This is the EU (Withdrawal Agreement) Bill Impact Assessment, dated 21 October 2019:

assets.publishing.service.gov.uk/government/upl…

It contains the Government’s own expectations at time the Brexit deal was done of the border/ checks required within UK, in the Irish Sea as a result of the PM’s deal:

assets.publishing.service.gov.uk/government/upl…

It contains the Government’s own expectations at time the Brexit deal was done of the border/ checks required within UK, in the Irish Sea as a result of the PM’s deal:

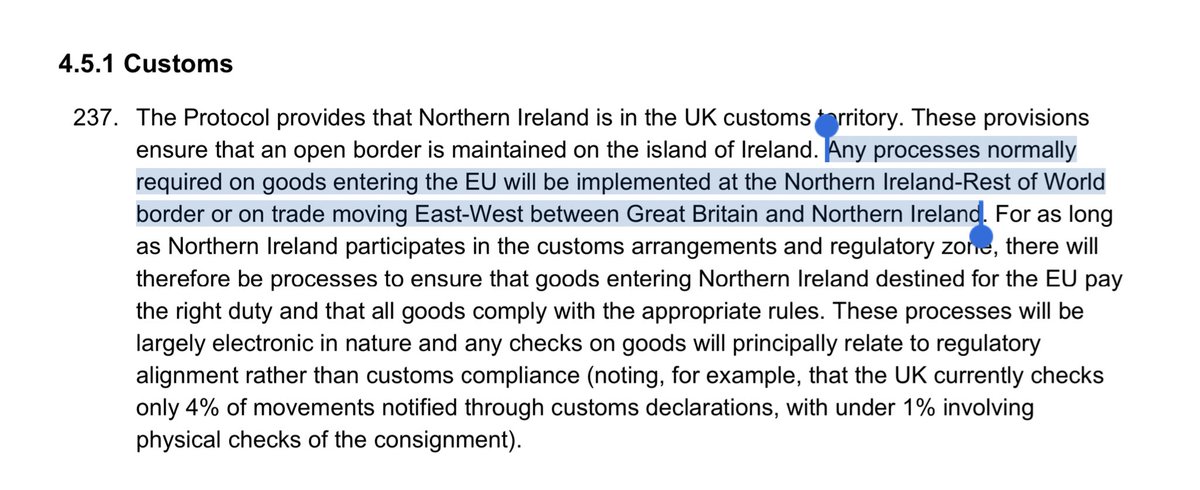

4.5.1: Customs: “Any processes normally required on goods entering EU will be implemented at NI-RoW border or on trade moving East-West between GB & NI”

4.5.4.2.1 “Agrifood goods enter NI from GB via Border Inspection Post as required under EU law”

4.5.4.2.1 “Agrifood goods enter NI from GB via Border Inspection Post as required under EU law”

264: “additional documentation required on all agrifood goods moving from GB to NI.. incl EHCs, PCs, admin cost”

266: “Protocol will require additional checks covering all products subject to SPS”.. “upper limit in Table 8”

Table 8: “%age subject to physical checks 20%-100%”

266: “Protocol will require additional checks covering all products subject to SPS”.. “upper limit in Table 8”

Table 8: “%age subject to physical checks 20%-100%”

4.5.4.2.2 Manufactured goods regulation

“businesses in Great Britain placing goods on the market in Northern Ireland will need to ensure they are complying with the relevant EU rules and could be subject to risk based checks at the boundary of the regulatory zone”

“businesses in Great Britain placing goods on the market in Northern Ireland will need to ensure they are complying with the relevant EU rules and could be subject to risk based checks at the boundary of the regulatory zone”

further corroborated by internal leak of this HMT document two months later, which detailed

- table of the “potential fetters” to GB-NI trade, both ways

- listed “previous commitments” ie in Theresa May’s Brexit deal for “unfettered access” no longer guaranteed in Johnson deal

- table of the “potential fetters” to GB-NI trade, both ways

- listed “previous commitments” ie in Theresa May’s Brexit deal for “unfettered access” no longer guaranteed in Johnson deal

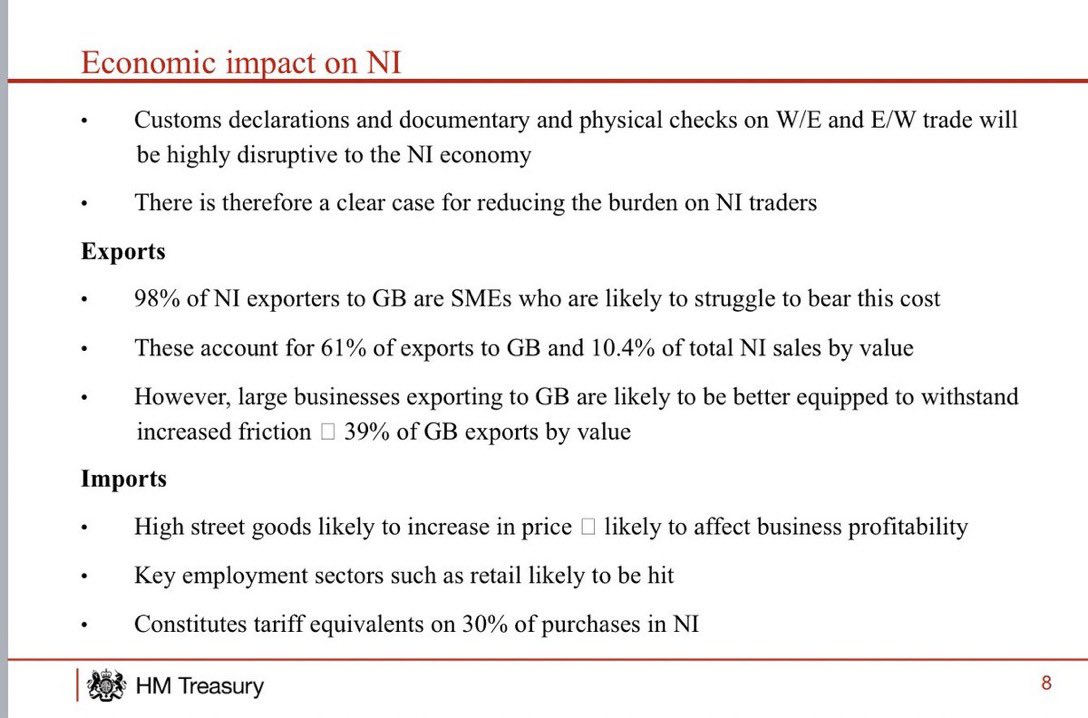

.. this leaked Treasury presentation in 2019 went on to say checks and declarations from the Protocol would be “highly disruptive to the NI economy” that SMEs are “likely to struggle to bear cost” and acknowledged that it would increase the price of high street goods…

And then there this separate leak of a Dexeu memo, reported by both myself and the FT warning of "security, social and economic impacts" of “high levels” of checks and controls as a result of the Brexit deal’s NI Protocol…

bbc.co.uk/news/50714151

bbc.co.uk/news/50714151

FTA negotiation created within it scope to lessen some of these frictions, but the above pretty clearly show that many of the consequences now seen of the new Brexit deal NI Protocol, weren’t just predictable, & predicted internally, but actually published by Government itself.

If plan all along was to renege on Protocol as some former insiders have suggested, the Econ challenge is deal signed gave EU hard leverage by allowing “cross retaliation” from the withdrawal agreement to the free trade deal.

Ie tariffing of key UK export industries/fishing

Ie tariffing of key UK export industries/fishing

Counter leverage here would be UK tariffing European imports, but that would be quite the dilemma during stagflationary period/already double digit inflation, esp in any period of dependence on eu imports of eg fresh produce. Indeed policy direction has been abandoning new checks

• • •

Missing some Tweet in this thread? You can try to

force a refresh