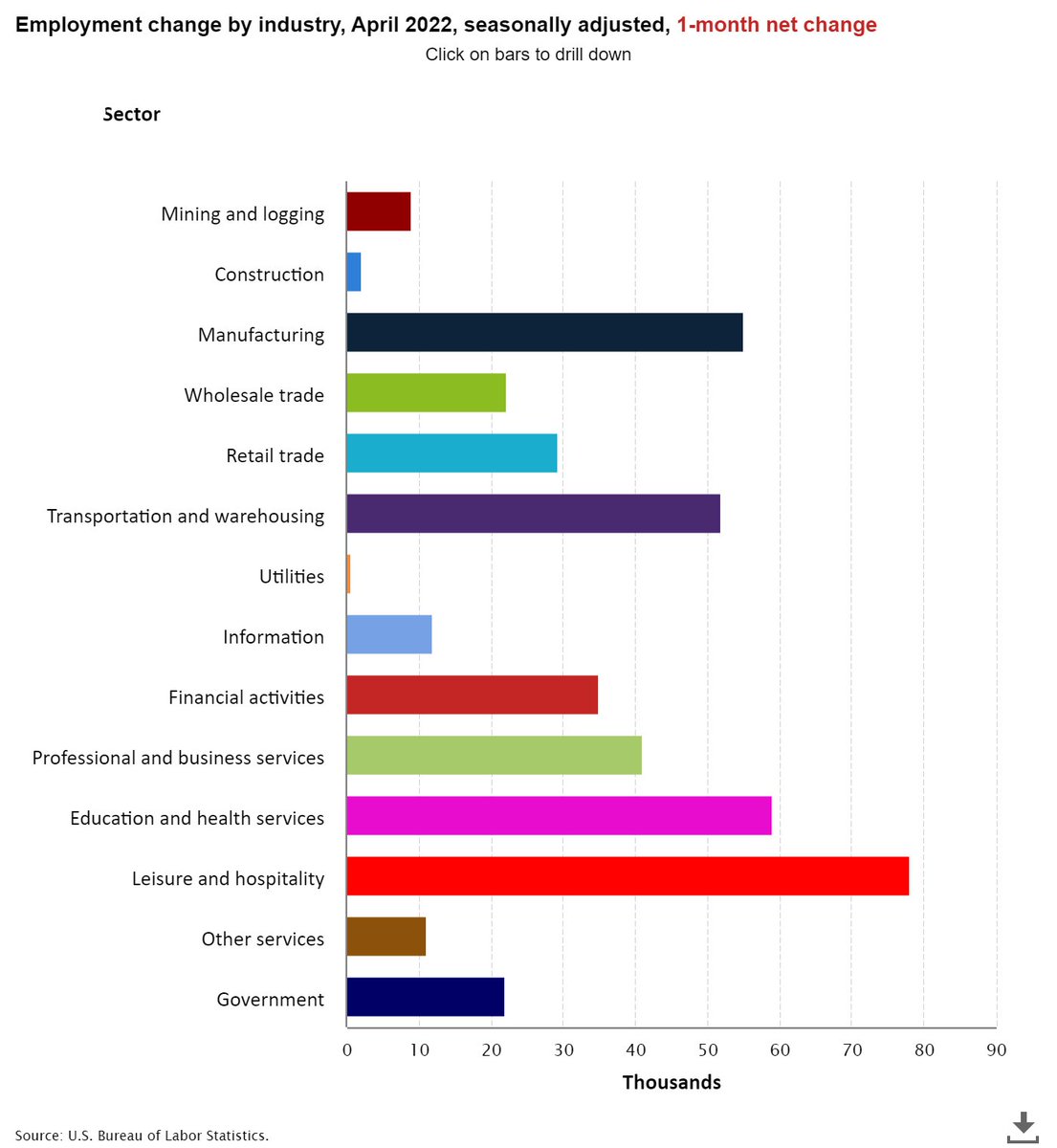

428K jobs 💪🏾

Revisions for the first time in a while are negative by 39K

#Jobs

Here is a breakdown of the unemployment rate and educational attainment for those 25 years and older:

—Less than a high school diploma: 5.4%.

—High school graduate and no college: 4.0%

—Some college or associate degree: 3.1%

—Bachelor’s degree and higher: 2.0%

Here is a breakdown of the unemployment rate and educational attainment for those 25 years and older:

—Less than a high school diploma: 5.4%.

