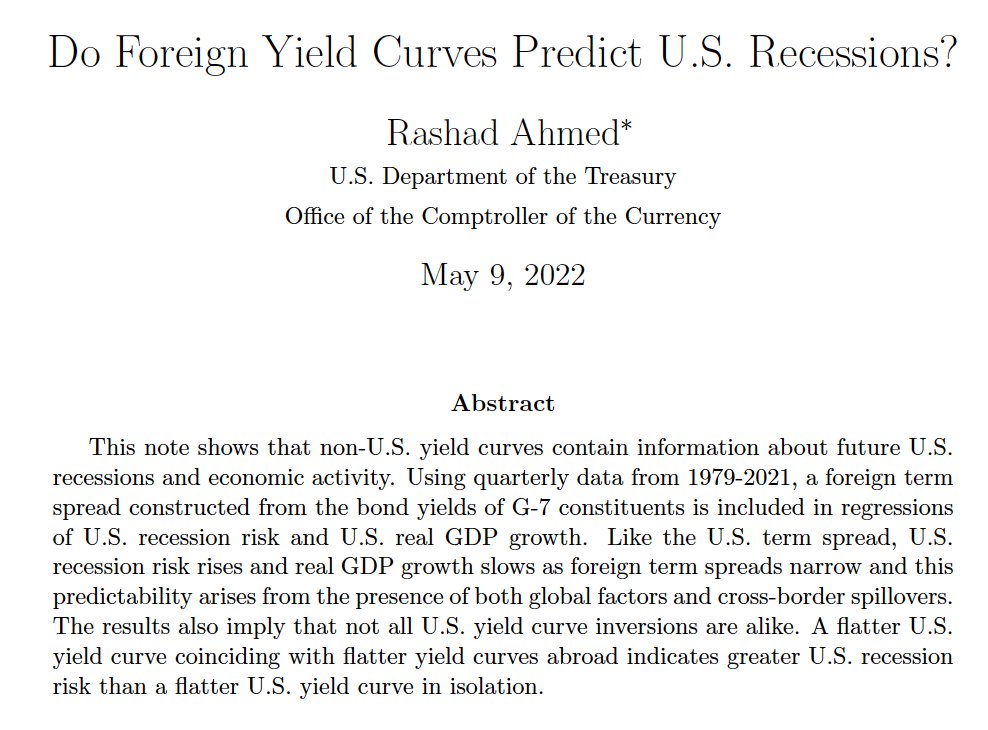

Do foreign yield curves help predict US recessions? It seems so: papers.ssrn.com/sol3/papers.cf…

A short 🧵1/5 #EconTwitter #fintwit

A short 🧵1/5 #EconTwitter #fintwit

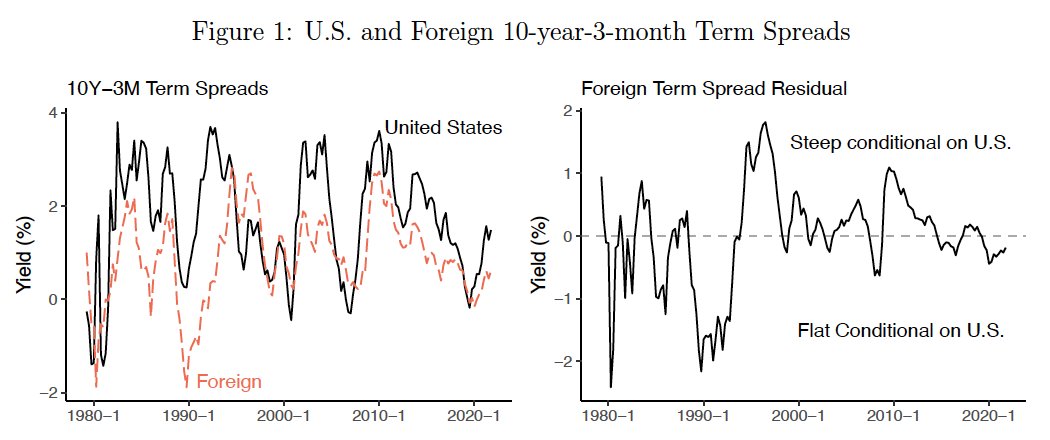

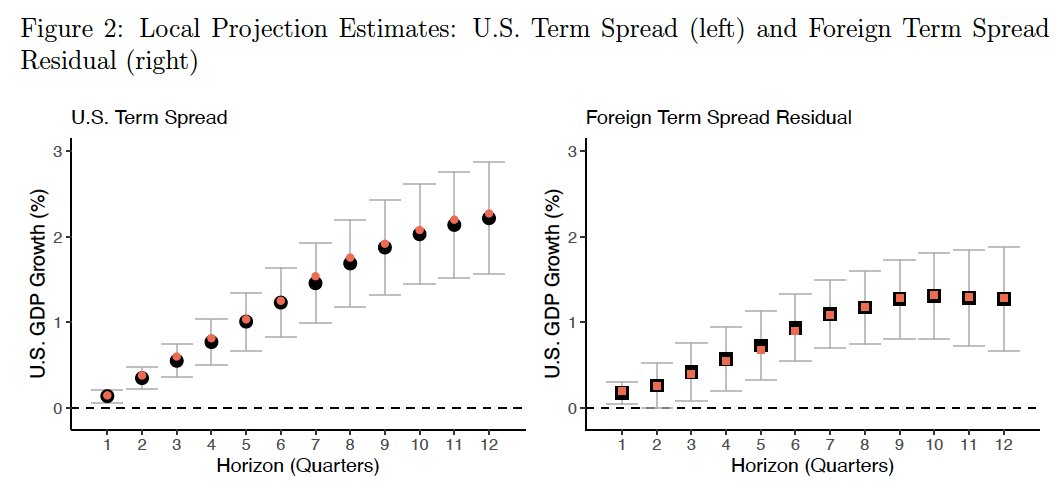

The short note shows that foreign term spreads (3m10s) constructed from non-US G7 constituents contain information about future US recessions *even after* accounting for the predictive content of the US term spread and several other leading indicators

2/5

2/5

Not just recession risk, but steeper (flatter) US *and* foreign term spreads are associated with faster (slower) future real GDP growth in the US

3/5

3/5

Why? foreign yields seem to inform US recession risk due to both:

A) Common factors underlying globally synchronized economic activity reflected in yield curves around the world

B) Spillovers: non-US recessions, led by foreign yield curves, are partially exported to the US

4/5

A) Common factors underlying globally synchronized economic activity reflected in yield curves around the world

B) Spillovers: non-US recessions, led by foreign yield curves, are partially exported to the US

4/5

What it means: not all US yield curve inversions are alike. Flatter US yield curves alongside flatter foreign yield curves may indicate greater recession risk than flatter US yield curves in isolation

As always - comments welcome!

5/5

As always - comments welcome!

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh