Viceroy’s review of @KPMG_DE_FOR’s Adler investigation is now live:

viceroyresearch.org/2022/04/29/rev…

Viceroy do not believe it is possible that auditors can make reasonable assurances that #Adler’s accounts are free from misstatements given the damning findings by KPMG. $ADJ #thread 1/

viceroyresearch.org/2022/04/29/rev…

Viceroy do not believe it is possible that auditors can make reasonable assurances that #Adler’s accounts are free from misstatements given the damning findings by KPMG. $ADJ #thread 1/

In a moment of pure lunacy: Adler management claims KPMG's report absolves them of Viceroy's allegations. This is demonstrably inconsistent with KPMG’s review, but consistent with management’s legacy of swindling investors. $ADJ 2/

Adler's has anonymized identities of those involved. Viceroy have attempted to deanonymize the identities of most concerned parties, including most of the Caner Cabal. This codebreaker glossary can be found in Annexure 1 of our report. $ADJ 3/

Viceroy Research has also been in contact with various aggrieved suppliers and contractors of Consus. This report provides an update on outstanding invoices of ~€78m, which do not appear to be reflected in $ADJ’s interim accounts. $ADJ 4/

KPMG LIMITATIONS

Adler withheld ~800k documents from KPMG, claiming legal privilege. KPMG notes that these documents are likely significant to its investigations. $ADJ 5/

Adler withheld ~800k documents from KPMG, claiming legal privilege. KPMG notes that these documents are likely significant to its investigations. $ADJ 5/

Documents earmarked as legally privileged include emails from Caner to Adler's management team. We fail to see how these emails were made for the dominant purpose of providing legal advice or entering in litigation. $ADJ 6/

Throughout KPMG's report, it is noted that Adler ignored requests for explanations and supplement documents from KPMG to account for significant deviations in their review. $ADJ 7/

Bank documents were not made available to KPMG, including all transactions relating to Adler Real Estate AG which " [Adler] cannot access electronically". Many Adler Group accounts that could be accessed electronically were not made available to KPMG as original copies. $ADJ 8/

KPMG did not extend the investigation into media reports of malfeasance and corruption at Adler , nor the context of investigations of various regulatory investigations previously undisclosed to the market. $ADJ 9/

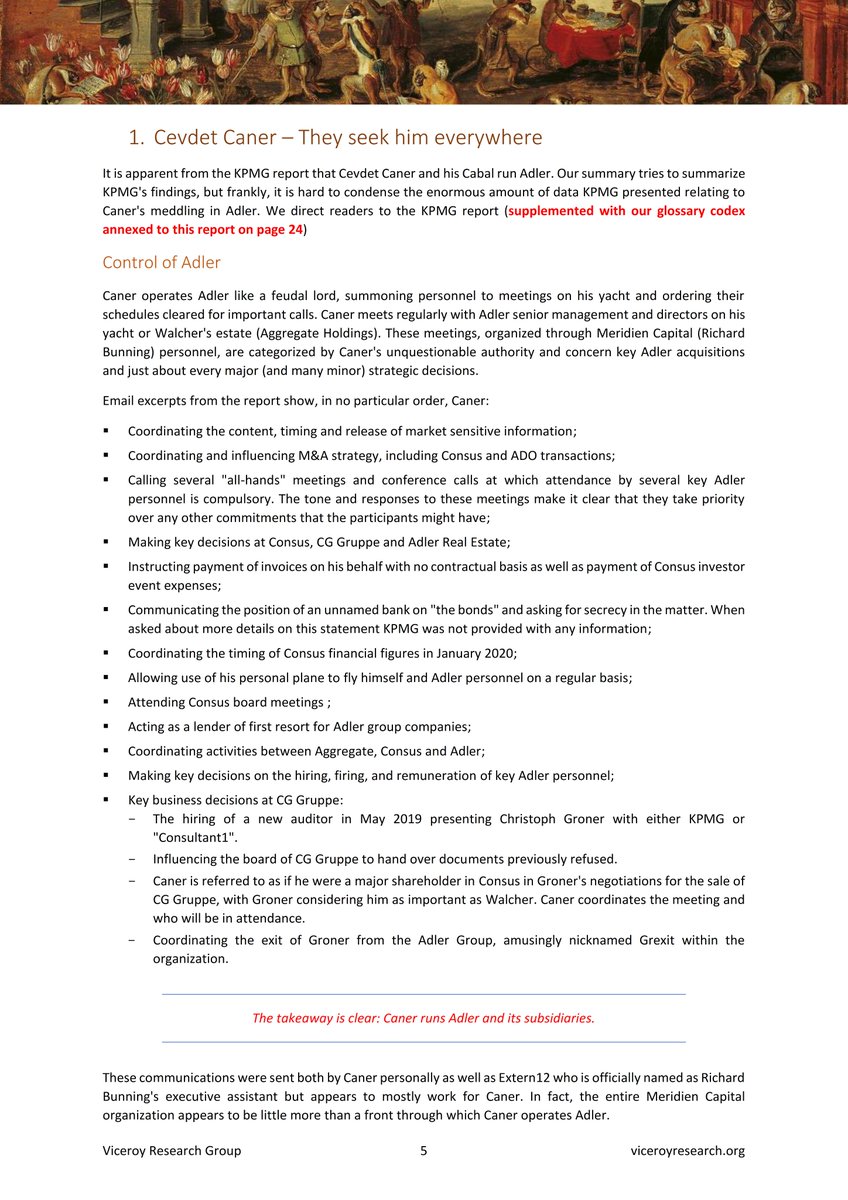

CEVDET CANER – SHADOW DIRECTOR

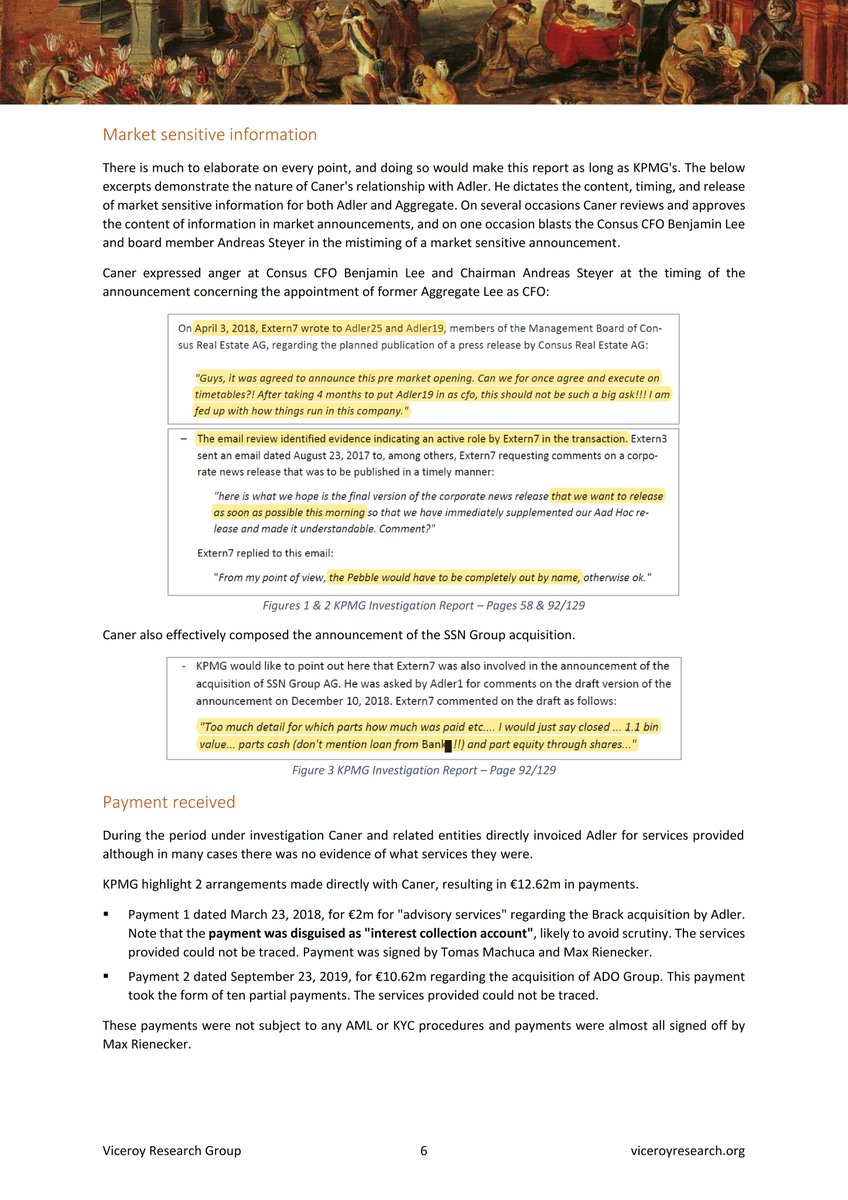

Caner organized meetings with the board, dictated acquisitions, approved senior management remuneration, and timetabled market sensitive announcements. $ADJ 10/

Caner organized meetings with the board, dictated acquisitions, approved senior management remuneration, and timetabled market sensitive announcements. $ADJ 10/

Caner held consulting agreements with Adler and its subsidiaries, and was paid fees for transactions despite contracts being signed post-acquisition and providing no performance records of work conducted. $ADJ 11/

Given the outsized role Caner's Cabal plays in Adler, we believe Caner’s involvement is ongoing. $ADJ 12/

FINANCIAL CONTROLS, LOOTING & DISPOSALS

KPMG highlight that little/no due diligence was completed in respect to various acquisitions, demonstrating inexistent internal controls. $ADJ 13/

KPMG highlight that little/no due diligence was completed in respect to various acquisitions, demonstrating inexistent internal controls. $ADJ 13/

Without such controls, Viceroy do not believe it is possible that auditors can make reasonable assurances that Adler’s accounts are free from misstatements. $ADJ 14/

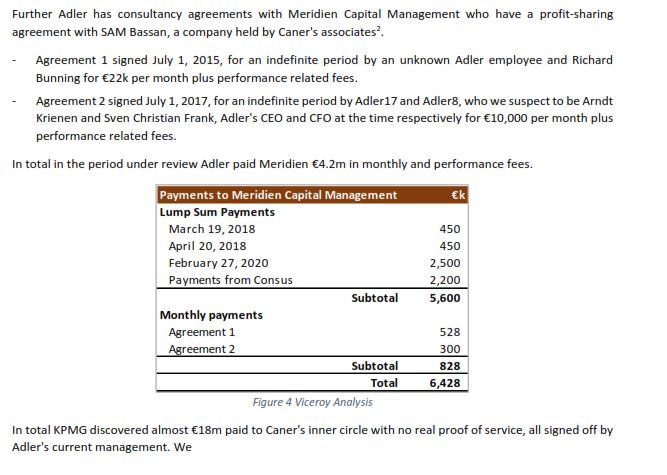

Adler paid tens of millions of euros in commission and monthly payments to Caner, Meridien Capital, and Mezzanine. There was no recorded proof of performance for these payments, but there was significant evidence that these third parties ran the show. $ADJ 15/

Payments for Caner's services were paid out in partial payments to intermediaries, including his wife and other hidden third parties. This followed Caner’s bank's compliance office blocking payment to him directly. $ADJ 16/

KYC checks were not conducted on any of the recipients of Caner’s payments. This largely constitutes money laundering. $ADJ 17

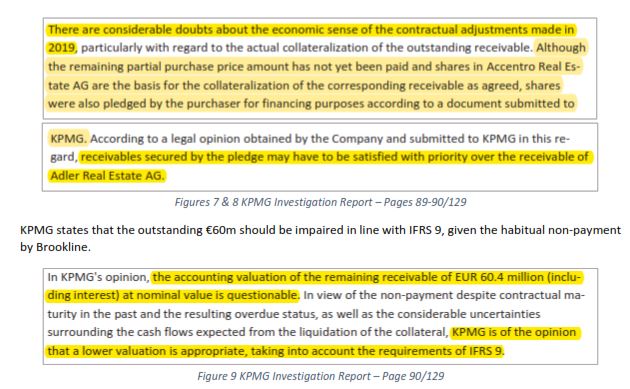

KPMG confirms Aggregate is a related party of Adler, and notes Adler holds a significant undisclosed amount of Aggregate bonds. These bonds are now trading at ~43c to the Euro, and Aggregate has defaulted on loan repayments to Vonovia. $ADJ 18/

