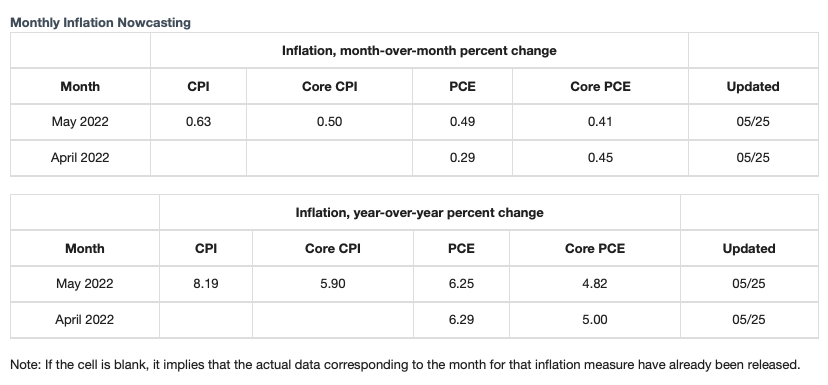

1/5. A Bloomberg article this morning discussing the Fed minutes put me onto a resource I was not aware of before: the Cleveland Fed's 'Inflation Now Cast'.

clevelandfed.org/our-research/i…

clevelandfed.org/our-research/i…

2/5. Does not bode well for official Private Consumption Expenditures (PCE) inflation index (Fed's favourite) release out tomorrow. Both 5.00% y/y & 0.45% m/m core PCE figures for April are slightly ahead of consensus. Trading Economics has core PCE y/y at 4.90% & m/m at 0.30%.

3/5. Note also that in the Working Paper backing this Now Cast Inflation model, the Cleveland Fed claims that its #s are superior to a the most popular consensus forecasts.

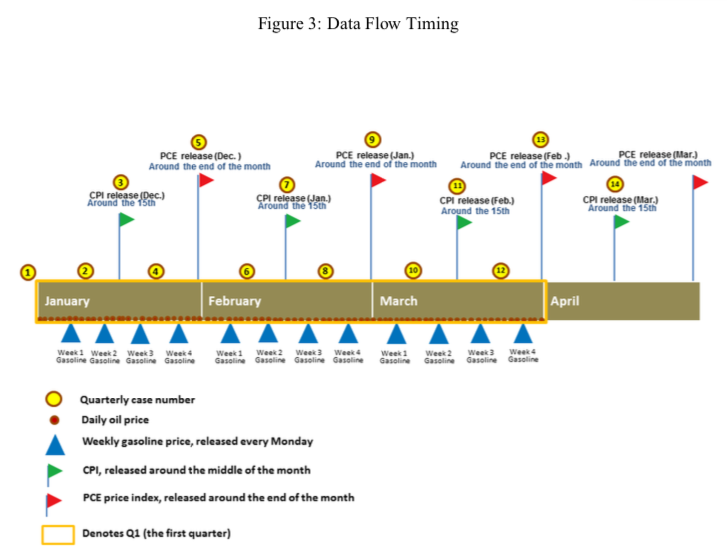

4/5. The Working Paper also has this data time line if you are confused over the release schedule of the PCE and CPI. The link to the Working Paper is below.

clevelandfed.org/en/newsroom-an…

clevelandfed.org/en/newsroom-an…

5/5. Cleveland Fed says that they update their CPE & PCE Inflation Now Cast daily. Definitely will be a resource I will be checking in on from time to time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh