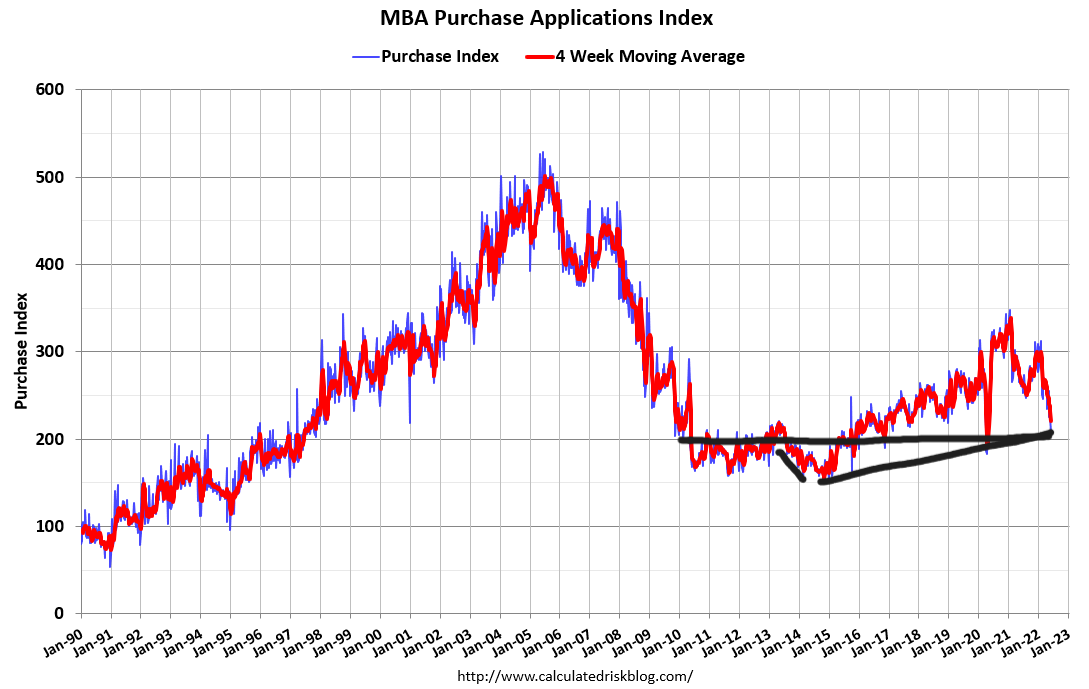

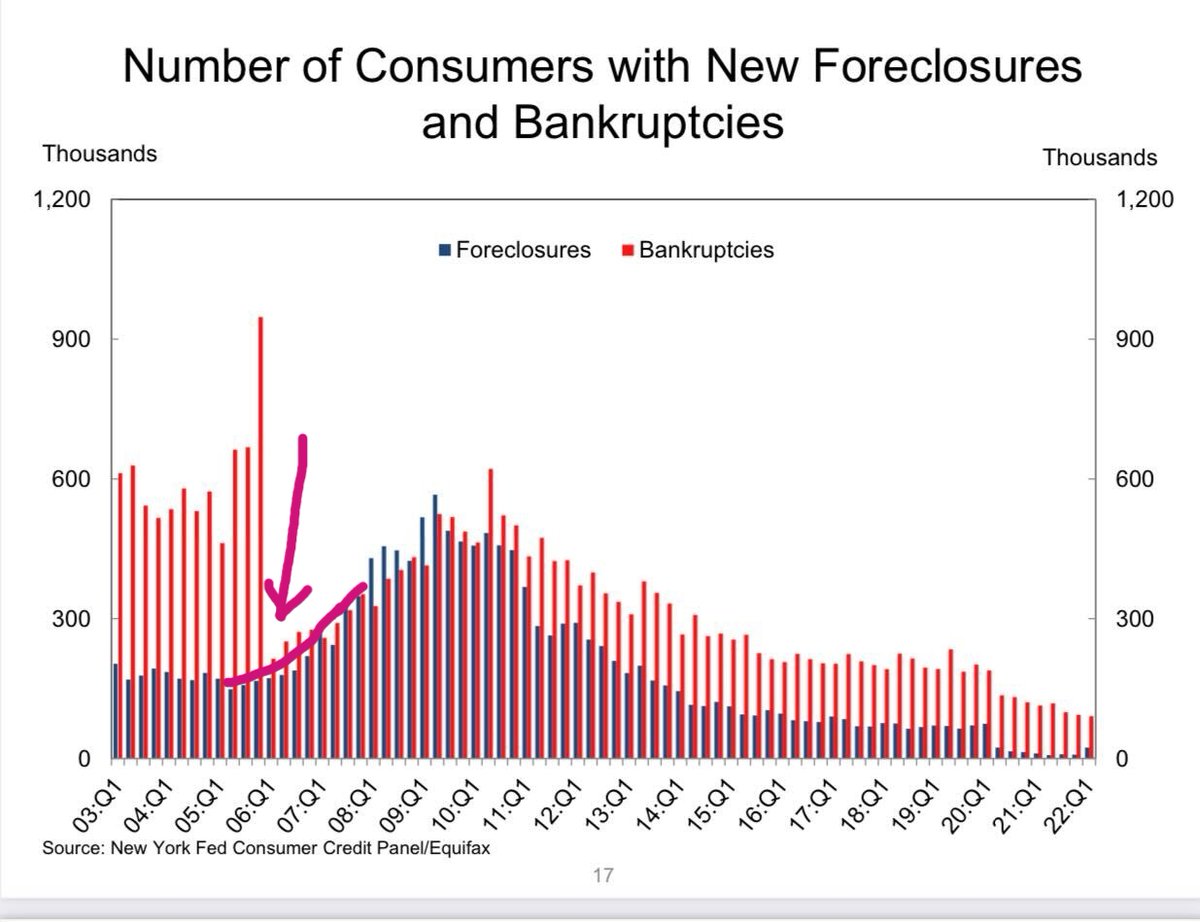

Forbearance went from near 5,000,000 to under 500K today. The Forbearance Crash Bros were all really Anti-Central Bank Housing Bubble Boys 2.0 people; I just gave them a new name for 2020/2021

