With all the $UST drama I thought I'd tell you a story...

You see, everyone knows the story of the Bank of England vs Soros. BOE lost, Soros won but people forget the HKMA vs the hedge funds in 1998...

You see, everyone knows the story of the Bank of England vs Soros. BOE lost, Soros won but people forget the HKMA vs the hedge funds in 1998...

The game in town for the macro hedge funds was to slot the HK$, which forced rates to rise due to the currency peg, which caused equities to fall. They shorted stocks and the $HKD. It was a beautiful spiral and everyone added and added to their trade. Pegs break, don't they?

Then the HKMA changed the game. They bought equities. Everyone got carried out. The HKMA won.

Peg breaks are drama but no one knows how they will place out. @BarrySilbert points out, most recover.

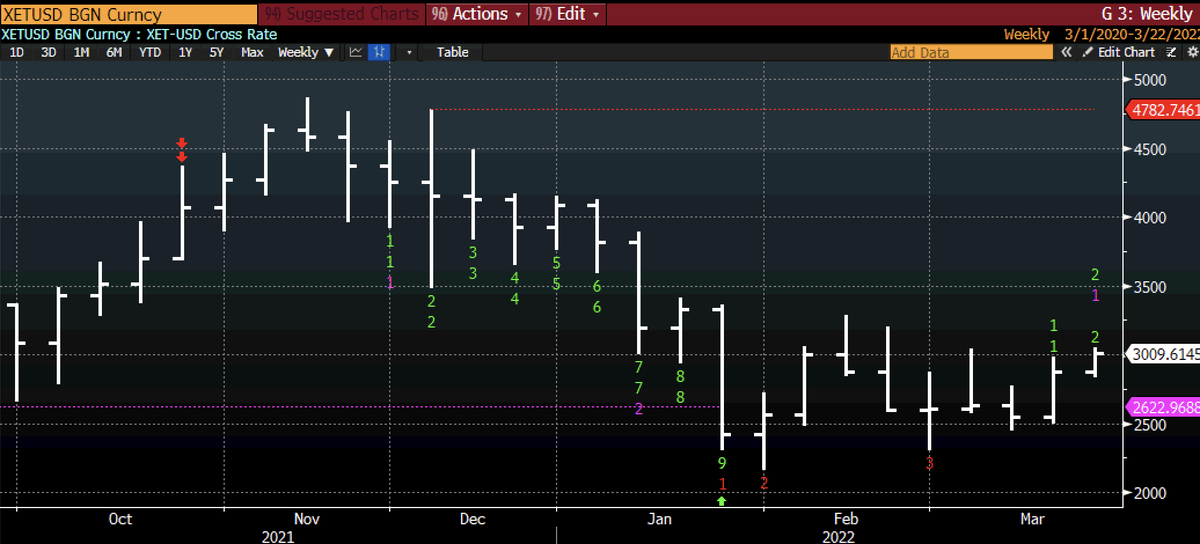

$UST look like they stepped away from support. That gets the shorts hot to trot!

Peg breaks are drama but no one knows how they will place out. @BarrySilbert points out, most recover.

$UST look like they stepped away from support. That gets the shorts hot to trot!

But when everyone is all in on the short side, they are the vulnerable ones, not the peg.

I have no idea how it plays out and have no skin in the game but I see that #LFG held off from using reserves and that is smart.

The drama is probably not over. It's a hunch...

I have no idea how it plays out and have no skin in the game but I see that #LFG held off from using reserves and that is smart.

The drama is probably not over. It's a hunch...

There are different rule books to play. Markets like finding pain.

Is the pain now to squeeze the shorts? Probably. Let's see. Again, I have no skin in this, just an observer who has seen many rule books ripped up over the years.

Is the pain now to squeeze the shorts? Probably. Let's see. Again, I have no skin in this, just an observer who has seen many rule books ripped up over the years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh