Senior Vice President, Research and Knowledge, and Chief Economist at @WeRRestaurants. Former Chief Economist at @ShopFloorNAM and @AdvocacySBA.

How to get URL link on X (Twitter) App

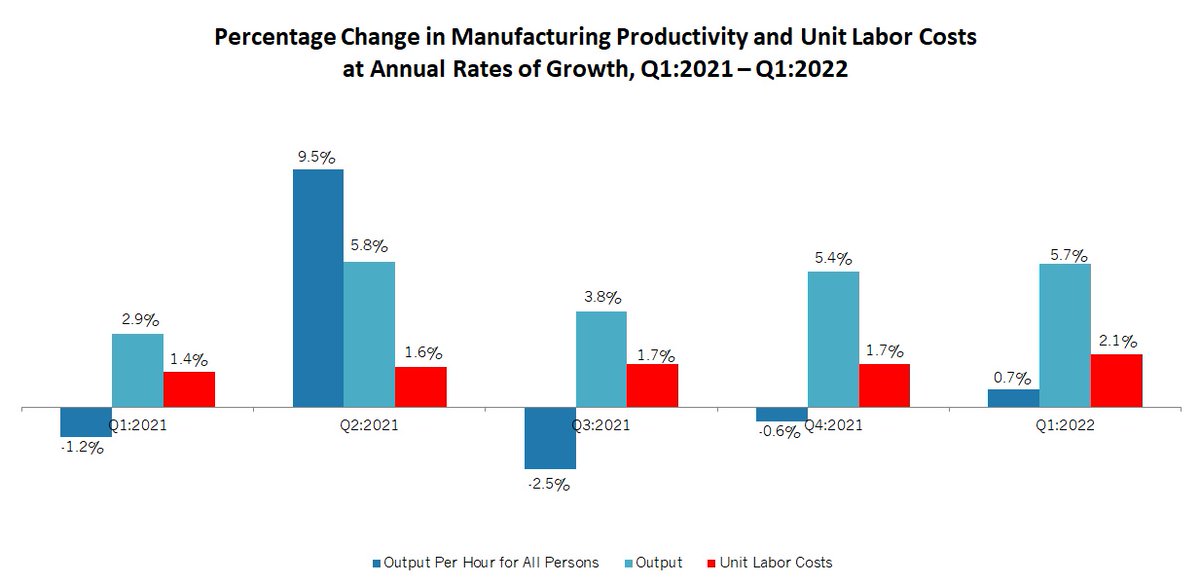

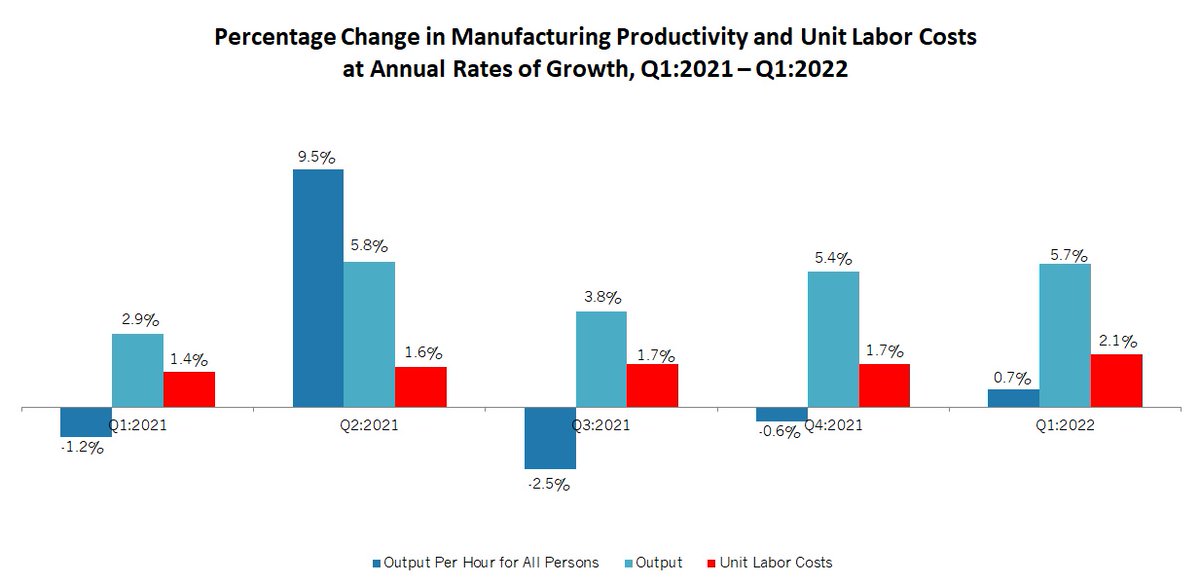

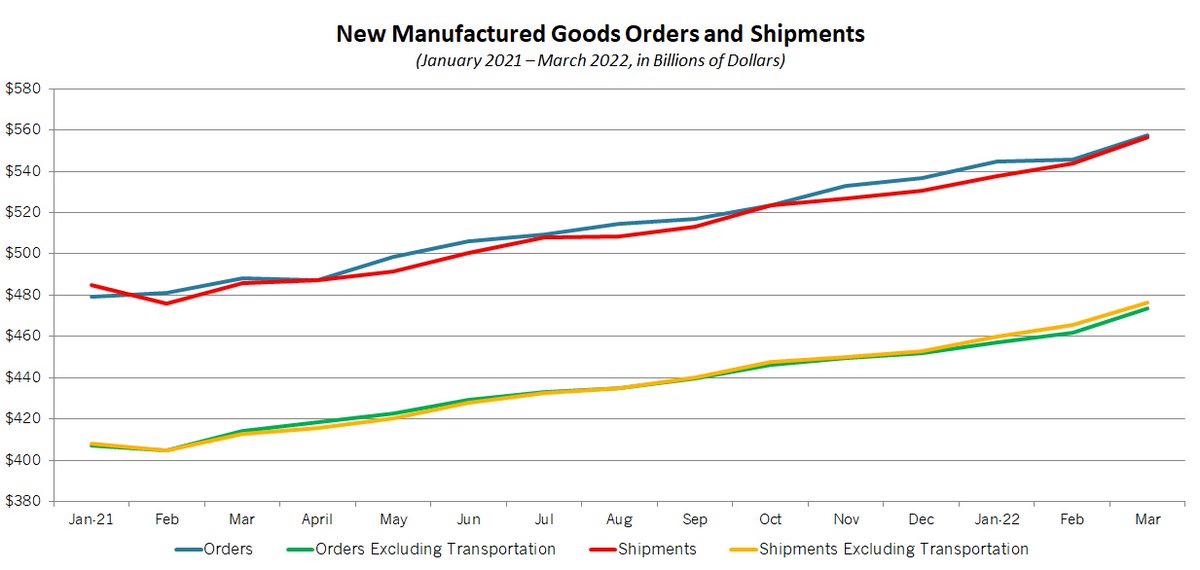

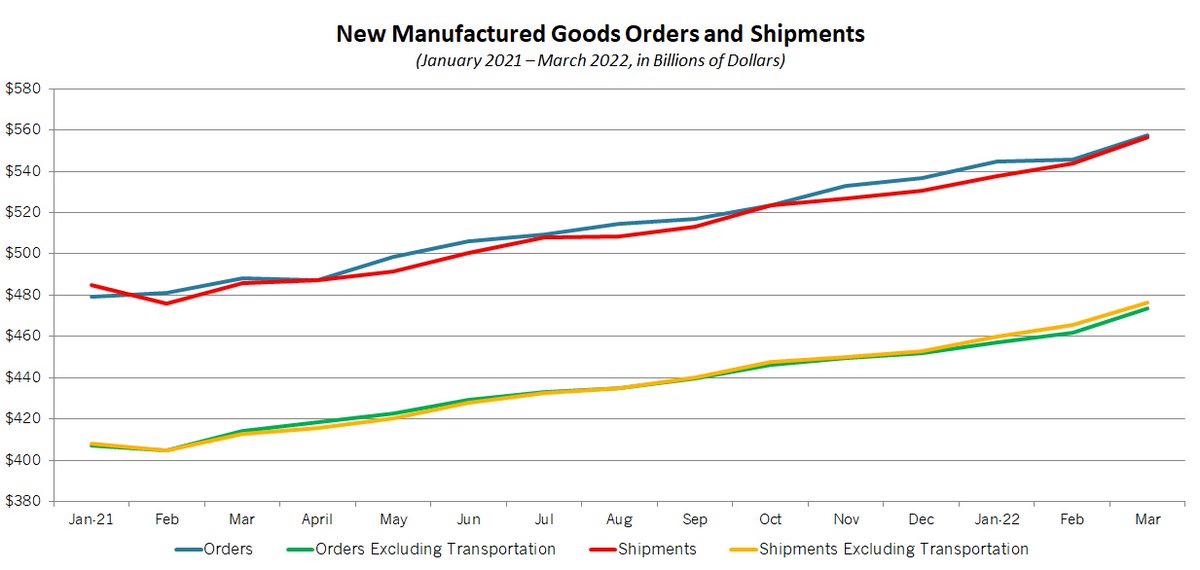

The output data continue to reflect solid growth in demand for goods despite ongoing challenges with supply chain and workforce issues. The number of hours worked rose 5.1% in the first quarter, with unit labor costs up 2.1%.

The output data continue to reflect solid growth in demand for goods despite ongoing challenges with supply chain and workforce issues. The number of hours worked rose 5.1% in the first quarter, with unit labor costs up 2.1%.

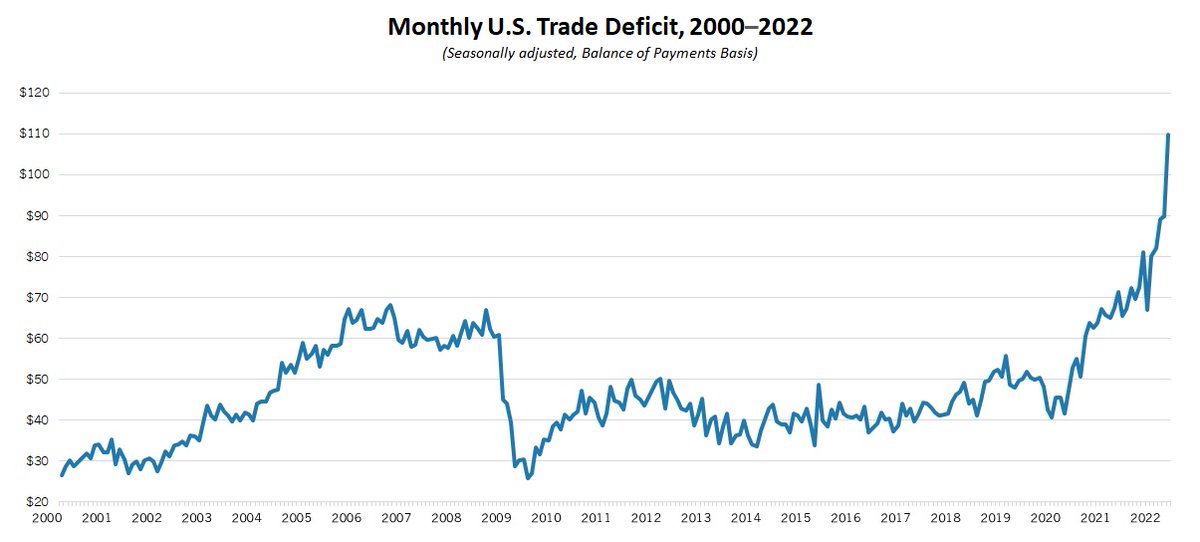

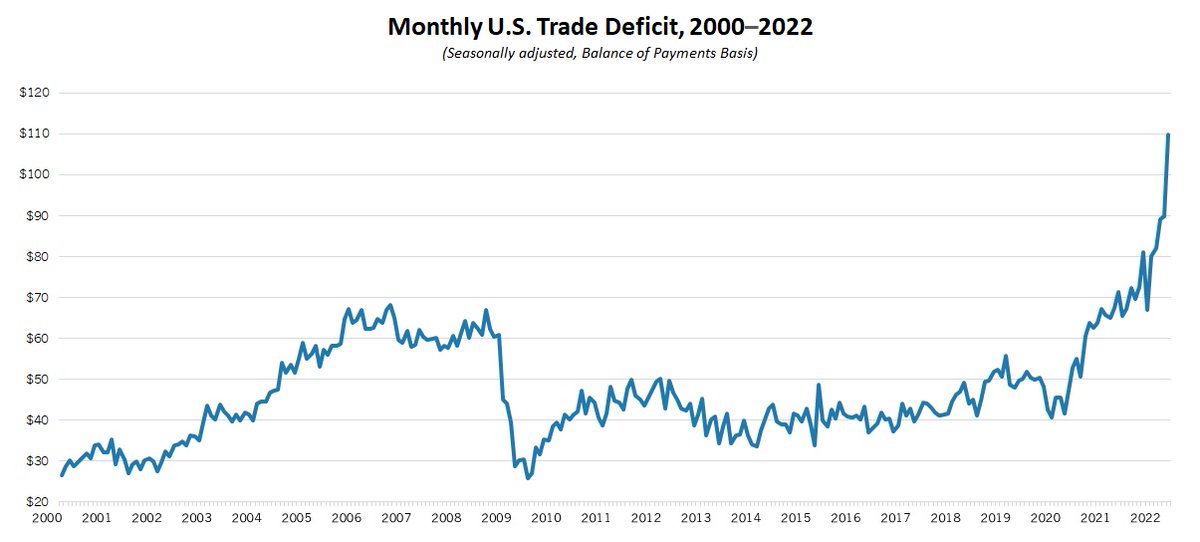

These data continued to be skewed by supply chain disruptions, higher petroleum prices and stronger economic growth in the U.S. relative to other markets. The goods trade deficit also jumped to new heights, up from $107.78 billion to $128.14 billion.

These data continued to be skewed by supply chain disruptions, higher petroleum prices and stronger economic growth in the U.S. relative to other markets. The goods trade deficit also jumped to new heights, up from $107.78 billion to $128.14 billion.

Defense and nondefense aircraft and parts sales, which can be highly volatile from month to month, were both sharply lower in March, but motor vehicles and parts orders rebounded with a 3.0% gain for the month.

Defense and nondefense aircraft and parts sales, which can be highly volatile from month to month, were both sharply lower in March, but motor vehicles and parts orders rebounded with a 3.0% gain for the month.

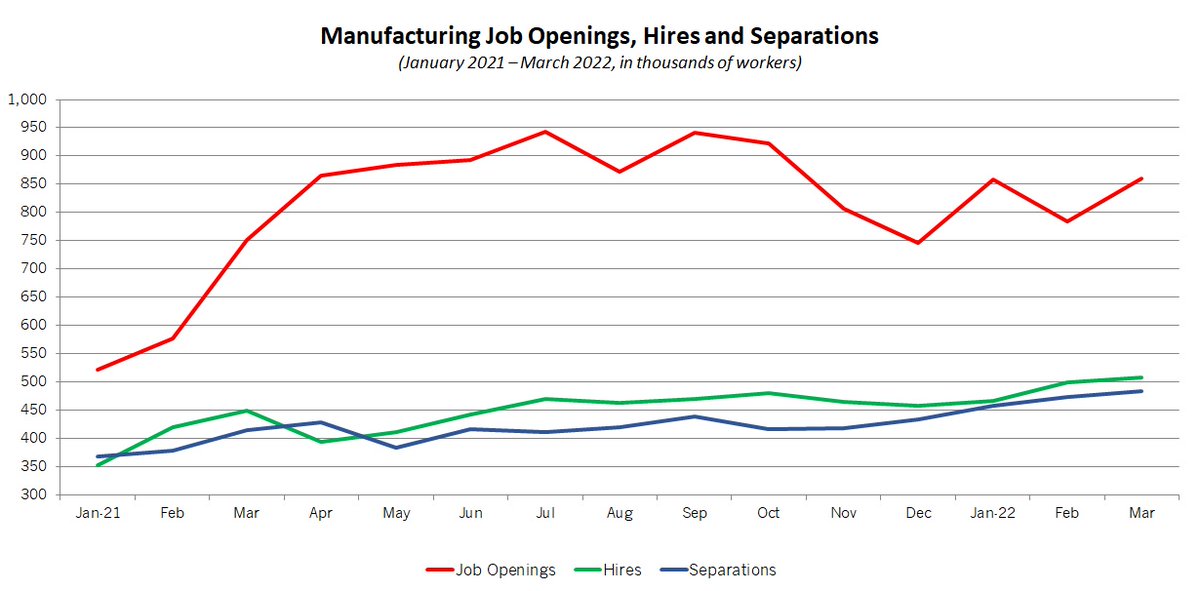

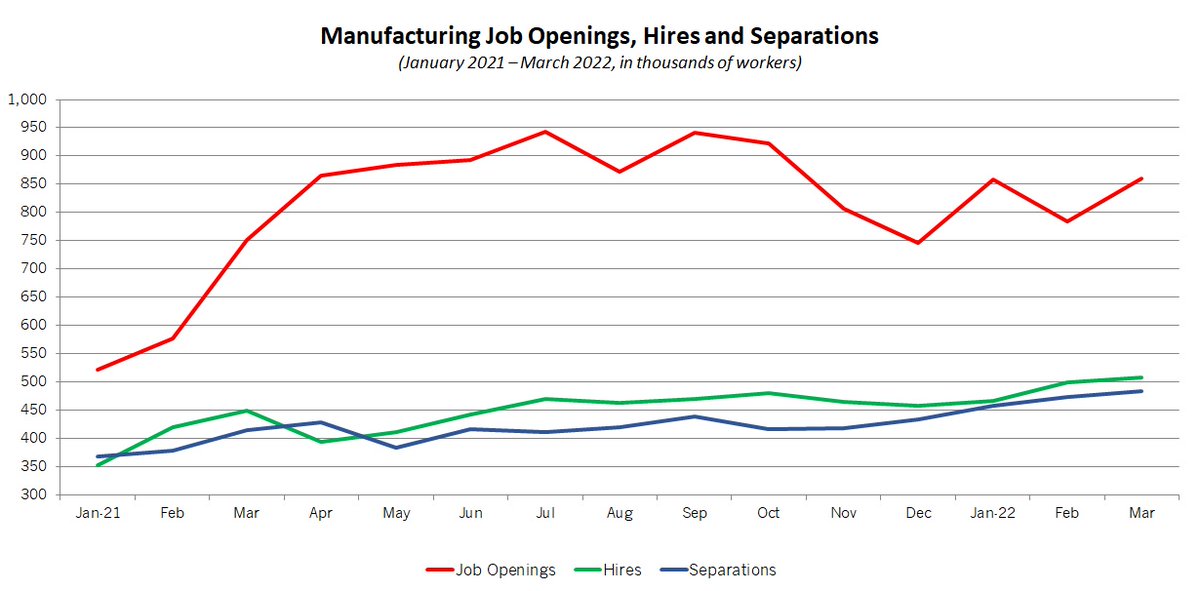

The number of job postings continued to be well above pre-pandemic levels, as companies ramped up activity and looked for more workers to meet the additional capacity.

The number of job postings continued to be well above pre-pandemic levels, as companies ramped up activity and looked for more workers to meet the additional capacity.

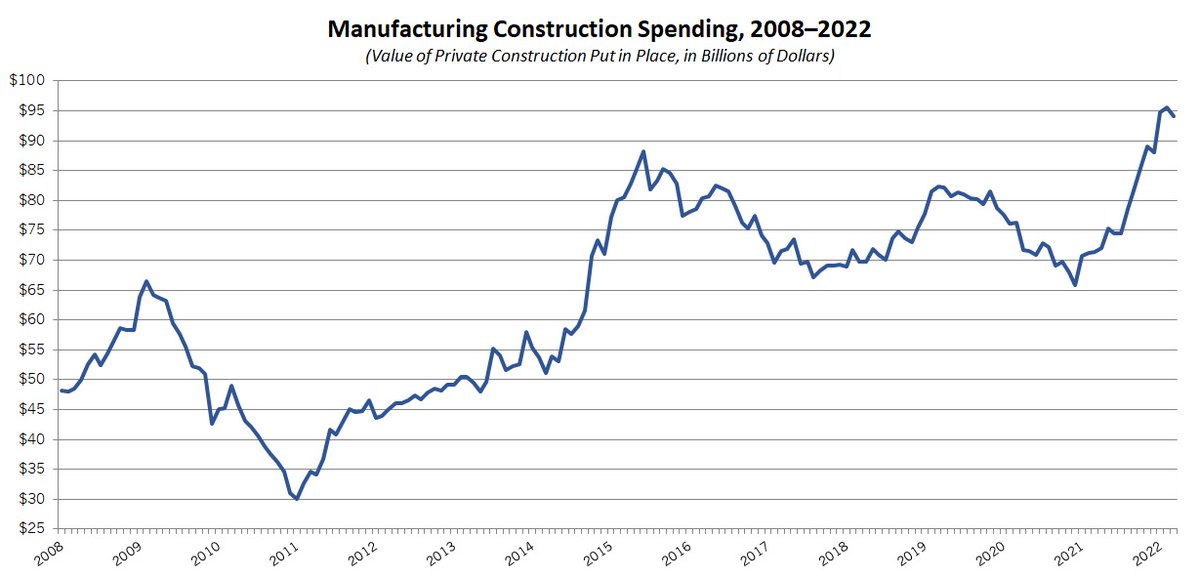

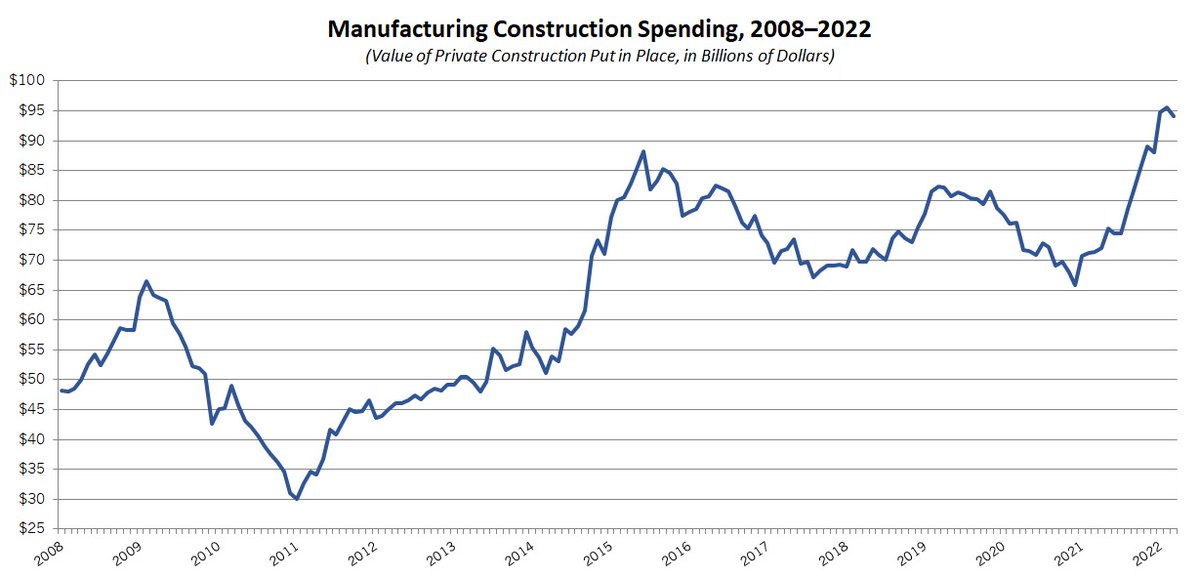

Despite some easing in the latest date, private construction activity in the sector has trended strongly higher since bottoming out at $65.92 billion in December 2020.

Despite some easing in the latest date, private construction activity in the sector has trended strongly higher since bottoming out at $65.92 billion in December 2020.

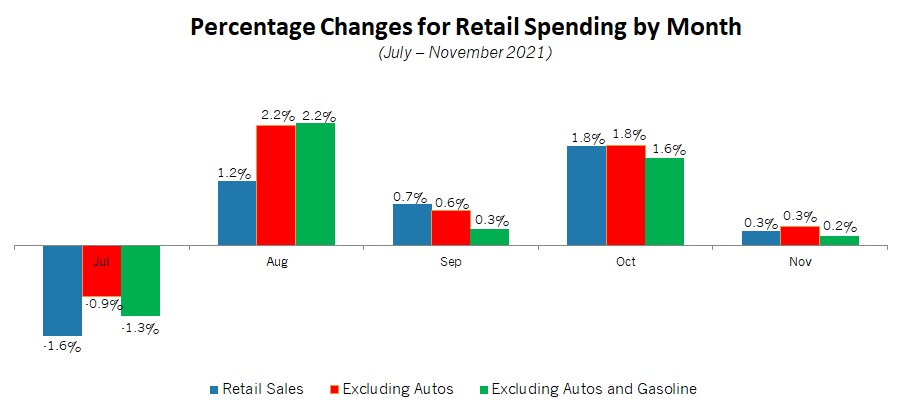

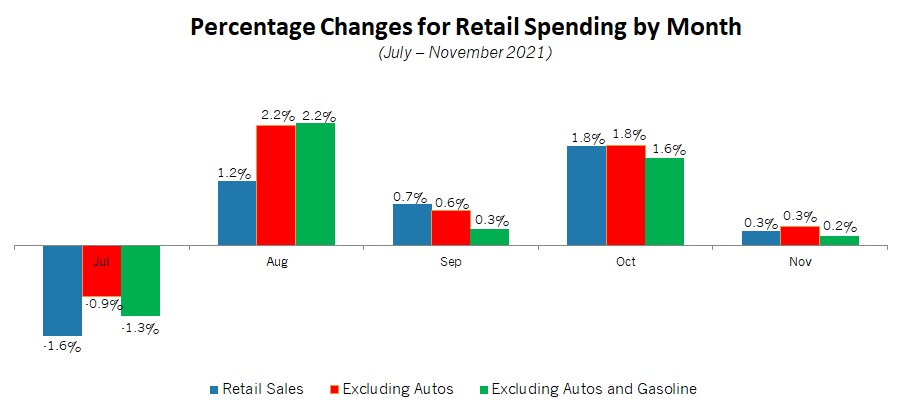

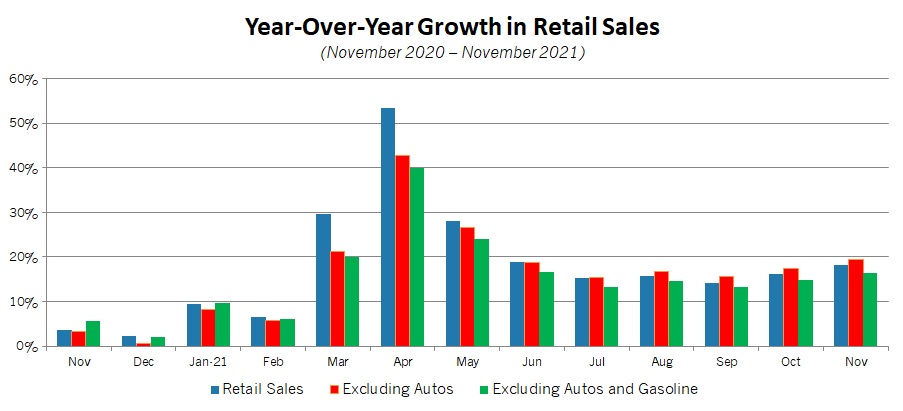

Yet, the data continue to reflect an American consumer that has opened their wallets over the past year as the economy has rebounded. Indeed, retail spending has soared 18.2% over the past 12 months, or 15.8% with gasoline stations and motor vehicle and parts sales excluded.

Yet, the data continue to reflect an American consumer that has opened their wallets over the past year as the economy has rebounded. Indeed, retail spending has soared 18.2% over the past 12 months, or 15.8% with gasoline stations and motor vehicle and parts sales excluded.

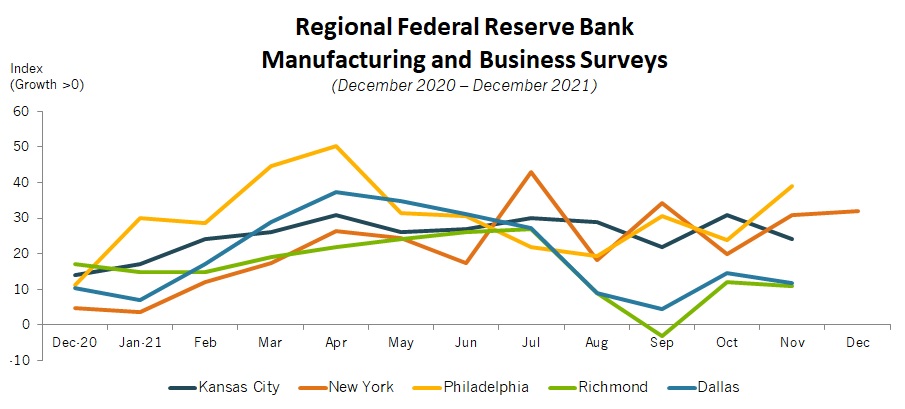

Growth in new orders, shipments, hiring and the average workweek softened slightly but at still healthy paces. Delivery times eased somewhat but remained highly elevated. Even with a slight deceleration in December, input costs expanded just shy of the record pace seen in May.

Growth in new orders, shipments, hiring and the average workweek softened slightly but at still healthy paces. Delivery times eased somewhat but remained highly elevated. Even with a slight deceleration in December, input costs expanded just shy of the record pace seen in May.

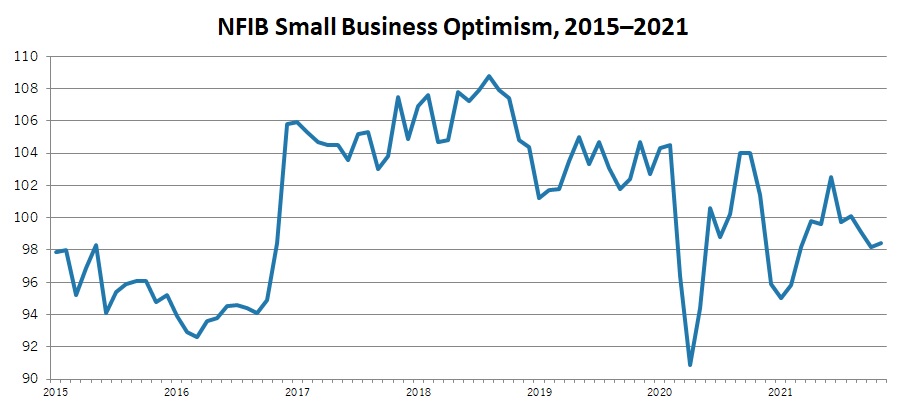

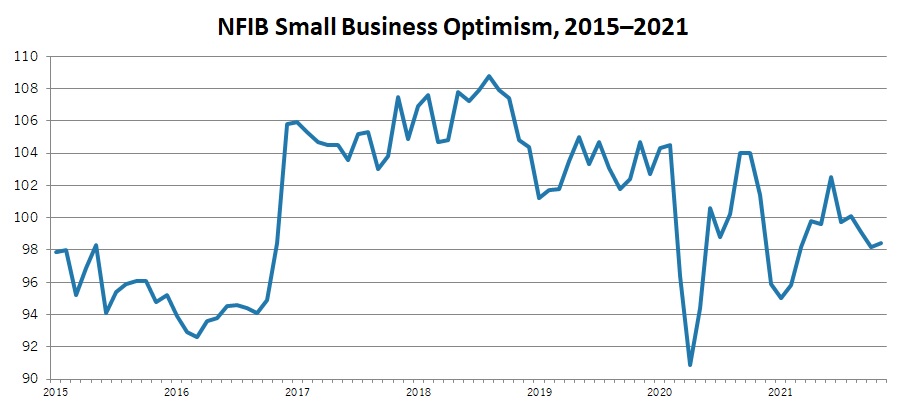

Small business owners remain challenged by supply chain disruptions, workforce shortages, inflation and COVID-19. The net percentage expecting better business conditions 6 months from now has plummeted from -33% in Sept. to -38% in Nov., the lowest level since November 2012.

Small business owners remain challenged by supply chain disruptions, workforce shortages, inflation and COVID-19. The net percentage expecting better business conditions 6 months from now has plummeted from -33% in Sept. to -38% in Nov., the lowest level since November 2012.

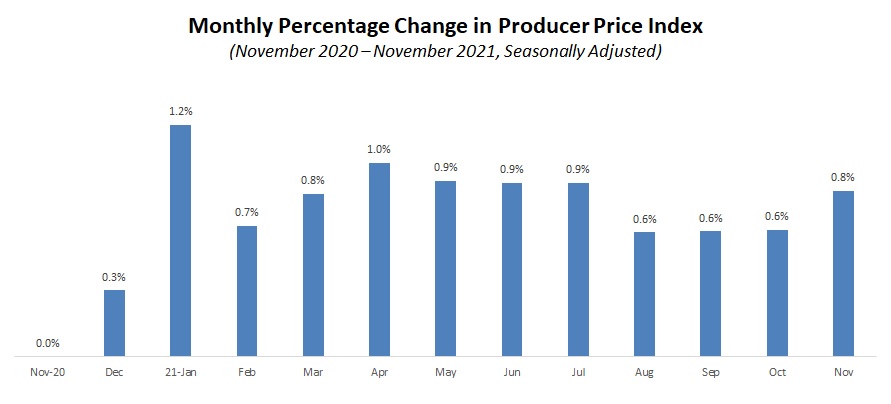

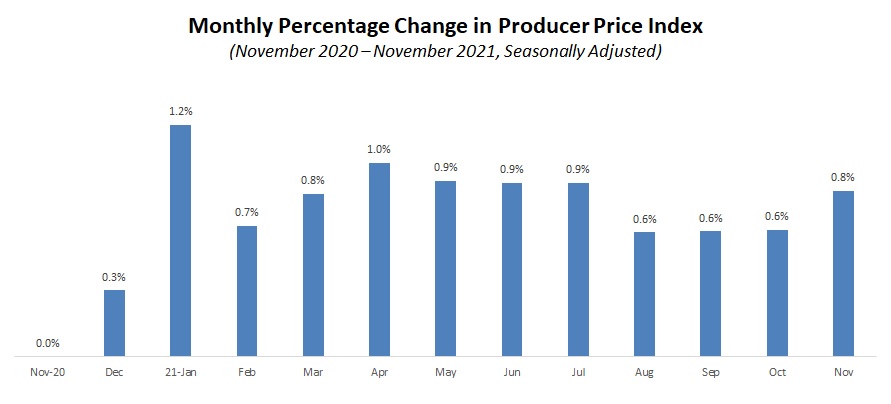

Food and energy costs increased 1.2% and 2.5%, respectively, for the month. Excluding food and energy, producer prices for final demand goods increased 0.8% in November, up from 0.6% in October and also the fastest since July.

Food and energy costs increased 1.2% and 2.5%, respectively, for the month. Excluding food and energy, producer prices for final demand goods increased 0.8% in November, up from 0.6% in October and also the fastest since July.

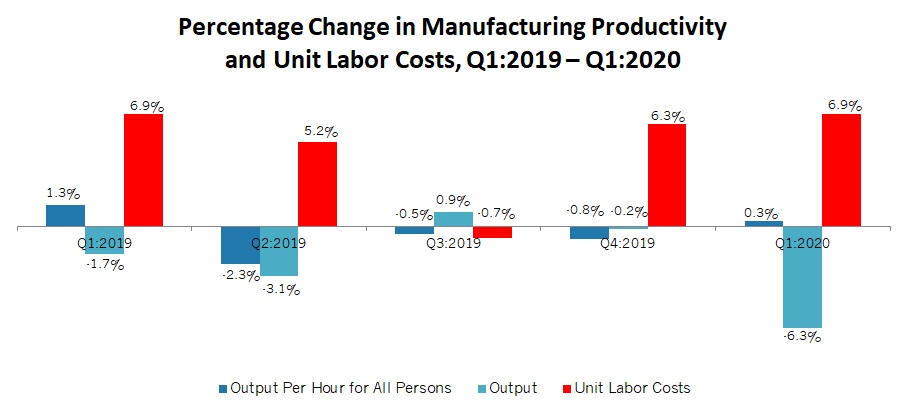

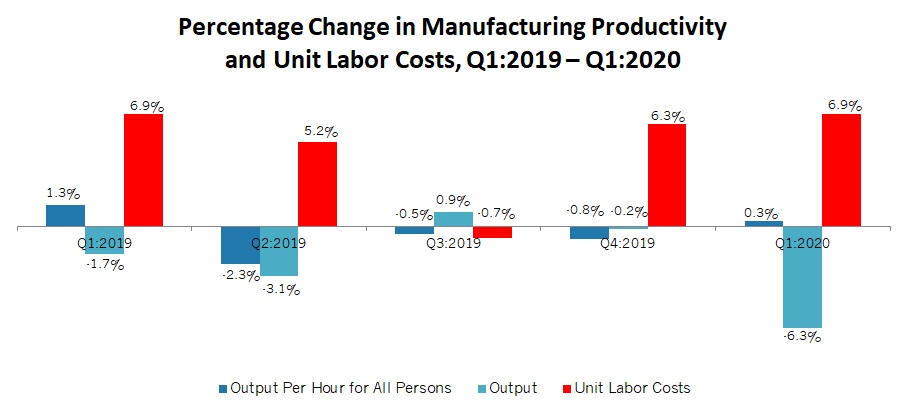

The number of hours worked decreased 6.6%, with unit labor costs up 6.9%. Labor productivity for durable goods manufacturers declined 3.5% in the first quarter, with output off 10.2%.

The number of hours worked decreased 6.6%, with unit labor costs up 6.9%. Labor productivity for durable goods manufacturers declined 3.5% in the first quarter, with output off 10.2%.