#FinanceTwitterJa Here is a thread on Dolla Financial Services Limited Initial Public Offering. Firstly, Dolla is being offered at $1.00 JMD per share.

jamstockex.com/dolla-financia…

jamstockex.com/dolla-financia…

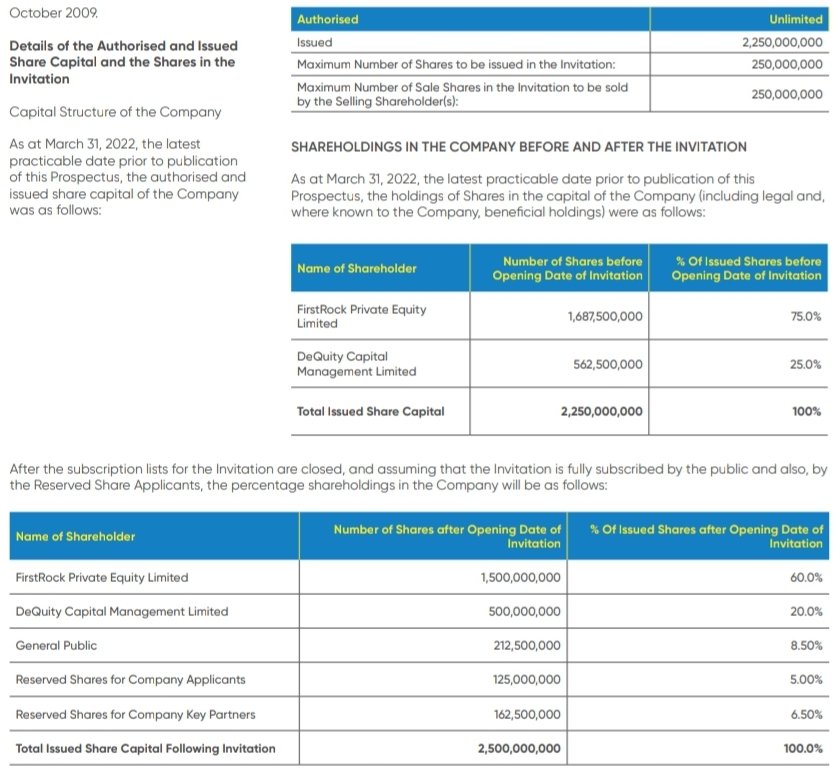

The company is seeking to raise $250 million through the issuance of 250 million shares. First Rock Global Holdings Limited T/A First Rock Private Equity (FRPE) and DeQuity Capital Management Limited are selling 250 million shares. The offer is capitalized at $500 million JMD.

Dolla is a subsidiary of FRPE and associate of DeQuity Capital. Dolla owns a wholly owned subsidiary called Dolla Financial Services (Guyana) Inc. based in Georgetown, Guyana. Dolla has 8 branches in Jamaica and has a consolidated net portfolio of $870.26 million as of March 2022

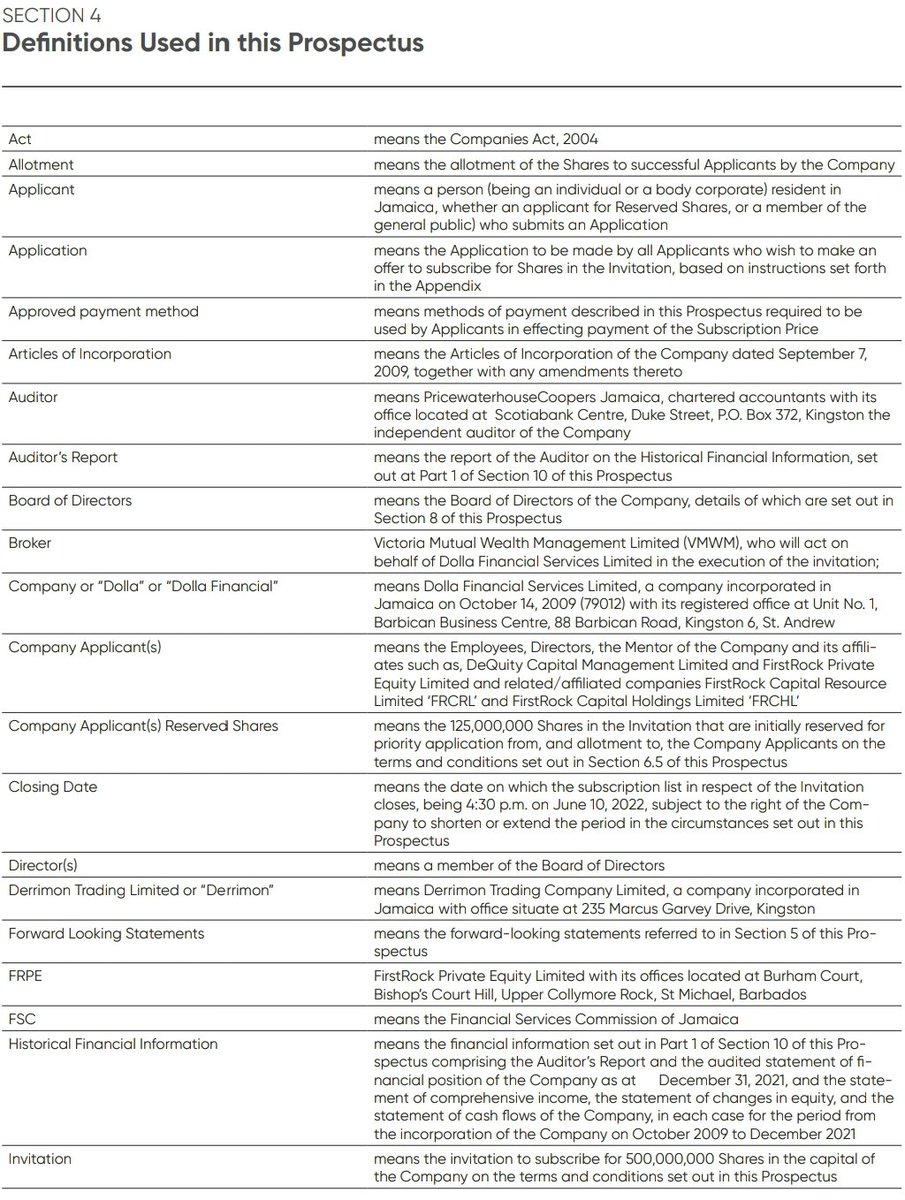

212,500,000 ordinary shares are being offered to the general public or those not in the reserved share pool. Company applicants have 125 million shares allocated to their pool. Definition in the 2nd photo.

The Key Partners pool has 162,500,000 ordinary shares. Customers and suppliers are considered Key Partners along with @myvmgroup Wealth and its managed funds. Confirmed selling agents include @MayberryInvJA & @BaritaLimited.

The company intends to use the proceeds to expand its loan portfolio which includes acquisitions. They applied to the @CentralBankJA for a Microcredit license in January ahead of the July deadline for the Microcredit Act. Founding memb of Jamaica Association for Micro

Financing

Financing

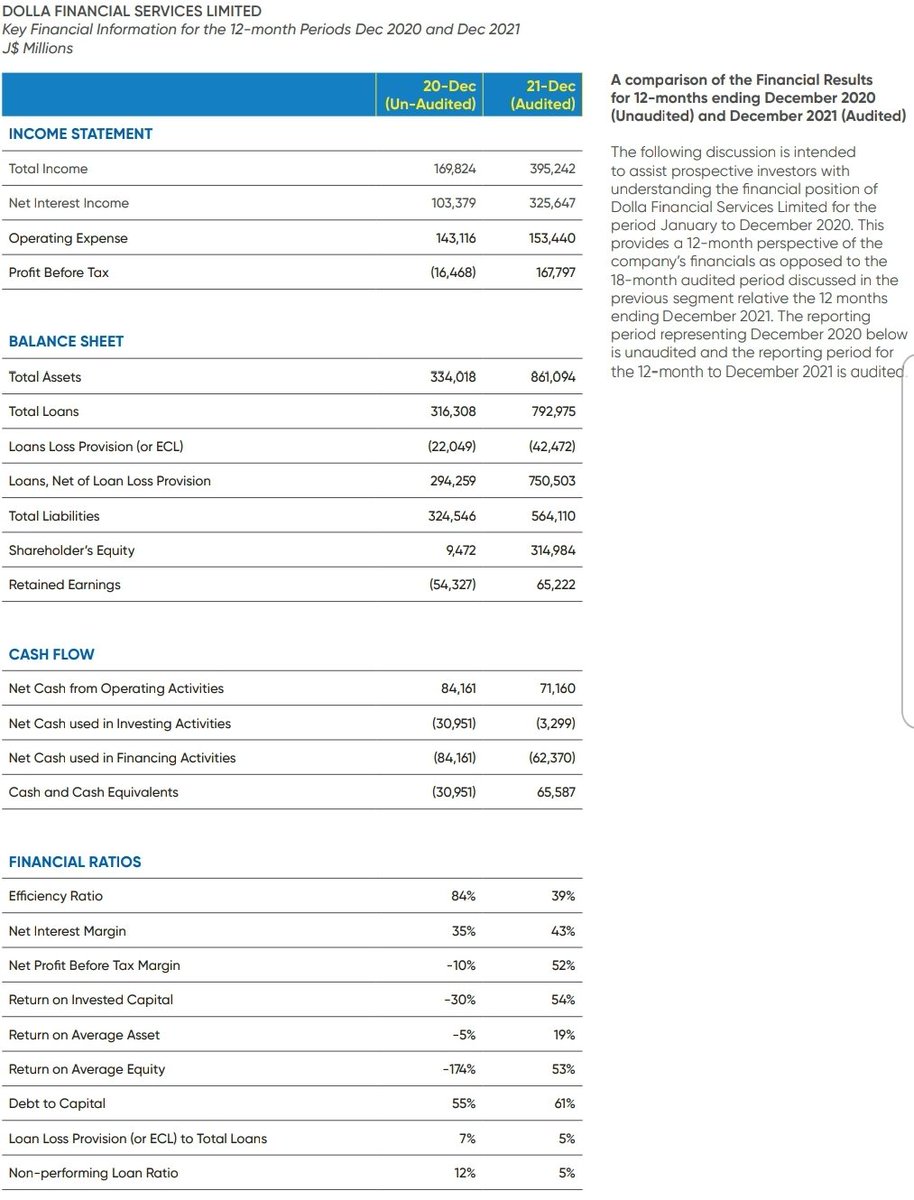

How does Dolla make money and grow its loan portfolio? Dolla borrows capital (debt) and gets equity which includes convertible preference shares. Debt has a maturity date and an interest cost while equity considers ownership.

They lend this money out at a higher rate to those who need it. As seen in that pie chart, the Dolla Elite and Dolla Valu Personal products made up 80% of their $379.05 million in interest income.

The difference between what they lend (interest income) and the cost to fund (interest expense) is the net interest income.

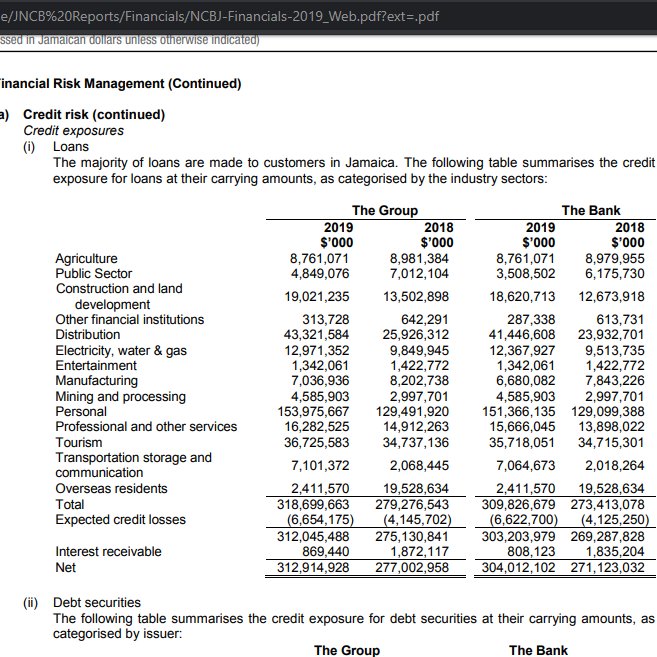

Banks and other deposit taking institutions fund their operations through the use of deposits and repurchase agreements which have a lower cost when used in funding operations.

