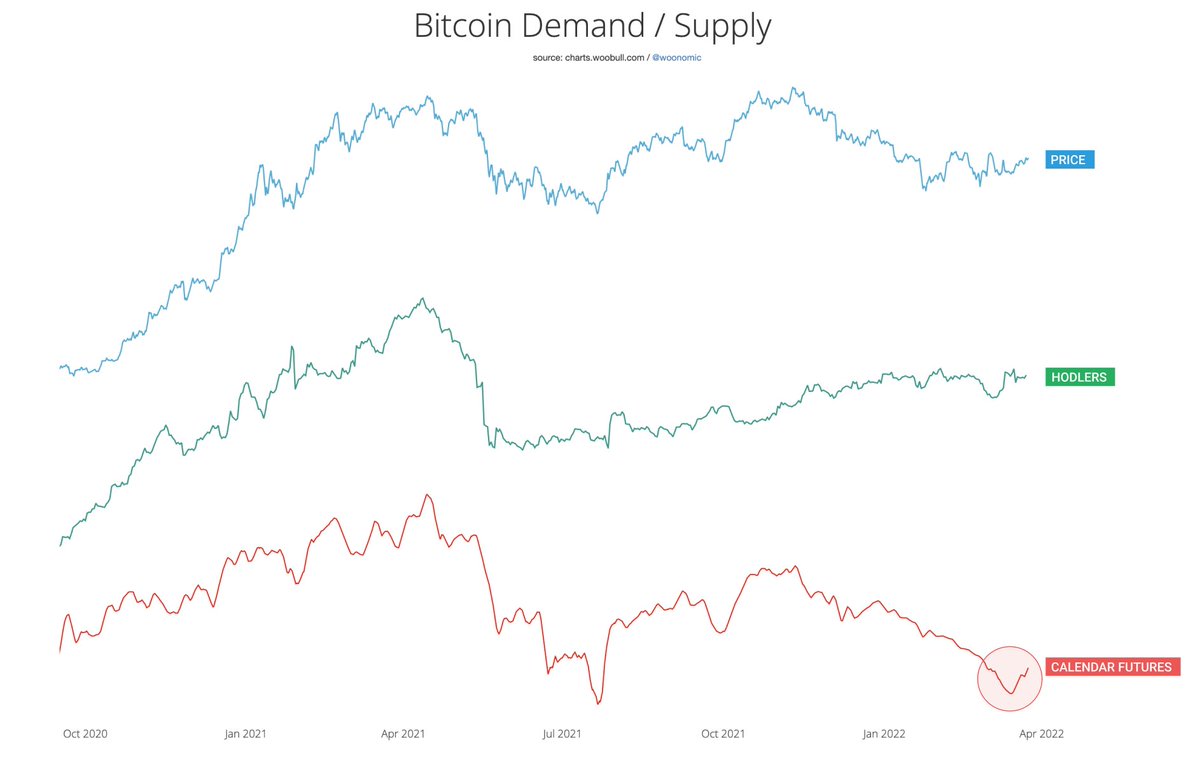

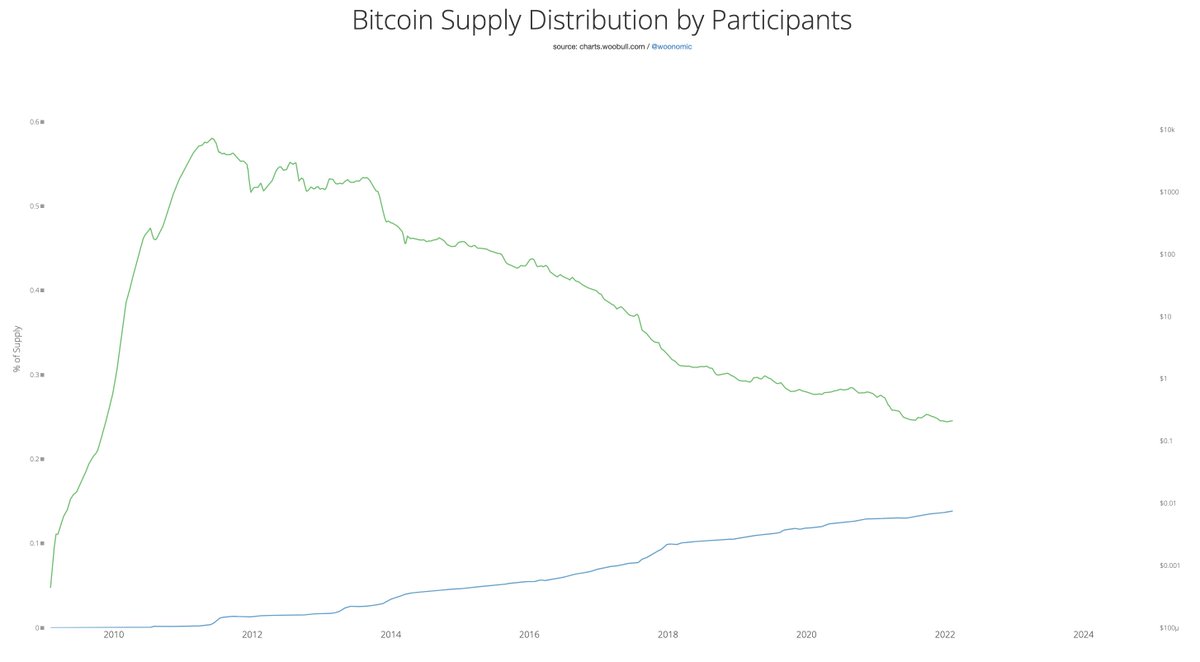

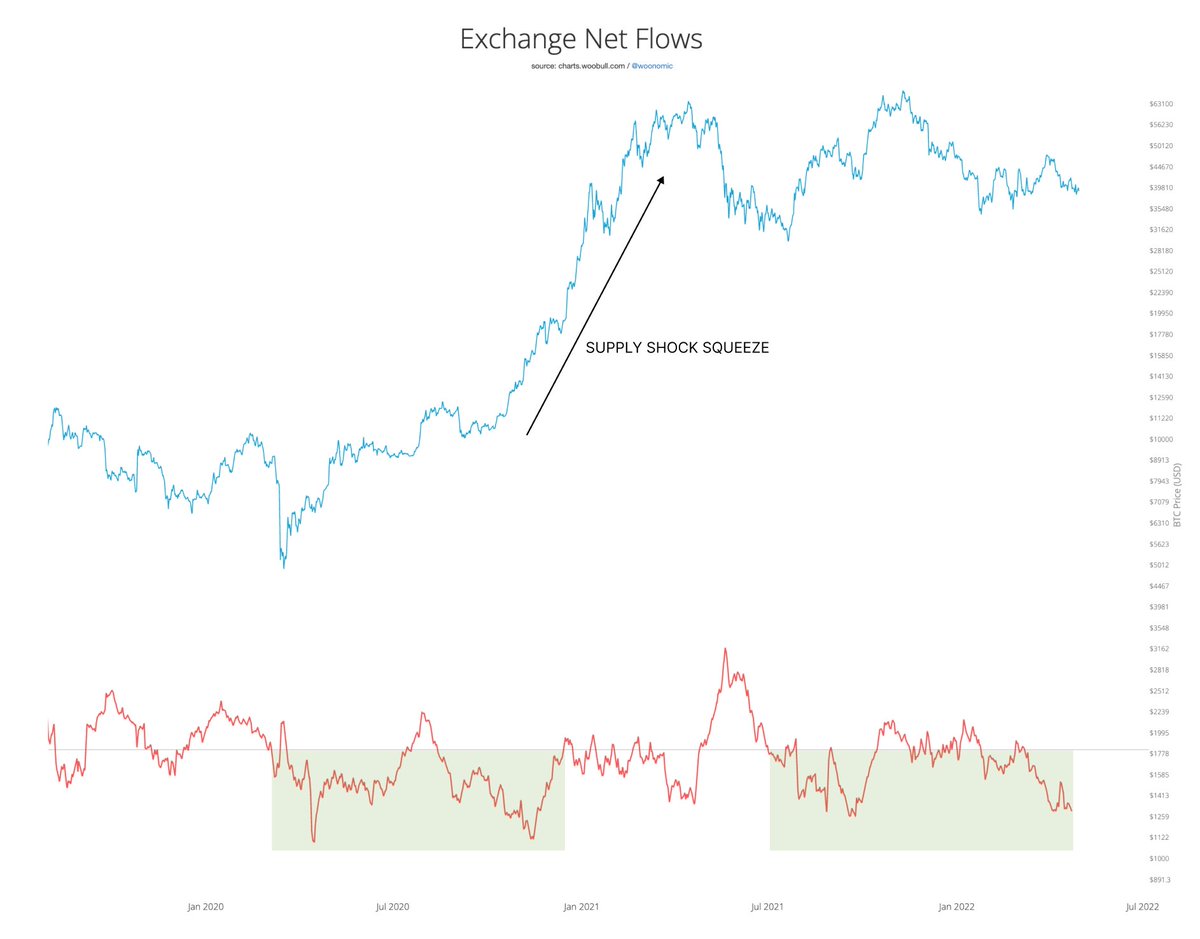

#Bitcoin price is sideways because of Wall St is selling futures contract in a macro risk-off trade. Meanwhile institutional money is scooping spot BTC at peak rates and moving to cold storage.

It's times like these I remember the Q4 2020 supply shock squeeze.

It's times like these I remember the Q4 2020 supply shock squeeze.

BTC price holding up well while equities tank and USD Index moons is testament to the unprecedented spot buying happening right now.

In other words: Investors already see BTC as a safehaven, it will take time for price to reflect. Wait for the futures sells to run out of ammo.

In other words: Investors already see BTC as a safehaven, it will take time for price to reflect. Wait for the futures sells to run out of ammo.

• • •

Missing some Tweet in this thread? You can try to

force a refresh