New to #crypto?

Here's some basic terminology and concepts to get you started...

+ some pro tips for navigating Crypto Twitter at the end.

👇 🧵

Here's some basic terminology and concepts to get you started...

+ some pro tips for navigating Crypto Twitter at the end.

👇 🧵

1/ Basic Terminology:

• Wallet: A wallet is your gateway to crypto. Wallets can store and send crypto, and can connect with and interact with decentralized apps.

• Dapps or Decentralized apps - these are apps built on a decentralized blockchain.

• Wallet: A wallet is your gateway to crypto. Wallets can store and send crypto, and can connect with and interact with decentralized apps.

• Dapps or Decentralized apps - these are apps built on a decentralized blockchain.

2/ Web2 vs Web3

• web2: Centralized web (most of the internet): Facebook, Twitter, etc

• web3: Decentralized web, apps are built on decentralized blockchains.

Typically, web3 apps will not require an email login, but will just ask you to connect with your wallet.

• web2: Centralized web (most of the internet): Facebook, Twitter, etc

• web3: Decentralized web, apps are built on decentralized blockchains.

Typically, web3 apps will not require an email login, but will just ask you to connect with your wallet.

3/ • Fiat: Regular government-issued currency that is not backed by a commodity like Gold. USD, CAD, GBP, EUR, INR, etc are all examples of fiat currency.

Here's the problem with fiat currency right now according to BTC bulls:

Here's the problem with fiat currency right now according to BTC bulls:

https://twitter.com/momentum_6/status/1504782731821019140?s=21&t=EjxZKWqOTWfxTWP4finVsg

4/ • Stablecoins: Coins that are pegged to a fiat currency like USD, (or to an asset like Gold).

Some popular stablecoins include $USDC, $USDT, $UST, $DAI, $FRAX

Here's a video I made about stablecoins:

Some popular stablecoins include $USDC, $USDT, $UST, $DAI, $FRAX

Here's a video I made about stablecoins:

5/ • Fungible Tokens: My BTC coins are the same as anyone else's BTC coins. i.e - Cryptos like BTC, ETH, etc are fungible. So are fiat currencies like USD.

• Non-Fungible: The Mona Lisa is perfectly unique. It is a one-of-a-kind asset. The Mona Lisa is non-fungible.

• Non-Fungible: The Mona Lisa is perfectly unique. It is a one-of-a-kind asset. The Mona Lisa is non-fungible.

6/ • NFTs or Non-Fungible Tokens:

They are most commonly used for digital art and collectibles right now, but they can also be used to represent other one-of-a-kind assets like property, ownership rights, identity, memberships, etc.

They are most commonly used for digital art and collectibles right now, but they can also be used to represent other one-of-a-kind assets like property, ownership rights, identity, memberships, etc.

7/ • Centralized Exchange (CEX):

Exchanges like @Binance, @coinbase, @kucoincom, etc.

Typically they use an order-book model to facilitate exchange of assets.

Exchanges like @Binance, @coinbase, @kucoincom, etc.

Typically they use an order-book model to facilitate exchange of assets.

8/ • Decentralized Exchange (DEX):

Exchanges like @Uniswap, @SushiSwap, @SpookySwap, @traderjoe_xyz.

Typically they use an Automated Market Maker (AMM) to facilitate exchanges

Exchanges like @Uniswap, @SushiSwap, @SpookySwap, @traderjoe_xyz.

Typically they use an Automated Market Maker (AMM) to facilitate exchanges

9/ • Airdrops:

New crypto projects may send tokens to wallets that have used their dapp when they launch a token.

This is meant to encourage adoption + help with marketing.

Famously, @Uniswap airdrop holders received 400 $UNI tokens which would have been worth ~$18k at ATH.

New crypto projects may send tokens to wallets that have used their dapp when they launch a token.

This is meant to encourage adoption + help with marketing.

Famously, @Uniswap airdrop holders received 400 $UNI tokens which would have been worth ~$18k at ATH.

10/ • ATH: All-Time High

• CT: Crypto Twitter

• Pump: Coin price go up

• Dump: Coin price go down

• Rekt: Get wrecked (destroyed)

• CT: Crypto Twitter

• Pump: Coin price go up

• Dump: Coin price go down

• Rekt: Get wrecked (destroyed)

11/ • Ape: Invest into a project ASAP (typically without doing DD)

• DD: Due Diligence

• FUD: Fear, uncertainty & Doubt (bearish)

• FOMO: Fear of missing out (bullish)

• Bridging: Transferring assets from one chain to another.

• DD: Due Diligence

• FUD: Fear, uncertainty & Doubt (bearish)

• FOMO: Fear of missing out (bullish)

• Bridging: Transferring assets from one chain to another.

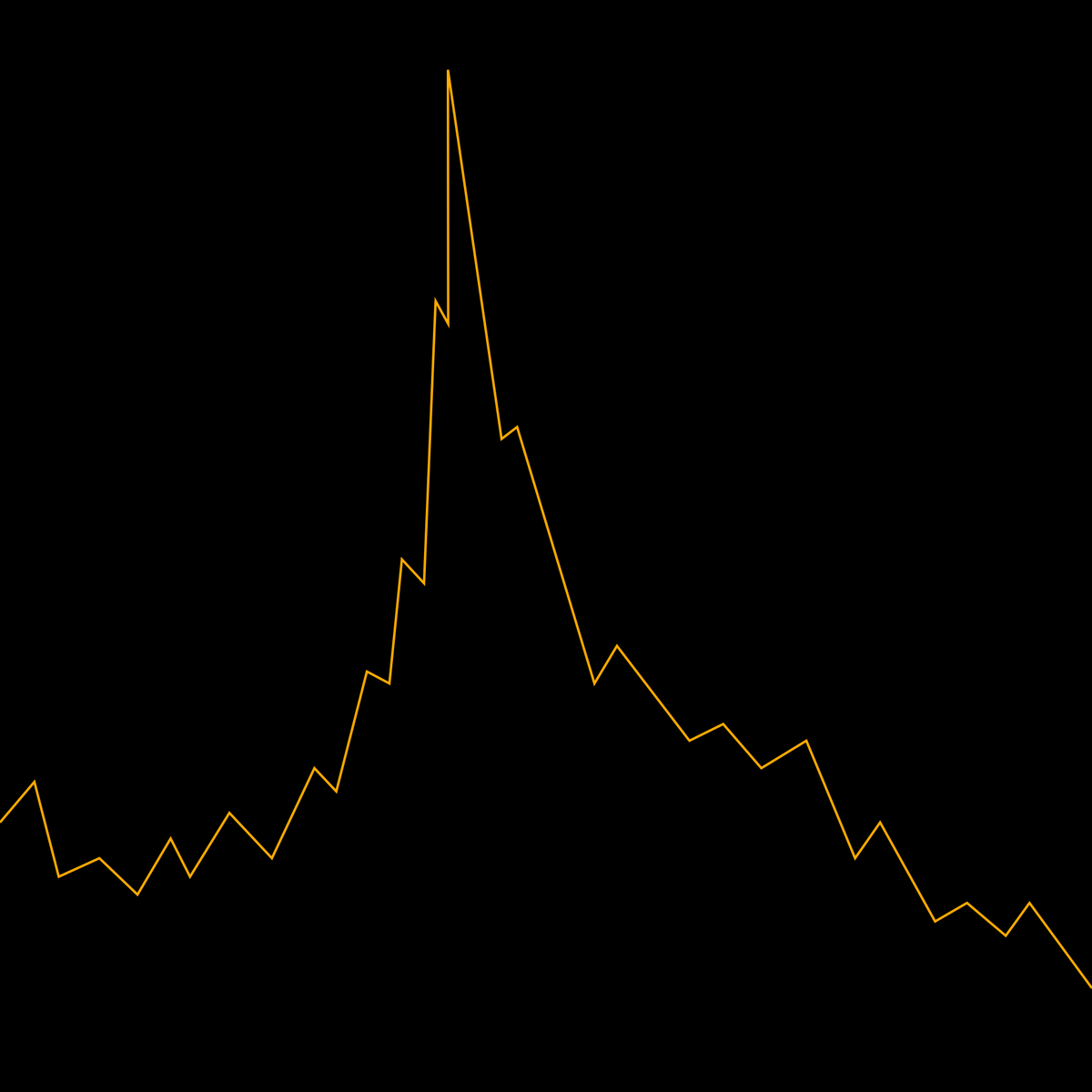

12/ • Pump & Dump: A scam where a group (on telegram usually) will make coordinated buys on a coin to pump up the price, and then sell it very soon after.

The chart for a pump and dump might look something like this over a very short time frame (a few mins or hours)

The chart for a pump and dump might look something like this over a very short time frame (a few mins or hours)

13/ • Ponzi: A common scam where current investors are paid dividends from new investors only (with no plan or path for long term sustainability)

en.wikipedia.org/wiki/Ponzi_sch…

en.wikipedia.org/wiki/Ponzi_sch…

14/ • Shill: Shillers will try to promote a coin by spamming about it all over crypto twitter. Typically, this is either because they were paid to do so, or because they are trying to pump their own bags.

15/ • Phishing: Hackers may try to "phish" sensitive information from you by sending you fake links that look like real links.

16/ • Maxi: A Bitcoin Maximalist or Maxi believes that Bitcoin is the only cryptocurrency worth holding, and that everything else is a scam or shitcoin.

You'll find maxis for other altcoins as well.

You'll find maxis for other altcoins as well.

17/ • TA (Technical Analysis): Analysis based on looking at chart patterns, technical indicators, support and resistance levels, moving averages, etc.

18/ • FA (Fundamental Analysis): Analysis based on the fundamentals of a project such as use cases, adoption & growth, protocol revenue, tokenomics, supply & demand drivers, etc.

19/ • Miners / Validators: They sign the transaction and verify that it is correct.

• Consensus Mechanism: The mechanism by which all miners or validators come to an agreement about the state of the network.

Different blockchains may use different consensus mechanisms.

• Consensus Mechanism: The mechanism by which all miners or validators come to an agreement about the state of the network.

Different blockchains may use different consensus mechanisms.

20/ • Proof-of-Work (PoW): The consensus mechanism used by the Bitcoin blockchain (and some others) to come to an agreement.

In this, miners compete to solve a complicated math problem to verify the block, and win the block reward.

In this, miners compete to solve a complicated math problem to verify the block, and win the block reward.

21/ • Proof-of-Stake (PoS): A consensus mechanism used by many other blockchains, where a validator must "stake" some of their own crypto in order to incentivize them to validate transactions correctly.

Good validator = interest on crypto 💰

Bad validator = crypto slashed 🗡️

Good validator = interest on crypto 💰

Bad validator = crypto slashed 🗡️

22/ Now for some DeFi terms:

• APR: Annualized Percentage Rate (for loan, interest, or yield typically)

• APY: Annualized Percentage Yield (for loan, interest, or yield typically)

• APR: Annualized Percentage Rate (for loan, interest, or yield typically)

• APY: Annualized Percentage Yield (for loan, interest, or yield typically)

https://twitter.com/magikinvestxyz/status/1512164430544470016?s=20&t=dzyrGKnz6ZB2edk76j8ZBg

23/ Liquidity Pools

https://twitter.com/momentum_6/status/1482006875373723652?s=21&t=EjxZKWqOTWfxTWP4finVsg

24/ Impermanent Loss

https://twitter.com/momentum_6/status/1494376714063028225?s=21&t=EjxZKWqOTWfxTWP4finVsg

25/ Navigating Crypto Twitter:

• Symbols for #cryptos are denominated with $ tags. Example: $BTC, $ETH, ...

• Click on these to read top posts about the coin.

Note: with so many coins in the space, many coins might be using the same symbols so use common sense.

• Symbols for #cryptos are denominated with $ tags. Example: $BTC, $ETH, ...

• Click on these to read top posts about the coin.

Note: with so many coins in the space, many coins might be using the same symbols so use common sense.

26/ • Bonus: no one uses these terms accurately (not even us), but here's the difference between a Coin and a Token

https://twitter.com/momentum_6/status/1494376714063028225?s=21&t=EjxZKWqOTWfxTWP4finVsg

27/ Here are some DeFi concepts we want to write an overview of and expand on in future threads:

• L0 / L1 / L2

• Interoperability

• Bridges (🧵)

• Yield Farming (🧵)

• Nodes

• Launchpads

• Different types of stablecoins (🧵)

• DeFi 2.0

• FaaS

• Boosting

...

• L0 / L1 / L2

• Interoperability

• Bridges (🧵)

• Yield Farming (🧵)

• Nodes

• Launchpads

• Different types of stablecoins (🧵)

• DeFi 2.0

• FaaS

• Boosting

...

28/ Pro Tips for CT: Now that you're a pro user, try this

• Search "from:@momentum_6 min_retweets:50" in the twitter search bar.

You can do this to find popular posts by a creator.

• Search "from:@momentum_6 min_retweets:50" in the twitter search bar.

You can do this to find popular posts by a creator.

29/ Here's an awesome guide by @buffer for advanced Twitter search features:

buffer.com/library/twitte…

buffer.com/library/twitte…

30/ I hope you've found this thread helpful.

Follow me @Momentum_6 for more.

Like/Retweet the first tweet below if you can:

Follow me @Momentum_6 for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/Momentum_6/status/1520014484990947330

31/ You can read the unrolled version of this thread here: typefully.com/Momentum_6/1Ix…

• • •

Missing some Tweet in this thread? You can try to

force a refresh