A company like Dolla has to find the capital elsewhere. It should also be noted that when Dolla and other microcredit firms become regulated by the BOJ, their tax costs will go up. taxsummaries.pwc.com/jamaica/corpor…

By listing on the JSE's Junior Market, they will get their first 5 years with a 100% income tax remission while the remaining 5 years are at 50% the normal rate. Dolla is currently taxed at 25%.

The company's non-performing loans to gross loans ratio was trending down before 2020 when the pandemic struck. It's below pre-covid levels again which is a good sign. Its loan and asset base have grown in tandem over the five years as well.

Dolla's loan are mainly with the tourism and hospitality industry which have seen a steady rebound this year. Ask anyone staying at a hotel this weekend. 64% of business loans are secured which is critical when dealing with any going concern.

While they have 3% of unsecured business loans, they charge a higher interest rate to compensate for that additional risk.

Example below

Example below

https://twitter.com/JCKNIGHT2/status/1521854859162656768?t=ZhNdNWH8UE0aQ0lLufvqrQ&s=19

Their last 5 years have been trending up slowly. Note that the 2020 figure seen their is for a 18 month period. Dolla's FY used to be July-June and it's now January-December. That's why they included a comparative base here.

The company was owned by @ssljamaica up to March 2020 when First Rock Capital Holdings bought the 75% stake in the firm for US$500k. FRPE bought that same stake a year later for US$1.1 million. The remaining 60% stake assuming a successful offer will be worth $1.5 billion JMD.

The company's first quarter interest income was 37% of the 2021 figure while net profit was 46% of the 2021 performance. Jamaican economy rebounding plus continued growth in Guyana all bodes well for the business.

The board of directors is chaired by @firstrockryboy and includes chief executive officer @kadeenmairs. The mentor is @WaldronTania. The board sub-committees and exposure is listed below.

@myvmgroup Wealth is the lead broker for the offer. Their Wealth IPO Edge platform (wealthipo.vmbs.com/login) is the general platform anyone can use for the offer.

When you create your account, you will then see my accounts to the left on a desktop or at the top in mobile. You can add a JCSD account for each and every broker you use if you so choose.

When you're finished adding your account, you'll select view details to ensure you apply for the right pool and so on. When you get to the actual application page, you will select the relevant account and how you'll fund it. Take note of the bank transfer info.

For everyone asking if @JMMBGroupJA or @ncbja will be selling agents, please wait until Tuesday when businesses are open again and can confirm their stance. Selling agent agreements aren't done instantly and still need to be reviewed by relevant parties.

@ICInsider run by @johnhjack has already added it to the top 10 list with a $4 price target and an earnings per share target of $0.20 when 2.5 billion shares will be in circulation. The current PE is 13 times based on the $1 price and 2.25 billion shares oustanding.

The Dolla Financial story

jamaicaobserver.com/business/the-d…

jamaicaobserver.com/business/the-d…

A dollar for Dolla

jamaicaobserver.com/news/a-dollar-…

@kadeenmairs I probably going to butcher the last letter in your name for a couple more days. 🤣

jamaicaobserver.com/news/a-dollar-…

@kadeenmairs I probably going to butcher the last letter in your name for a couple more days. 🤣

The offer opens on May 27 at 9:30 am and is scheduled to close on June 10 at 4:30 pm. All Jamaican times here. You can apply before the offer formally opens to subscribe to the offer. You don't need to open an account with the lead broker to subscribe.

Once you have a brokerage/equity/stock account which is functional, you can apply with your relevant broker if they're a selling agent or on VM Wealth's Wealth IPO Edge Platform.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh