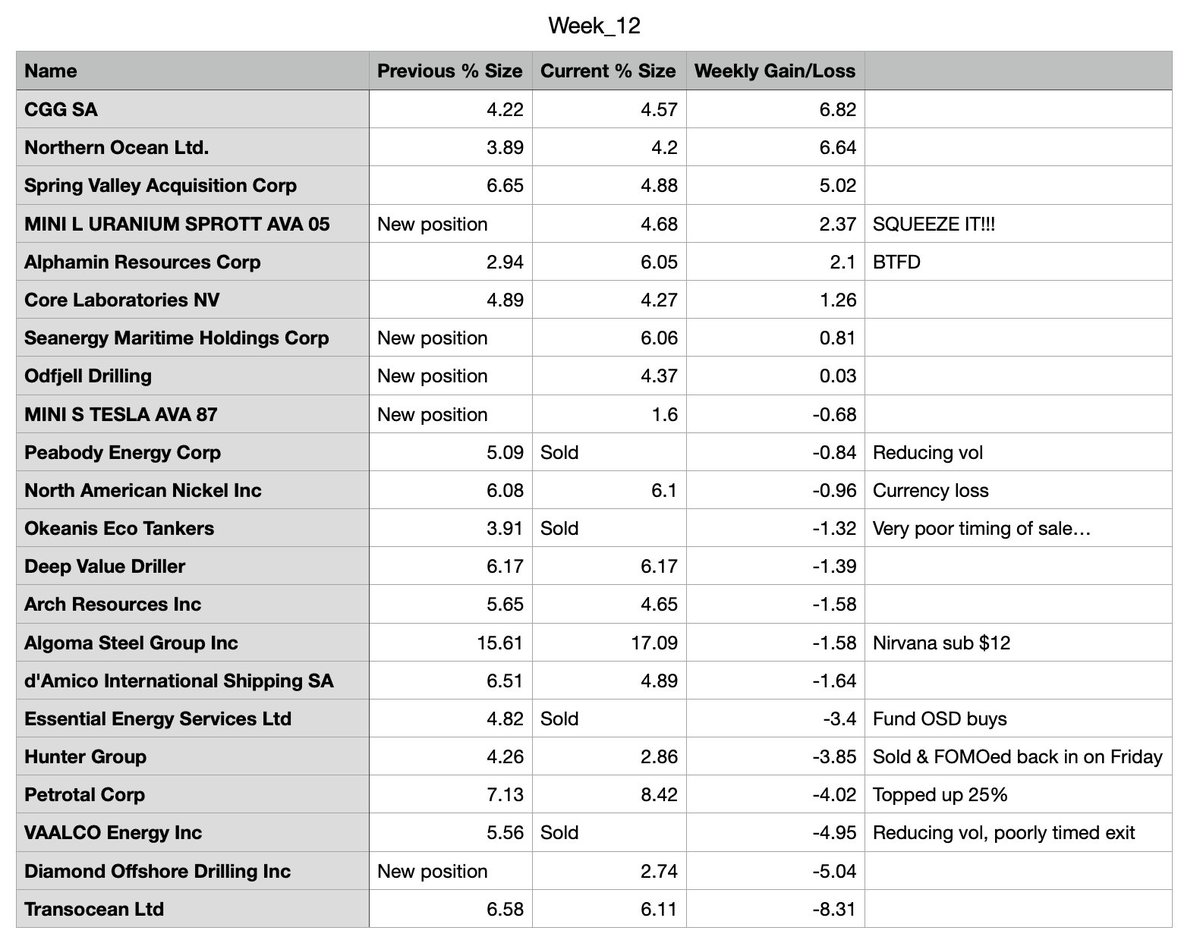

Cut my tankers which survived the sell-off very well, to fund BTFD today again. Topped up $ASTL, bought more coal $ARCH & got a starter position in #Saipem $SPM

https://twitter.com/Edark94/status/1517210905934770177

Fuck being a PUSSY, it's either MELT-UP FUCKING BOOM to the moon or the streets for ya boi!!! Nothing in-between, LFG!!!

Morning flush in resource stonks got instantly bought on solid volume & lots of name have gone from r/g quickly. Looks very promising friends 👀

Dips are getting bought & a melt-up boom is imminent friends, watch & learn!!!

https://twitter.com/WallStJesus/status/1517502445827538947

• • •

Missing some Tweet in this thread? You can try to

force a refresh