Swansea City’s 2020/21 accounts covered a season when they finished 4th in the Championship, thus reaching the play-offs, but were beaten in the final by Brentford. Head coach Steve Cooper since replaced by Russell Martin. Some thoughts in the following thread #Swans

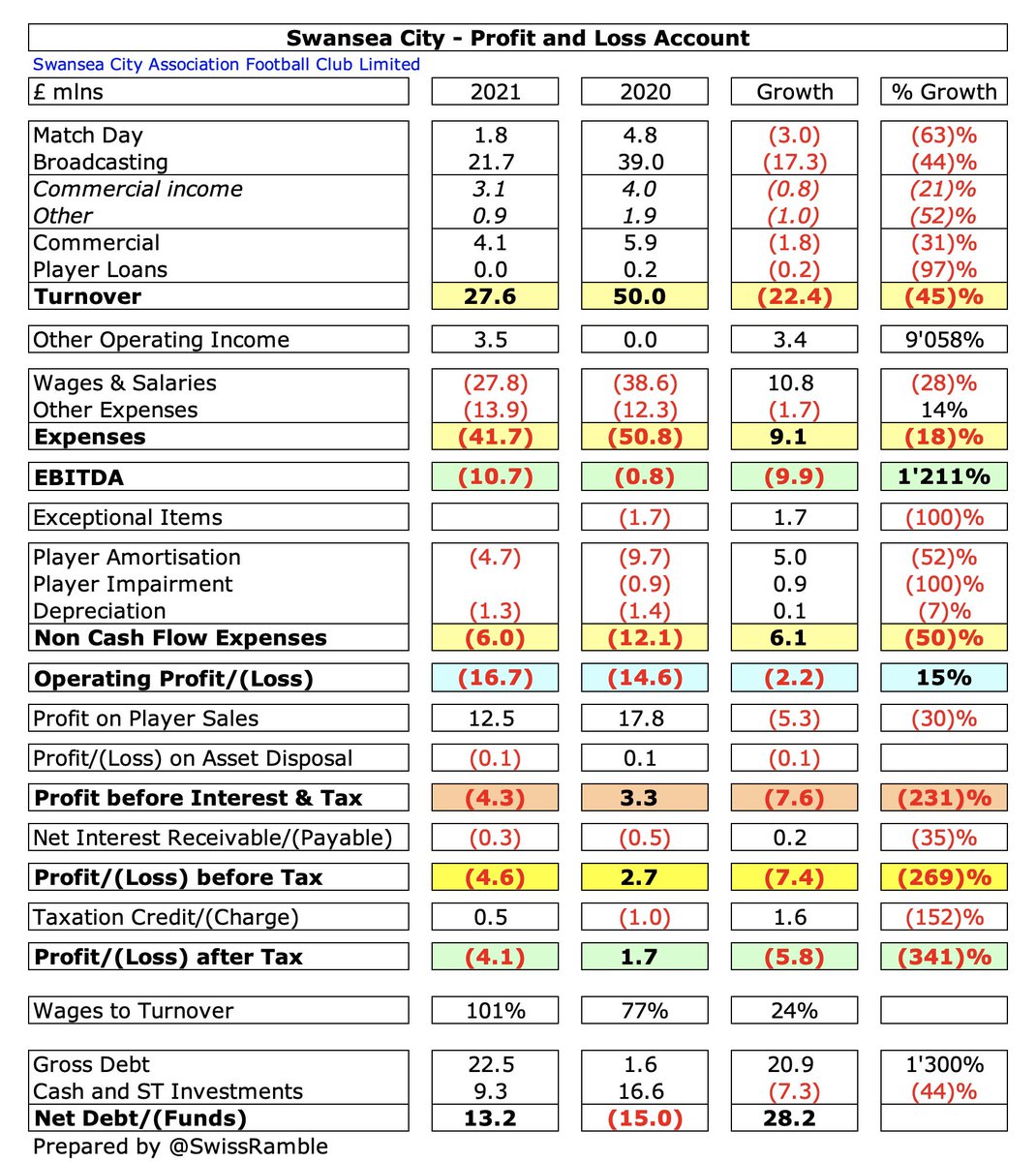

#Swans swung from a pre-tax profit of £2.7m to a loss of £4.6m, as revenue fell £22m (45%) from £50m to £28m and profit from player sales dropped £5m (30%) to £12m, partly offset by total expenses reducing by £17m (26%) and £3.3m insurance claim. Loss after tax was £4.1m.

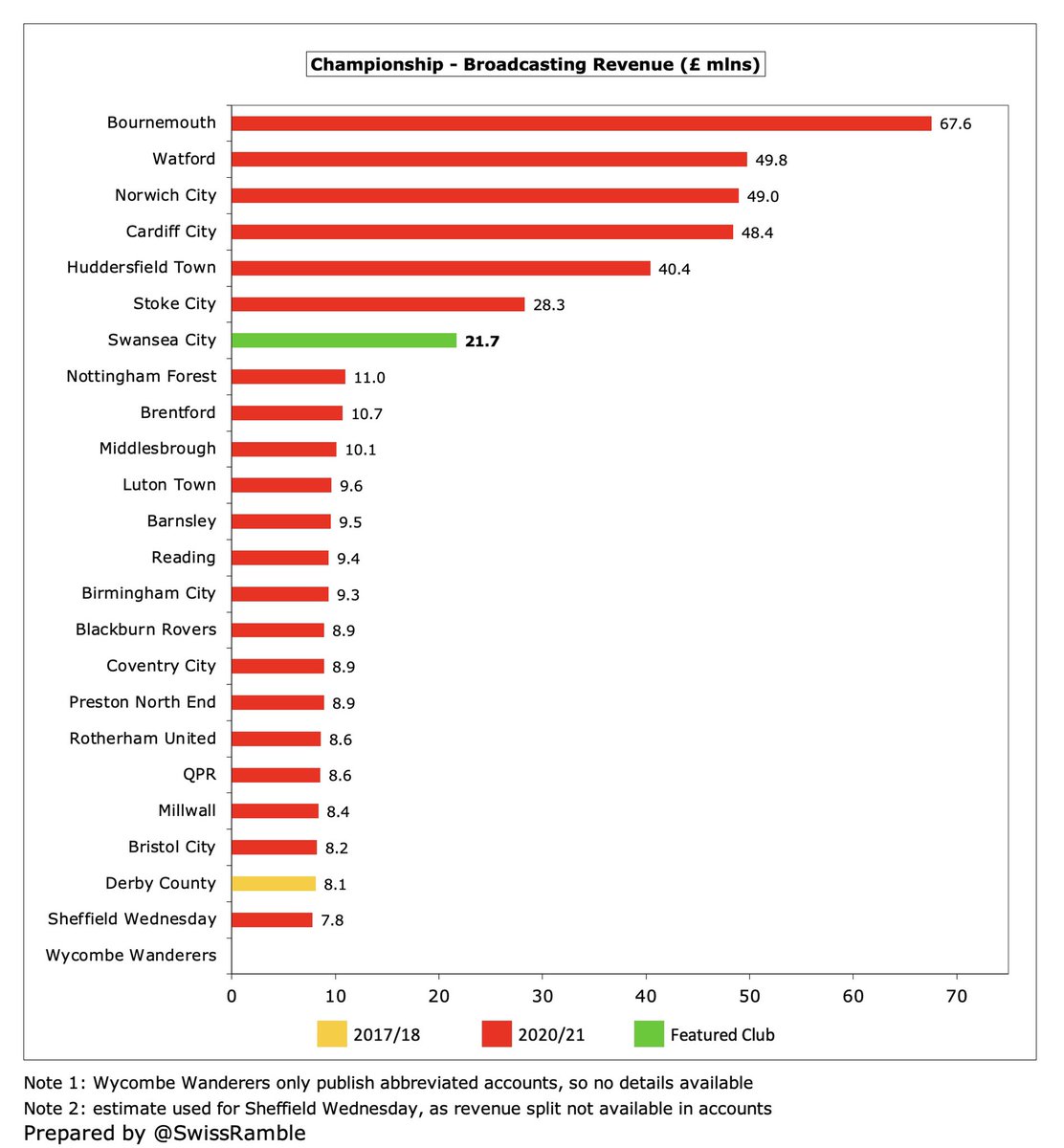

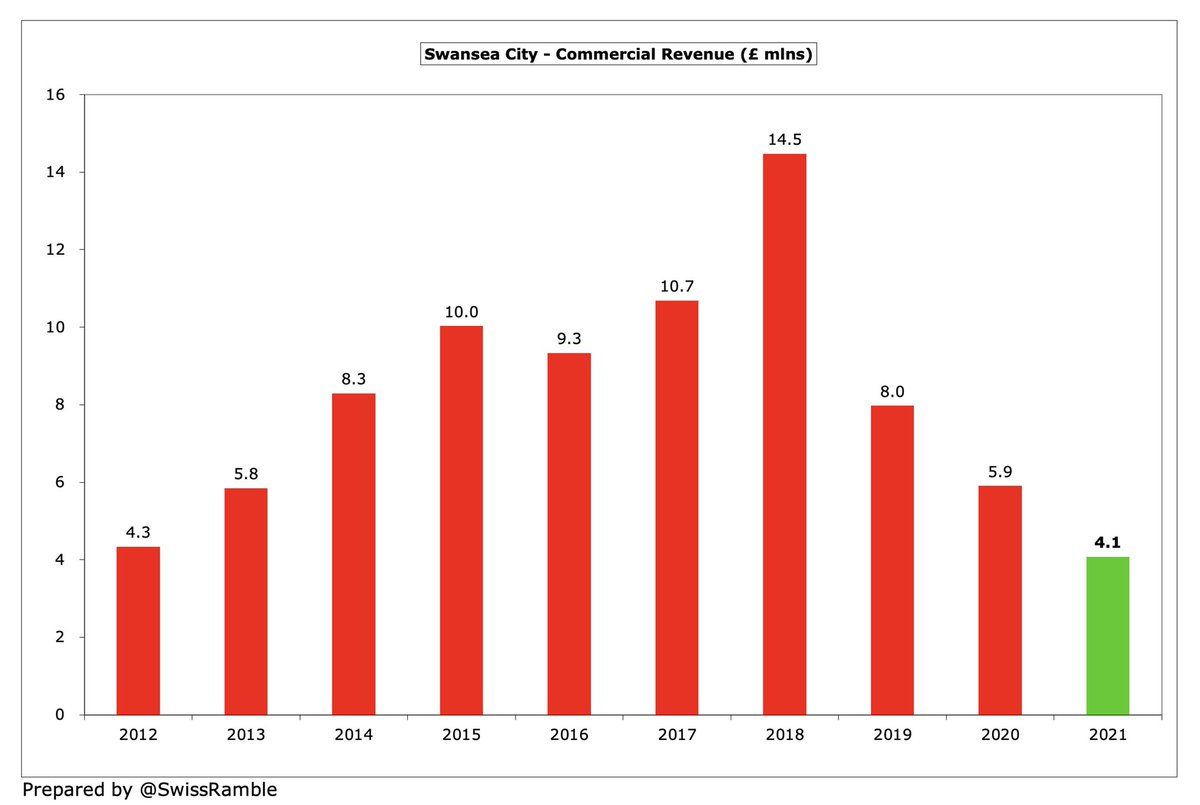

The main reason for #Swans £22m revenue decrease was broadcasting, which dropped £17m (44%) from £39m to £22m, mainly due to lower parachute payment, though COVID also drove reductions in match day, down £3.0m (63%) to £1.8m, and commercial, down £1.8m (31%) to £4.1m.

To offset the steep revenue reduction, #Swans cut the wage bill by £11m (28%) from £39m to £28m, while player amortisation/impairment was down £6m (56%) to £5m and there was no repeat of £2m exceptional items. However, other expenses increased £2m (14%) to £14m.

Although a loss is rarely good news, #Swans £4.6m deficit was one of the better results in 2020/21 with 5 clubs posting losses above £20m. As chief executive Julian Winter said, “The club remains in a comparatively positive financial position within the Championship.”

#Swans did not quantify the adverse impact of COVID-19, though this obviously impacted gate receipts, retail and hospitality revenue, even though these were partly mitigated by a successful insurance claim.

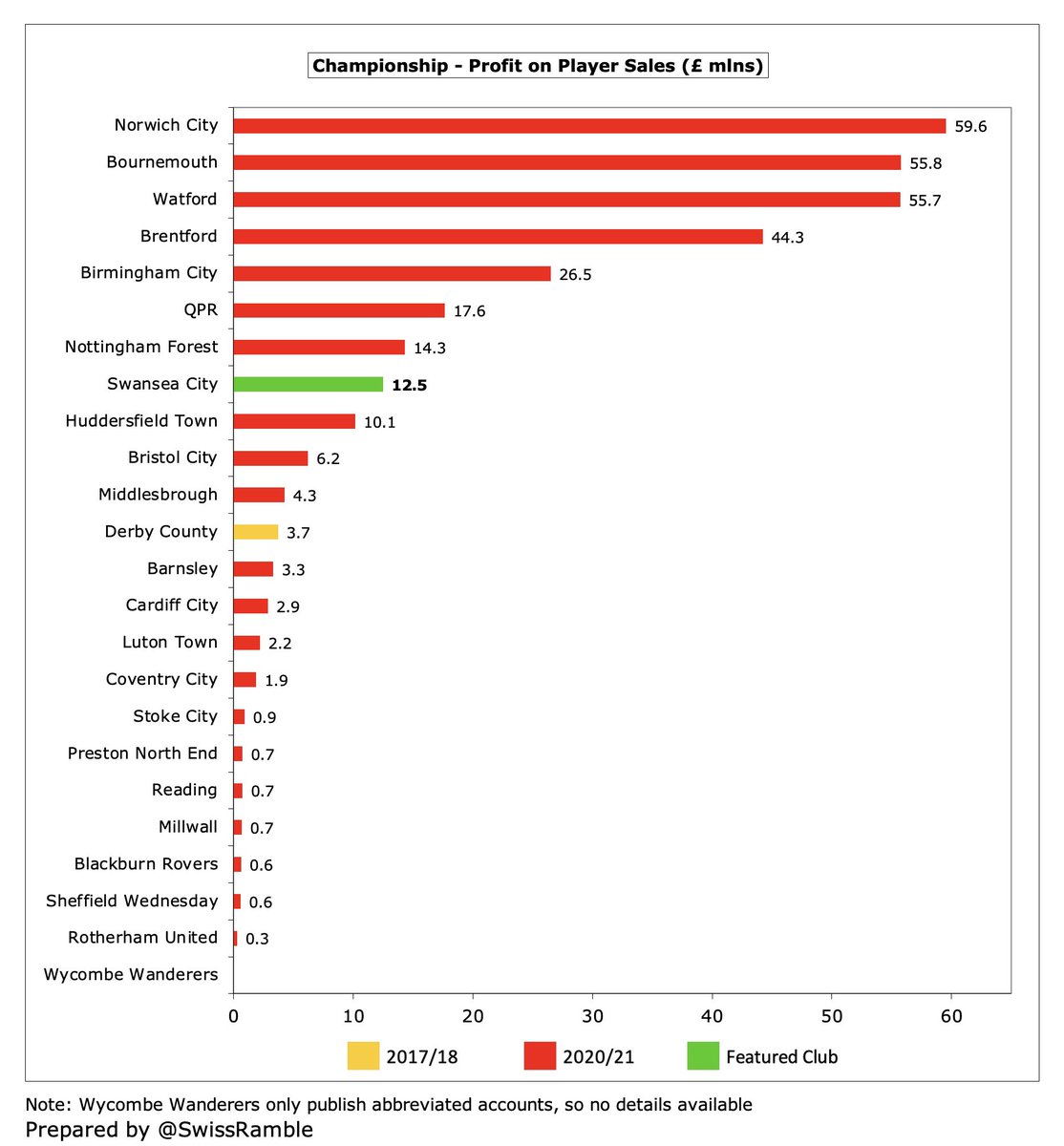

#Swans noted that £12.5m profit from player sales was “used to partially fund the operating loss”, though down from prior year’s £17.8m. Mainly came from sale of Joe Rodon to #THFC. Still pretty good, but a fair bit lower than #NCFC, #AFCB and Watford (with £56m to £60m).

In their seven seasons in the Premier League (between 2012 and 2018), #Swans profits amounted to an impressive £36m. Performance has deteriorated in the last three seasons in the Championship, but this has only resulted in a relatively low net loss of £9m.

#Swans have become quite reliant on player sales, adding up to £144m in last 5 years, compared to £46m in preceding 5-year period. This season’s profit will be lower (Connor Roberts to Burnley & Jamal Lowe to #AFCB), so more player trading likely this summer to balance the books.

If #Swans forecast player sales are not achieved, they would need to find further sources of funding to maintain cash flow. The auditors noted, “This represents a material uncertainty which may cast significant doubt about the club’s ability to continue as a going concern.”

#Swans operating loss (i.e. excluding player sales and interest) worsened from £13m to £17m, though this is actually one of the better performances in the Championship. Almost every club in this division posts substantial operating losses, i.e. ten of them are above £30m.

Since relegation from the Premier League, #Swans revenue has dropped by £99m (78%) from £127m in 2018 to £28m, very largely due to less TV money in the Championship (£83m decrease), though commercial and match day are also down £10m and £6m respectively.

#Swans revenue decline has been cushioned by Premier League parachute payments, though these have fallen in each of the three years since relegation: 2019 £43m, 2020 £34m and £2021 £15m. Last season was the final tranche, so 2021/22 revenue will be even lower.

Even after the fall, #Swans £28m revenue was still 7th highest in the 2020/21 Championship, though less than half of the clubs receiving the largest parachute payments (#AFCB £72m, #NCFC £57m and Watford £57m).

#Swans broadcasting income fell £17m (44%) from £39m to £22m, due to the smaller parachute payment, which is the club’s lowest since 2011. Most Championship clubs receive £8-10m TV money, but there is a huge gap to clubs benefiting from parachutes.

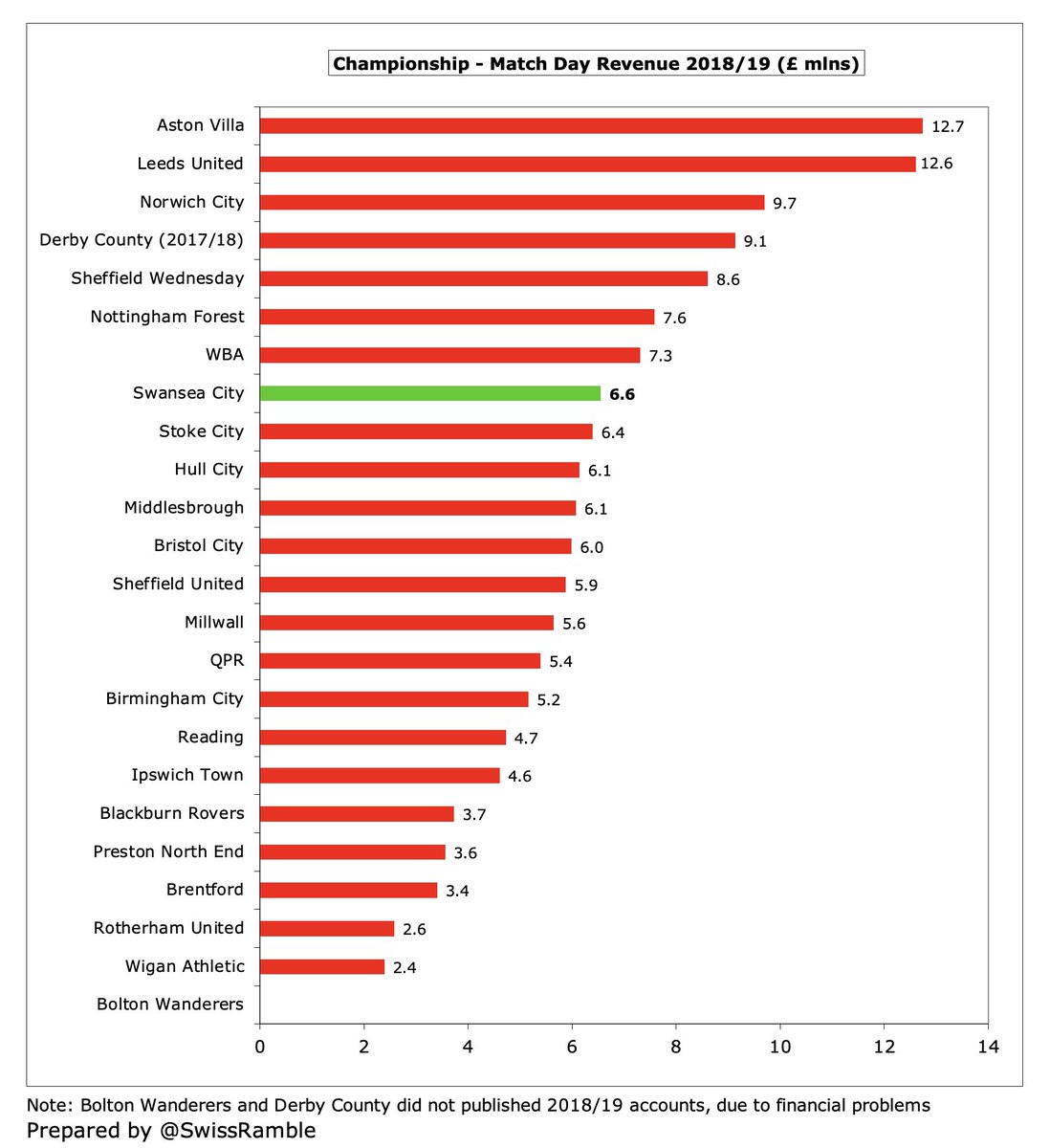

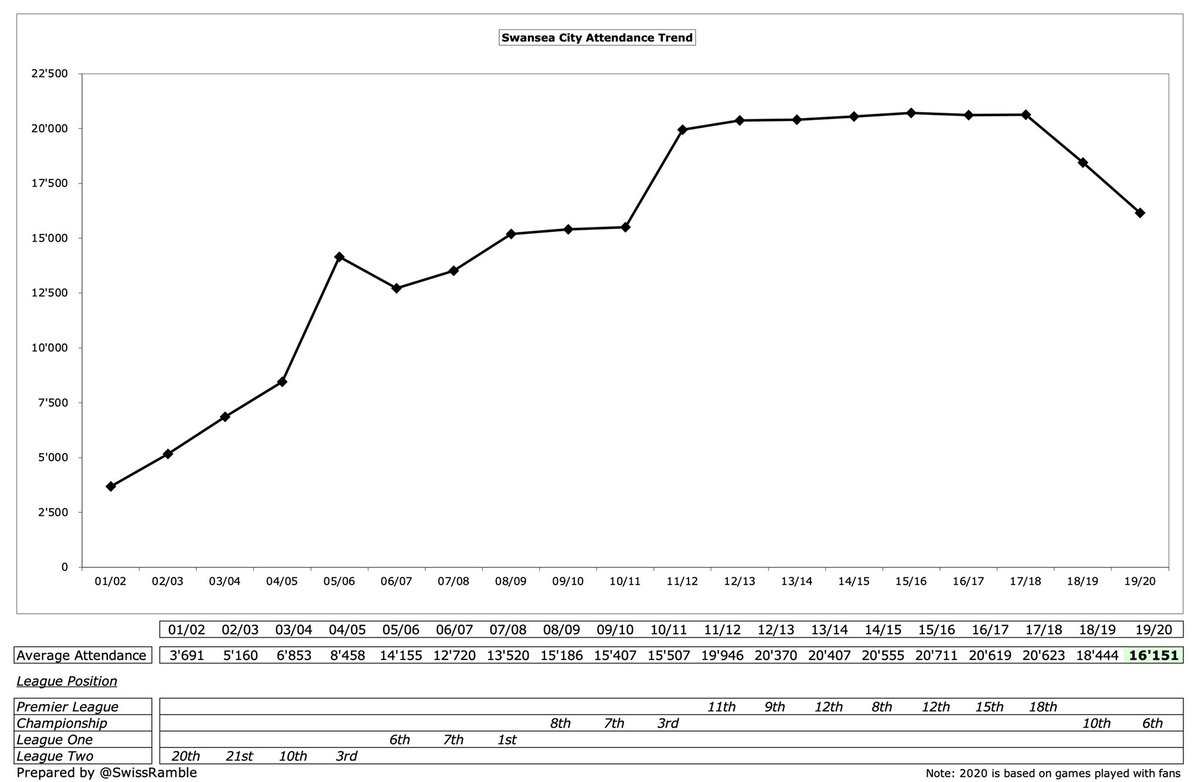

#Swans match day income dropped £3.0m (63%) to £1.8m, as all home games were played behind closed doors, though some fans donated their season ticket money. This revenue stream was 8th highest in the Championship before the pandemic in 2019, but has now fallen 9 years in a row.

#Swans average attendance in 2019/20 (for games played with fans) was 16,151, which was in the bottom half of the Championship. Down 4,500 (22%) since relegation. The club slashed ticket renewal prices for the 2021/22 campaign.

#Swans have bought the land at the south end of the stadium, while acquiring 100% of the company responsible for the Liberty Stadium management. This would facilitate stadium capacity expansion, but this would only be considered after a return to the Premier League.

#Swans commercial revenue fell £1.8m (31%) to £4.1m, comprising £3.1m commercial income and £0.9m other, the lowest since 2011 and down from £14.5m three years ago. Mid-table in the Championship, a fair way below the likes of Stoke City £12m, #NCFC £8m and Bristol City £8m.

