With all this talk about a #bearmarket I've decided to think long and hard about what's important for #DeFi during these sideways times. I've come up with a checklist and strategy to help me and you though these times of turbulence. NFA

Here is my #DEFI checklist. Print it, save it, whatever helps you to get through these times. Remember, its only a #bearmarket until its not 🐻

Im just going to iterate a few things that my not be clear. Point 3 - On #CoinGecko you can switch off your folio $ value - see below.

Point 5 - if you didn't already know, you can create a watch list on #defilama

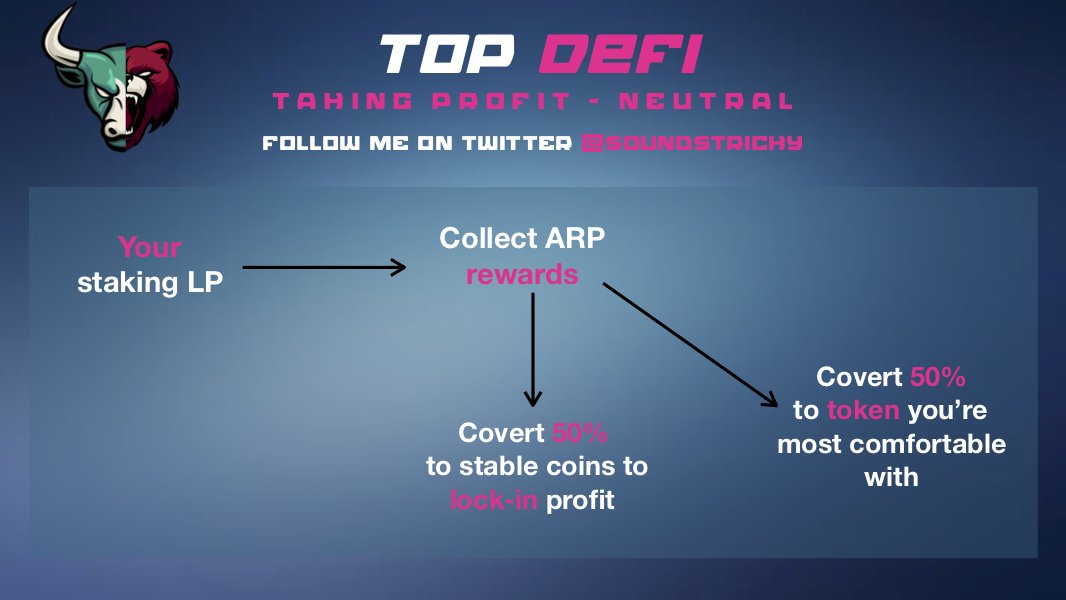

Point 8 - See my taking profit strategies from a few weeks ago. Choose 1 and stick to it. This is still important, now maybe more than ever. NFA

Lastly::: Point 10 - take a look over the this bear market token builder. NFA.DYOR. This is an example only. $ETH $MATIC $WETH Please don't use your investments, build from rewards only.

I hope this helps you during these times of uncertainty.

Please share and help others as well. Stay cool, keep rocking it and Stack, Stake, Chilax 👍

Please share and help others as well. Stay cool, keep rocking it and Stack, Stake, Chilax 👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh