This thread is on Investing in FGN Savings Bonds with as little as N5,000.

#getfinanceandinvestmentip #savingsbonds

#getfinanceandinvestmentip #savingsbonds

1/ What is FGN Savings Bond?

A savings bond is a government bond/financial instrument used to borrow money from retail investors. It is considered one of the safest investments because they are backed by the full faith & credit of the FG.

A savings bond is a government bond/financial instrument used to borrow money from retail investors. It is considered one of the safest investments because they are backed by the full faith & credit of the FG.

2/ Similar to a typical bond, when you buy a savings bond, you're effectively lending your money to the government at a fixed rate of interest, with the government responsible for returning the loan in full plus interest.

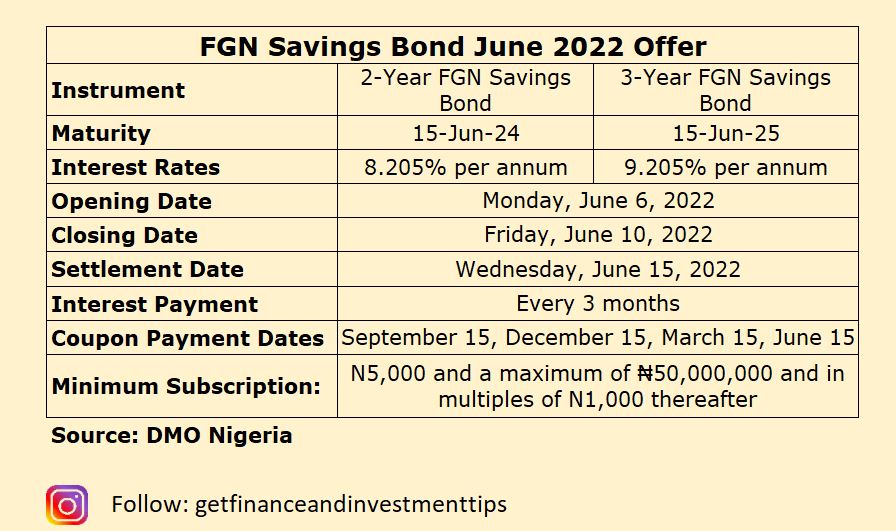

3/ The bond is issued monthly by the Debt Management Office (DMO) on behalf of the government, it is available for five days from the date of announcement and the tenor is 2 and 3 years.

4/ Features/Benefits of a Savings Bond

a. The bond is issued monthly by the FG through the DMO via an offer for subscription at an interest rate based on market rates. The rates are announced by the DMO on the first day of each month.

a. The bond is issued monthly by the FG through the DMO via an offer for subscription at an interest rate based on market rates. The rates are announced by the DMO on the first day of each month.

5/ b. The bond earns an investor a coupon or an interest income that is paid quarterly, and directly into the investor’s bank account. Notably, the interest rate for the June 2022 auction was 8.205% for the 2-year bond and 9.205% for the 3-year bond.

6/ ...The coupon/interest income from the Savings Bond is tax-free.

c. The bond is tailored towards encouraging a savings culture, therefore, the minimum investment amount is as low as N5,000, while the maximum amount is N50,000,000.

c. The bond is tailored towards encouraging a savings culture, therefore, the minimum investment amount is as low as N5,000, while the maximum amount is N50,000,000.

7/ d. The bond can be sold before maturity through the Nigerian Exchange Limited Retail Bonds Market by authorizing your stockbroker to sell your investment in the secondary market.

8/ e. There are no transaction costs incurred in buying the savings bond in the primary market; however, charges are applicable for investors when buying or selling a savings bond in the secondary market.

9/ f. Savings bonds are low-risk investments, this implies you're unlikely to lose any money, as the probability of the FGN defaulting on its savings bond obligations is extremely low. The bond is acceptable as collateral for loans.

10/ Difference between FGN Savings Bonds and FGN Bonds

Both instruments are backed by the full faith and credit of the FG of Nigeria, hence have minimal risk. The difference highlights the advantages of FGN Savings Bonds over the main FGN Bonds.

Both instruments are backed by the full faith and credit of the FG of Nigeria, hence have minimal risk. The difference highlights the advantages of FGN Savings Bonds over the main FGN Bonds.

11/ How does FGN Savings Bond work?

a. You will be required to complete and submit a subscription form through your stockbroker.

b. A Central Securities Clearing System (CSCS) account will be opened for you by your stockbroker where the bond will be deposited.

a. You will be required to complete and submit a subscription form through your stockbroker.

b. A Central Securities Clearing System (CSCS) account will be opened for you by your stockbroker where the bond will be deposited.

12/ You can use your stock CSCS account if you already invest in stocks in Nigeria.

The CSCS is the custodian and transfer agent that assists with the holding of your investment and transmits/updates your bank details to the CBN.

The CSCS is the custodian and transfer agent that assists with the holding of your investment and transmits/updates your bank details to the CBN.

13/ The CBN is the Registrars to the Savings bonds with the responsibility to ensure interest and principal are paid as and when due. As a result, it is mandatory to have a bank account.

14/ An Example

If you invest N100,000 in 3-year FGN Savings Bonds at an interest rate of 8% per annum, you will be paid N2,000 every 3 months for the next 3 years directly into your bank account.

If you invest N100,000 in 3-year FGN Savings Bonds at an interest rate of 8% per annum, you will be paid N2,000 every 3 months for the next 3 years directly into your bank account.

15/ That is you will receive N2,000 for 12 quarters translating to a total interest of N24,000. You will be repaid your N100,000 with the final N2,000 interest at the end of the third year.

16/ Please note that you can sell before maturity at the prevailing price through your stockbroker but it is always advisable to hold for the period of the bond.

17/ How to build and compound your portfolio with FGN Savings?

You can set a target to purchase a certain amount monthly, for instance, N10,000 monthly for the next 5 years, at an average interest rate of 7.0%, your total savings will be N600,000 with an estimated interest

You can set a target to purchase a certain amount monthly, for instance, N10,000 monthly for the next 5 years, at an average interest rate of 7.0%, your total savings will be N600,000 with an estimated interest

18/ ...of N119,343.90 translating to a total of N719,343.90. If your monthly target is N50,000 or N100,000, your total estimated investment value will be N3,596,719.50 or N7,193,438.99.

19/ This assumes that you reinvest any interest paid/principal at maturity to your bank account with your monthly contribution (investment can only be done in a multiple of N1,000).

20/ As a result, it is advised to have a dedicated bank account for this purchase and not your regular bank account.

As always emphasized, doing nothing makes you worse off due to the continued impact of inflation on your savings/investment.

As always emphasized, doing nothing makes you worse off due to the continued impact of inflation on your savings/investment.

21/ With the inflation rate at 16.82% as of April 2022 in Nigeria, investing in savings bonds helps you to reduce this impact by an average of 8% per annum.

22/ I hope this information has been helpful. Happy to respond to your questions and provide further clarification.

23/ To invest, kindly contact your stockbroker and if you do not have one currently, kindly send an email to - brokerageteam@afrinvest.com. Coincidentally, @Afrinvest is the first on the list of accredited @DMONigeria distribution agents dmo.gov.ng/fgn-bonds/savi…

24/ You can also view additional information @DMONigeria .

You can also follow me on Instagram @getfinanceandinvestmentips and on YouTube @ Get Finance and Investment Tips for more frequent investment tips.

You can also follow me on Instagram @getfinanceandinvestmentips and on YouTube @ Get Finance and Investment Tips for more frequent investment tips.

• • •

Missing some Tweet in this thread? You can try to

force a refresh