#RIP

#RIP

https://twitter.com/nishantvyas/status/1534314005778550785

The biggest reason this group failed is that they didn't read. Reading is a good thing, not a bad thing

housingwire.com/articles/end-o…

housingwire.com/articles/end-o…

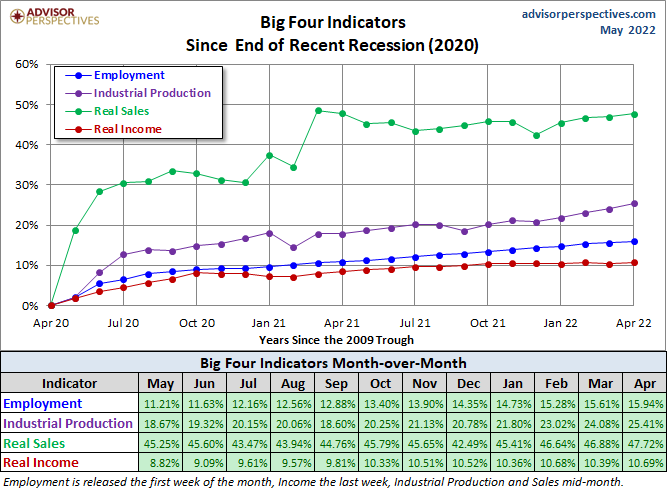

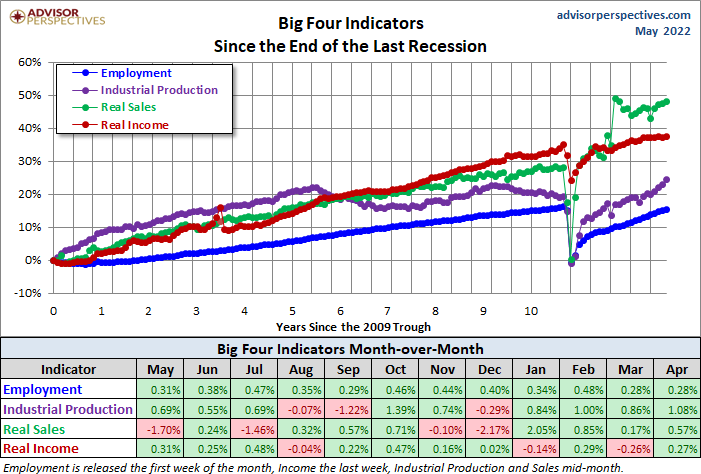

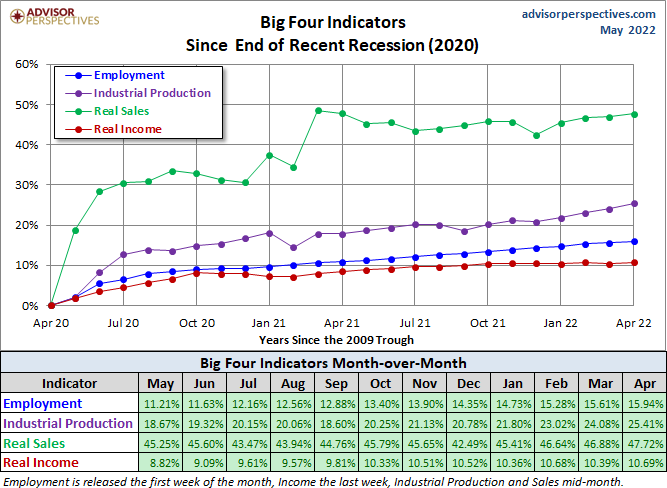

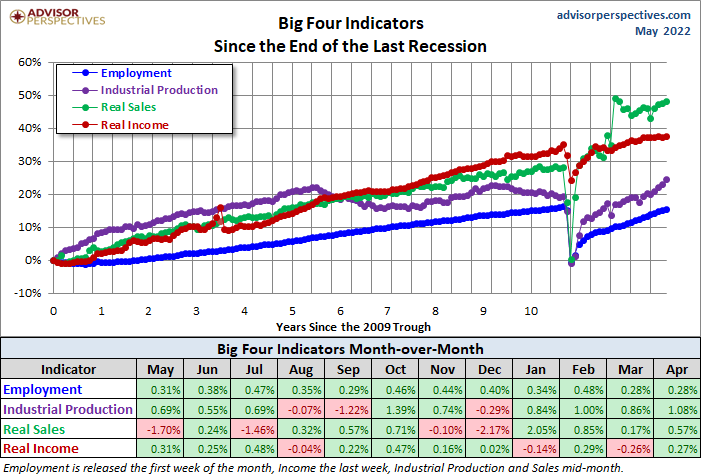

The quick version was that most people who made over 60K got their jobs back by October 2020, so Forbearance was going to collapse, and it was going to take time getting off the data line. This is why a credit risk profile blackguard could have helped 😉

And reading the data could have helped. Reading is such an essential part of acquiring knowledge. Youtube, not so much! 😇

• • •

Missing some Tweet in this thread? You can try to

force a refresh