"It is a beautiful thing when a career and a passion come together" | Value Investor - Founder & CEO ARN Financial Advisors - #PSX - #Stocks - #Investments

2 subscribers

How to get URL link on X (Twitter) App

For certain brands, Interloop even holds an "Inspection-Free Status" due to its long-standing business relationships and operational excellence.

For certain brands, Interloop even holds an "Inspection-Free Status" due to its long-standing business relationships and operational excellence.

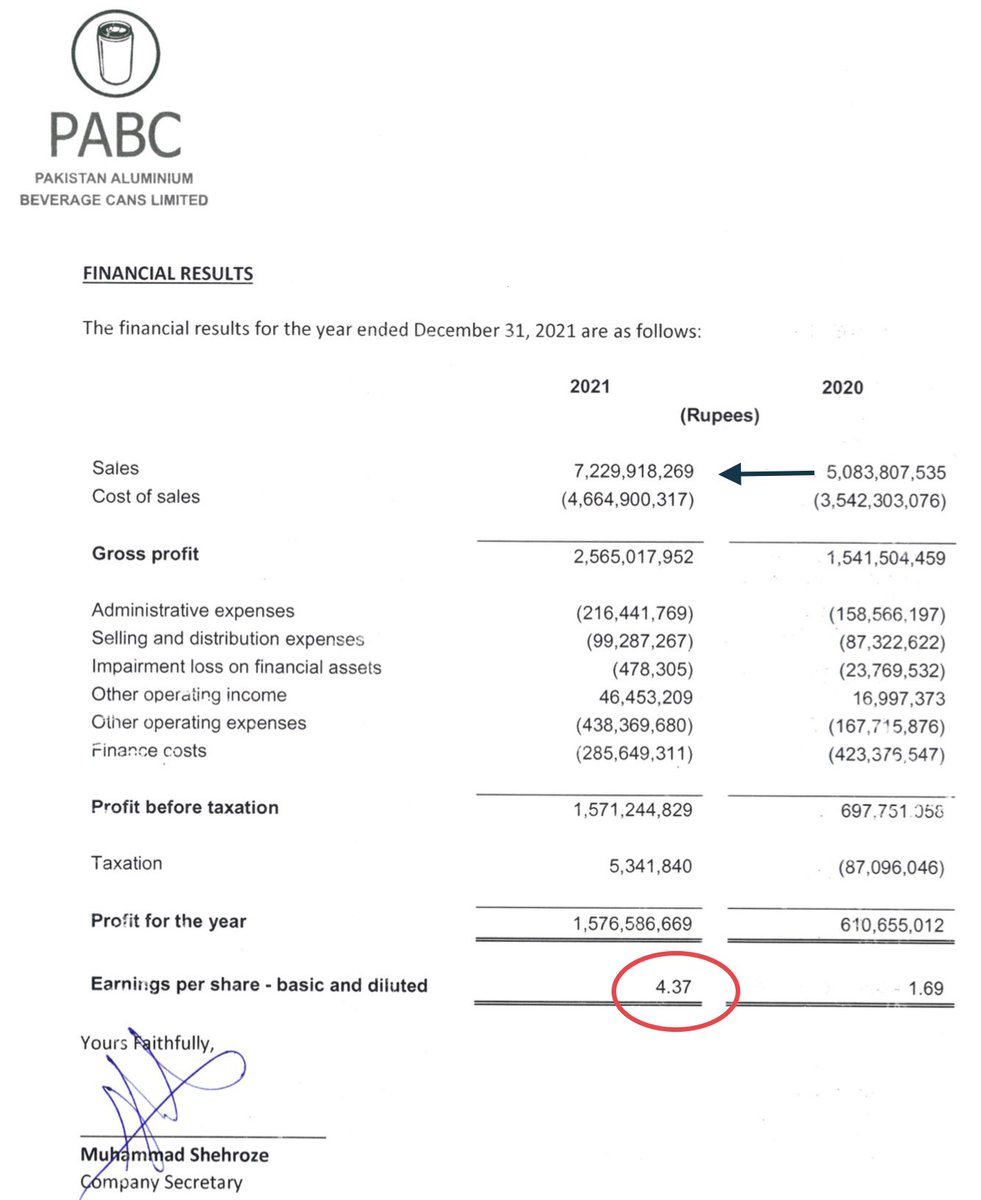

1st Aluminium Cans Facility in 🇵🇰🇵🇰 was established in Allama Iqbal SEZ (Faisalabad) by Ashmore in 2017

1st Aluminium Cans Facility in 🇵🇰🇵🇰 was established in Allama Iqbal SEZ (Faisalabad) by Ashmore in 2017

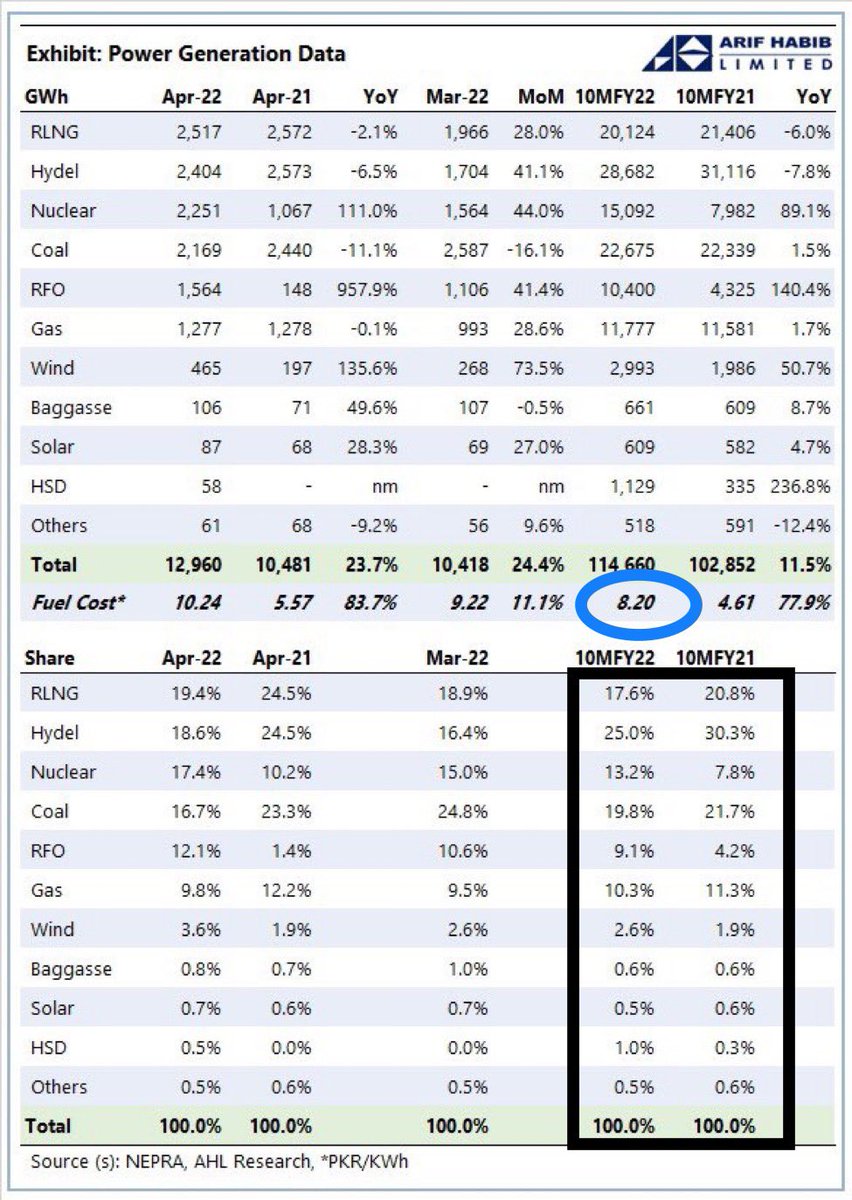

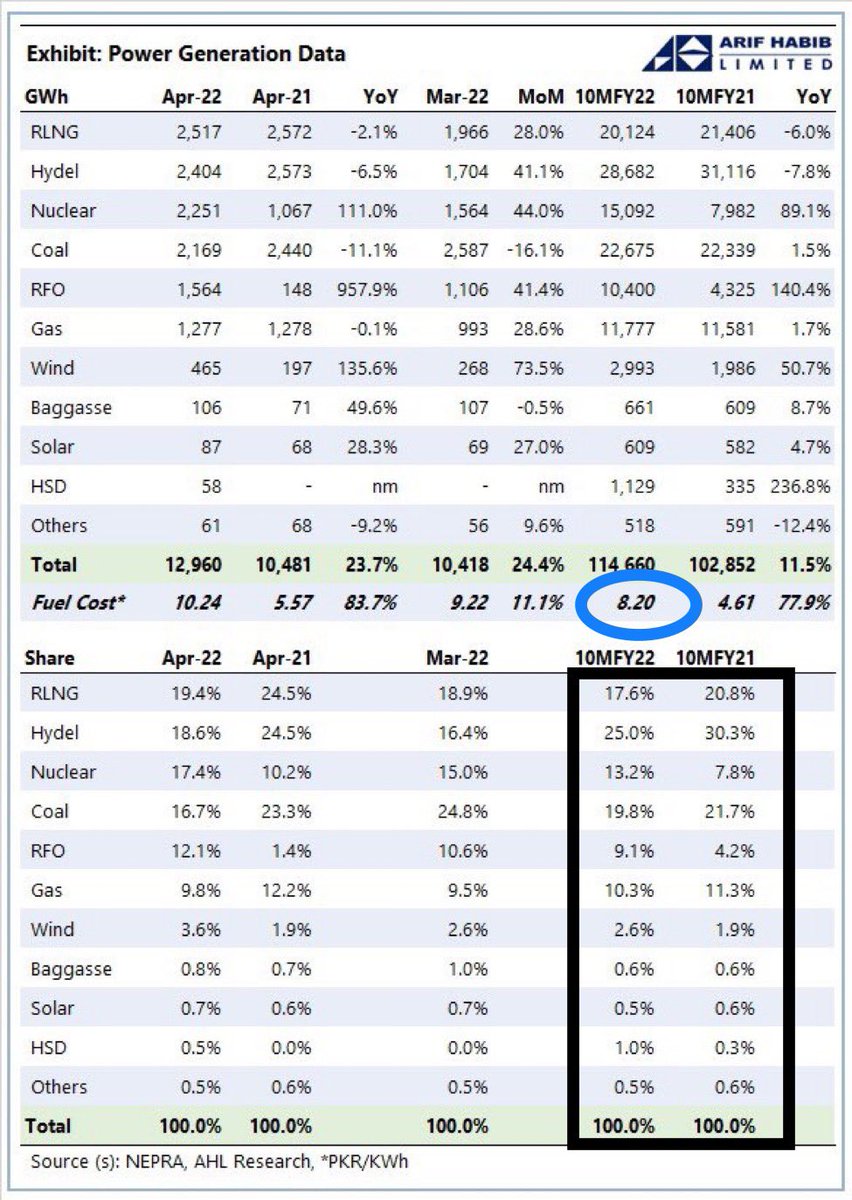

First of all, some Ground Knowledge about HUBCOs multiple Projects

First of all, some Ground Knowledge about HUBCOs multiple Projects

No way Pak Economy can achieve Sustainable Growth until Foreign Inflows reach $85-90Bn. There are 3 sources👇🏼

No way Pak Economy can achieve Sustainable Growth until Foreign Inflows reach $85-90Bn. There are 3 sources👇🏼

PPA is the Holy Grail to value an IPP. Most Important aspects include

PPA is the Holy Grail to value an IPP. Most Important aspects include

Cement is a very low value Commodity ($40-$50/Ton) and cannot absorb Road Freight Charges of $30(South to North). Plants are setup in proximity of Demand Centers

Cement is a very low value Commodity ($40-$50/Ton) and cannot absorb Road Freight Charges of $30(South to North). Plants are setup in proximity of Demand Centers