(1/17)

About:

Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer recommendations and conversions through relevant Mobile Advertising. It aims to enhance returns on marketing investment through contextual mobile ads.

About:

Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer recommendations and conversions through relevant Mobile Advertising. It aims to enhance returns on marketing investment through contextual mobile ads.

(2/17)

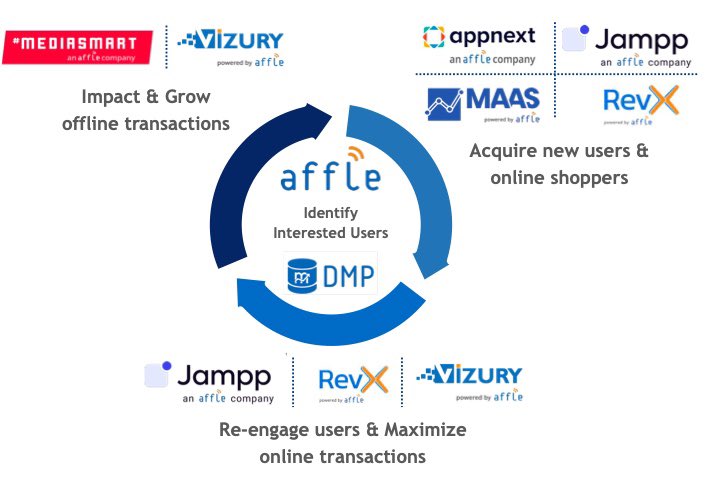

Affle’s platforms:

• Appnext

• Jampp

• MAAS

• mDMP

• mediasmart

• mTraction Enterprise

• RevX

• Vizury

Affle’s platforms:

• Appnext

• Jampp

• MAAS

• mDMP

• mediasmart

• mTraction Enterprise

• RevX

• Vizury

(3/17)

Business classification:

• Consumer Platform: Gives consumer recommendations and conversions through relevant mobile advertising for leading app marketers.

This forms the major chunk of revenue (99.1% share in total revenue)

Business classification:

• Consumer Platform: Gives consumer recommendations and conversions through relevant mobile advertising for leading app marketers.

This forms the major chunk of revenue (99.1% share in total revenue)

(4/17)

• Enterprise Platform: This Segment caters to offline businesses by enabling them to go online through app development, O2O Commerce and data Analytics.

However, it only contributed 0.9% in the total revenue that Affle India generates.

• Enterprise Platform: This Segment caters to offline businesses by enabling them to go online through app development, O2O Commerce and data Analytics.

However, it only contributed 0.9% in the total revenue that Affle India generates.

(5/17)

Geographies:

Affle provides its services in a number of countries in South East Asia, Middle East nations, Africa, South Korea and Australia.

Infact, majority of its revenue( 65%) comes from its international business and the remaining 35% comes from India.

Geographies:

Affle provides its services in a number of countries in South East Asia, Middle East nations, Africa, South Korea and Australia.

Infact, majority of its revenue( 65%) comes from its international business and the remaining 35% comes from India.

(6/17)

Quarter that went by:

Affle had an one off muted quarter 4 results. However, long term trend and industry growth outlook remains robust.

QoQ numbers:

• Revenue down by 7.2%

• EBITDA margin down by 1.42% to 18.5%

• Converted users down by 3.2% QoQ and up by 85% YOY

Quarter that went by:

Affle had an one off muted quarter 4 results. However, long term trend and industry growth outlook remains robust.

QoQ numbers:

• Revenue down by 7.2%

• EBITDA margin down by 1.42% to 18.5%

• Converted users down by 3.2% QoQ and up by 85% YOY

(7/17)

Key Growth triggers:

• Shift towards digital medium:

Companies all around the globe are focusing more on digital advertising as it is proving to be more efficient (focus on target audience). Targeted audience advertising using data helps to minimise ad spending.

Key Growth triggers:

• Shift towards digital medium:

Companies all around the globe are focusing more on digital advertising as it is proving to be more efficient (focus on target audience). Targeted audience advertising using data helps to minimise ad spending.

(8/17)

• Growing usage of Internet in Emerging markets like India:

Affle India recognises the potential of the developing markets as the data usage is growing many folds. This helps them to get more clients who are interested in digital advertising

• Growing usage of Internet in Emerging markets like India:

Affle India recognises the potential of the developing markets as the data usage is growing many folds. This helps them to get more clients who are interested in digital advertising

(9/17)

Key Risk:

• Regulatory risk on data or privacy law

• Overall reduction in EBIT margin in corporates leading to less spending on advertisement

Key Risk:

• Regulatory risk on data or privacy law

• Overall reduction in EBIT margin in corporates leading to less spending on advertisement

(10/17)

• Focus on technology to accelerate growth:

Affle is focusing on asset light, automated and scalable platform.

Their platforms forms a connected ecosystem. The number of platforms help them from identifying interested users, acquire new users to re engage users.

• Focus on technology to accelerate growth:

Affle is focusing on asset light, automated and scalable platform.

Their platforms forms a connected ecosystem. The number of platforms help them from identifying interested users, acquire new users to re engage users.

(11/17)

Addressing key data related issues:

The company invests a lot of its capital to solve data related issues like privacy & ad fraud. They have a total of 20 patents (6 granted in US)

It’s Ad fraud detection platform mFaas, is an example of that

Addressing key data related issues:

The company invests a lot of its capital to solve data related issues like privacy & ad fraud. They have a total of 20 patents (6 granted in US)

It’s Ad fraud detection platform mFaas, is an example of that

(12/17)

As spend trend:

• The global CAGR of digital ad spend is 9% & that of Mobile ad spend is 11.3%.

• India numbers look even better with Mobile spend CAGR of 32.4%

• India currently has 650 million Mobile users which is less than half of the total population

As spend trend:

• The global CAGR of digital ad spend is 9% & that of Mobile ad spend is 11.3%.

• India numbers look even better with Mobile spend CAGR of 32.4%

• India currently has 650 million Mobile users which is less than half of the total population

(13/17)

Segments Affle focuses on:

• E-commerce

• Edtech

• Entertainment

• Fintech

• FMCG

• Foodtech

• Gaming

• Government

• Groceries

• Healthtech

• Hospitality

• Travel

Segments Affle focuses on:

• E-commerce

• Edtech

• Entertainment

• Fintech

• FMCG

• Foodtech

• Gaming

• Government

• Groceries

• Healthtech

• Hospitality

• Travel

(14/17)

Factors Affle India is betting on:

• Fastest growing Indian digital ad market

• Growing penetration of connected devices

• Digitization of new industry verticals

Factors Affle India is betting on:

• Fastest growing Indian digital ad market

• Growing penetration of connected devices

• Digitization of new industry verticals

(15/17)

Growth trends:

• 4 year revenue CAGR of 45.9%

• 4 year EBITDA CAGR of 42%

• 4 year PAT CAGR of 54.7%

Other numbers:

• ROE 29.4%

• ROCE 17.9%

• ROA 14.3%

• Gross D/E 0.24x

Growth trends:

• 4 year revenue CAGR of 45.9%

• 4 year EBITDA CAGR of 42%

• 4 year PAT CAGR of 54.7%

Other numbers:

• ROE 29.4%

• ROCE 17.9%

• ROA 14.3%

• Gross D/E 0.24x

(16/17)

Shareholding pattern:

• Promoters : 59.89%

• FIIs : 15.4%

• DIIs : 6.37%

• Public : 18.33%

Shareholding pattern:

• Promoters : 59.89%

• FIIs : 15.4%

• DIIs : 6.37%

• Public : 18.33%

(17/17)

Do you think the numbers will sustain in the long term?

@caniravkaria @stockifi_Invest @kuttrapali26 @aparanjape

Do you think the numbers will sustain in the long term?

@caniravkaria @stockifi_Invest @kuttrapali26 @aparanjape

• • •

Missing some Tweet in this thread? You can try to

force a refresh