🧵on U.S. distillate (diesel) markets #OOTT

Long story short - the U.S. East Coast had a large part of it's import blanket pulled out from under it.

Long story short - the U.S. East Coast had a large part of it's import blanket pulled out from under it.

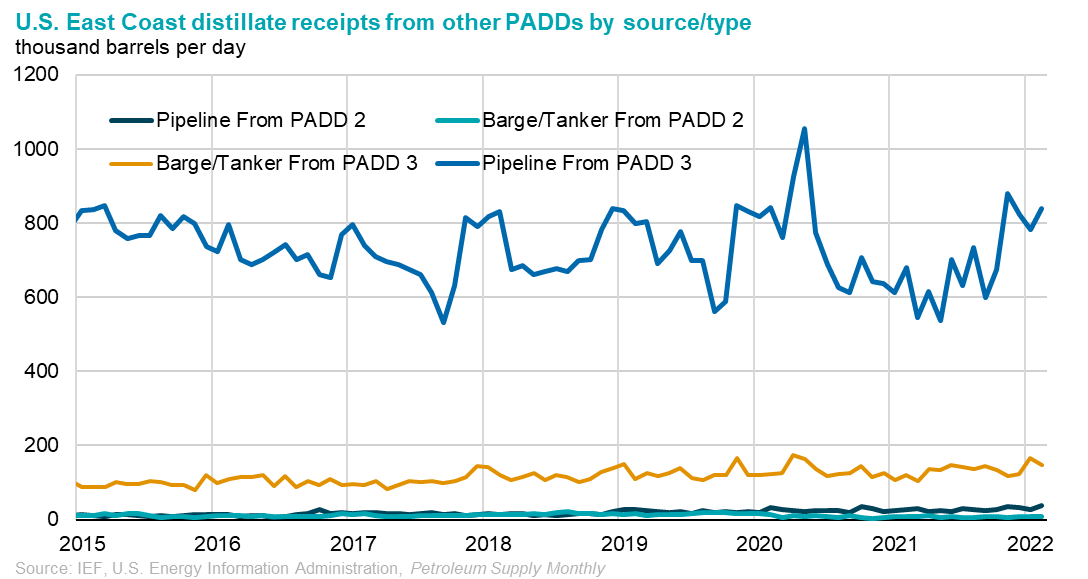

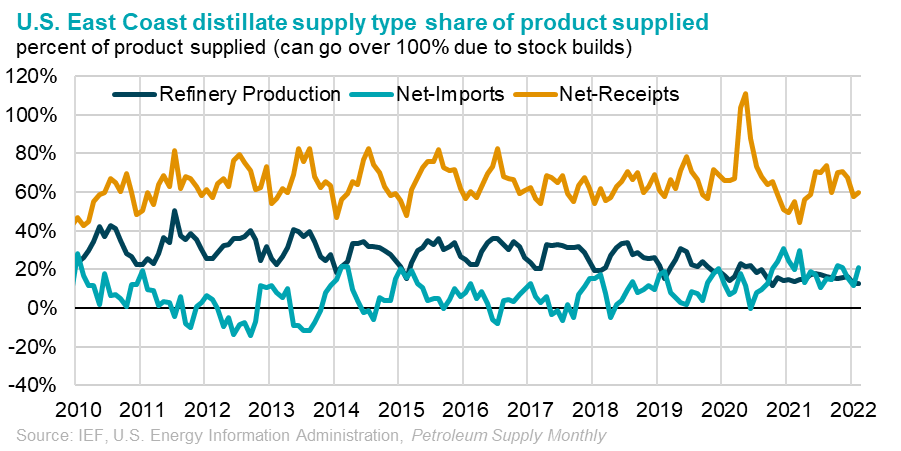

Looking at the PADD1 distillate supply/demand balance we can see that as in-region refinery production decreased due to refinery closures, PADD1 first relied on receipts (pipeline/tanker/barge) from other PADDs.

As the pandemic hit, (early 2020) the East Coast was inundated with supply up Colonial and Plantation Pipelines but then those receipts fell to around 600kb/d, until about Q3/4 of 2021.

This reshuffling (refinery closures, pandemic, etc.) resulted in imports of distillate becoming a larger part of the East Coast's distillate supply. Which, when times are normal is ok, many countries/regions do it. However, things aren't "normal" nowadays are they?

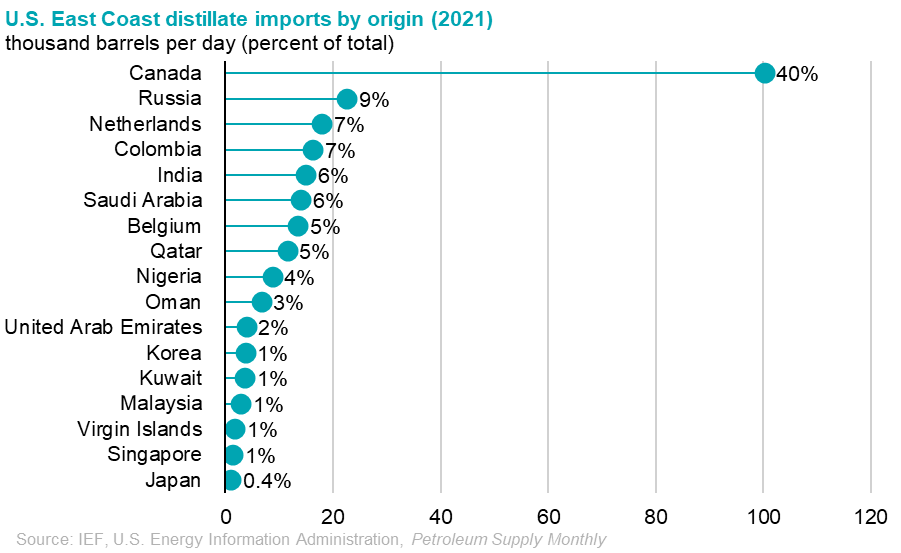

In 2021, imports from Canada represented 40% of total PADD1 distillate imports. But, look at #2: Russia with 9%, then Netherlands 7%, and a bit farther down Belgium 5%.

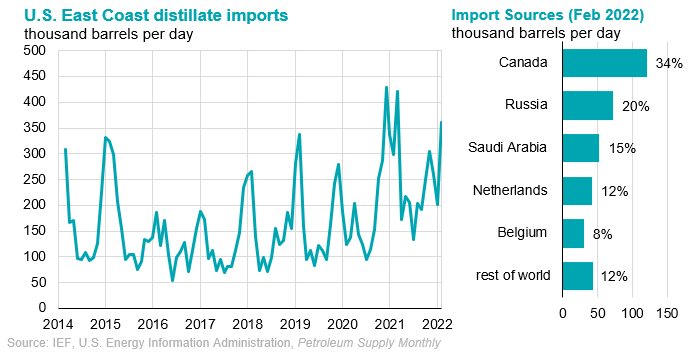

Even in the latest data (February 2022) Russia was 20% of distillate imports, with Netherlands and Belgium 12% and 8%, respectively.

See where things are headed?

See where things are headed?

As you know, things with Russian distillate imports got....complicated in late Feb/March, and thus complicated for refineries and distillate supplies in Belgium and the Netherlands - and by extension the U.S. East Coast.

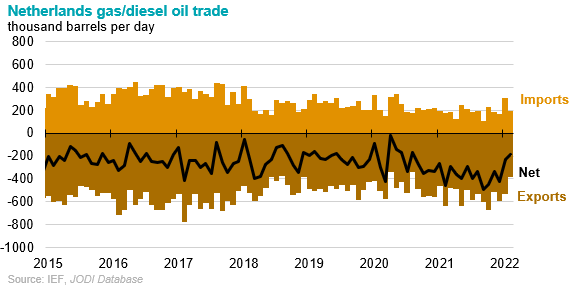

In the most recent @JODI_Data exports of gasoil/diesel from the Netherlands fell to 382kb/d in February, compared to 632kb/d in Feb of 2021.

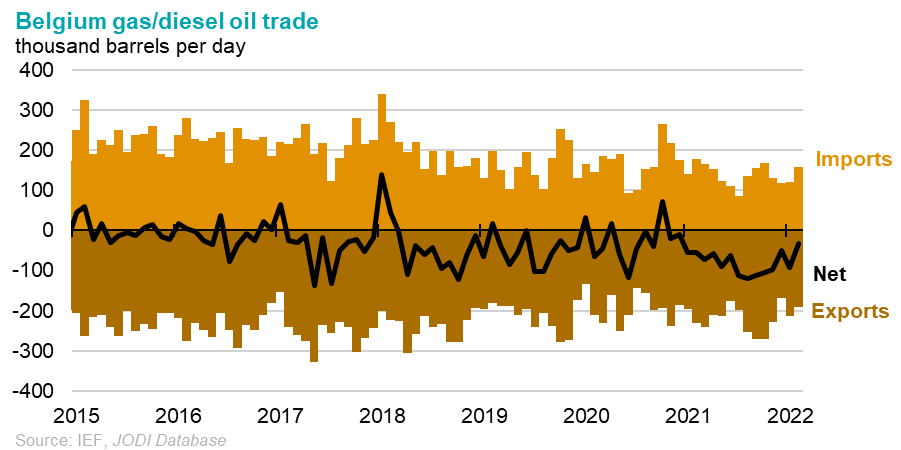

In Belgium, @JODI_Data shows gasoil/diesel exports were down slightly, to 189kb/d in Feb 2022, compared with 230kb/d at the same time last year.

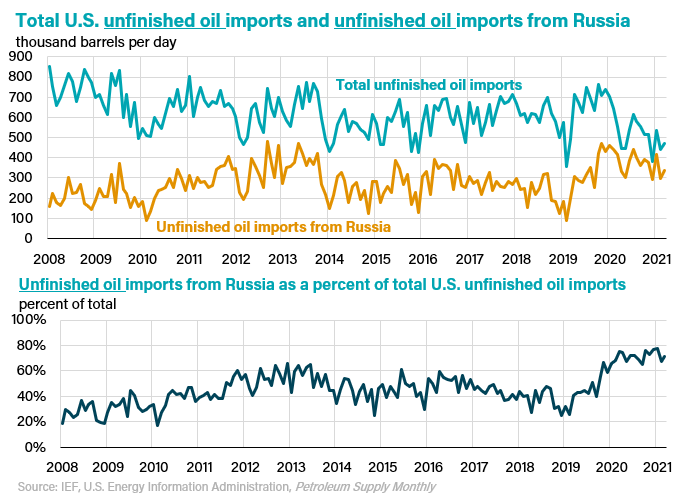

An additional complication: Refineries in Netherlands and Belgium historically imported intermediate feedstocks from Russian refineries, processing it to make gasoil/diesel.

This data is all through February, but March data is likely to show similar and stronger signs of the trends highlighted in this thread.

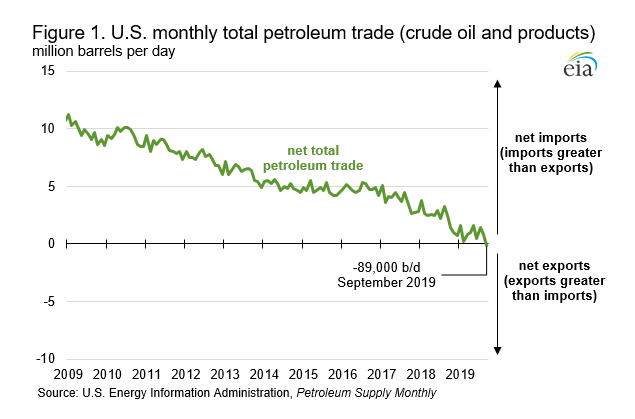

So to recap, East Coast refineries close, pandemic hits, pipeline shipments surge, demand recovers, inventories drawn down while reliance on imports increases.

Then in March 22, the U.S. East Coast is forced to replace lost Russian distillate imports, as well as lost imports from E.U. in a market where everyone is trying to buy available distillate barrels. Hence, inventories down & prices up. I hope this helps.

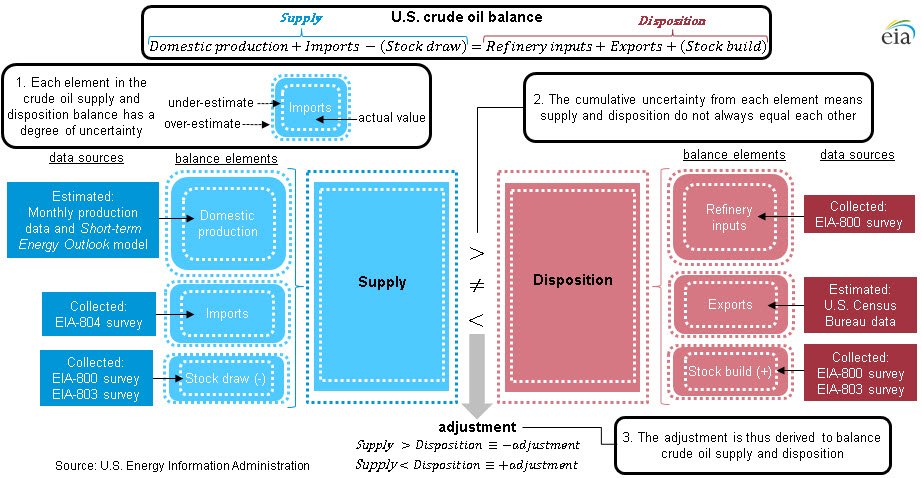

Another note: One of my favorite reports from @EIAgov is due out next month - the Annual Refinery Capacity Report. This report will provide LOTS of details about refinery downstream unit capacities and will help with analysis considering all that's changed recently.

• • •

Missing some Tweet in this thread? You can try to

force a refresh