VP of Econ & Research @APIenergy. Coming up with 61.8% good ideas, 38.2% bad. Energy analyst, meme enthusiast. Ex-EIA, DOE, IEF. Have a nice day. Tweets my own!

2 subscribers

How to get URL link on X (Twitter) App

The port of Baltimore is the 22nd largest "import" port for petroleum products - so is not a major entry location for products entering the United States....

The port of Baltimore is the 22nd largest "import" port for petroleum products - so is not a major entry location for products entering the United States....

Some highlights:

Some highlights:

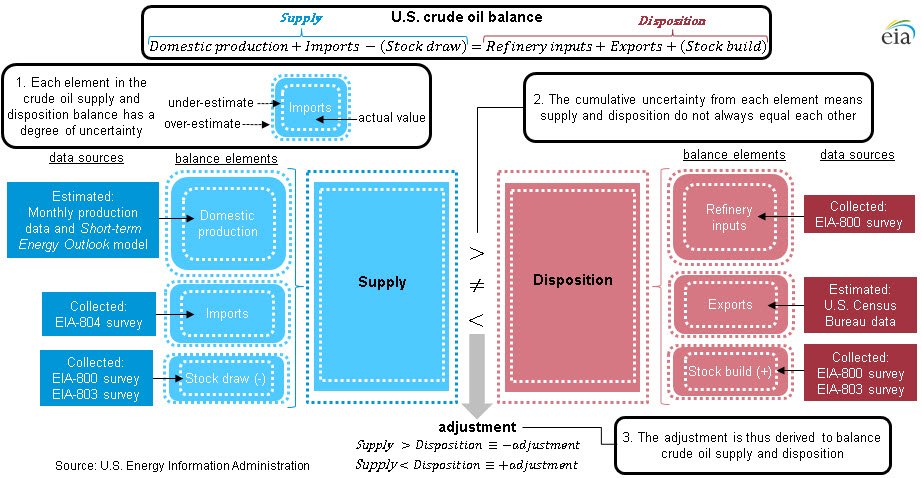

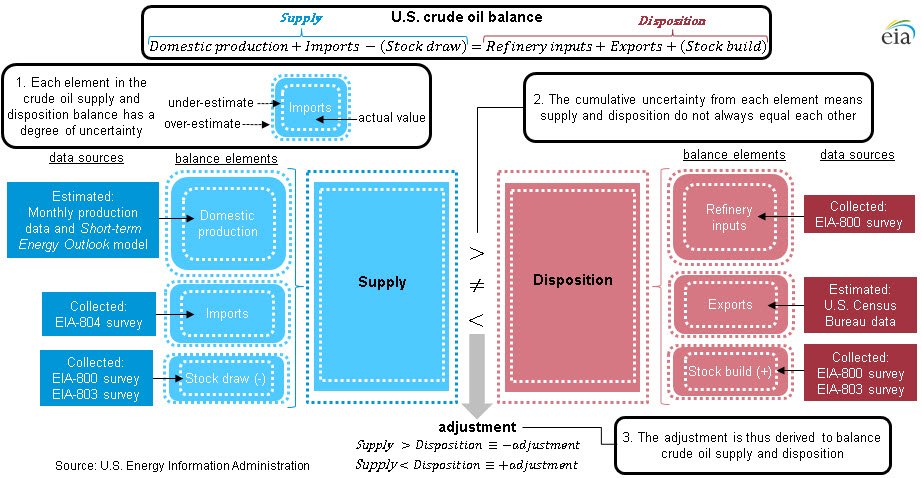

EIA’s latest round of monthly petroleum data is jam packed with interesting information and details about what’s going on with U.S. and to many degrees, with international markets. But one number in particular is gaining more and more attention – the crude oil supply “adjustment”

EIA’s latest round of monthly petroleum data is jam packed with interesting information and details about what’s going on with U.S. and to many degrees, with international markets. But one number in particular is gaining more and more attention – the crude oil supply “adjustment”

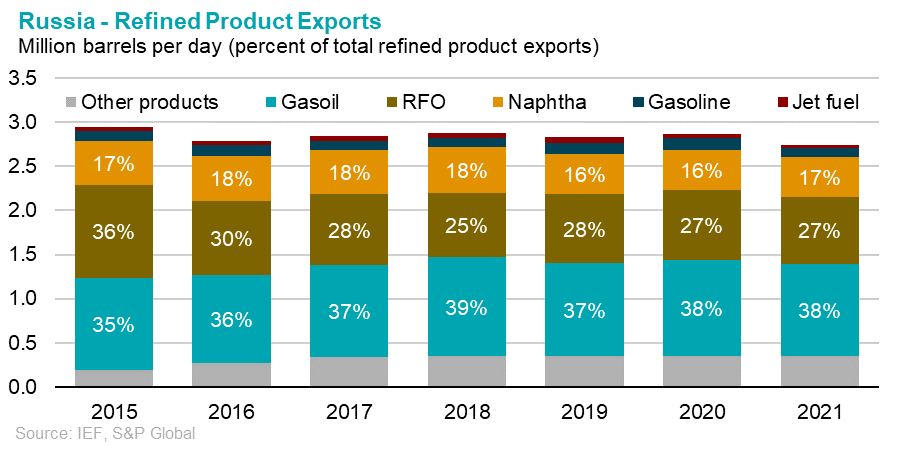

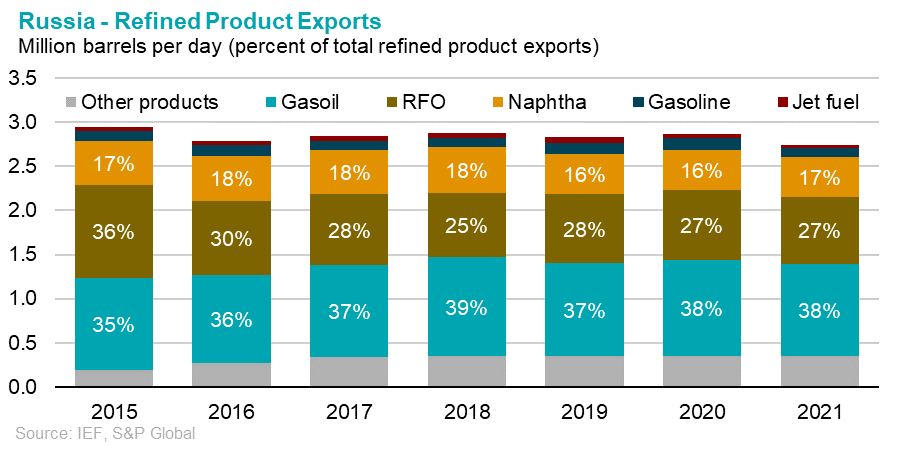

Rerouting Russian product flows is more complicated than for crude oil. Tenders and contracts for products often have product specifications (sulfur, octane, etc.) tailored to specific markets.

Rerouting Russian product flows is more complicated than for crude oil. Tenders and contracts for products often have product specifications (sulfur, octane, etc.) tailored to specific markets.

U.S. refineries produce "BOB", or the petroleum component of motor gasoline, that is below retail pump octane specifications i.e. 85 rather than 87 regular. That missing octane is supplied by ethanol.

U.S. refineries produce "BOB", or the petroleum component of motor gasoline, that is below retail pump octane specifications i.e. 85 rather than 87 regular. That missing octane is supplied by ethanol.

Refineries on the U.S. East Coast are the most reliant on crude by rail supplies (6.5% of receipts in 2021), a majority of which is domestically sourced crude oil.

Refineries on the U.S. East Coast are the most reliant on crude by rail supplies (6.5% of receipts in 2021), a majority of which is domestically sourced crude oil.

EIA's weekly product supplied does not capture motor gasoline being pumped OUT of retail gasoline stations.

EIA's weekly product supplied does not capture motor gasoline being pumped OUT of retail gasoline stations.

Looking at the PADD1 distillate supply/demand balance we can see that as in-region refinery production decreased due to refinery closures, PADD1 first relied on receipts (pipeline/tanker/barge) from other PADDs.

Looking at the PADD1 distillate supply/demand balance we can see that as in-region refinery production decreased due to refinery closures, PADD1 first relied on receipts (pipeline/tanker/barge) from other PADDs.

https://twitter.com/EIAgov/status/1524756959374815233The old system was massively easier to use and understandable than this V2. I could navigate to what I wanted, click the key, get the code, copy/paste into excel, then run the EIA excel plug-in and boom my data appears. But now...

Russia is not a significant source of crude oil for U.S. refineries. But because total U.S. crude oil imports have fallen, Russia's share has gone up - that's basic math.

Russia is not a significant source of crude oil for U.S. refineries. But because total U.S. crude oil imports have fallen, Russia's share has gone up - that's basic math.

This means more cars likely say "Premium recommended" (i.e. to get EPA sticker numbers), and not "Premium Required". At the same time, the share of premium gasoline sales is rising - up to 13%, the highest it's been since ~2003, and have recovered faster than other grades.

This means more cars likely say "Premium recommended" (i.e. to get EPA sticker numbers), and not "Premium Required". At the same time, the share of premium gasoline sales is rising - up to 13%, the highest it's been since ~2003, and have recovered faster than other grades.

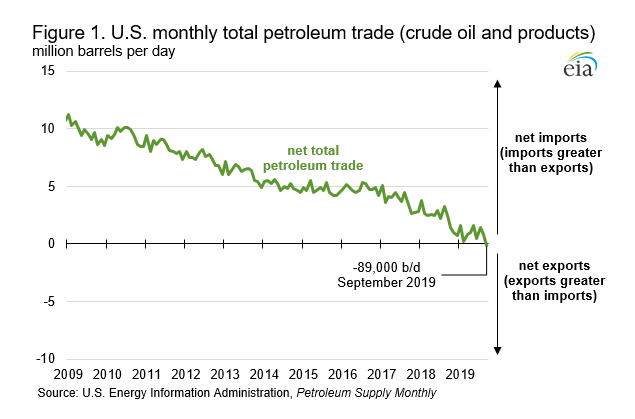

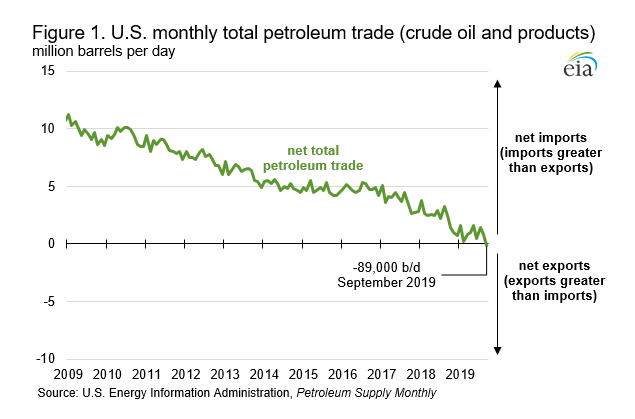

The United States is a net exporter of petroleum!

The United States is a net exporter of petroleum!

If the reported supply and disposition of crude oil balanced perfectly each week, the adjustment would equal zero. For several reasons, however, this is rarely the case. Hence the need for the adjustment.

If the reported supply and disposition of crude oil balanced perfectly each week, the adjustment would equal zero. For several reasons, however, this is rarely the case. Hence the need for the adjustment.