—High school graduate and no college: 4.0%

—Some college or associate degree: 3.1%

—Bachelor’s degree and higher: 2.0%

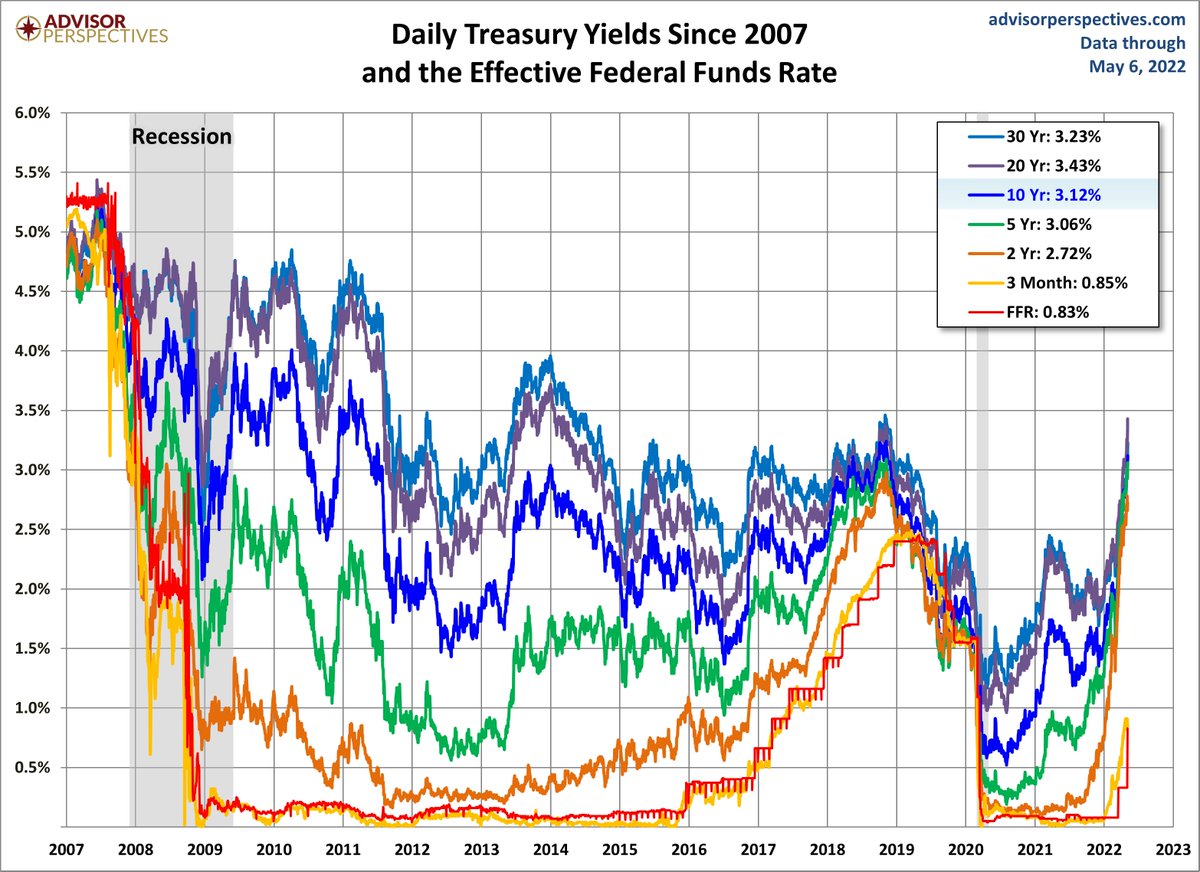

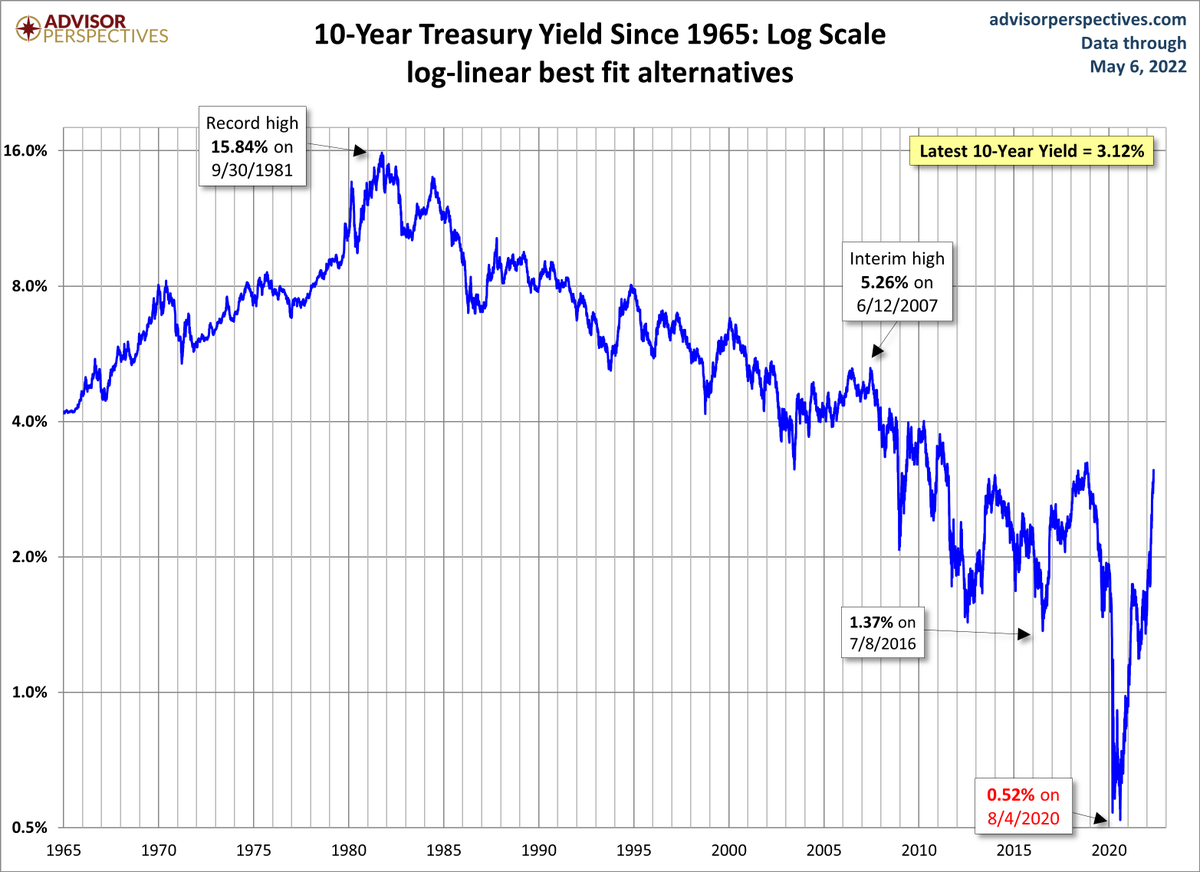

10-year yield 3.08% 🥳❤️🔥🔥

Getting closer and closer to my September 2022 forecast that we will get all the jobs back lost to Covid19 by then. The #JOLTS 10,000,000 premise has already been smashed

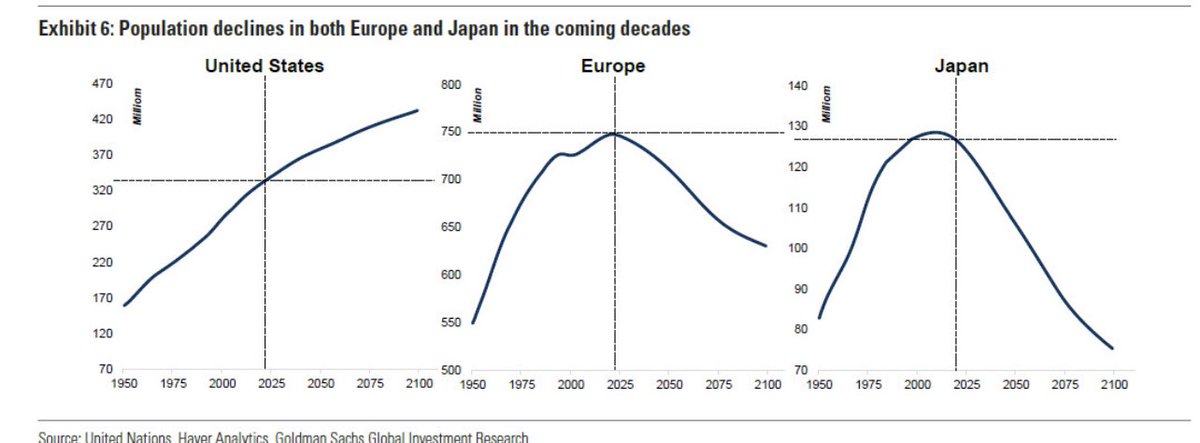

As we get back to a normal economy, job growth will be slow and steady. Always remember the limits of a country that has a slowing population growth. Job growth will slow down even in an expansion, as we saw before Covid19.

• • •

Missing some Tweet in this thread? You can try to

force a refresh