Adler did not conduct creditworthy assessments or any sufficient due diligence on transactions with Mr Schrattbauer, Natig Ganiyev or Christoph Groner related entities. These undisclosed related parties still owe Adler hundreds of millions of euros. $ADJ 19/

The Gerresheim transaction was an absolute mess, and textbook example of internal control failures. $ADJ 20/

Due diligence was also not carried out is larger transactions, including ADO and Consus. $ADJ 21/

Stefan Kirsten previously worked for the Dayan family at Vivion. The Dayan family appears to be complicit in the ADO Coup D’état transaction. KPMG note it was not possible to identify the beneficial owner of an investment fund who benefitted from the transaction. $ADJ 22/

Adler's live LTV calculations have not been represented in line with calculation methods in bond contracts. Adler has historically breached its LTV constraints. $ADJ 23/

DEVELOPMENT PORTFOLIO

KPMG have confirmed that most Adler projects were in a construction stop as of 30 June 2021. $ADJ 24/

KPMG have confirmed that most Adler projects were in a construction stop as of 30 June 2021. $ADJ 24/

KPMG's revised valuation does not consider the fact that these projects will never be finished, despite this, KPMG' cannot refute Viceroy's opinion that Adler's financial resources are not sufficient to complete these development projects. $ADJ 25/

"Actual construction costs differ significantly between the documents provided to KPMG and cannot be reconciled". KPMG also infers some construction costs are non-recoverable. $ADJ 26/

Management has consciously applied higher developer profit rates in valuation calculations of "almost all" projects than those determined in NAI Apollos' appraisal, and have thus represented their own valuation as a third-party appraisal. $ADJ 27/

It should also be noted that many of these development projects have been forward sold and are subject to possible claw-backs to the tune of hundreds of millions of Euro. Despite forward sales, Adler does not appear to have sufficient capital to complete projects. $ADJ 28/

Further to KPMG's damning findings, Viceroy have provided a detailed status update on Adler's development projects, showing that most projects are shut off, & have failed to maintain basic administrative activities (such as lodging statutory accounts since 2019). $ADJ 29/

Whistleblowers and aggrieved suppliers have provided a list of outstanding invoices to Adler developments dating back to 2019. These exceed €77m at Q1 2021, €70m of which was due in 2020. $ADJ 30/

RESIDENTIAL PORTFOLIO

We believe that KPMG has avoided making any realistic assumptions and has assessed the portfolio in silo of the rampant dirty dealing at Adler. $ADJ 31/

We believe that KPMG has avoided making any realistic assumptions and has assessed the portfolio in silo of the rampant dirty dealing at Adler. $ADJ 31/

KPMG's breakdown of Viceroy's findings – together with the apparent basis of their response – was simplified to a point where they are neither useful nor provide meaningful analysis. This was expected, and Viceroy stands behind its original research. $ADJ 32/

Adler states that it holds the properties for the purposes of generating income. This is demonstrably false. Alder has accelerated the disposal of properties, including substantial sales since the appointment of KPMG. $ADJ 33/

Presumed market purchasers of Adler's properties would also use this valuation method, thus arriving at the same fair value. This is a strawman argument. ..cont. $ADJ 34/

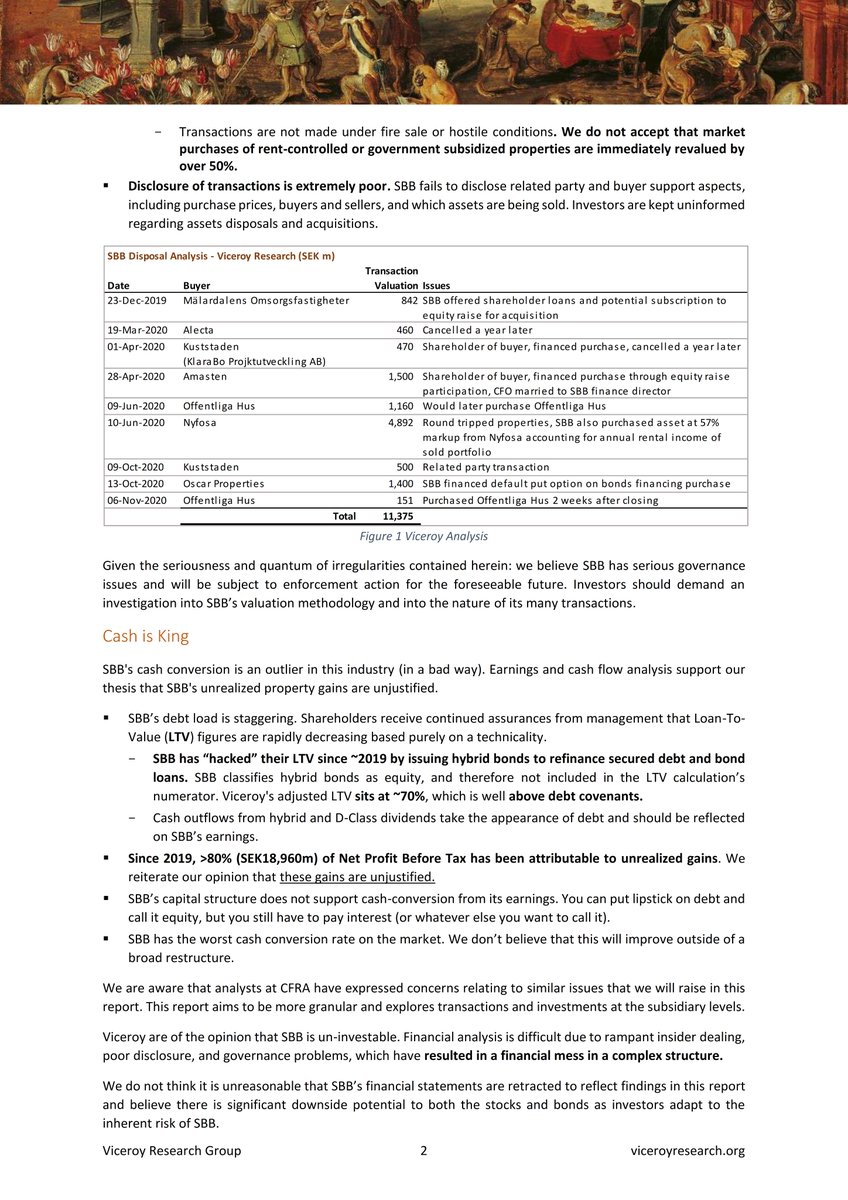

Adler records enormous revaluations on properties it acquires on the market and from purported "arms-length" transactions with undisclosed related parties, then validate these valuations through disposals of properties with undisclosed related parties. $ADJ 35/

KPMG compares historical rental growth rates of peers and Adler, not future rates, and claim they're above the rent group. Historical growth rates obviously do not affect DCF. Adler future DCF are significantly above peers. $ADJ 36/

KPMG suggests that our depicted cap rates were inconclusive and "uniform". “Uniformity" is subjective. A 0.25% point increase to Adler's residential portfolio cap rate would result in a ~€740m fall in value. Uniformity is undefined in KPMG's parameters. $ADJ 37/

Notwithstanding the above, KPMG's sample assessment still derives a -4.4% delta against Adler's recorded market values. $ADJ 38/

READ THE KPMG REPORT

Viceroy have summarized the key issues as best we can, but we could have written dozens more pages on KPMG's findings. $ADJ 39/

Viceroy have summarized the key issues as best we can, but we could have written dozens more pages on KPMG's findings. $ADJ 39/

We don't believe KPMG can obtain reasonable assurance that Adler's accounts are free of misstatement, & thus do not believe audits will be completed by 30 April. In the event @KPMG_DE sign the audit, we predict they will be a defendant in class actions $ADJ 40/end

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh