1/ Time for a check-in on $NMM

With clean product tanker rates surging I have seen a lot of enthusiasm and speculation about what this means for EPS going forward.

Updated my model with the latest charters from 20-F and ran a spot rate sensitivity on remaining open/index days:

With clean product tanker rates surging I have seen a lot of enthusiasm and speculation about what this means for EPS going forward.

Updated my model with the latest charters from 20-F and ran a spot rate sensitivity on remaining open/index days:

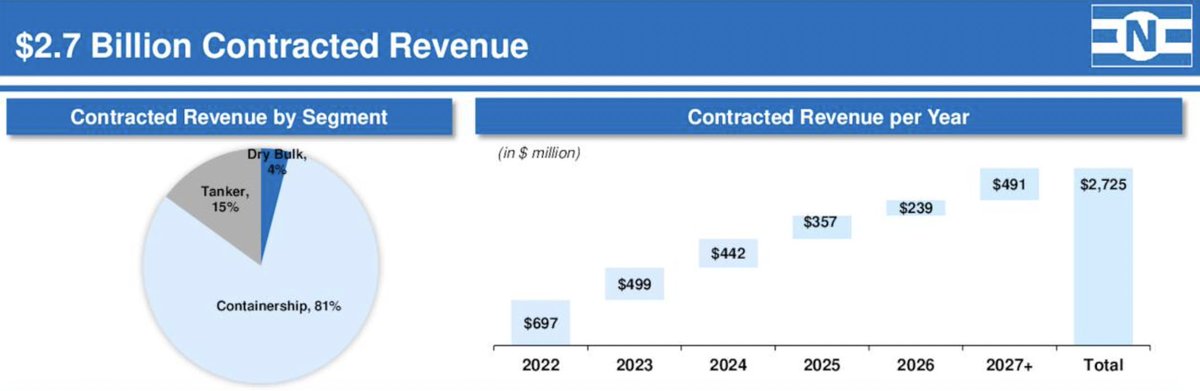

2/ Unfortunately most of $NMM's product tanker fleet is already fixed for Q2, gradually rolling off charter throughout the rest of the year and into 2023.

It seems more likely to be a tailwind to an already huge contract backlog in containers and strong expectations in drybulk.

It seems more likely to be a tailwind to an already huge contract backlog in containers and strong expectations in drybulk.

3/ Personally I am expecting around $16 EPS and $700M of operating cash flow for 2022 with the way markets are shaping up.

This puts year end net debt and capital leases at around $900M and EV at around $1.8B

This puts year end net debt and capital leases at around $900M and EV at around $1.8B

4/ With the shockingly low 2023 orderbooks in both #drybulk and #tankers I am much more bullish on rates. I would not be surprised to see mid $20k on tankers and low $30k on drybulk rates for the year.

This would yield around $25 EPS and ~$1B in cash flow for NMM in 2023.

This would yield around $25 EPS and ~$1B in cash flow for NMM in 2023.

5/ $NMM remains extraordinarily cheap with contracted revenue exceeding its enterprise value and the current scrap value of its fleet exceeding the value of its debt.

The question remains, will we see shareholder returns?

The question remains, will we see shareholder returns?

6/ In the latest conference call, CEO Angeliki Frangou has a distinct change of tone regarding growth vs returns and mentions a working capital requirement of $2M/ship ($290M total) which should be reached by the end of Q2. It could mean more shareholder returns starting in Q3.

7/ It was a bumpy ride with $NMM in 2021. It remains my largest position. If share buybacks ever come to pass, it is likely to unleash a coiled spring. We shall see.

• • •

Missing some Tweet in this thread? You can try to

force a refresh