1. I'm an obvious #AVALANCHE maxi but have been paying extremely close attention to @0xSunflowerLand

a #GAMEFI project on #Polygon.

I believe the game is an interesting #tokenomics laboratory and it may yield some significant insights because of it's scale.

#SunflowerLand

a #GAMEFI project on #Polygon.

I believe the game is an interesting #tokenomics laboratory and it may yield some significant insights because of it's scale.

#SunflowerLand

2. 100,000 users were given access to the Beta State and allowed to mint NFT farms for approximately 1 Matic, at the time ~ $1.25.

The games token $SFL is created solely through playing the game - no $SFL was pre-generated, and there will be no LP farming.

The games token $SFL is created solely through playing the game - no $SFL was pre-generated, and there will be no LP farming.

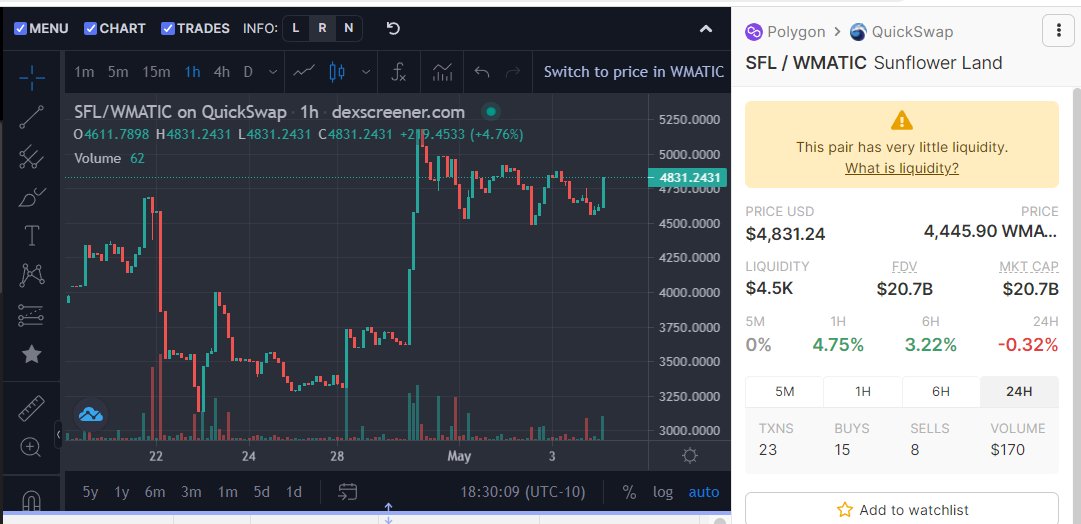

3. On May 9th players will be able to withdraw their $SFL and trade it on Quickswap, individuals will provide the liquidity but there is no current plan for protocol owned liquidity.

A minor amount of Liquidity is currently on Quickswap

A minor amount of Liquidity is currently on Quickswap

4. The game has novel mechanisms to constrain token outflow.

Game assets have an $SFL cost payed by players - these tokens are sent to the Null wallet an permanently removed from circulation

A withdrawal fee-up to 20% of $SFL will be captured at withdrawal.

Game assets have an $SFL cost payed by players - these tokens are sent to the Null wallet an permanently removed from circulation

A withdrawal fee-up to 20% of $SFL will be captured at withdrawal.

5. $SFL tokens are generated by planting various seeds and then selling the sunflowers, potatoes, carrots and other crops to the in game store.

The game tracks the cumulative $SFL generated and at specific points reduces the cost of seeds and the price paid for crops by half.

The game tracks the cumulative $SFL generated and at specific points reduces the cost of seeds and the price paid for crops by half.

6. The "halvening" feature, means the quantity of $SFL entering the chain will progressively decrease even as the number of players increase.

Currently 7,647,636 SFL exist, with 2,919,115 are permanently out of circulation - the next halvening will occur at 10,000,000 SFL.

Currently 7,647,636 SFL exist, with 2,919,115 are permanently out of circulation - the next halvening will occur at 10,000,000 SFL.

7. Shortly after tokens are allowed to be withdrawn to Polygon on May 9, the Sunflower team will open up the Beta to an additional 50,000 users/farmers.

Sunflower Land is already the 14 most active DAPP.

Sunflower Land is already the 14 most active DAPP.

8. It will be interesting to see the price discovery for $SFL on May 9, and if they low cost of participation and the novel mechanisms of Sunflower allow that price to be sustained or increased over time.

#PlayToEarn projects and #tokenomic researchers should watch closely!

#PlayToEarn projects and #tokenomic researchers should watch closely!

9. The Game site is - sunflower-land.com

You can learn more about the project on their Discord Server at - discord.gg/85cVxcTt

You can learn more about the project on their Discord Server at - discord.gg/85cVxcTt

• • •

Missing some Tweet in this thread? You can try to

force a refresh