#LFG & #USTDepeg drama reminds me of the 1968 Collapse of the London Gold Pool (LGP)

Global Central Banks attempted to peg the price of Gold, and failed miserably. USD 'survived', but the peg died.

🧵 Let me tell you a story of arrogance & collapse...

1/

Global Central Banks attempted to peg the price of Gold, and failed miserably. USD 'survived', but the peg died.

🧵 Let me tell you a story of arrogance & collapse...

1/

In 1944, at Bretton Woods, the world powers agreed to use the US-Dollar as the "anchor" currency for all global trade.

Put simply: all currencies would have a fixed-convertibility to the USD (w/ some room for error) & in return, the USD would be pegged to gold at $35 per oz

2/

Put simply: all currencies would have a fixed-convertibility to the USD (w/ some room for error) & in return, the USD would be pegged to gold at $35 per oz

2/

This was great in theory. The price-fixing allowed for easier trade and trade-relations.

But there was still a free-market open... and free-market forces will eventually win out.

3/

But there was still a free-market open... and free-market forces will eventually win out.

3/

You see, even though nations agreed to trade to gold at $35 per Oz, the open precious-metal markets were trading freely.

This allowed for massive arbitrage opportunities. 💸

4/

This allowed for massive arbitrage opportunities. 💸

4/

If Gold went up in price in the free-market, Central Banks could buy Gold from "Bretton Woods" for $35 & sell it higher in the free market.

The arbitrage pressure built, slowly but surely...

5/

The arbitrage pressure built, slowly but surely...

5/

US Treasury Gold reserves were being consistently drained throughout the 1950s. Before Bretton Woods, the USA had around 72% of the global Gold Reserves.

By 1960s, that number was closer to 48%... a massive decline, but most of it happened between 1958-1960 📉

6/

By 1960s, that number was closer to 48%... a massive decline, but most of it happened between 1958-1960 📉

6/

A death spiral was beginning to emerge.

The wider the spread (gold-window) the more incentivized Central Banks were to redeem Gold from USA, and sell to free markets.

It's arrogant to think you can beat the "Invisible Hand" .

7/

The wider the spread (gold-window) the more incentivized Central Banks were to redeem Gold from USA, and sell to free markets.

It's arrogant to think you can beat the "Invisible Hand" .

7/

Alas, arrogance usually dies a stubborn death...

Enter: London Gold Pool (LGP)

In 1962, eight Central Banks created the "London Gold Pool" intervene and fix the price of Gold by SELLING gold to re-peg the price down to $35

8/

Enter: London Gold Pool (LGP)

In 1962, eight Central Banks created the "London Gold Pool" intervene and fix the price of Gold by SELLING gold to re-peg the price down to $35

8/

Even though they called themselves LGP, USA provided 50% of the gold that would be sold.

Essentially, USA would largely be under pressure to hold down the price, while operations took place out of London.

Let the games, begin...

9/

Essentially, USA would largely be under pressure to hold down the price, while operations took place out of London.

Let the games, begin...

9/

The initial psychological impact didn't last long. But market pressures eventually won out...

USAs Vietnam War combined with global economic stress put immense pressure on LGP to sell increasing amounts of Gold (and hence put pressure on each of the LGP members)

10/

USAs Vietnam War combined with global economic stress put immense pressure on LGP to sell increasing amounts of Gold (and hence put pressure on each of the LGP members)

10/

You see, these "Groups" are all fine & dandy when market conditions are bullish. But when put under stress, everyone goes into "Look out for yourself" mode.

In-fighting & Capitulations begin...

11/

In-fighting & Capitulations begin...

11/

France and Belgium were the first ones to publicly express their doubt.

The capitulations started soon after - with France beginning to convert all its USD into Gold.

12/

The capitulations started soon after - with France beginning to convert all its USD into Gold.

12/

The in-fighting continued. And the French President turned up the FUD with public denouncements and speeches.

France was still be part of the LGP at this point. But there was no doubt that LGPs days were certainly numbered...

13/

France was still be part of the LGP at this point. But there was no doubt that LGPs days were certainly numbered...

13/

In 1967, the British dealt the next big blow with the devaluation of the Sterling by 14%. Economic conditions forced their hand & the devaluation led to a bank run for Gold, draining Gold reserves even more.

This was likely the nail in the coffin for the LGP.

14/

This was likely the nail in the coffin for the LGP.

14/

The bank run for Gold heated up, and panic ensued.

The British closed the London Gold market (largest in the world) for a day to relieve some pressure.

The Queen petitioned for another Bank Holiday... None of it was enough.

The market stayed close for 14 days more...

15/

The British closed the London Gold market (largest in the world) for a day to relieve some pressure.

The Queen petitioned for another Bank Holiday... None of it was enough.

The market stayed close for 14 days more...

15/

At this point, the LGP was pretty much dead. All treaties were off, and Central Banks were looking out for themselves.

Netherlands had already started dumping USD for Gold. And USA was inflating their money supply with nonchalance.

Bretton Woods itself was unwinding...

16/

Netherlands had already started dumping USD for Gold. And USA was inflating their money supply with nonchalance.

Bretton Woods itself was unwinding...

16/

Early 1971, Germany was the first to exit Bretton Woods officially.

Switzerland & France followed, and cumulatively drained 140million in Gold

USAs Gold reserves dwindled to its lowest since the Great Depression decade...

17/

Switzerland & France followed, and cumulatively drained 140million in Gold

USAs Gold reserves dwindled to its lowest since the Great Depression decade...

17/

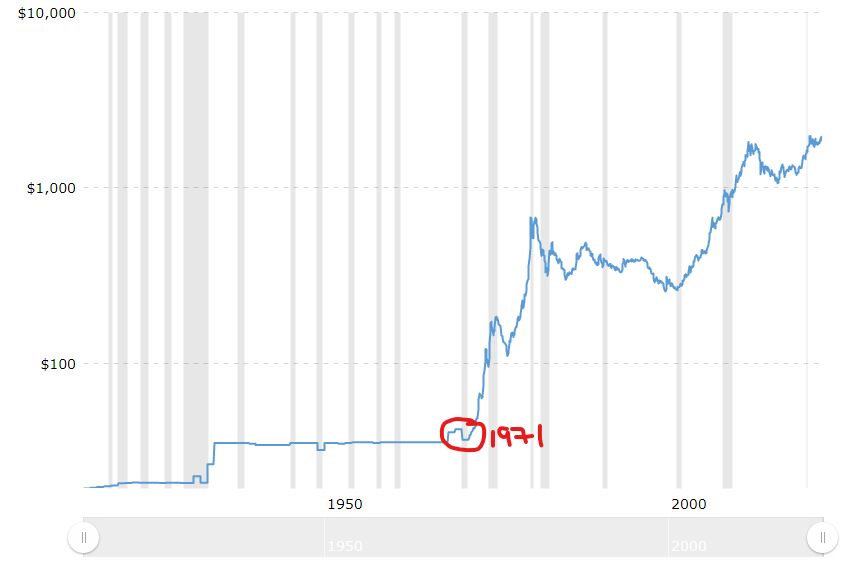

This led to the famous "Nixon Shock" of 1971, where President Nixon ended the convertibility of USD to Gold.

Gold, now free, swiftly rose to $100 and eventually making it's way all the way to $600-$800 per oz.

18/

Gold, now free, swiftly rose to $100 and eventually making it's way all the way to $600-$800 per oz.

18/

The chart above is illustrative how how free-market forces eventually catchup. Gold was flatlined for decades...and then unraveled all at once.

It happens slowly at first, then surely, and then legendarily...

19/

It happens slowly at first, then surely, and then legendarily...

19/

You can never really know how free-market forces will catchup, you just know it will.

The #Luna story may seem more nuanced, but so was the story that unfolded with global monetary system in 1960/70s. Interest rates, fixed pegs, low reserves etc.

20/

The #Luna story may seem more nuanced, but so was the story that unfolded with global monetary system in 1960/70s. Interest rates, fixed pegs, low reserves etc.

20/

#UST may survive just like the US-Dollar did, but not in its current form. There will be massive changes & reform needed. I really hope everything recovers without hiccups.

But I suspect we will be hearing more stories soon (in-fighting? lawsuits? regulatory intervention?)

21/

But I suspect we will be hearing more stories soon (in-fighting? lawsuits? regulatory intervention?)

21/

Time will tell. But if you guys got hurt out there, don't do anything stupid/harmful to yourselves. Time heals all. 🕐

With this too, remember: Slowly, Surely, Legendarily.

/End

With this too, remember: Slowly, Surely, Legendarily.

/End

If you enjoy finance stories like this - consider following me!

I like to explain stories & concepts in an easy-to-read way :)

twitter.com/ShawnReadsAlot

I like to explain stories & concepts in an easy-to-read way :)

twitter.com/ShawnReadsAlot

• • •

Missing some Tweet in this thread? You can try to

force a refresh