DM for email. Tweets don't equate to recommendations on any stock listed in Jamaica or other jurisdiction.

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/JamaicaGleaner/status/1841817131974832257SSL is a regulated securities dealer under the remit of the Financial Services Commission (FSC). The FSC regulates securities, insurance, pension, and corporate services. So, if there is an issue at any in these industries, it's the FSC's role to resolve it.

The company is seeking to raise $250 million through the issuance of 250 million shares. First Rock Global Holdings Limited T/A First Rock Private Equity (FRPE) and DeQuity Capital Management Limited are selling 250 million shares. The offer is capitalized at $500 million JMD.

The company is seeking to raise $250 million through the issuance of 250 million shares. First Rock Global Holdings Limited T/A First Rock Private Equity (FRPE) and DeQuity Capital Management Limited are selling 250 million shares. The offer is capitalized at $500 million JMD.

https://twitter.com/JCKNIGHT2/status/1412205794855112707

Note, the preference share in the photo is already listed. The one in the quoted tweet is on offer now at an issue price of $20. If you want to subscribe, check here ().einvest.sagicorjamaica.com/offers

Note, the preference share in the photo is already listed. The one in the quoted tweet is on offer now at an issue price of $20. If you want to subscribe, check here ().einvest.sagicorjamaica.com/offers

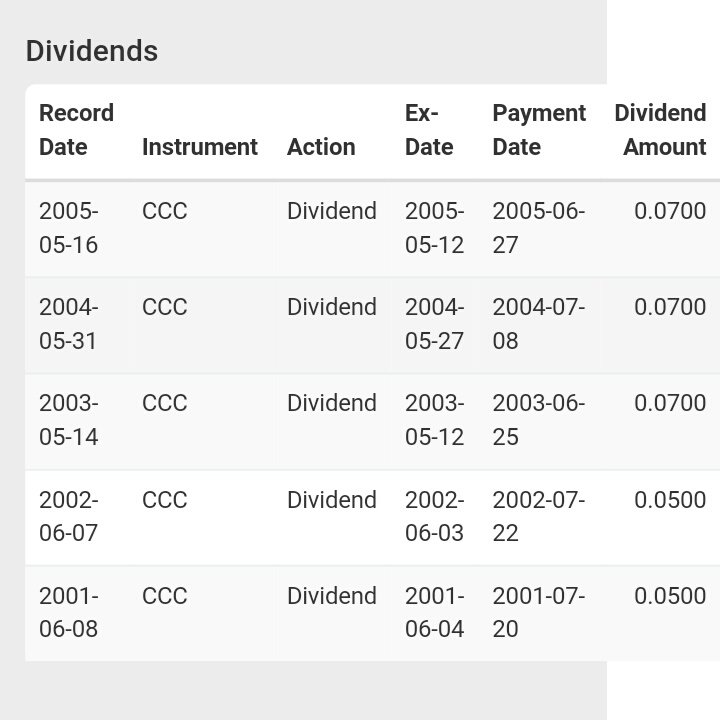

https://twitter.com/JCKNIGHT2/status/1151201353928253442?s=20For those looking for price data, here's a trick. jamstockex.com/market-data/do… Edit this link above and change the symbol to the desired stock and you'll get the prices from December 31, 2017 - January 3, 2020. For those looking for dividend, stock split and rights issue data, check

$KEY.ja is up 15% for the month after news of $GK.ja's intention to acquire a majority stake in the company. This comes after the company reported a $298.8 Million net loss for the 9 months with claims nearly consuming premium income. bit.ly/2OeGn79

$KEY.ja is up 15% for the month after news of $GK.ja's intention to acquire a majority stake in the company. This comes after the company reported a $298.8 Million net loss for the 9 months with claims nearly consuming premium income. bit.ly/2OeGn79

https://twitter.com/JCKNIGHT2/status/1172774686696103936@JMMBGROUP & @SagicorJa not assisting some clients with the IPO application and the relatively small allocation to the public (jamstockex.com/limners-and-ba…), there was an expectation that the company would increase in price very quickly. jamstockex.com/market-data/li… Within the first few