I decided to mint #OtherDeed and purchase more on secondary

Let me tell you why I see 💪 5-15x upside and limited downside:

A fundamental TradFi approach to valuing metaverse land NFTs - in this case #Otherdeed from the @OthersideMeta @BoredApeYC @yugalabs🧵:

Let me tell you why I see 💪 5-15x upside and limited downside:

A fundamental TradFi approach to valuing metaverse land NFTs - in this case #Otherdeed from the @OthersideMeta @BoredApeYC @yugalabs🧵:

https://twitter.com/OthersideMeta/status/1520564882860617730

Investment summary

🔹Dream the dream: premier metaverse gaming asset producing economic value

🔹305APE or 2.2ETH mint, 100k supply

🔹Upside 5x to 12ETH

🔹Bull case 15x to 32ETH

🔹Downside to 2.6ETH

🔹Misunderstanding is high: new issuance, multiple product catalysts

/2

🔹Dream the dream: premier metaverse gaming asset producing economic value

🔹305APE or 2.2ETH mint, 100k supply

🔹Upside 5x to 12ETH

🔹Bull case 15x to 32ETH

🔹Downside to 2.6ETH

🔹Misunderstanding is high: new issuance, multiple product catalysts

/2

“What” is this? In short, these are plots of digital land in a new metaverse created by @yugalabs

🙏 Props to the many creators dropping alfa with great background and context this past week @JayLow @ArdonLukas @davidgokhshtein @CapetainTrippy @farokh

/3

🙏 Props to the many creators dropping alfa with great background and context this past week @JayLow @ArdonLukas @davidgokhshtein @CapetainTrippy @farokh

https://twitter.com/yugalabs/status/1505014986556551172

/3

🤔“Why” should we care – here's the investment case from a reformed TradFi value investor’s perspective

There are others better at the technical dynamics 📈📉

@LiamHerbst @DrJayDD @TenaciousEth @tyu_crypto @0xcrumb @0x_b1

/4

There are others better at the technical dynamics 📈📉

@LiamHerbst @DrJayDD @TenaciousEth @tyu_crypto @0xcrumb @0x_b1

/4

✍️First principles – what is the purpose of land?

Land utility in the metaverse will be different than in the physical world – in this case, it relates to game mechanics such as resource generation, artifacts, and a Koda, which will be a key NFT character in @OthersideMeta

/5

Land utility in the metaverse will be different than in the physical world – in this case, it relates to game mechanics such as resource generation, artifacts, and a Koda, which will be a key NFT character in @OthersideMeta

/5

🙅 As an aside – what will it not be? In physical real estate it’s all about “location, location, location” – which won’t matter in the metaverse. How ridiculous would it be to be limited by distance? We'll zap in/zap out of locations like in Ready Player One or Wreck it Ralph

/6

/6

So for digital land to have value, you have to believe this framework:

✅This game will be fun and attract users

✅Users will need in-game resources to play

✅This demand will create a productive in-game economy

✅Owning resource generation, via the land, has value

/7

✅This game will be fun and attract users

✅Users will need in-game resources to play

✅This demand will create a productive in-game economy

✅Owning resource generation, via the land, has value

/7

How big can digital economies be? Very

Gaming is a $200bn market with many large individual economics incl:

🔹@Roblox $2.7bn bookings ('21)

🔹@FortniteGame $2.5bn bookings ('21)

🔹@MetaQuestVR >$1bn app spend (cuml)

🔹@Warcraft $600mm in-game GDP ('20)

/8

massivelyop.com/2021/01/21/wor…

Gaming is a $200bn market with many large individual economics incl:

🔹@Roblox $2.7bn bookings ('21)

🔹@FortniteGame $2.5bn bookings ('21)

🔹@MetaQuestVR >$1bn app spend (cuml)

🔹@Warcraft $600mm in-game GDP ('20)

/8

massivelyop.com/2021/01/21/wor…

Thesis: gaming is going to onboard the next BILLION users to crypto, and @yugalabs is making a strong push

Engagement a la @StarCraft or @Warcraft would be huge – as a fellow gamer @CryptoGarga would know

/9

Engagement a la @StarCraft or @Warcraft would be huge – as a fellow gamer @CryptoGarga would know

/9

https://twitter.com/yugalabs/status/1478100707991506948?s=20&t=SZNL-DJyc3B5Qnymm33bvw

🎯 Let's talk brass tacks: Valuation framework

For thinking about metaverse real estate value – I’ll give two:

1⃣ Analogy to US commercial real estate

2⃣ Relative to existing comps @TheSandboxGame, @decentraland, @cryptovoxels, @SomniumSpace, @nftworldsNFT, @Worldwide_WEB3

/10

For thinking about metaverse real estate value – I’ll give two:

1⃣ Analogy to US commercial real estate

2⃣ Relative to existing comps @TheSandboxGame, @decentraland, @cryptovoxels, @SomniumSpace, @nftworldsNFT, @Worldwide_WEB3

/10

1⃣ US commercial real estate is roughly equivalent to the value of US GDP

US GDP is $21tn, roughly equal to US Commercial RE value at $21tn per @REITs_Nareit

Real estate is 3x GDP if you include housing

➡️In other words, 1-3x Real Estate Value / GDP in the real economy

/11

US GDP is $21tn, roughly equal to US Commercial RE value at $21tn per @REITs_Nareit

Real estate is 3x GDP if you include housing

➡️In other words, 1-3x Real Estate Value / GDP in the real economy

/11

Back of the envelope math sense check on retailer unit economics suggests this makes sense

🔹 B&M retailers spend 10% of revenue on rent

🔹 CRE is typically valued at a 4-12% cap rate

➡️ This works out to roughly 1:1 value Real Estate Value / Revenue

/12

🔹 B&M retailers spend 10% of revenue on rent

🔹 CRE is typically valued at a 4-12% cap rate

➡️ This works out to roughly 1:1 value Real Estate Value / Revenue

/12

Next variable: sizing the economy of @OthersideMeta. We have a few benchmarks:

🔹$5bn annual trading volume of @BoredApeYC, mutants and dogs

🔹Other in-game economies (above): @Warcraft at $600mm up to @Roblox at $2.7bn

/13

🔹$5bn annual trading volume of @BoredApeYC, mutants and dogs

🔹Other in-game economies (above): @Warcraft at $600mm up to @Roblox at $2.7bn

/13

⏩9-27 ETH value is reasonable per @OthersideMeta land NFT using the US commercial real estate (CRE) market and other in-game economies as an analogy

Sensitivity table below for you to choose your own adventure – could be higher (or lower!) 👇

/14

Sensitivity table below for you to choose your own adventure – could be higher (or lower!) 👇

/14

2⃣ Mint price in-line with comps, when I think it should be 2-4x higher = 6-11ETH

Why? @yugalabs has created A-tier content with focused execution

➡️The “dream” is alive, which isn’t true for competitors who have stalled

@ParcelNFT is great resource for competitor overviews

/15

Why? @yugalabs has created A-tier content with focused execution

➡️The “dream” is alive, which isn’t true for competitors who have stalled

@ParcelNFT is great resource for competitor overviews

/15

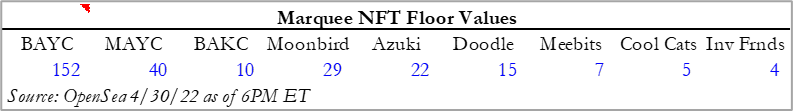

Additionally: the upcoming #Koda NFT airdrop lowers the cost basis

Each land has 10% shot at a Koda = 1-5 ETH per land

🔹As the genesis NFT of @OthersideMeta, fair shot at @moonbirds or #MAYC at 30-40ETH

🔹At worst, it will be respectable like @coolcatsnft @meebits at 5ETH

/16

Each land has 10% shot at a Koda = 1-5 ETH per land

🔹As the genesis NFT of @OthersideMeta, fair shot at @moonbirds or #MAYC at 30-40ETH

🔹At worst, it will be respectable like @coolcatsnft @meebits at 5ETH

/16

Pulling this all together 🥅:

🔹Base case = 5x to 12ETH, assuming 9ETH for Land + 3ETH for Koda NPV

🔹Bull case = 15x to 32ETH (or cost-less if deduct Koda from basis)

🔹Downside is 30% to 1.6ETH (Sandbox value, assume no Koda)

/17

🔹Base case = 5x to 12ETH, assuming 9ETH for Land + 3ETH for Koda NPV

🔹Bull case = 15x to 32ETH (or cost-less if deduct Koda from basis)

🔹Downside is 30% to 1.6ETH (Sandbox value, assume no Koda)

/17

Analysis at various prices for the secondary market using my base/bull/downside cases (AVP for the TradFi model monkeys 🐒) ⬇️:

@geniexyz @gemxyz @LooksRareNFT @opensea

/18

@geniexyz @gemxyz @LooksRareNFT @opensea

/18

There are multiple future catalysts on product roadmap to keep the excitement going and create ecosystem value, including:

🔹Native marketplace launch – imminent?

🔹Koda drop in 1-2mths

🔹MMO game launch 4Q22

What am I missing @CryptoGarga @GordonGoner @TomatoBAYC @SassBAYC

/19

🔹Native marketplace launch – imminent?

🔹Koda drop in 1-2mths

🔹MMO game launch 4Q22

What am I missing @CryptoGarga @GordonGoner @TomatoBAYC @SassBAYC

/19

Risks/concerns - I'll give 3️⃣:

🔹Otherdeed release of 100k more lands over the next few months will dilute the market

🔹Land value accrual will be different in the metaverse than IRL – the 1x ratio RE / GDP basis for my valuation framework may be totally off

/20

🔹Otherdeed release of 100k more lands over the next few months will dilute the market

🔹Land value accrual will be different in the metaverse than IRL – the 1x ratio RE / GDP basis for my valuation framework may be totally off

/20

🔹Is this vaporware? Other metaverse projects so far have been disappointing – lot of hype and land speculation, but not much utility to get excited about yet @TheSandboxGame @decentraland

This is the most fair and damning observation about metaverse and web3/crypto broadly

/21

This is the most fair and damning observation about metaverse and web3/crypto broadly

/21

Bottomline – I see a strong risk/reward

What keeps me in the @BoredApeYC ecosystem is the value of its marquee IP and potential across all media (esp. gaming)

The power of reflexivity is strong in early stage.

Prior BAYC thesis 👇

/22

What keeps me in the @BoredApeYC ecosystem is the value of its marquee IP and potential across all media (esp. gaming)

The power of reflexivity is strong in early stage.

Prior BAYC thesis 👇

https://twitter.com/cosmo_jiang/status/1490764515184500738

/22

👋 DMs open and all comments / feedback are welcome!

❤️ If you like the thread please give me a follow! I apply tradfi frameworks to crypto

🙏 Grateful for the learnings and to be along for the ride by @OthersideMeta @BoredApeYC @yugalabs #apefollowape

❤️ If you like the thread please give me a follow! I apply tradfi frameworks to crypto

🙏 Grateful for the learnings and to be along for the ride by @OthersideMeta @BoredApeYC @yugalabs #apefollowape

https://twitter.com/cosmo_jiang/status/1520768252678316033

• • •

Missing some Tweet in this thread? You can try to

force a refresh