#Swans had a new shirt sponsor in 2020/21, as Swansea University replaced YOBET, with the deal since extended to 2021/22. The long-term kit supplier agreement with Joma was extended three years to 2022/23.

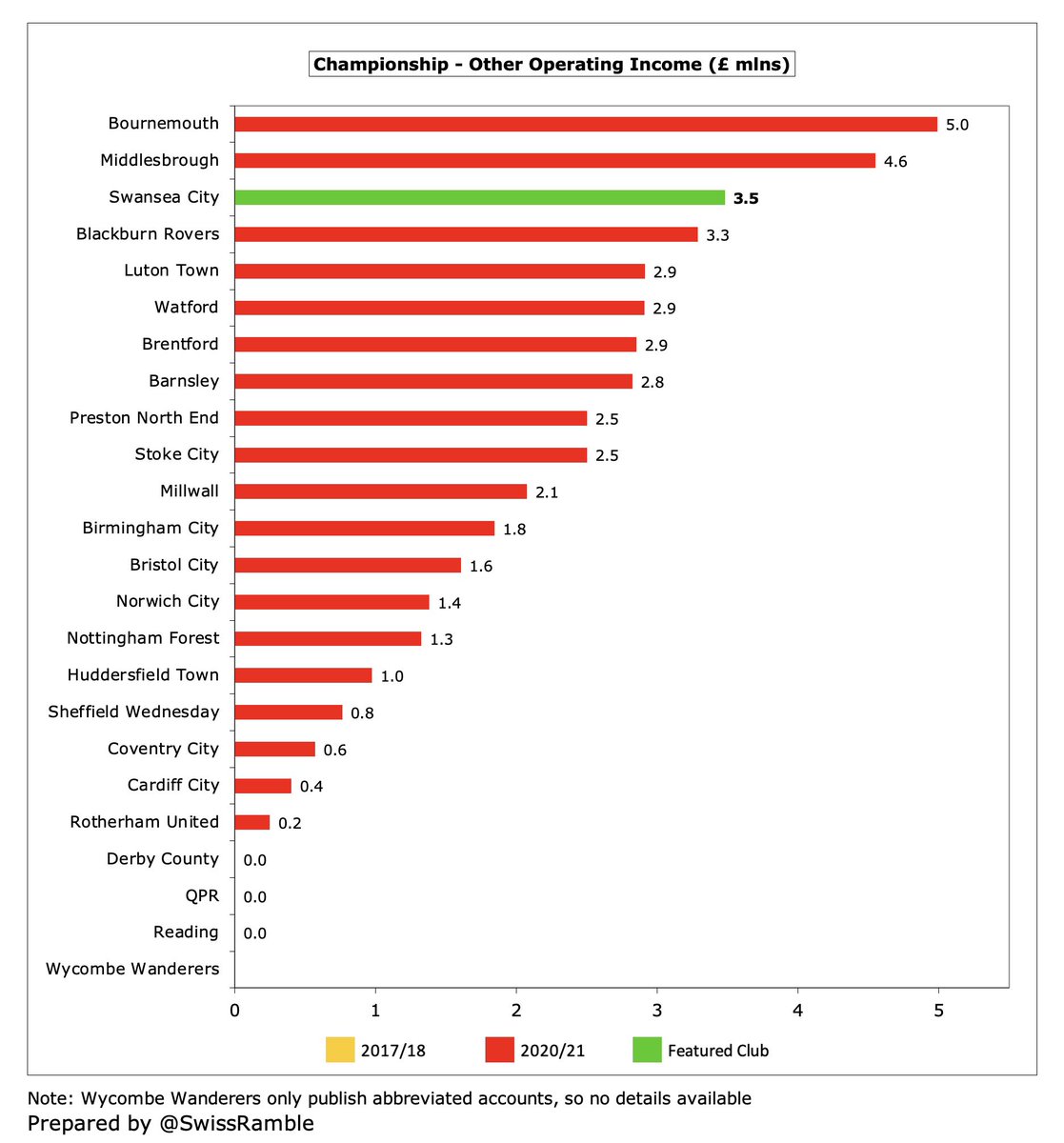

#Swans had £3.5m other operating income, including insurance proceeds £3.3m and Premier League grant income £0.1m. Third highest in this category in the Championship, only below #AFCB £5.0m (including £1.8m player loans) and #Boro £4.6m.

#Swans wage bill fell £11m (28%) from £39m (excluding £1.7m onerous contracts) to £28m, which means that wages have been cut by £63m (69%) in the three years since relegation (revenue down £99m in same period). Club’s lowest wage bill since £17m in 2011.

Following the decrease, #Swans £28m wage bill is mid-table in the Championship. Less than half of Watford £68m, #NCFC £67m and #AFCB £57m (though the first two included hefty promotion bonuses). Number of staff reduced from 409 in the Premier League to 244.

Despite the reduction in wages, #Swans wages to turnover ratio increased from 77% to 101%, though this was actually one of the lowest (best) in the Championship. The vast majority of clubs in this division have unsustainable ratios well above 100% (incredibly six are over 200%).

Total remuneration for #Swans directors increased by 83% from £310k to £568k, the 8th highest in the Championship, though the amount for the highest paid director more than halved from £310k to £142k.

#Swans player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell significantly by £5m (52%) from £10m to £5m, the club’s lowest since 2012 and in the bottom half of the Championship. Reduction partly due to previous player impairment.

#Swans spent £4.3m on player purchases, including Jamal Lowe, Morgan Whittaker and Ryan Manning. This was mid-table in the Championship, but a long way below the likes of Brentford, #NCFC and Watford (£21-22m).

#Swans have only spent £8m on transfers in the three years since relegation, a massive reduction on the £120m splashed out in the last two seasons in the Premier League. Net sales of £70m since 2019. Similar story this season with only £4.6m outlay.

#Swans gross debt rose £21m from £2m to £23m, including £13.6m convertible loan (as a result of director Jake Silverstein’s investment in August 2020) and two interest-free EFL loans amounting to £7.5m. This is the club’s highest debt since 2015.

Despite the increase, #Swans £23m gross debt is one of the smallest in the Championship, far below Stoke City £212m, #AFCB £165m, #BRFC £152m and Watford £139m. However, almost all debt in this division is from the clubs’ owners, so is “soft” in nature.

#Swans convertible loan charges interest at 5% a year, though £0.5m was added to the outstanding debt in 2020/21, so the club only paid £136k. Much of the loans in the Championship are provided interest-free by club owners, so only four paid more than £1m last season.

#Swans don’t separately report transfer debt, but assuming 90% of Trade Creditors, this fell slightly to £3m. Swansea are owed £11m by other clubs, so they have £8m net receivables. In addition, there are £6m contingent liabilities, dependent on appearances, team success, etc.

#Swans £17m operating loss worsened to £37m cash flow, as £6m non-cash items were offset by £27m working capital moves, boosted by £11m net player sales (sales £15m, purchases £4m). Shortfall funded by £13m owner loans and £7m external loans, but £7m net outflow.

As a result, #Swans cash balance fell from £17m to £9m, though was still 3rd highest in the Championship, only surpassed by #NCFC £17m and Brentford £13m. Most clubs in this division held less than £3m cash in the bank, emphasising clubs’ reliance on their owners’ money.

In the last decade #Swans had £50m available cash: £32m from operations plus £17m new loans. Most has been spent on infrastructure £31m with only £3m on player purchases (net). Another £4m went on dividends and £2m interest. The rest simply increased the cash balance by £10m.

#Swans are now in the sixth season under the control of an American consortium led by Stephen Kaplan and Jason Levien, who bought 68% of the shares, while the Supporters Trust hold 21%. Jake Silverstein also made a “significant investment” in the club in August 2020.

The owners put in £13m convertible loan notes last year, but have otherwise been unwilling (or unable) to provide funding with player sales covering any shortfall. The sustainable approach is admirable, but #Swans fans will have noted the club’s decline since their arrival.

In fact, #Swans owner funding in the last 10 years is firmly in the bottom half of the Championship, as their £13m is significantly lower than other clubs, e.g. QPR £283m, Stoke City £195m and Cardiff City £194m, though money has clearly not been a guarantee of success.

Given their sustainable model, it is no surprise that #Swans have no problem with Profitability and Sustainability rules. In fact, their aggregate loss over the 3-year monitoring period is well within target even before allowable deductions for “good” investment and COVID impact.

As #Swans chief executive Julian Winter noted, “These accounts covered an extremely uncertain period for all clubs”, so a small loss is pretty good in the circumstances. However, the challenge now is how to move forward (sustainably) without the benefit of parachute payments.

• • •

Missing some Tweet in this thread? You can try to

force a refresh