“The sickening day I lost £125k - Britain’s biggest advice firm (#StJamesPlace) is investigating claims that a 64-year-old investor was misled” In an all too familiar toxic mix of the @TheFCA’s men/women + high upfront commission/fee high risk products …

2/ - with a twist: the acquisition **in mid 2014** of FCA IFA Gilruth independent advisors ltd “Gilruth” (renamed after acquisition to Regentia lifestyle planning ltd “Regentia”) by the owner of another FCA IFA (Regency Wealth Ltd “Regency” - an A.R. of St James Place).

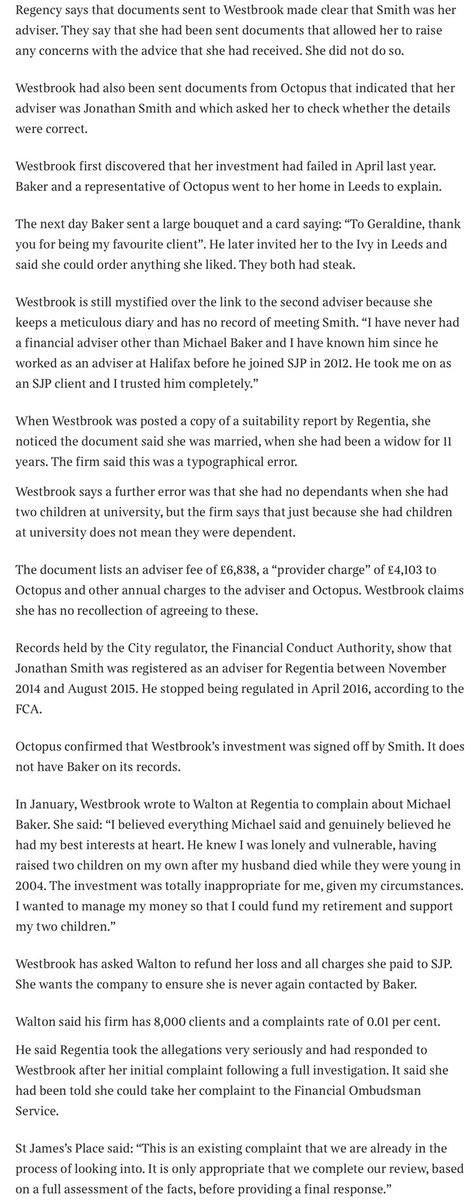

3/ Regency was reportedly limited to hawking only St James Place products, but it’s new sibling Regentia reportedly could also hawk anything it wanted to. The client, a 64 yr old mother & widower thought she was dealing with her Regency IFA she had dealt with for many years.

4/ It reportedly came as a shock to her when Regency claimed (with allegedly error ridden docs) that she had been dealing with an IFA from it’s then sister (non St James Place) FCA IFA op Regentia + an IFA (Jonathan Smith) the client claimed never to have heard of or met.

6/ Regency & it’s double act with it’s then newly acquired sister company Regentia (Gilruth) have, however, allegedly ‘past form’ - “SJP firm Regency ‘misled’ client of purchased IFA into switching”. Finally, the ‘elephant in the room’ - the product reportedly peddled, …

7/ which was one of FCA DFM #Octopus’s EIS products (an Italian Solar Energy EIS in this case), allegedly peddled not as a high risk/high return EIS but as a very different lower risk tax avoidance/capital preservation focused EIS product.

8/ Quite why Regency’s story is that it’s IFA told the client he wasn’t allowed to peddle Octopus’ Italian Solar EIS (but it’s sister company could) isn’t clear, as a FOS ruling indicated that fellow St James Place IFAs were at around this time allegedly peddling it. At around ..

9/ the time the 2 St James Place’s IFA clients were allegedly being peddled Octopus’ Italian Solar EIS, Octopus’ likewise ‘lower risk’ Film Scheme EIS was making the news - for the wrong reasons - 'Lower risk' film fund's losses leave investors fuming’ (citywire.com/funds-insider/…).

10/ Seemingly @TheFCA & it’s IFAs took little notice. Last year in “When things go wrong” Octopus’ CEO/founder blamed the “undeniably poor performance” of it’s Italian Solar EIS on “a deterioration in the market for Italian solar assets” - the effect rather than the cause.

11/ A superficial peek at the history of the Italian solar (PV) market highlights the ‘licence to print money’ of Italian solar ops (caused by setting subsidy levels at an astonishingly high level - 2x Germany’s) ended in the ‘mad rush’ of 2011 as the Italian govt announced …

12/ the slashing of incentives for solar ops. The legacy unsurprisingly was of many solar ops with suboptimal size/locations (poor locations +/or in the South, far away from large consumers) + substandard solar equipment, exposed as subsidies reduced. Added to this are the …

13/ country issues of lengthy/difficult approval processes, corruption & organised crime. Circa 2015 when the two investors (highlighted in the Times stories) were allegedly peddled the Octopus Italian Solar EIS by FCA IFAs one ponders what exactly they were told about the …

14/ state of play in the Italian solar market (incl. the onerous ‘Spalma Incentivi’ in 08/2014) as well as the high risk of lack of diversification. One also ponders the reasons for, as Octopus’ CEO stated, the “undeniably poor performance” of its Italian Solar EIS.

15/15 Only a few months later Octopus withdrew completely from selling EIS products (ft.com/content/18842e…).

• • •

Missing some Tweet in this thread? You can try to

force a refresh