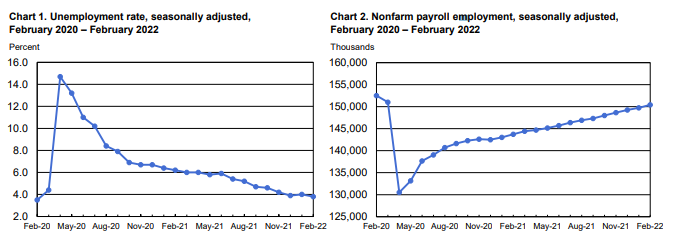

Today's #JobsReport shows a continuing healthy recovery from the pandemic recession as payroll employment came in at 428,00 jobs added. The unemployment rate held steady though the participation rate and employment-to-population ratio ticked down.

bls.gov/news.release/p…

bls.gov/news.release/p…

While the share of the population with a job ticked down slightly in April, it has been trending strongly in the right direction for months. I'm optimistic this will simply be a blip on the way to a full recovery in EPOPs by the end of 2022.

While overall unemployment remained unchanged at 3.6%, today's report shows some promise for Black unemployment which has just ticked down below 6.0% for the first time in this recovery.

White unemployment remains far below Black unemployment ever.

(More volatile series noted)

White unemployment remains far below Black unemployment ever.

(More volatile series noted)

The labor market bounce back remains very strong as job growth over the last year averaged 550k a month. Strikingly stronger than the prolonged recovery from the Great Recession. The labor market is now just below pre-pandemic levels.

Private sector employment bounce back remains significantly stronger than public sector. After falling much further, private-sector employment is now 0.4% from pre-pandemic levels while public-sector employment is still 3.5% below and has seen little improvement in months.

The largest gains in April were in leisure and hospitality, up 78,000 jobs. Each month gains in that sector eat away at its jobs shortfall, currently 1.4 million below pre-pandemic levels.

No matter how you look at it, nominal wage growth is moderating (and decidedly not accelerating). On a quarterly or monthly basis, nominal wage growth is actually falling even in the face of continued inflation. We can keep labor markets tight without feeding inflation.

Taking into considering population growth since February 2020, the labor market is facing a 3.5 million job shortfall. That said, given recent job growth, the labor market is on track to return to pre-pandemic labor market conditions by the end of 2022.

For more jobs day graphics, please visit @EconomicPolicy's jobs day landing page: epi.org/indicators/une….

Huge thank you to Katie deCourcy, @jorjorwell_, and @Dannperr for pulling the data and updating the figures!

Huge thank you to Katie deCourcy, @jorjorwell_, and @Dannperr for pulling the data and updating the figures!

• • •

Missing some Tweet in this thread? You can try to

force a refresh