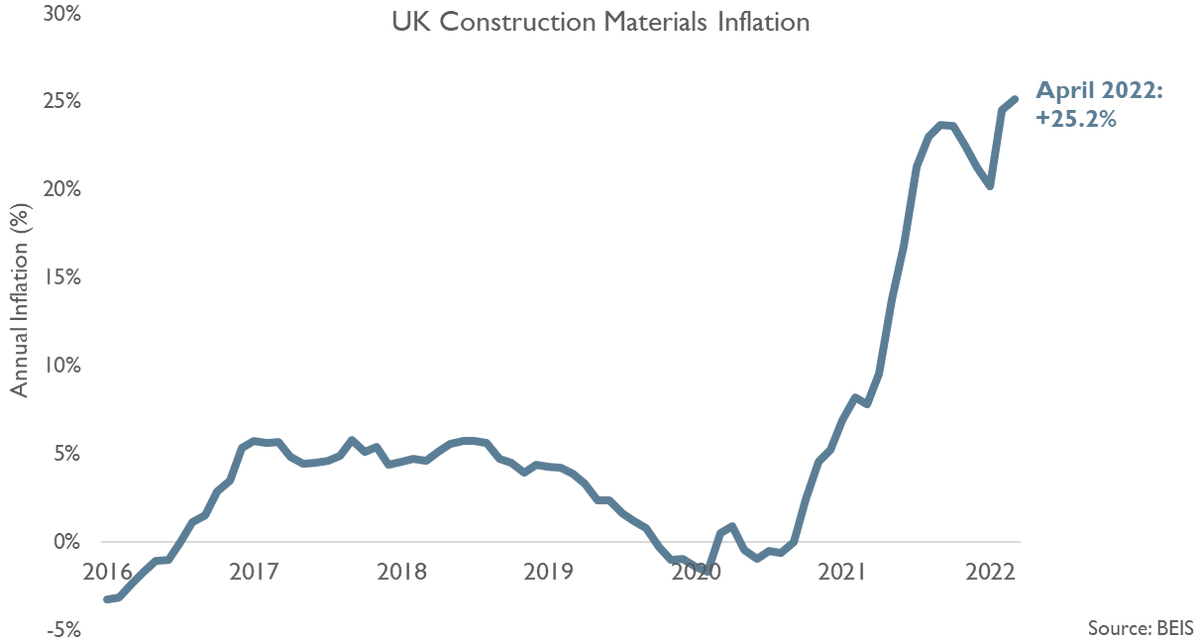

A further rise in UK construction materials prices as expected as the spikes in energy costs & commodity prices continue to feed through after the Ukraine invasion. Materials prices in April 2022 were 25.2% higher than a year ago according to BEIS...

#ukconstruction #construction

#ukconstruction #construction

... & the 25.2% annual increase in UK construction materials prices in April 2022 compares with 24.5% in March & the recent peak of 23.7% in October 2021 (when there were materials availability issues) & it is worth noting that, firstly,...

#ukconstruction #construction

#ukconstruction #construction

... materials prices in April 2022 were not only 25.2% higher than a year ago but prices are now 38.4% higher than in January 2020, pre-pandemic, which affects contractors on fixed-price contracts signed up to over the last few years, secondly...

#ukconstruction #construction

#ukconstruction #construction

... the full impact of energy cost & commodity price rises on construction materials inflation after the Ukraine invasion will still be coming through over the next 3-6 months due to the use pre-purchasing & forward contracts &, thirdly,...

#ukconstruction #construction

#ukconstruction #construction

... that the UK construction materials inflation varies considerably by product, with the sharpest price rises in the year to April 2022 on steel products such as concrete reinforcing bars (62%) & fabricated structural steel (46%) because...

#ukconstruction #construction

#ukconstruction #construction

... 13% of UK imports of construction steel come from Russia & Ukraine (so supply is directly affected & there is a rise in demand & price from other sources), recent commodity price spikes are leading to iron ore & steel price rises plus...

#ukconstruction #construction

#ukconstruction #construction

... steel construction is energy-intensive (& energy costs account for between 25% & 33% of total costs for energy-intensive product manufacturers) so the recent sharp energy cost rises are also contributing to the sharp price rises. For...

#ukconstruction #construction

#ukconstruction #construction

... softwood timber products, around 6% of UK imports come from Russia & Ukraine so there is a slight supply impact & import price rise as demand rises from other sources although these are not energy-intensive products so the price rises are not...

#ukconstruction #construction

#ukconstruction #construction

... for softwood timber are not as high as for steel & it is worth noting timber prices were falling, albeit from high levels, between October 2021 & February 2022 with prices rising from March 2022 due to the Ukraine invasion supply impact &...

#ukconstruction #construction

#ukconstruction #construction

... & as construction activity ramps up in the Spring in certain sectors such as private housing & renovation combined with merchant stocks of softwood timber simultaneously falling.

#ukconstruction #construction

#ukconstruction #construction

• • •

Missing some Tweet in this thread? You can try to

force a refresh