Some reflections from investing in the $LUNA $UST debacle. 🧵👇 1/16

DISCLOSURE: I'm a moron who lost a metric-ton of capital this week on a project currently circling the drain to $0.00, so read & heed at your own peril.☠️

DISCLOSURE: I'm a moron who lost a metric-ton of capital this week on a project currently circling the drain to $0.00, so read & heed at your own peril.☠️

2/

#Diversification isn't sexy, but can help you live 2 fight another day

Diversify by:

-asset class (stonks, gold, crypto, stable)

-account (margin, IRA, Roth, multi-wallet)

-strategy (stake, LP, leverage, hedge)

Concentration can get you to the moon faster but far less often.

#Diversification isn't sexy, but can help you live 2 fight another day

Diversify by:

-asset class (stonks, gold, crypto, stable)

-account (margin, IRA, Roth, multi-wallet)

-strategy (stake, LP, leverage, hedge)

Concentration can get you to the moon faster but far less often.

3/ #TradFi money managers often have both a "Core & Satellite" position where:

Core = strategic (longer-term buy & hold)

Satellite = tactical (trading shorter term moves)

In between tactical moves, low-yielding stable plays or boring LP's are better than riding crazy delta down

Core = strategic (longer-term buy & hold)

Satellite = tactical (trading shorter term moves)

In between tactical moves, low-yielding stable plays or boring LP's are better than riding crazy delta down

4/ Diversifying by chain & staking small amounts can protect you from "your best moon-boi thinking."

Happy I forced myself to spread exposure in my Core to have at least smol bags of:

- $VGX

- $AVAX

- $OSMO

- $JUNO

- $DOT

- $ETH

Have newfound appreciation for un-bonding periods

Happy I forced myself to spread exposure in my Core to have at least smol bags of:

- $VGX

- $AVAX

- $OSMO

- $JUNO

- $DOT

- $ETH

Have newfound appreciation for un-bonding periods

5/

Leverage is fine if defined.

Don't chase good money after bad.

- Use separate wallets

- Know your "line in the sand"

- If you're wrong, stomach the loss

- Ideally choose lenders where liquidation is 1 & done (like 🪞 vs.⚓️)

Only lever-up lil portions of your satellite bag

Leverage is fine if defined.

Don't chase good money after bad.

- Use separate wallets

- Know your "line in the sand"

- If you're wrong, stomach the loss

- Ideally choose lenders where liquidation is 1 & done (like 🪞 vs.⚓️)

Only lever-up lil portions of your satellite bag

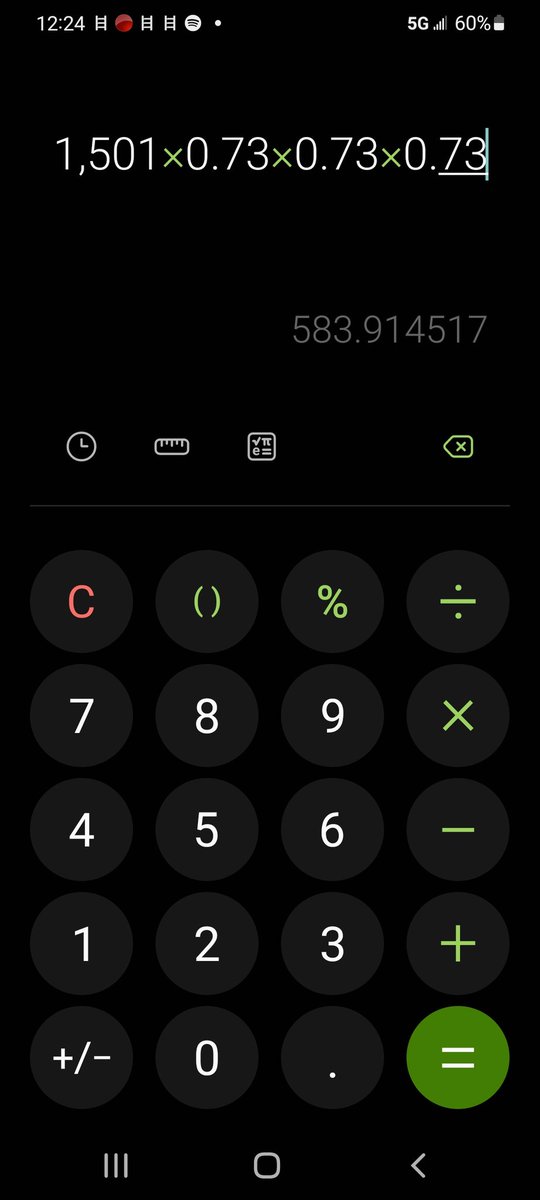

6/ After getting a good chunk of the desired move, DCA sell exponentially on the way⏫ (like you would DCA buy on the way⏬).

Use short term profits to pay down loans and/or pad your bag.

Don't chase mediocre opportunities (alts & setups) that you're not fully convicted about.

Use short term profits to pay down loans and/or pad your bag.

Don't chase mediocre opportunities (alts & setups) that you're not fully convicted about.

7/ Don't be afraid to short if you see the setup.

Now that $LUNA's almost dead, there's not a whole lot I'm bullish on ATM. I fear #Terra was the 1st "bear raid" and wouldn't surprise me if it's the fuse used to bomb $BTC lower next.

We may be in a trader's market for a while

Now that $LUNA's almost dead, there's not a whole lot I'm bullish on ATM. I fear #Terra was the 1st "bear raid" and wouldn't surprise me if it's the fuse used to bomb $BTC lower next.

We may be in a trader's market for a while

8/ Learn to use the tools provided by CEX's to either trade or hedge (futures, perps, margin).

Do research and/or get help.

Paper trade or size yourself very small when learning new trading techniques & tools.

Do research and/or get help.

Paper trade or size yourself very small when learning new trading techniques & tools.

9/ Plan your work & work your plan (Satellite Bag)

- Set exit & entry levels ahead of time w/ a clear head.

- Use limit orders & stops to do the dirty work to remove fear & greed

- Position size or leverage according to the highest quality set-ups

- If you don't fill so be it

- Set exit & entry levels ahead of time w/ a clear head.

- Use limit orders & stops to do the dirty work to remove fear & greed

- Position size or leverage according to the highest quality set-ups

- If you don't fill so be it

10/ Plan your work & work your plan (Core Bag)

- Know the levels you want to DCA at

- Be prepared to quickly shift liquidity wen close

- Consider tactically trading a portion after a chunky move to lower cost basis. Meaning buy enough for both a core & satellite holding period

- Know the levels you want to DCA at

- Be prepared to quickly shift liquidity wen close

- Consider tactically trading a portion after a chunky move to lower cost basis. Meaning buy enough for both a core & satellite holding period

11/

Find a source of income during this most likely incoming choppy market.

That way you don't dilute your stack and hopefully can continue adding to it. Imagine how many units you can buy if we keep dipping down.

Nothing like fresh capital to keep fertilizing your portfolio.

Find a source of income during this most likely incoming choppy market.

That way you don't dilute your stack and hopefully can continue adding to it. Imagine how many units you can buy if we keep dipping down.

Nothing like fresh capital to keep fertilizing your portfolio.

12/

Don't rule out stonks after the rout they're getting, but don't try and catch the falling knife either.

Either nibble on the way down or wait for a capitulating bounce w/ confirmation before entry.

Take some profits on the way up. Prepare to buy enough to core & satellite.

Don't rule out stonks after the rout they're getting, but don't try and catch the falling knife either.

Either nibble on the way down or wait for a capitulating bounce w/ confirmation before entry.

Take some profits on the way up. Prepare to buy enough to core & satellite.

13/

NFA: Research paper gold (ETFs) for some of your holdings so there isn't total correlation in your brokerage account.

Buying gold ETFs near channel lows often helps stabilize overall portfolio volatility

Not what you'd expected to see wen inflation is near recent highs?

NFA: Research paper gold (ETFs) for some of your holdings so there isn't total correlation in your brokerage account.

Buying gold ETFs near channel lows often helps stabilize overall portfolio volatility

Not what you'd expected to see wen inflation is near recent highs?

14/

You can sparingly use margin equity as your IRL emergency fund wen using @IBKR global brokerage

For smaller accounts partial liquidations begin at a 50% LTV, so temporarily borrowing 20% gives you room to lose more than 1/2 the value

Margin % Rates = cheap & tax deductible

You can sparingly use margin equity as your IRL emergency fund wen using @IBKR global brokerage

For smaller accounts partial liquidations begin at a 50% LTV, so temporarily borrowing 20% gives you room to lose more than 1/2 the value

Margin % Rates = cheap & tax deductible

15/

@IBKR lets you link a checking for free ACH transfers. It only takes 1-day to borrow money out, but wen depositing or paying back it takes about 4-days.

= A handy liquidity-management tool or for DCA

Referral code to earn up to $1,000 in IBKR stock

ibkr.com/referral/john3…

@IBKR lets you link a checking for free ACH transfers. It only takes 1-day to borrow money out, but wen depositing or paying back it takes about 4-days.

= A handy liquidity-management tool or for DCA

Referral code to earn up to $1,000 in IBKR stock

ibkr.com/referral/john3…

16/ Remember, using leverage of any kind increases either your reward or risk.

Use sparingly and have an exit-strategy either way and/or DCA plan to pay down the loan.

If you enjoyed this thread please retweet the 1st tweet (here below):

Use sparingly and have an exit-strategy either way and/or DCA plan to pay down the loan.

If you enjoyed this thread please retweet the 1st tweet (here below):

https://twitter.com/hutchonthego/status/1525378084165210112?s=20&t=-qUh4O8huu3pJCZuhWVqeQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh