Economist, bike commuter, ultimate frisbee player. Studying wages, poverty, jobs, health care, and economic mobility. Striving to be part of the solution.

How to get URL link on X (Twitter) App

The slight uptick in the unemployment rate to 4.1% in June—ending a 30-month streak of at or below 4.0% unemployment—was largely due to an increase in labor force participation, as more workers sought jobs. Employment increased as the employment-to-population rate held steady.

The slight uptick in the unemployment rate to 4.1% in June—ending a 30-month streak of at or below 4.0% unemployment—was largely due to an increase in labor force participation, as more workers sought jobs. Employment increased as the employment-to-population rate held steady.

Comprehensive measures of poverty—specifically those based on the Supplemental Poverty Measures—showed very sharp increases. The unfortunate headline from today's report is that child poverty more than doubled between 2021 and 2022, rising from 5.2% to 12.4%.

Comprehensive measures of poverty—specifically those based on the Supplemental Poverty Measures—showed very sharp increases. The unfortunate headline from today's report is that child poverty more than doubled between 2021 and 2022, rising from 5.2% to 12.4%.

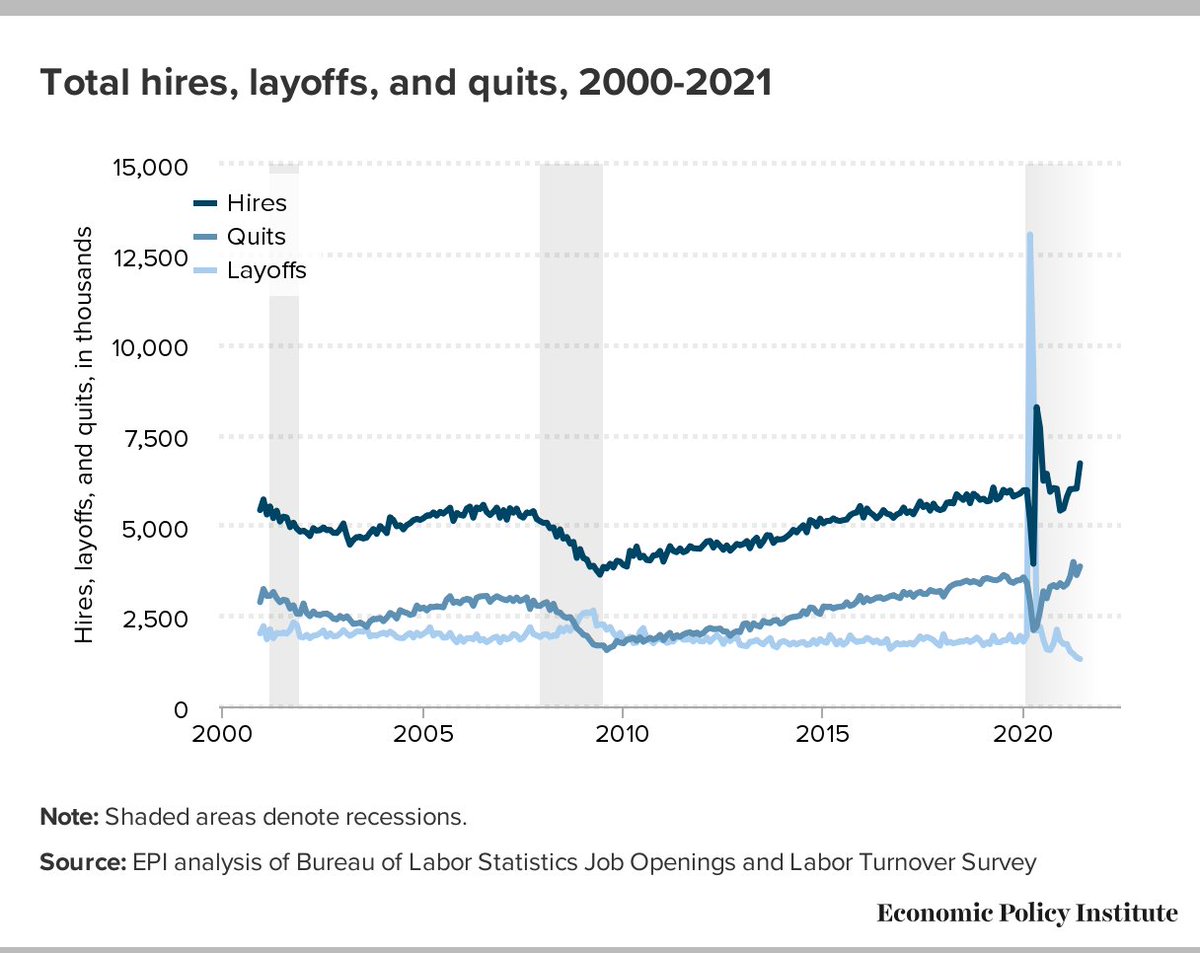

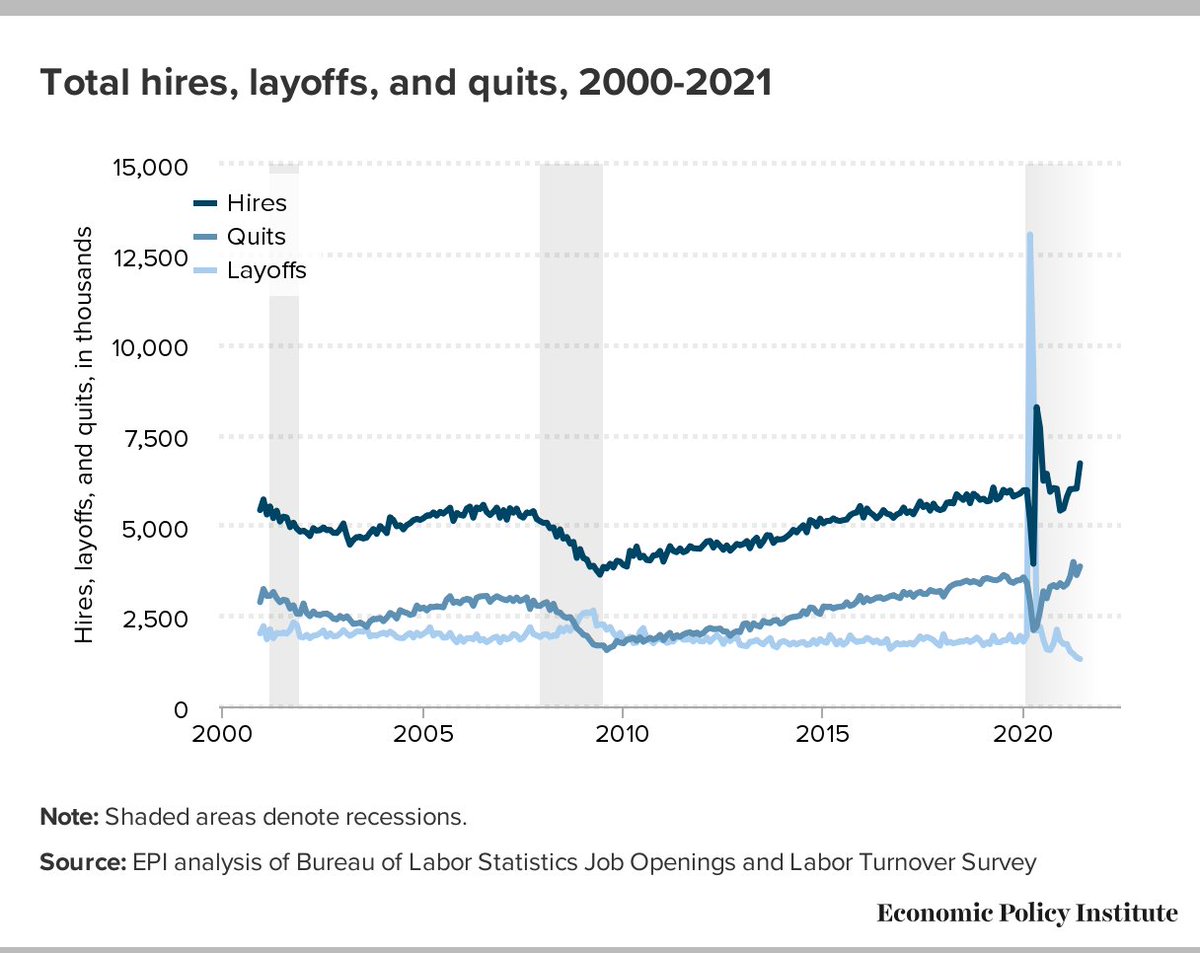

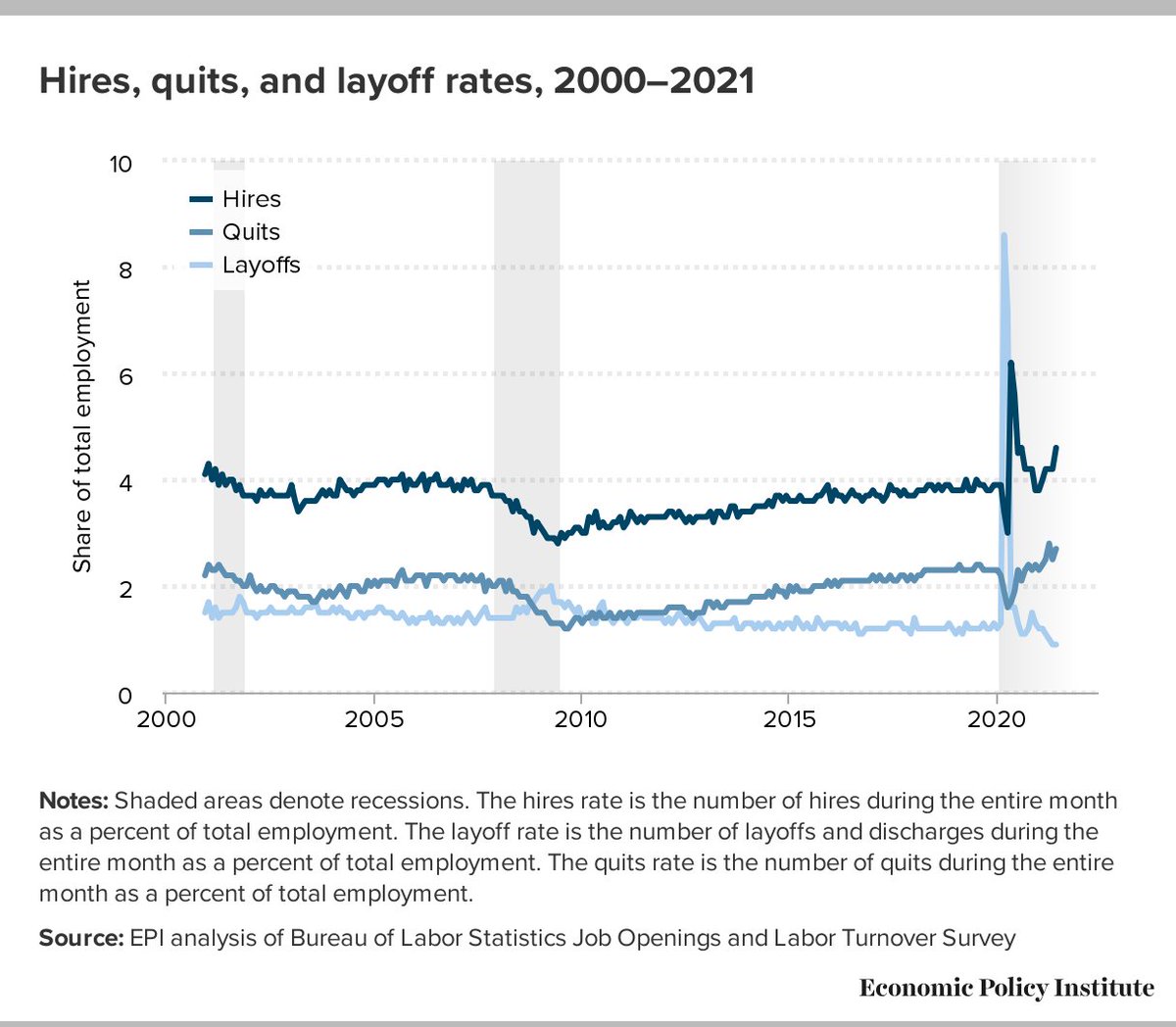

Job openings have generally been decreasing over the last year, slowly but steadily moving closer to their pre-pandemic levels, though clearly not there yet. Much of the elevated rates we've seen may have been because of the increased labor market churn and not net new demand.

Job openings have generally been decreasing over the last year, slowly but steadily moving closer to their pre-pandemic levels, though clearly not there yet. Much of the elevated rates we've seen may have been because of the increased labor market churn and not net new demand.

https://twitter.com/eliselgould/status/1577301711529676800

Other topline indicators in the #JOLTS report saw little to no change in August. The hires rate was unchanged as separations ticked up slightly, due in part to a mild increase in the layoffs and discharges rate while the quits rate held steady.

Other topline indicators in the #JOLTS report saw little to no change in August. The hires rate was unchanged as separations ticked up slightly, due in part to a mild increase in the layoffs and discharges rate while the quits rate held steady.

Slight correction. Job openings are down each month since March's series high. That's three months in a row of declines. Please pardon the error in counting months when it's now August and the data are for June.

Slight correction. Job openings are down each month since March's series high. That's three months in a row of declines. Please pardon the error in counting months when it's now August and the data are for June.

The large compositional effects of the pandemic on wage growth are now largely behind us. Wage growth continues to be slower than inflation, and there’s no real sign of that changing anytime soon. So far, wage growth continues to dampen price growth rather than feed it.

The large compositional effects of the pandemic on wage growth are now largely behind us. Wage growth continues to be slower than inflation, and there’s no real sign of that changing anytime soon. So far, wage growth continues to dampen price growth rather than feed it.

The hires rate remains higher than the quits rate in every major industry. This indicates that when workers quit, they are taking other jobs-likely in the same sector-not dropping out of the labor force altogether.

The hires rate remains higher than the quits rate in every major industry. This indicates that when workers quit, they are taking other jobs-likely in the same sector-not dropping out of the labor force altogether.

The uptick in the quits rate is notable, likely due in part to increased opportunities for workers to find better job matches, potentially with higher wages or safer working conditions in the lingering pandemic (which had not worsening as much during the June reference period).

The uptick in the quits rate is notable, likely due in part to increased opportunities for workers to find better job matches, potentially with higher wages or safer working conditions in the lingering pandemic (which had not worsening as much during the June reference period).