#FOMC statement thread:

The Federal Open Market Committee voted to increase the federal funds rate by 50 basis points at the conclusion of their May 3–4 meeting, consistent with expectations, with the current range being 0.75 to 1.00 percent.

The Federal Open Market Committee voted to increase the federal funds rate by 50 basis points at the conclusion of their May 3–4 meeting, consistent with expectations, with the current range being 0.75 to 1.00 percent.

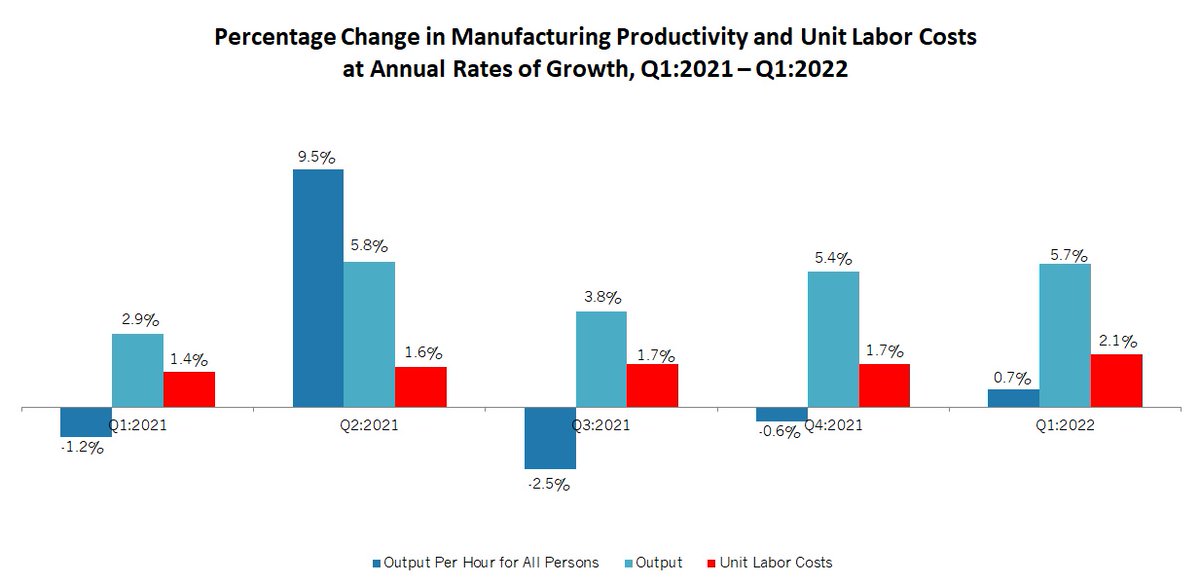

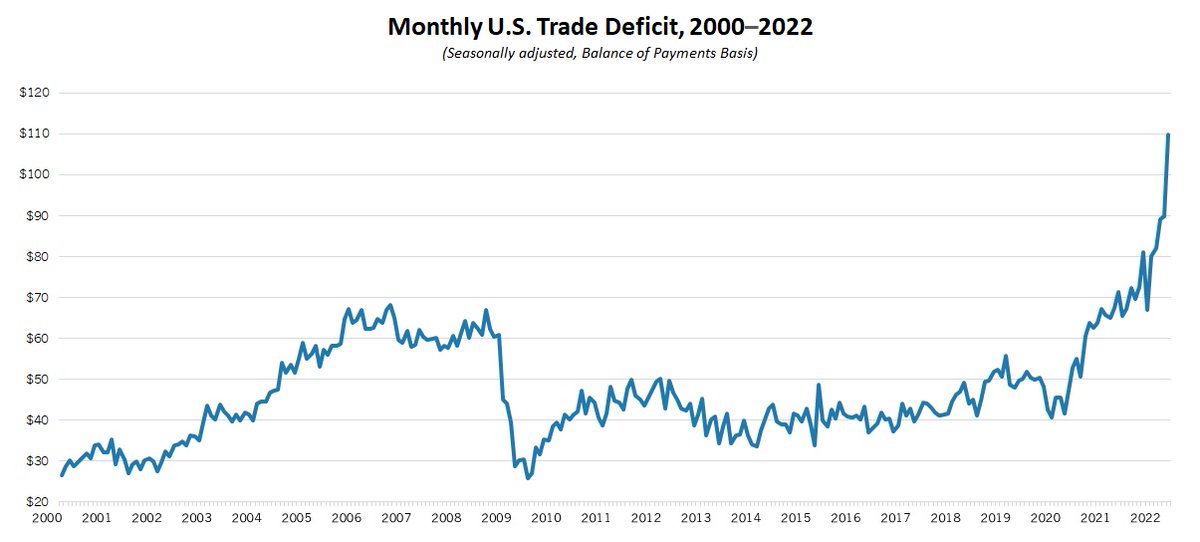

“Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” The Fed also notes that Russian invasion in Ukraine and COVID-19-related closures in China exacerbate pricing, supply chain problems.

The FOMC’s moves are meant to cool inflationary pressures in the economy, and it is widely anticipated that the Federal Reserve will hike interest rates by another 50 basis points at its upcoming June 14–15 meeting, with additional increases forthcoming at later meetings.

In addition to increases in the federal funds rate, the FOMC also voted to start reducing the size of its balance sheet, which has ballooned to nearly $9 trillion, beginning on June 1.

It will reduce its holdings of Treasury securities by up to $30 billion each month and of mortgage-backed securities by up to $17.5 billion each month. Then, after three months, it will step up those reductions to $60 billion and $35 billion each month, respectively.

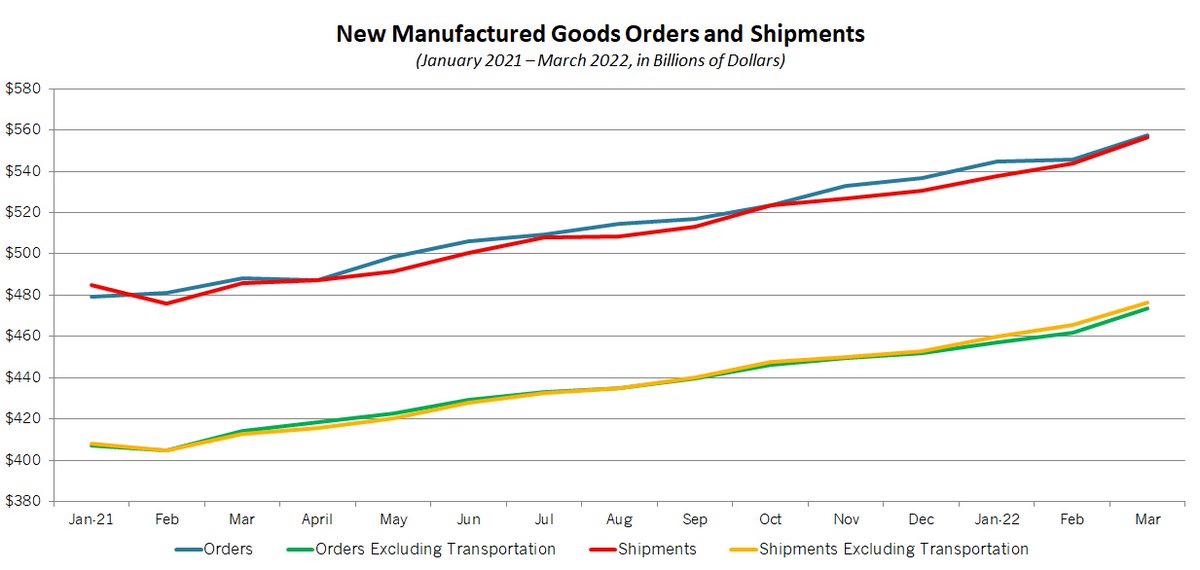

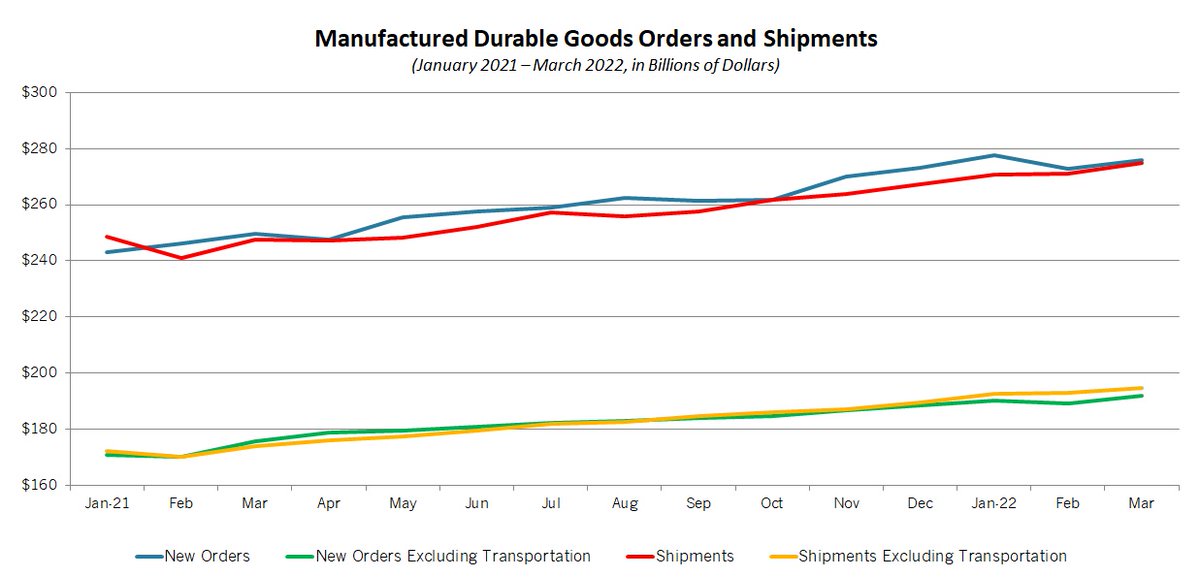

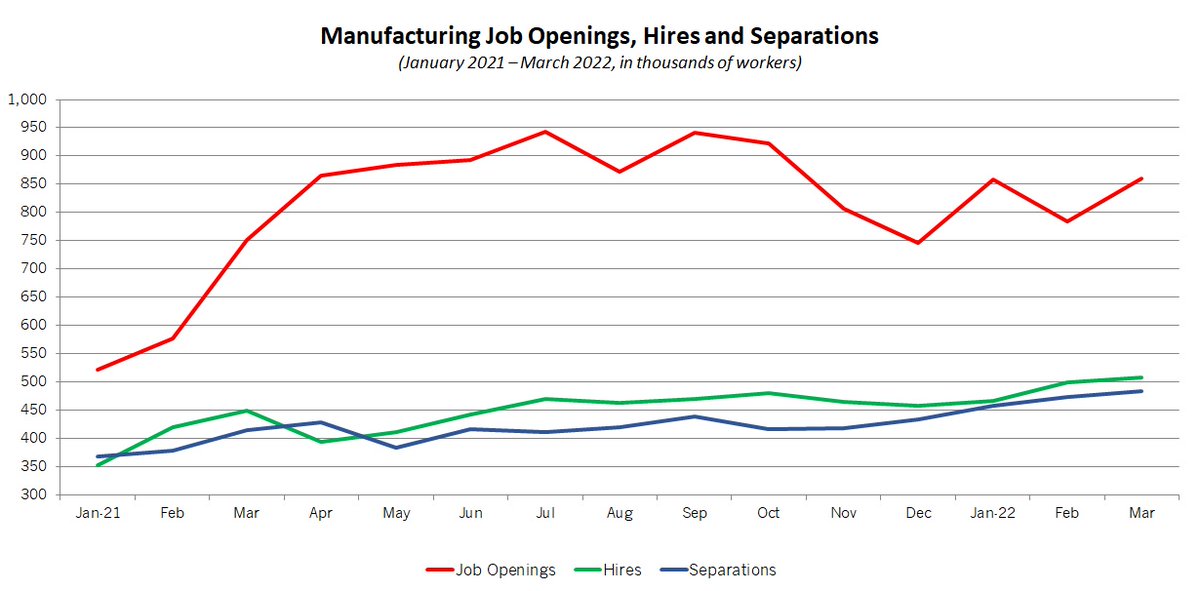

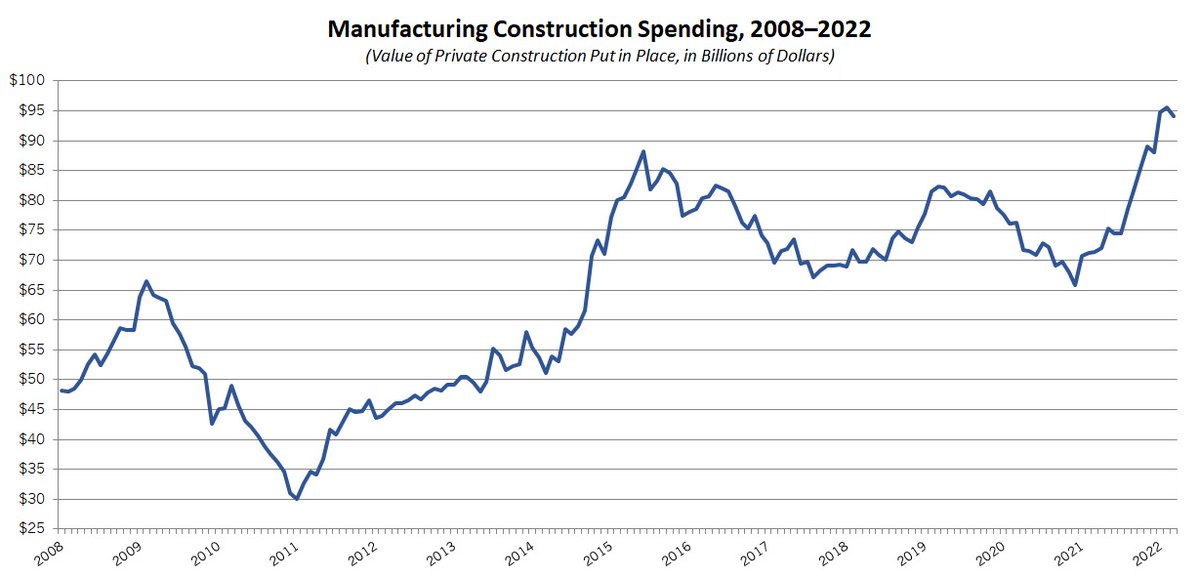

Despite the more-hawkish steps taken by the Federal Reserve as it attempts to dampen inflationary pressures, the U.S. notes continuing strengths in the economy. For instance, business and consumer spending remain robust, and the labor market continues to be very tight.

At the same time, there are significant challenges that present uncertainties to the outlook, and FOMC participants will focus on incoming data before deciding future moves in monetary policy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh