Many Cement companies down 50% from Highs of last year, now is a good time to review this Cyclical Industry for future Investments

♦️"Cement cannot Travel"

♦️Coal and Power usage 👉🏻 Low Cost producers

♦️Use Cyclicality to your advantage

🧶 Thread 🧶

#Cement #KSE100 #PSX

♦️"Cement cannot Travel"

♦️Coal and Power usage 👉🏻 Low Cost producers

♦️Use Cyclicality to your advantage

🧶 Thread 🧶

#Cement #KSE100 #PSX

Cement is a very low value Commodity ($40-$50/Ton) and cannot absorb Road Freight Charges of $30(South to North). Plants are setup in proximity of Demand Centers

It is vital to Bifurcate North and South players. Local Sales, Exports of both regions should never be combined

1/17

It is vital to Bifurcate North and South players. Local Sales, Exports of both regions should never be combined

1/17

Cement Industry is competitive and has invested in Cost efficiency measures like Captive Power & Waste Heat Recovery

Low cost of production & high Freight (Cement cannot Travel) protects the Industry from Foreign competition

2/17

Low cost of production & high Freight (Cement cannot Travel) protects the Industry from Foreign competition

2/17

Approx 1Ton of Coal is required to make 8Tons of Cement. At current Coal prices it makes up 60% of COGS

Imported Coal (mostly South African RB2), Afghan Coal and Local Coal are 3 types used. Afghan coal is 25% cheaper than Imported and Local at a further 15-20% discount

3/17

Imported Coal (mostly South African RB2), Afghan Coal and Local Coal are 3 types used. Afghan coal is 25% cheaper than Imported and Local at a further 15-20% discount

3/17

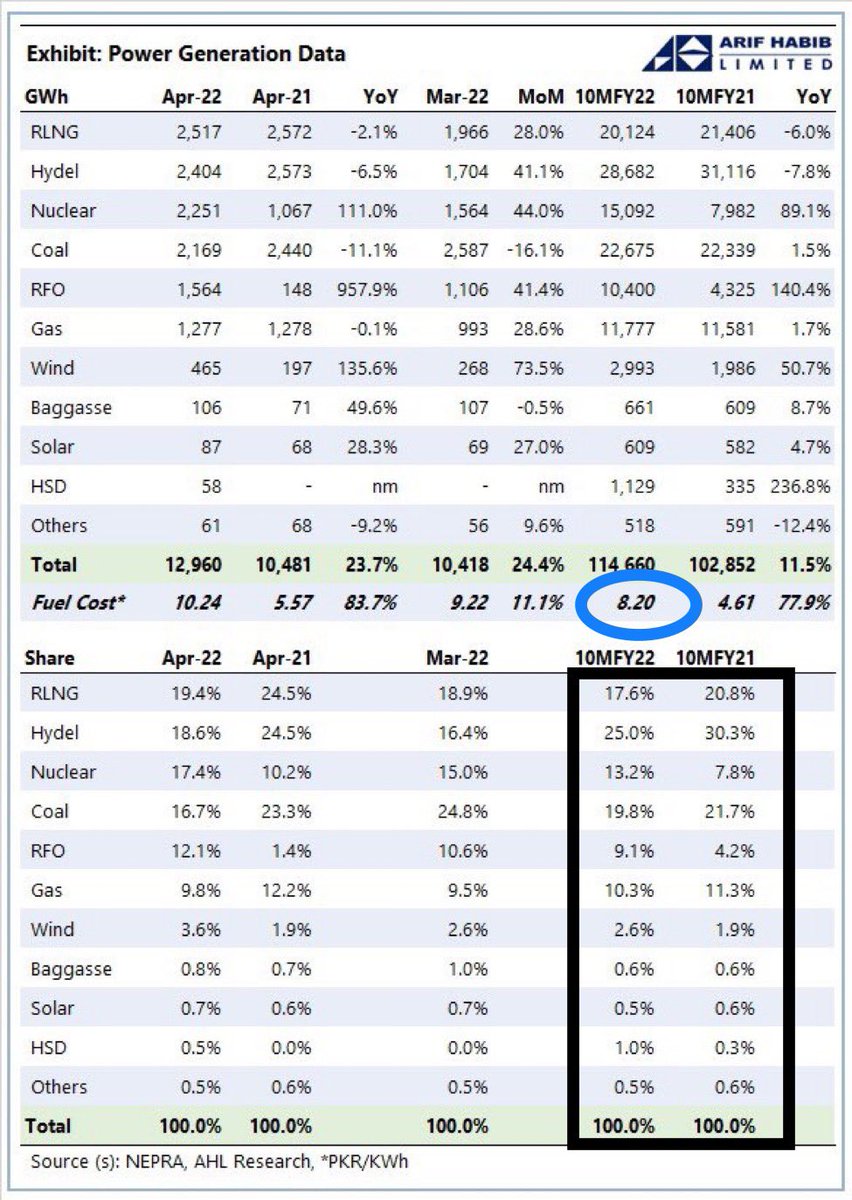

80-90 Units of Electricity are req for 1Ton production depending on Plant Efficiency. It is essential to study the Energy mix of the Company

Plants on System Gas (Cherat, Lucky (South) have the lowest cost of Energy followed by Local/Afghan Coal (Maple, Flying, Pioneer)

4/17

Plants on System Gas (Cherat, Lucky (South) have the lowest cost of Energy followed by Local/Afghan Coal (Maple, Flying, Pioneer)

4/17

Future Expansionary cycles will not be as volatile as past ones

Minimum size of an efficient Cement Line is between 7000TPD to 9000TPD (2.2Mn Tons to 3Mn Tons)

6-7 players in North expand together adding 15-20Mn Tons capacity in one go !!

5/17

Minimum size of an efficient Cement Line is between 7000TPD to 9000TPD (2.2Mn Tons to 3Mn Tons)

6-7 players in North expand together adding 15-20Mn Tons capacity in one go !!

5/17

10 years back an Expansionary cycle led to doubling of Production Capacity and when demand did not grow as expected 🔻

A price war originated eroding Margins, leading some companies close to bankruptcy

6/17

A price war originated eroding Margins, leading some companies close to bankruptcy

6/17

With the current size (50Mn Tons), an expansionary cycle only adds 25-30% new capacity which is easier to absorb

Earlier, it took minimum 4 years to install a new Production line which can now be installed in 2-2.5 years, further reducing mismatch between Demand and Supply

7/17

Earlier, it took minimum 4 years to install a new Production line which can now be installed in 2-2.5 years, further reducing mismatch between Demand and Supply

7/17

A Brownfield Expansion costs around $60/Ton (approx Rs 10-12Bn/Million Ton)

Due to the Cyclical nature, using P/E multiple is plain stupid. Instead Enterprise Value (Plant size) after adjusting for Energy efficiencies and Debt should be used

8/17

Due to the Cyclical nature, using P/E multiple is plain stupid. Instead Enterprise Value (Plant size) after adjusting for Energy efficiencies and Debt should be used

8/17

South Based Plants (DG & Power) were installed in anticipation of Infrastructure spending in Karachi which has not materialised

Local Sales contribute about 50% of Capacity. Due to high competition and freight costs, Exports are generally less profitable than Local Sales

9/17

Local Sales contribute about 50% of Capacity. Due to high competition and freight costs, Exports are generally less profitable than Local Sales

9/17

North based Capacity is roughly 50Mn Tons while 10Mn Tons (Bestway, Lucky, Maple & Flying) additional capacity will be added in next 9-12 months

To maintain decent margins, Local Sales in North have to reach 40-42Mn Tons (3.5Mn Tons/month) to achieve 70% utilisation

10/17

To maintain decent margins, Local Sales in North have to reach 40-42Mn Tons (3.5Mn Tons/month) to achieve 70% utilisation

10/17

Local Sales in North for last 2 months has been dismal averaging 2.6Mn Tons.

Pre-Buying, Political turmoil and Ramazan/Eid Holidays have contributed to this trend and market expects this to continue

Improvement in Sales will bring optimism in the Sector going forward

11/17

Pre-Buying, Political turmoil and Ramazan/Eid Holidays have contributed to this trend and market expects this to continue

Improvement in Sales will bring optimism in the Sector going forward

11/17

Exports to India for Punjab based players and Afghanistan for KPK based players provide a good Market in times of Overcapacity

Resumption of trade with India and any improvement in Afghan situation can easily add 5Mn Tons to Exports for North based Industry

12/17

Resumption of trade with India and any improvement in Afghan situation can easily add 5Mn Tons to Exports for North based Industry

12/17

Private sector construction has slowed down greatly due to Steel prices touching 200K/ton

2nd source of Demand is Infrastructure projects (Dams, roads etc) which have slowed down massively due to cuts in PSDP

13/17

2nd source of Demand is Infrastructure projects (Dams, roads etc) which have slowed down massively due to cuts in PSDP

13/17

Rebar prices drive construction activity as it makes up 40% of total construction costs while Cement only contributes 15-20%.

Scrap prices have declined 30% in the last 3 months which can bring back Cement demand in the coming months

14/17

Scrap prices have declined 30% in the last 3 months which can bring back Cement demand in the coming months

14/17

North based Company’s valuations have declined massively due to rising Coal prices and declining Local demand

Market is pessimistic about future demand and expecting massive hit on margins in the coming quarters

15/17

Market is pessimistic about future demand and expecting massive hit on margins in the coming quarters

15/17

I personally value Cement Comp with an efficient Plant and Competitive Energy (WHR+CCP) using the formula

(Efficient Capacity x 90% x 10Bn) - Net Debt

A good estimate of Net Debt👇🏻

Current Assets - Total Liabilities

Try to buy at min 50% Discount

NOT FINANCIAL ADVICE

16/17

(Efficient Capacity x 90% x 10Bn) - Net Debt

A good estimate of Net Debt👇🏻

Current Assets - Total Liabilities

Try to buy at min 50% Discount

NOT FINANCIAL ADVICE

16/17

Capital preservation is No1 strategy of any Value Investor. Hence, I do not invest in highly Leveraged Companies

Due to this cyclicality, some companies might be available at 30-40% of their fair value in the coming months

Be prepared !!

Share & RT. Thank you

17/17

Due to this cyclicality, some companies might be available at 30-40% of their fair value in the coming months

Be prepared !!

Share & RT. Thank you

17/17

@Sabbandkardo

@PseudoEconomist

@arafayzafar

@UnderCsPakstani

@MOPasha84

@FaizanKamran1

@AzamAKhan2

@NajamAli2020

@ahfazmustaf

@MishaZahid12345

Would love to know what you guys think about the Sector !!

@PseudoEconomist

@arafayzafar

@UnderCsPakstani

@MOPasha84

@FaizanKamran1

@AzamAKhan2

@NajamAli2020

@ahfazmustaf

@MishaZahid12345

Would love to know what you guys think about the Sector !!

• • •

Missing some Tweet in this thread? You can try to

force a refresh