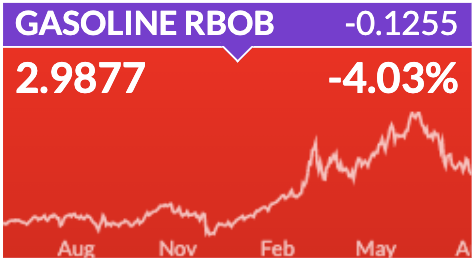

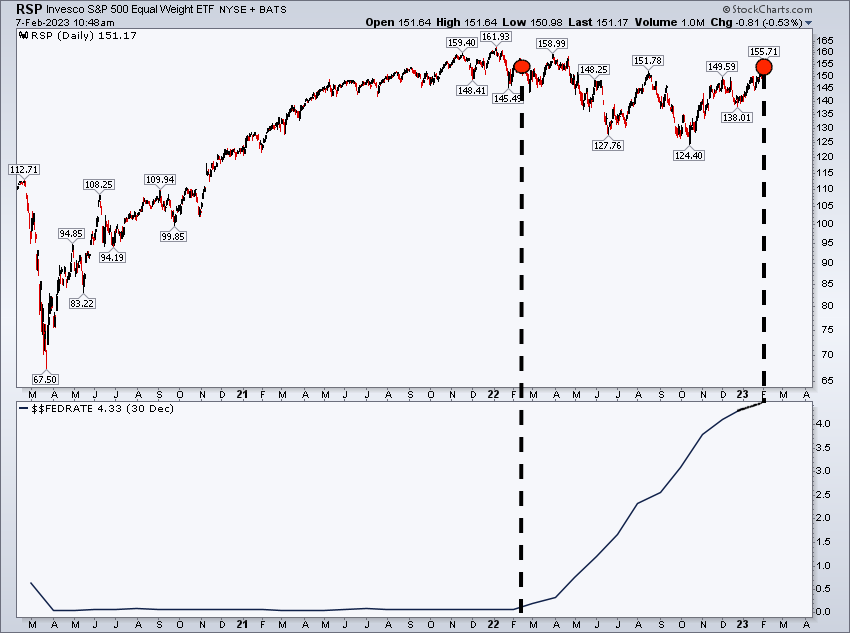

Update on the gasoline thread. Basically the RSI divergences have hit all assets one by one since the market started tightening in '21.

$2.80+ is clearly the next level on gasoline, which is also about where the war spike began. Note price had trended higher into that move.

$2.80+ is clearly the next level on gasoline, which is also about where the war spike began. Note price had trended higher into that move.

Step back on gasoline. Another inflection. ETF on left, continuous on right. I tend to know what's happening with each. Cancel out pandemic panic low, clear trendlines in play. Arguably has been biggest bull input last 6 weeks.

Always amazed how perfectly technical something can trade when the crowd is on the other side of the boat etc.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh