1. Rhetorical violence, defending block chain value - what lessons you can learn from the recent public exchange between leading personalities in #AVALANCHE and #POLYGON.

The belligerents Dr. Emin Gün Sirer founder Avalanche, and Sandeep Nailwal co-cofounder Polygon.

The belligerents Dr. Emin Gün Sirer founder Avalanche, and Sandeep Nailwal co-cofounder Polygon.

2. First, understand the current crypto markets, the profusion of block chains alternatives have saturated the attention market.

Assets are now easily bridged between various chains.

Chains are fiercely competing to offer services across a spectrum of business cases.

Assets are now easily bridged between various chains.

Chains are fiercely competing to offer services across a spectrum of business cases.

3. This week Sandeep, fired off a emotional tinged criticism of Avalanche after tepid response and accusations from crypto enthusiasts that Polygon's "SUPERNETS" are a rebranded derivative of Avalanche's SUBNETS.

4. Sandeep here is a rational actor - his goal is to defend Polygon's products - without realizing the leading statement - "insecure and scared" appears identify his own emotional sentiments.

Rather than projecting strength Sandeep has communicated that he is worried.

Rather than projecting strength Sandeep has communicated that he is worried.

5. The failure of frame is compounded here - "literally asking for it" and "aggressively condescending" - Sandeep here bizarrely accuses Avalanche of being hyper competitive and simultaneously wearing the wrong dress on the wrong street.

6. Sandeep - gives the final clue here in responding to an Ava Labs figure - "I couldn't take it anymore" - is an unfortunate confession of loss of emotional and cognitive control, which confirms the inadvertent narrative by that he is experience fear and uncertainty.

7. Lessons - observe who in Ava Labs leadership is not engaged in the rhetorical brawl. Why?

Avalanche is demonstrating a well ordered hierarchy with the business facing side staying oriented to mission.

Avalanche is demonstrating a well ordered hierarchy with the business facing side staying oriented to mission.

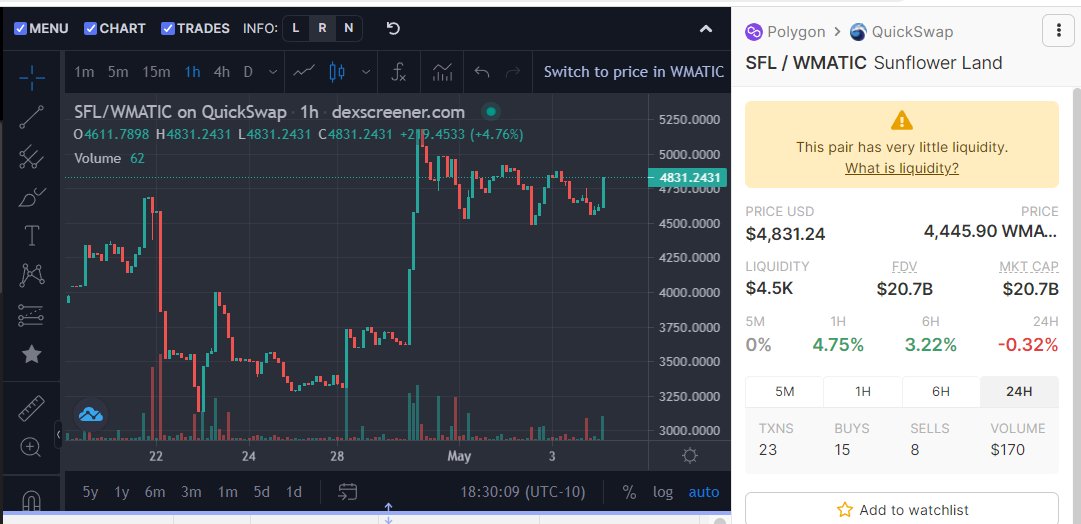

8. Context - Polygon is an L2 solution for ETH with an inexpensive token - Matic - and relatively low cost transaction fees.

Polygon's branding is less coherent than Avalanche/Avax branding.

Avalanche's market cap is twice as large as Polygon.

Polygon's branding is less coherent than Avalanche/Avax branding.

Avalanche's market cap is twice as large as Polygon.

9. What may have created the perceived state of fear at Polygon.

Avalanche subnets were recently significantly advance with the creation of the the DeFi Kingdom Chain on an Avalanche Subnet.

100s of Millions in value were established on the subnet within hours of launch.

Avalanche subnets were recently significantly advance with the creation of the the DeFi Kingdom Chain on an Avalanche Subnet.

100s of Millions in value were established on the subnet within hours of launch.

10. Subnets leverage the strength of Avalanche's validator network and consensus mechanisms, the overall resiliency and reliability of Avalanche while allowing low cost transaction fees paid in any arbitrary token.

This is direct competition to much of Polygons market.

This is direct competition to much of Polygons market.

11. Chain on chain competition is likely to escalate with depressed market conditions, and the growing number of entrants to the crypto space.

Complaining about that competition can unwittingly communicate weakness.

Complaining about that competition can unwittingly communicate weakness.

12. Users, investors, and holders have a reasonable expectation that their value will be protected by the respective parties - if is is not - they will quickly move to where there value increases and is defended.

13. Every combative communication potentially exposes a weakness and a surface or edge for exploitation, at worst it creates a narrative that escapes the control of the initiator and reveals unintended information.

14. None of Sandeep's communications here appear to be optimistic about his own products - and he inadvertently frames Avalanche as tough talking and hard competitors - which is exactly who most investors want to trust with their capital.

15. Polygon appears to need better communications, and to focus on their core strengths.

Defensive complaints are not appealing to investors and business when conducting risk analysis.

Defensive complaints are not appealing to investors and business when conducting risk analysis.

16. None of the conversation was growth oriented- which itself is a significant communication.

Most of the communications where expressed in terms that were incomprehensible to 99% of the population.

Most of the communications where expressed in terms that were incomprehensible to 99% of the population.

17. The initiated likely already have formed their own opinions about Avalanche and Polygon, which likely vary depending on their holdings on either chain or their businesses specific use cases.

No one was likely swayed by the arguments presented.

No one was likely swayed by the arguments presented.

18. Chains should play to their strengths and their target markets - and avoid reactionary overwrought wailing on Twitter.

Build, grow, iterate and innovate.

Whining isn't winning.

Build, grow, iterate and innovate.

Whining isn't winning.

• • •

Missing some Tweet in this thread? You can try to

force a refresh