About -

Allcargo Logistics Ltd. (ALL) provides logistics services such as Non-Vessel Owning Common Carrier (NVOCC), Container Freight Station(CFS), Inland Container Depot (ICD), warehousing, coastal shipping, express logistics, project logistics and equipment leasing.

Allcargo Logistics Ltd. (ALL) provides logistics services such as Non-Vessel Owning Common Carrier (NVOCC), Container Freight Station(CFS), Inland Container Depot (ICD), warehousing, coastal shipping, express logistics, project logistics and equipment leasing.

Financial Summary -

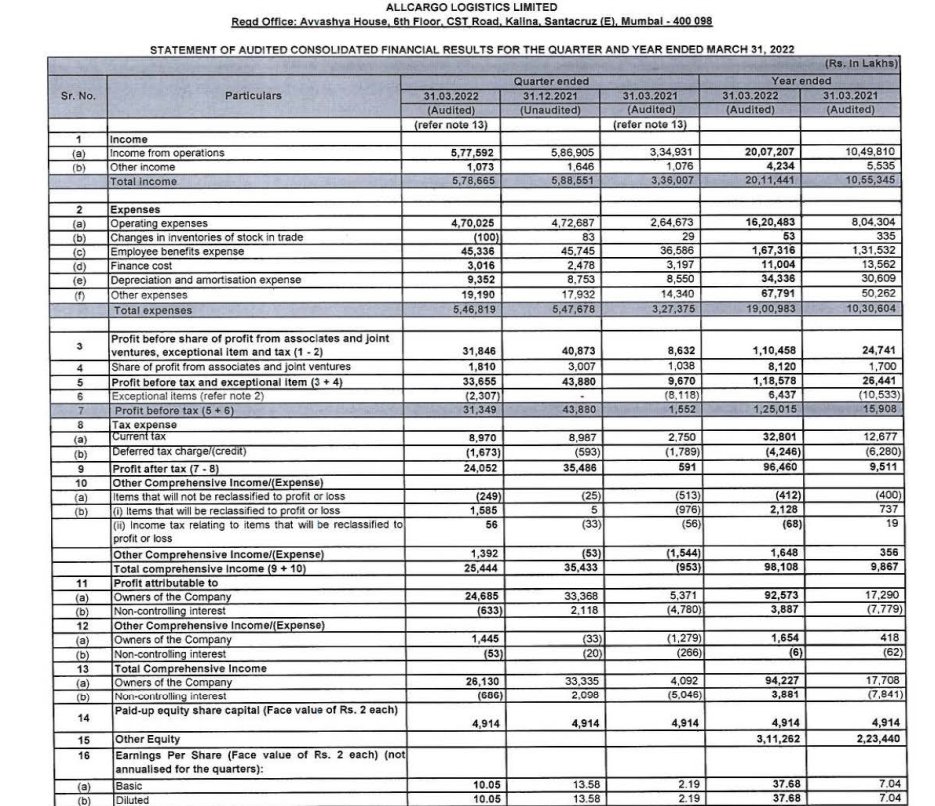

Q4 FY22 (YoY)

Revenue were at ₹ 5786 Cr vs 3360 Cr

PBT at ₹ 337 Cr vs 97 Cr

PAT at ₹ 241 Cr vs 6 Cr

Q4 FY22 (YoY)

Revenue were at ₹ 5786 Cr vs 3360 Cr

PBT at ₹ 337 Cr vs 97 Cr

PAT at ₹ 241 Cr vs 6 Cr

END-TO-END Integrated Logistics Solutions Experts

International Supply Chain (MTO) -

• Market Leadership in LCL through complex hub & spoke network.

• Operates 4,000 port pairs & 2,400 direct trade lanes

• Unlocking next stage of growth through FCL, Air & Door-to-Door

International Supply Chain (MTO) -

• Market Leadership in LCL through complex hub & spoke network.

• Operates 4,000 port pairs & 2,400 direct trade lanes

• Unlocking next stage of growth through FCL, Air & Door-to-Door

Container Freight Stations & ICDs -

• CFS at JNPT, Chennai, Mundra, Kolkata & 1 ICD at Dadri

• Total handling capacity of over 1 Mn TEUs (asset light facilities)

• One of the largest CFS operators

• CFS at JNPT, Chennai, Mundra, Kolkata & 1 ICD at Dadri

• Total handling capacity of over 1 Mn TEUs (asset light facilities)

• One of the largest CFS operators

Express & Ecommerce Logistics -

• Solutions for time bound, door to door, high value, critical shipments

• Pan-India coverage, 99% of the GoI approved Pincodes

• Customised Supply Chain solutions to consumer industries

• Solutions for time bound, door to door, high value, critical shipments

• Pan-India coverage, 99% of the GoI approved Pincodes

• Customised Supply Chain solutions to consumer industries

Contract Logistics -

• Offers 3PL - Logistics, Warehousing & other value added services

• Area under management ~5 mn sq.ft. across 45 locations

• Indian & International clients in chemicals, pharma, auto, e-com etc.

• Offers 3PL - Logistics, Warehousing & other value added services

• Area under management ~5 mn sq.ft. across 45 locations

• Indian & International clients in chemicals, pharma, auto, e-com etc.

Rental & Other Businesses -

• Logistics Parks providing customized sector specific Grade A warehouses

• Projects division moving ODC cargo aiding infrastructure creation.

• Own & operate cranes & container handling equipments, etc.

• Logistics Parks providing customized sector specific Grade A warehouses

• Projects division moving ODC cargo aiding infrastructure creation.

• Own & operate cranes & container handling equipments, etc.

Multimodal Transport Operations (MTO) -

The global MTO business is the largest revenue contributing segment for ALL. MTO segment includes Non-Vessel Operating Common Carrier (NVOCC) operations, including Less than Container Load (LCL) consolidation & FCL forwarding activities.

The global MTO business is the largest revenue contributing segment for ALL. MTO segment includes Non-Vessel Operating Common Carrier (NVOCC) operations, including Less than Container Load (LCL) consolidation & FCL forwarding activities.

Shortage continues across the globe for ocean shipment in both FCL/LCL. Ocean Export freight rates continue to remain highest for Latin America, South America, North America, Australia & Africa.

Container Freight Station (CFS)/ Inland Container Depots (ICD) -

The CFS /ICD segment operations cater to the handling of import and export cargo, customs clearance, warehousing, and other related ancillary logistics services.

These CFS/ICD facilities have a total installed

The CFS /ICD segment operations cater to the handling of import and export cargo, customs clearance, warehousing, and other related ancillary logistics services.

These CFS/ICD facilities have a total installed

capacity of 5,00,000 TEUs, geared with the latest technology and backed by experienced teams who are equipped and trained to handle all import and export shipment requirements.

Projects and engineering (P&E) -

The projects and engineering segment provides services offering integrated end-to-end logistics services, including transportation of overdimensional & over-weight cargo, on-site lifting & shifting, equipment leasing, and coastal shipping.

The projects and engineering segment provides services offering integrated end-to-end logistics services, including transportation of overdimensional & over-weight cargo, on-site lifting & shifting, equipment leasing, and coastal shipping.

Allcargo has a fleet of 800+ owned equipment capable of executing projects, which need specialised cranes and lifting solutions, ranging in capacity from 50 to 3,000 metric tons.

Logistics parks -

Allcargo is building strategically located logistics parks across India on ~300 acres of land that they already own. These logistics parks help enhance the end-to-end logistics services capabilities of the company by providing warehousing, contract logistics,

Allcargo is building strategically located logistics parks across India on ~300 acres of land that they already own. These logistics parks help enhance the end-to-end logistics services capabilities of the company by providing warehousing, contract logistics,

and first & last-mile connectivity.

The company has built 6 mn sq. ft. of warehouses having strong connectivity to industrial hubs and transport routes. The company has focused on an asset-light strategy by moving assets to SPVs with planned stake dilution.

The company has built 6 mn sq. ft. of warehouses having strong connectivity to industrial hubs and transport routes. The company has focused on an asset-light strategy by moving assets to SPVs with planned stake dilution.

Supply Chain Management (SCM) -

The SCM and contract logistics business of Allcargo is carried out by its associate company AVVASHYA CCI.

Allcargo is a majority shareholder of the company owning a 61.2% stake. Services of the company include design and planning supply chains,

The SCM and contract logistics business of Allcargo is carried out by its associate company AVVASHYA CCI.

Allcargo is a majority shareholder of the company owning a 61.2% stake. Services of the company include design and planning supply chains,

warehousing, transporting & managing inventory for key clients in chemicals, auto & engineering, fashion & retail, including e-commerce sectors.

The co manages 3.5+ mn sq. ft. of warehousing space across 45 locations in India.

The co manages 3.5+ mn sq. ft. of warehousing space across 45 locations in India.

GATI - Express Logistics :

Co completed acquisition of a 46.86% stake in Gati in April 2020. The board of Gati has approved allotment of shares & warrants to ALL on 17 June 2021 to raise Rs.80 cr, so that post the conversion of warrants, the stake of ALL would rise to 50.2%.

Co completed acquisition of a 46.86% stake in Gati in April 2020. The board of Gati has approved allotment of shares & warrants to ALL on 17 June 2021 to raise Rs.80 cr, so that post the conversion of warrants, the stake of ALL would rise to 50.2%.

Gati Ltd. offers a wide range of services, viz. express distribution, supply chain management solution, e-commerce logistics, managed value-added transportation services (MVATS) & fuel stations. Express distribution & supply chain segment contributes 78% to revenue, while the

fuel station contributes 18%. The co has an pan-India presence that covers 735 out of the total of 739 districts in the country, operating on more than 1,900+ scheduled routes with 1,500 fleet,

5,000+ trucks and 600+ operating centres, &7,000 business partners.

5,000+ trucks and 600+ operating centres, &7,000 business partners.

Clients -

Co has Strong & long-term relations with Diversified Customers across Geographies.

Some of their Top Customers are :

Co has Strong & long-term relations with Diversified Customers across Geographies.

Some of their Top Customers are :

Key Risks -

• Volatility in EXIM trade volume

• Increasing competition in CFS

• A slowdown in the domestic economy will adversely impact P&E business

• Delays in turnaround of Gati’s operations would have

negative pressure on the rating.

• Volatility in EXIM trade volume

• Increasing competition in CFS

• A slowdown in the domestic economy will adversely impact P&E business

• Delays in turnaround of Gati’s operations would have

negative pressure on the rating.

Conclusion -

ALL has a leading position in the MTO segment, strategically located CFS at JNPT, Mundra, Chennai & Kolkata, primarily mitigating risks related to the

economic environment and trade volumes, as more than 80% of container traffic in India is handled by these four

ALL has a leading position in the MTO segment, strategically located CFS at JNPT, Mundra, Chennai & Kolkata, primarily mitigating risks related to the

economic environment and trade volumes, as more than 80% of container traffic in India is handled by these four

ports.With the acquisition of Gati, ALL will further enhance its presence into land and air freight.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful. @nid_rockz @safiranand @bullish_india

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful. @nid_rockz @safiranand @bullish_india

• • •

Missing some Tweet in this thread? You can try to

force a refresh