Swede with an interest in commodities & shipping | Armchair geologist | IR for Pambili $PNN.v & Switch Metals #SWT | CEO of @HesperianMetals

How to get URL link on X (Twitter) App

https://twitter.com/Edark94/status/1607878373069713410The main issue is in regards to the processing plant, using it or another option that came up. Can't speak too much of the situation, but both could work & have their own pros & cons. I'll go into detail once more info comes out.

https://twitter.com/Edark94/status/1553433745532805123

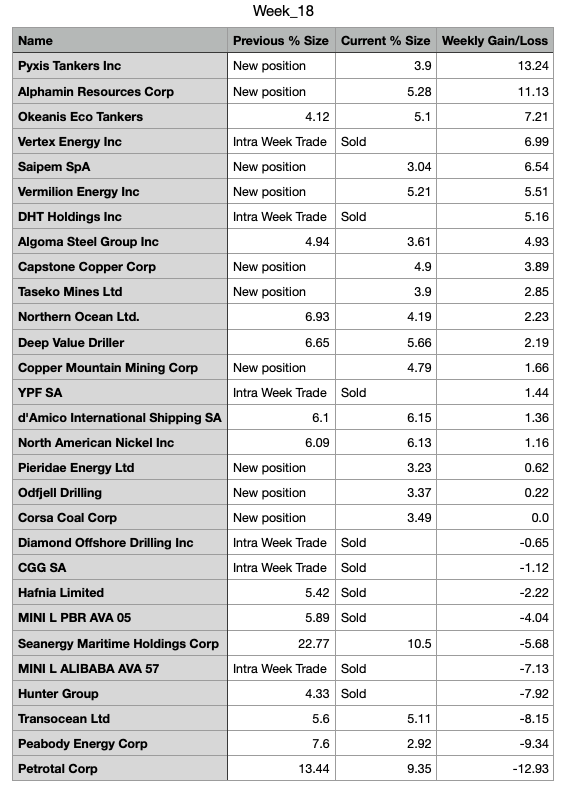

Current portfolio:

Current portfolio:

https://twitter.com/acosgrove003/status/14437044598261841962. Incoming supply:

https://twitter.com/acosgrove003/status/1410269585371185153

https://twitter.com/HFI_Research/status/1542205754567847936I'm incredibly surprised not more picked up on this dramatic increase of import quotas, second half of the year China crude demand will come ROARING BACK!!!

https://twitter.com/JimmyWar77/status/1542137250007351297

https://twitter.com/Edark94/status/1533046330242871296Current portfolio:

https://twitter.com/ragipsoylu/status/1527596732875427842BAVA is far too late to enter in size, but congrats to those crazy fucks which bought yday. Think it got some juice left if we get a proper #monkeypox scare over the weekend, so I don't mind punting it for fun...

https://twitter.com/Edark94/status/1522875425390739456

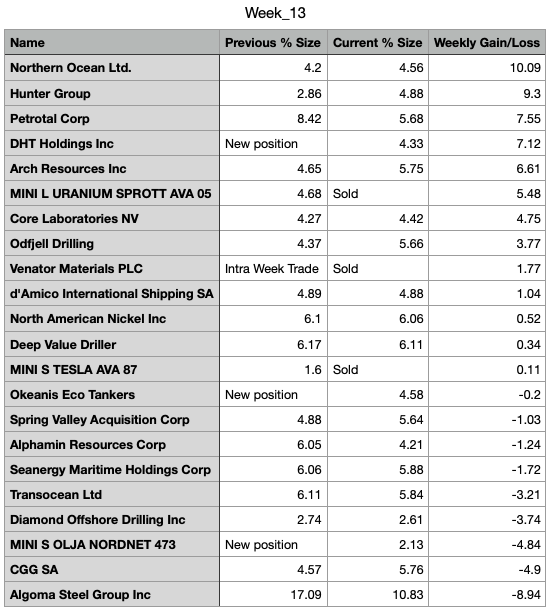

Current portfolio:

Current portfolio:

https://twitter.com/Edark94/status/1522119617635930112Uh oh... time to delete all my tweets about being bullish & calling for a bear market rally 😅

https://twitter.com/Sino_Market/status/1522215717885464582

https://twitter.com/Edark94/status/1517939987202859008

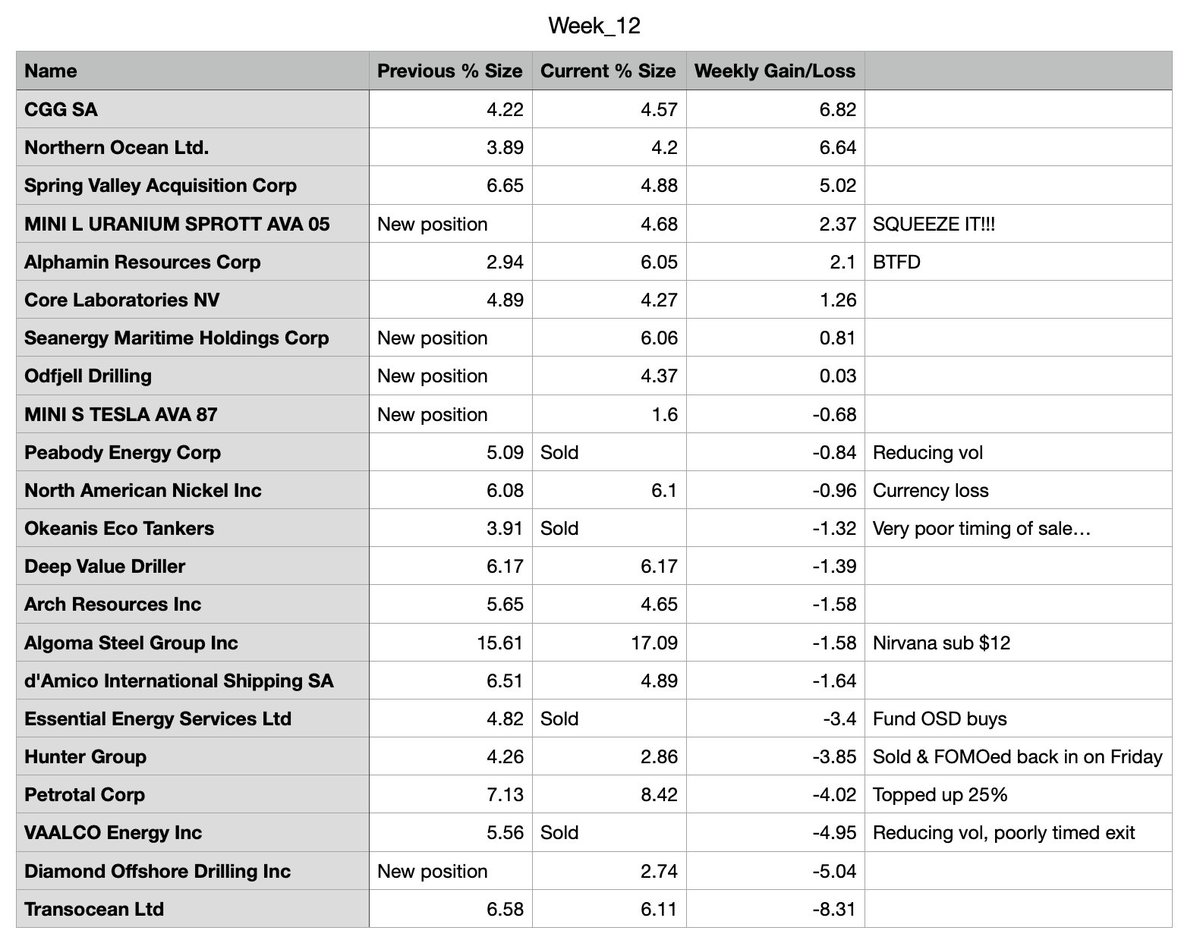

Current portfolio:

Current portfolio:

https://twitter.com/Sino_Market/status/1519886563445932032

How to play this you may ask? Drybulk coal iron steel are the ones I've pitched for weeks now. China tech is 💩, but it does appear the bottom is behind us so I might punt some $BABA. It's going 🚀 today, but I reckon they will puke in earnings next week & allow me to BTFD!!!

How to play this you may ask? Drybulk coal iron steel are the ones I've pitched for weeks now. China tech is 💩, but it does appear the bottom is behind us so I might punt some $BABA. It's going 🚀 today, but I reckon they will puke in earnings next week & allow me to BTFD!!!

https://twitter.com/GrantMBeasley/status/1332363383773904896@SantiagoAuFund It's very entertaining to see just how many thought the USD would end up dead & confidently held gold, missing out on the bullmarket of a century.

https://twitter.com/Silver_Gold_U/status/1464664241282105345?s=20&t=879DQ1UVDMkvIceYWjb-bg

https://twitter.com/peony_king/status/1517574689295671298If y'all wondering what I did, I bought MOAR $ARCH

https://twitter.com/Edark94/status/1517210905934770177Fuck being a PUSSY, it's either MELT-UP FUCKING BOOM to the moon or the streets for ya boi!!! Nothing in-between, LFG!!!

https://twitter.com/Edark94/status/1510168314714148867

Current portfolio:

Current portfolio:

https://twitter.com/Edark94/status/1507645693195866117

As I said earlier this week, I think the correct way to survive this headline driven market is by exiting volatile commodity exposure, so decided to cut BTU & EGY! Will be back once we're past the headlines, as ppl will realize commodities remain TIGHT even once the war ends!

As I said earlier this week, I think the correct way to survive this headline driven market is by exiting volatile commodity exposure, so decided to cut BTU & EGY! Will be back once we're past the headlines, as ppl will realize commodities remain TIGHT even once the war ends!

https://twitter.com/GasBuddyGuy/status/1509517711851855880OSD/OFS thesis is just getting strong & stronger...

https://twitter.com/EnergyCredit1/status/1509552977316663301

https://twitter.com/Edark94/status/1501140628809424897@METhompson72 #1SN starts trading the 8th, so I might miss out on the IPO pump but I'm sure it will be fine as tin is heading to +$100k within a year or two.

https://twitter.com/Pete__Panda/status/1509443758101864450

https://twitter.com/Edark94/status/1487383407084589056

Got quite the W in my AMZN punt (albeit not even close to as much as I hoped...), but it was just a 2% punt that was partly offset by my FB punt lol.

Got quite the W in my AMZN punt (albeit not even close to as much as I hoped...), but it was just a 2% punt that was partly offset by my FB punt lol.