Updated global fleet age and replacement requirements courtesy of the latest Danish Ship Finance report.

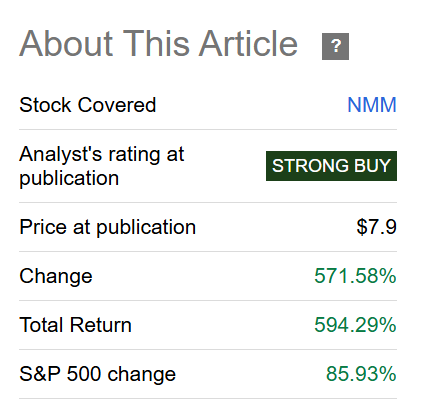

We are going to be hearing a lot more about negative fleet growth in #tankers and #drybulk in the coming years. Strap in for higher rates 🚀

We are going to be hearing a lot more about negative fleet growth in #tankers and #drybulk in the coming years. Strap in for higher rates 🚀

https://twitter.com/AllVentured/status/1515601052711763969

Shipbuilding capacity still decreasing. Many second tier yards are unable to build the modern designs and sizes required. 129 second tier yards that delivered a ship in 2021 *did not receive any new orders in 2021*. These yards will most likely cease to exist in coming years.

Product tankers. By far the lowest orderbook at just 4% of fleet. Compare this to today's earnings of $40k per day and DSF calling for 19% demand growth between 2022 and 2023. Just WOW.

• • •

Missing some Tweet in this thread? You can try to

force a refresh